Crypto's Busy Week in Davos

View in Browser

Sponsor: Consensus — Consensus Miami | May 5-7 | Save 20% with the code BANKLESS

- 🏆 Gold Breaks $5K as Tariff Threats and Shutdown Risks Mount. Gold's new all-time high extended a rally fueled by U.S. tariff threats, shutdown risks, and central bank buying.

- 📡 Ethereum Foundation Charts Post-Quantum Future, Announces $1M Prize. The EF wants a post-quantum transition with zero downtime and zero loss of funds.

- 📈 BlackRock Files to Launch BTC Call Overwriting ETF. The "iShares Bitcoin Premium Income ETF" will hold IBIT and sell calls to earn income.

| Prices as of 5pm ET | 24hr | 7d |

|

Crypto $2.98T | ↗ 2.4% | ↘ 6.0% |

|

BTC $88,131 | ↗ 2.1% | ↘ 5.0% |

|

ETH $2,927 | ↗ 4.7% | ↘ 8.6% |

As one might expect, crypto had its biggest presence ever at Davos this year.

Trump spoke about keeping America the "crypto capital of the world." Coinbase CEO Brian Armstrong sparred with a Bank of France governor over stablecoin yields. Binance’s CZ discussed tokenization deals with over a dozen governments.

While crypto’s presence was to be expected, it’s still jaw-dropping to see the technologies of our industry so center stage at the world's premier economic gathering. Here are the most important takeaways from last week's summit.

1. Tokenization as the Breakout Trend

Armstrong called tokenization the most-discussed topic at Davos, while also making clear that the conversation has moved well beyond just stablecoins. Equities, bonds, credit, real assets: everything is on the table. BlackRock CEO Larry Fink underscored the momentum. "Tokenization, decimalization is necessary," Fink said, pushing that a unified blockchain-based financial system could reduce costs, increase transparency, and broaden market access.

CZ revealed he's in active talks with "probably a dozen governments" on tokenizing state assets, with the goal of letting countries raise funds by offering fractional ownership of state-owned infrastructure to citizens and investors.

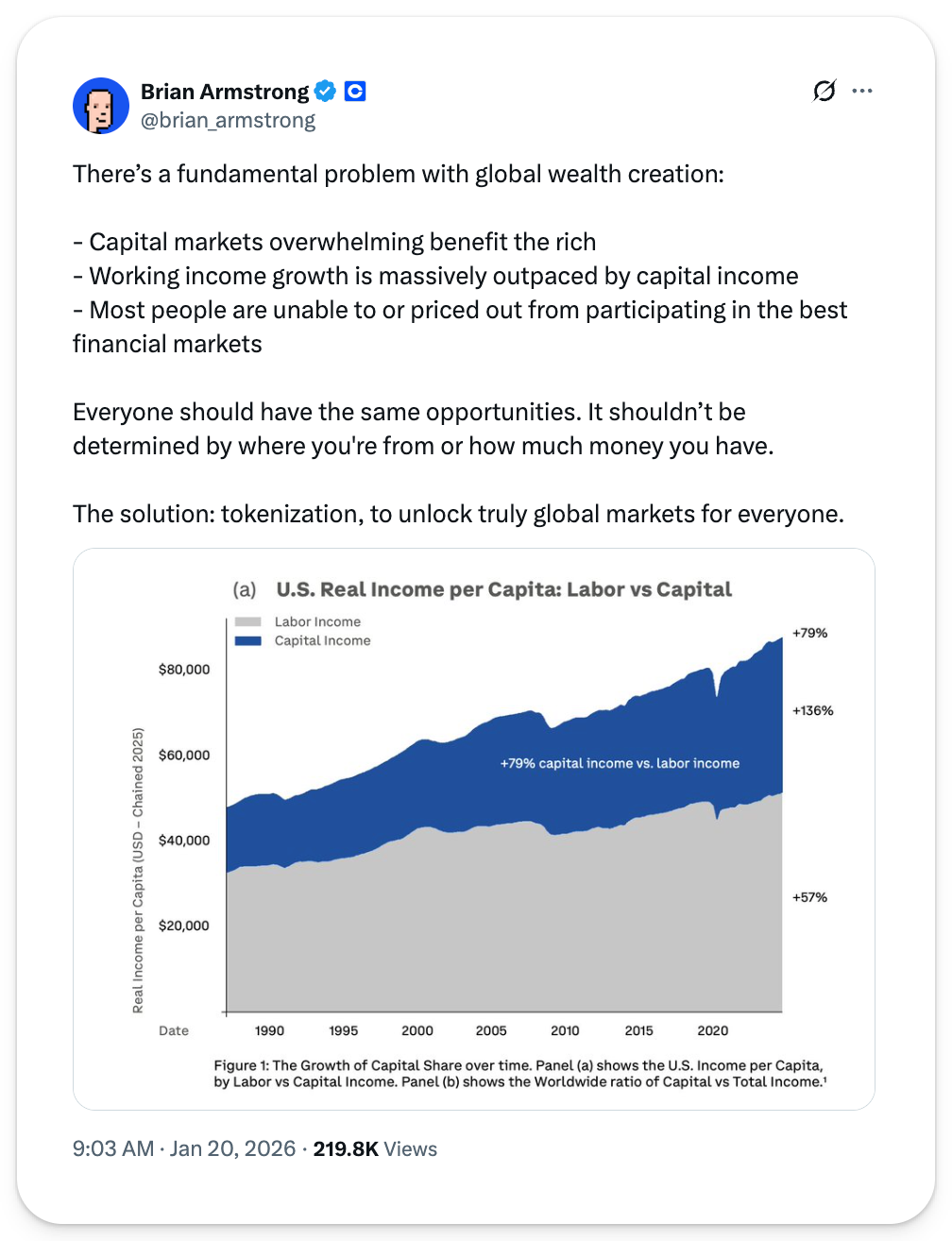

In order to frame tokenization as an opportunity not just for institutions but also for everyday market participants, Armstrong discussed what Coinbase calls the "unbrokered" – how roughly 4B adults globally have zero access to equity or bond markets. In the U.S., 96% of households in the top 10% by income own stocks, compared to just 17% across the entire bottom 20%, a reality which drastically impacts wealth preservation and growth. Tokenization, the argument goes, could close that gap by making high-quality investments accessible to anyone with a smartphone, though the argument sidesteps the issue of having expendable income to allocate towards these assets.

2. AI Agents Will Default to Crypto

CZ offered what may be the week's most quoted prediction: "The native currency of AI agents will be cryptocurrency."

His reasoning is straightforward and one our industry knows by heart now. AI agents can't open bank accounts or pass KYC checks. Once they reach true agency – booking flights, paying for services, coordinating with other agents – they'll need payment rails like x402 that don't require human identity verification. Stablecoins fit that bill.

Armstrong echoed the point: "Agents will default to using stablecoins for payments, since they can't be KYC'd like a human being. The infra exists, and usage is rapidly growing."

While this future is clearly understood by our particular industry, as well as those of AI and fintech, it’s now being broadcast on the world stage which will likely provide it additional momentum over the coming months. If this trend is of interest to you, make sure to check out our weekly Crypto AI newsletter, Mindshare, where I’ve been covering this trend for months.

3. Banks View Crypto as Existential

In his Davos wrap-up post, Armstrong shared an anecdote of a CEO of a top 10 global bank telling him crypto is now their "number one priority." Why? Because they view it as an existential threat they need to either adapt to or risk being cut out of.

Most bank CEOs Armstrong met were "very pro crypto and leaning into it as an opportunity," he said. But the underlying concern is disintermediation: stablecoins and tokenized assets could let users bypass banks entirely, moving value instantly without clearing delays or middlemen. While this is exactly what we’ve been fighting for, and why in many respects our industry was created, for institutions that have spent decades profiting from those frictions, that's an existential problem.

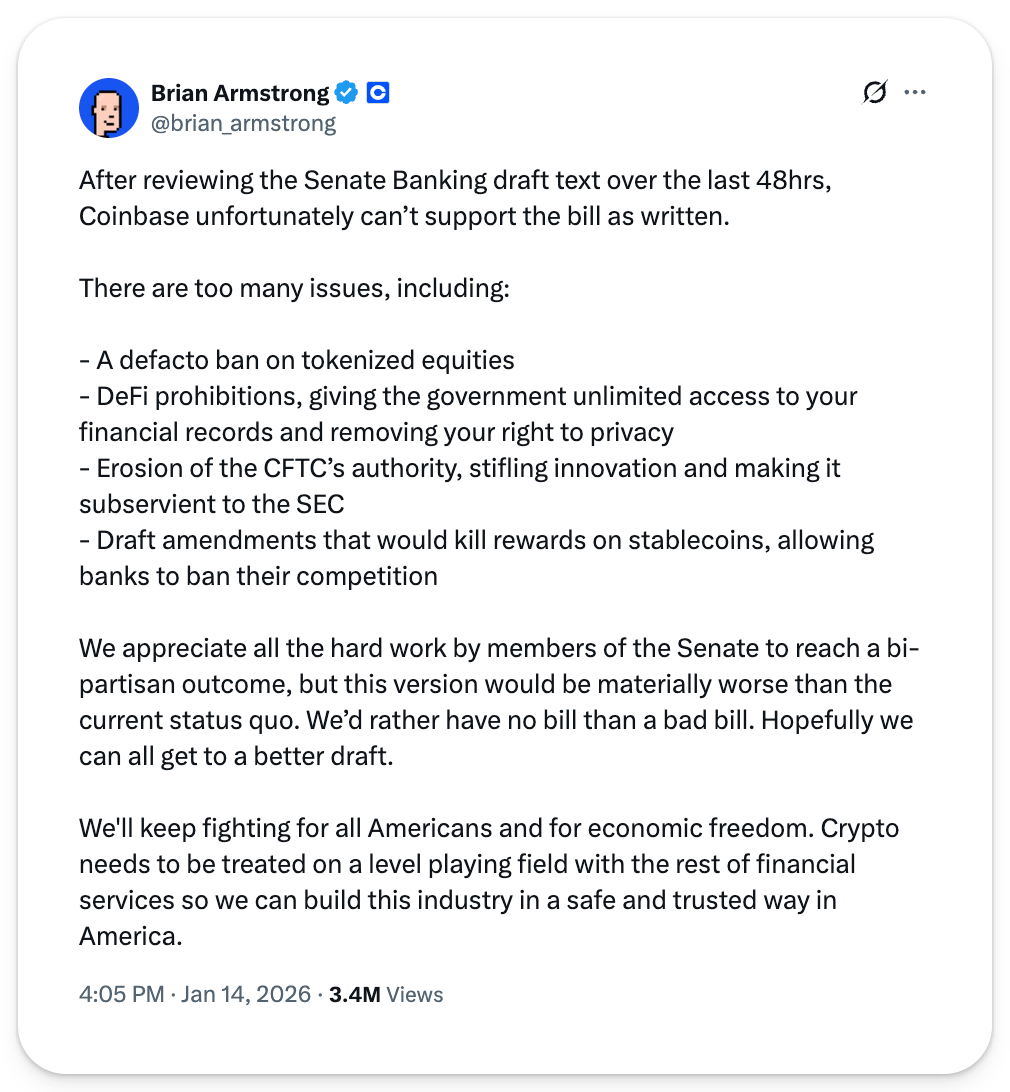

This tension has exploded publicly in the past few weeks. Coinbase withdrew support from the CLARITY Act – the market structure bill that was supposed to finally give crypto clear regulatory footing in the U.S. But Armstrong cited multiple issues with the Senate draft, with the flashpoint being stablecoin yield.

Banking groups had argued that allowing crypto platforms to offer interest-like returns on stablecoin balances could draw deposits away from traditional savings accounts. The Senate draft sought to bar digital asset providers from paying yield simply for holding stablecoins.

Armstrong framed it as regulatory capture: "It just felt deeply unfair to me that one industry would come in and get to do regulatory capture to ban their competition. They should have to compete on a level playing field."

The legislation is now in limbo.

4. Tempered Optimism for 2026

As one might expect from the founder of the world's largest crypto exchange, CZ expressed bullishness on price: "I have very strong feelings it will probably be a supercycle in 2026 for Bitcoin." His reasoning centers on the U.S. government's pro-crypto stance and other nations following suit – dynamics that could "break the four-year cycle." Ripple CEO Brad Garlinghouse echoed the bullishness, telling CNBC: "I'm very bullish, and yes, I'll go on record as saying, I think we'll see an all-time high" for crypto markets this year.

Yet these catalysts and expectations don’t mean nonstop short-term gains.

At the end of last year, our David Hoffman wrote about yearly candles and what to expect in 2026 after the most modestly red year in both BTC and ETH’s history. There are two possible reads – either the red isn't done expressing itself, or the industry is maturing and mainstream adoption is putting a fundamental bid under prices. Both could be true.

David's advice from that piece is worth repeating:

If you plan for a marginally red year but receive a green one, you'll be psychologically prepared to take advantage of the opportunities that emerge after others burn out. Crypto is a game of staying alive so you're there when the opportunity is ready for you.

5. U.S. Regulatory Momentum Is Real, Not Guaranteed

Trump declared in his Davos speech: "I'm also working to ensure America remains the crypto capital of the world."

The CLARITY Act was moving through Congress before the Coinbase dispute (rightfully) stalled it. Crypto czar David Sacks urged the industry to "resolve any remaining differences," noting that "passage of market structure legislation remains as close as it's ever been."

Armstrong gave credit where credit’s due, calling the current administration "the most crypto-forward government in the world." Clear rules are framed as essential for global competitiveness, particularly as China and other nations push forward on stablecoin infrastructure.

But the CLARITY Act saga shows how nothing is guaranteed. The bill was approaching a "do-or-die" moment before midterm election dynamics consume the legislative calendar. Whether the industry can patch its internal disagreements in time remains an open question.

Overall, crypto no longer being a side conversation at the world's premier economic forum is thrilling to see. The question now is whether the industry can translate that visibility into actual legislative wins, and whether the infrastructure being built for AI agents, tokenized assets, and stablecoin payments can deliver on the promises being made in the Swiss Alps. I expect that it will, but that the fight for making it a reality is not over yet.

Consensus Miami • May 5-7 — Crypto’s most influential event arrives in Miami’s electric epicenter of finance, tech and culture. Join 20K+ decision-makers representing trillions in capital for market-moving intel, dealmaking rocket fuel, and epic parties to match. Save 20% with the code BANKLESS.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.