Crypto is about to melt faces | Market Monday

Dear Bankless Nation,

The era of digital assets is upon us.

Let’s go through what’s happening now, next, and soon (the ETH effect)…because I have a feeling crypto is about to melt faces.

The Now…

Last week we saw Visa announce it’s using Ethereum to settle USDC transfers on its network. We also saw Goldman Sachs scrambling to enable Bitcoin offerings to its customers in an attempt to match Morgan Stanley's new Bitcoin funds.

Every week there’s more evidence that the institutions are building on crypto.

We also saw a historical quarter in venture funding for the crypto space.

And now some are hailing the awakening of the dragon in the East…

🧠 Kimchi premium: The increased valuation of crypto prices when traded against the South Korean Won. Who’s having flashbacks from 2017?

The Next…

On April 14th, Coinbase is expecting to publicly list $COIN on the NASDAQ. This is the first stock on public markets that represents pure, neutral exposure to ‘crypto’, and the hype will be insane.

Hello WallStreetBets. 👋

While the value of $COIN at launch is unknown, if we are truly in a late-stage credit cycle where there’s ample supply of fiat cash in every corner of the world, I expect COIN to pump basically no matter what.

This will be a good test of the public’s level of broad interest in crypto.

Meanwhile…there’s so much BTC ETF pressure on the SEC right now. We recently had a conversation with SEC Commissioner Hester Peirce who articulated her belief that Bitcoin is ready for an ETF. Watch the clip!

Above: Sneak Peak clip of our Conversation with Commissioner Hester Peirce. Coming out on the podcast next Monday!

A new SEC chairman and legacy institutions now pushing it—we have got to be close to the launch of multiple BTC ETFs…

The Soon (the ETH effect)…

All the while something big is happening in the background. I think ETH is about to flex its muscles and have the bull run it has long deserved. Let’s zoom in on ETH.

EIP 1559 is approved and slated for inclusion. This means that Ethereum fee burning begins in July. The significance of a DeFi enabled deflationary store-of-value asset has even elevated Ethereum to the front-page of Bloomberg.

Not only this but some core Ethereum developers are tossing around the possibility of accelerating the ETH 1 <> Beacon Chain merge to before the end of the year.

Why? Because it’s ready. At least this is what Justin Drake and a number of Ethereum developers seem to be indicating.

The ‘merge’ is where Proof of Work formally dies and Ethereum is 100% secured by Proof of Stake. ETH issuance drops from 4.75M ETH per year to less than 1M ETH per year and ETH as ultra sound money takes full form. 😱

These fundamental economic improvements as well as a building narrative will lead to an institutional bull run for ETH. We’re already seeing early evidence of this too.

DeFi resonates with traditional investors. Matt Hougan from Bitwise recently discussed why this is the case on State of the Nation.

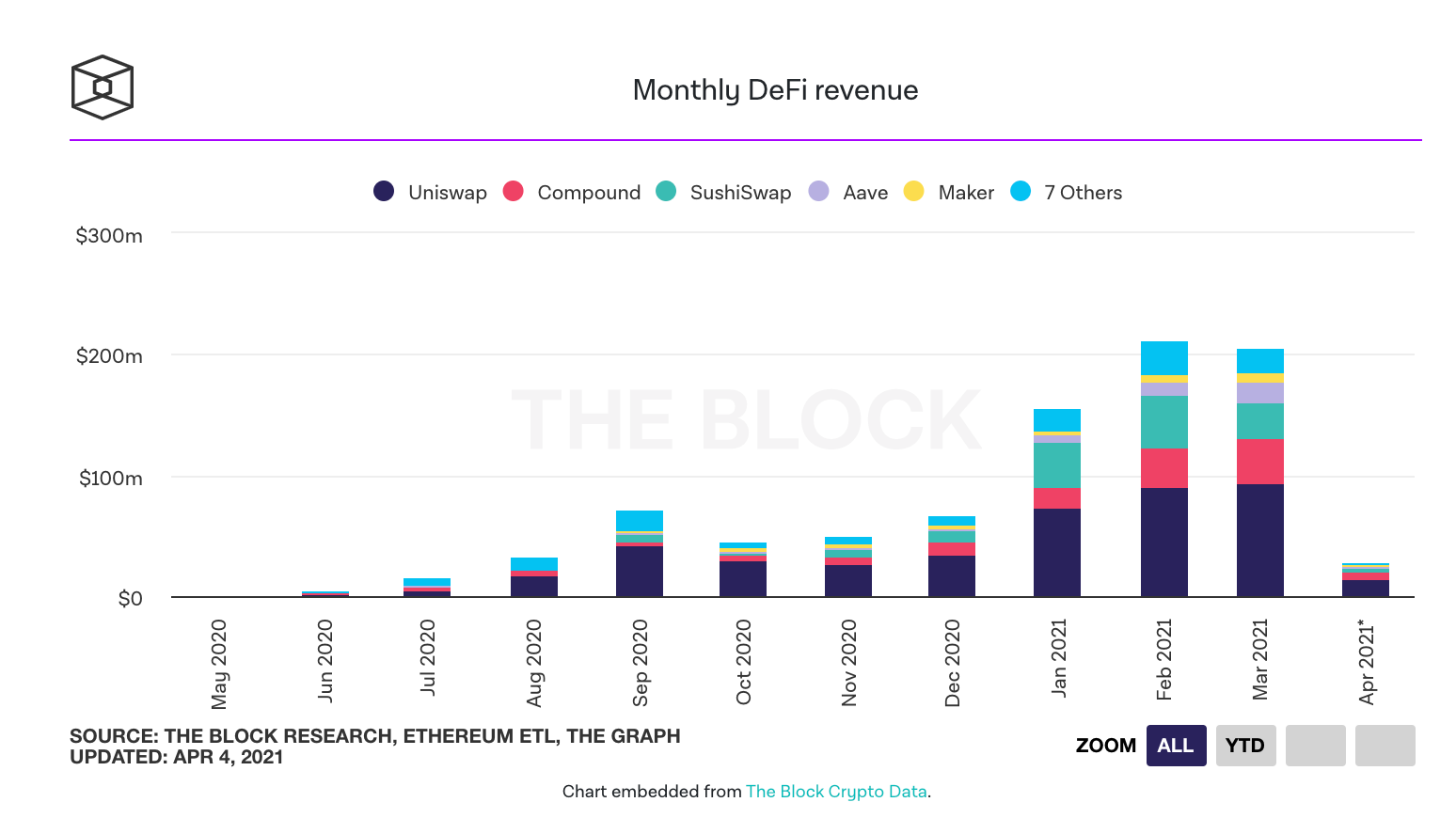

Institutional investors will look beyond Bitcoin and towards DeFi—the fast-growing sector that is generating over $200M in revenue each month.

Watch over the next 6 months as the Ethereum narrative bleeds into mainstream financial media. Here’s Ethereum being discussed on CNBC just this morning.

The now: institutions building, historic funding levels, retail awakening in the east.

The next: Coinbase IPO and Bitcoin ETF.

The soon: ETH’s narrative leaks into the mainstream.

Get ready to have your face melted. 🚀

- David Hoffman

🎙️ NEW PODCAST EPISODE

Listen in Podcast App | iTunes | Spotify | YouTube | RSS Feed

MARKET MONDAY:

Scan this section and dig into anything interesting

Market numbers 📊

- ETH moons +16.2% to $2,120 from $1,823 last Monday

- BTC inches up +2.2% to $58,900 from $57,600 last Monday

- TVL soars +20.1% to $51.2B from $42.5B last Monday

- DPI jumps +9.4% to $452 from $413 last Monday

- DAI stability fee on ETH holds 5.50%

Market opportunities 🤑

- Purchase call options on xSUSHI

- Trade on Kyber’s new Dynamic Market Maker (DMM)

- Borrow LUSD interest-free on Liquity (using Zerion too!)

- Work for one of these massive protocol treasuries (unlimited money lol)

- Onboard into crypto with the Ledger starter pack

- Speculate on RobinHood’s IPO via FTX

- Claim your ForeFront token airdrop if you hold any community tokens

- Claim the UMA KPI option airdrop

- Hack together a project for the DeFi Connected Hackathon

- Rescue your ERC20 tokens from a compromised wallet

- Collect this dank Bankless NFT (we now own 5)

Yield Farming 🌾

- David on how to cash out this bull cycle with Alchemix

- Earn 35-39% APY on PoolTogether with protected coverage with Nexus Mutual

- Earn 40-50% APY by going long 1.5x on ETH by becoming a FLI Uniswap LP

- FEI/TRIBE yield farming is live (APY lookin good)

What’s new 📰

- SuperRare raises $9M in Series A (NFTs blowing up)

- SUSHI joins the Bitwise DeFi index

- imToken releases $30M in Series B

- Dharma releases new version of mobile wallet (lots of awesome new features)

- Introducing Greenwood—interest rate optimizer for borrowers

- Element raises $4.4M to bring liquidity to fixed rate income

- Yearn releases decentralized payroll management for DAOs (very cool)

- Aave plans to integrate with Polygon (DeFi scaling!!)

- Tether produces documentation to verify that they’re solvent

What’s hot 🔥

- Grayscale intends to turn GBTC into an ETF (ETF this year??)

- Mark Cuban’s portfolio is 60% BTC, 30% ETH, and 10% ALTS

- RAC made more income in 1 day than 10 years of work (crypto is powerful)

- Compound hits $15B in lending volume (mooning)

- Popular meme “Overly Obsessed girlfriend” sells for over $400K

- Fei Protocol’s genesis sent Uniswap’s total liquidity to $8B ($2.2b from genesis)

- Illuvium breaks record for Balancer LBP volume

- BlackRock bought BTC futures back in January (bullish)

- Paypal launches crypto checkout service

Money reads 📚

- Great profile on the Winklevoss Twins - Forbes

- Deep dive recap on Gitcoin Grants Round 9 - Vitalik Buterin

- Will we ever see a multi-chain world? - DCInvestor

- Demystifying NFTs - Naval

- The Original Sin - Placeholder VC

- Open Source Monetary Policy - Ric Burton

- A Tale of 3 DeFi Indices - CoinGecko

Governance ⚖️

- Lido proposal to sell 10% of LDO tokens to Paradigm

- Index Coop proposal to increase the FLI liquidity cap

- Index Coop final proposal to launch TTI index from Token Terminal

- Index Coop to move BED Index to form IIP

- MakerDAO executive vote to increase debt ceiling on COMP, ZRX, YFI

- Uniswap vote to increase Grants Program funding for Q2

- Aave discussion to support MATIC

- Aave discussion on migration plan

WHAT I’M DOING

Check out a few cool things I’m capturing right now in crypto

- Ryan: Taking a closer look at DAO tools like Collab Land, Snapshot, SafeSnap, and DAO House. This space is shaping up!

- David: Farming ALCX in the ALCX/ETH Pool. Here’s a really solid 101 writeup on what Alchemix is and how it works. Farming APYs are pretty high too these days—almost 400% on the ALCX/ETH pair!

- Lucas: Learning about Fei Protocol. The genesis event was last week and a lot of the Bankless Nation participated. It’s an interesting take on algorithmic stablecoins and garnered over $2.2B in liquidity at genesis. But will it succeed? TBD…

WHAT YOU’RE DOING

What’s the coolest thing you did in crypto last week?

- @GraemeBlackwood allowing OG ETH addresses to mint an NFT

- @AnalyserOver co-authored a proposal to hedge against Synthetix debt

- @SebVentures published a research piece on DeFi

- @Eip1599 listened to the Hayden podcast!!

See the rest here!

Extra Credit Learning

- (Beginner) a16z’s NFT canon

- (Beginner) 1Confirmation on NFT bull market

- (Beginner) An overview on Fei Protocol

- (Intermediate) Yearn State of the Vaults

- (Intermediate) Thoughts on Fei Protocol design

- (Intermediate) DSD V2 Final Spec

Some recent tweets…

SOMEONE on the Bankless team STEALS TWEETS!!

Actions

- Execute any good market opportunities you saw

- Listen to Uniswap’s Origin Story | Hayden Adams