What Onchain Gaming Learned in 2025

This guest post was written by nejc of FOCGERS.

In 2025 onchain games stopped asking whether blockchain belonged in games and began to "just do it," mentioning onchain only where it created real risk, ownership, or social drama. It’s only the underlying tech at the end of the day. The game design is what needs to stand out.

Also, let’s not pretend 2025 was clean. Crypto games got dragged into the dirt this year. Studios shut down. CT was miserable. Meanwhile, other crypto verticals began their “institutional” arc, while games looked like the black sheep of the family.

Yet in the middle of all that, some teams just kept shipping. And when I talk to traditional gaming veterans who were into crypto games last cycle, they resoundingly say the space is healthier. Unsustainable projects are (mostly) gone. Fewer zombie projects.

Games seem to know what they’re trying to be.

Before we start: this post isn’t investment advice, a ranking, or a comprehensive “best of” list. Creators like Berna have you covered for this kind of content. This is more like a field report. I didn’t land on this take by staring at dashboards. I landed on it by watching people play.

This year, I led the curation and programming of the first-ever Devconnect Gaming District in Buenos Aires. With my trusty collaborator, Nexonik, we spotlighted 30+ crypto games running on 16 PCs over 6 days. Locals wandered in. Kids camped out. DeFi folks hovered behind chairs. Builders tried to explain their games. Players mostly ignored the explanations and ruthlessly prioritized whatever looked fun.

A quick note on tech, then I’ll get into the juicy part

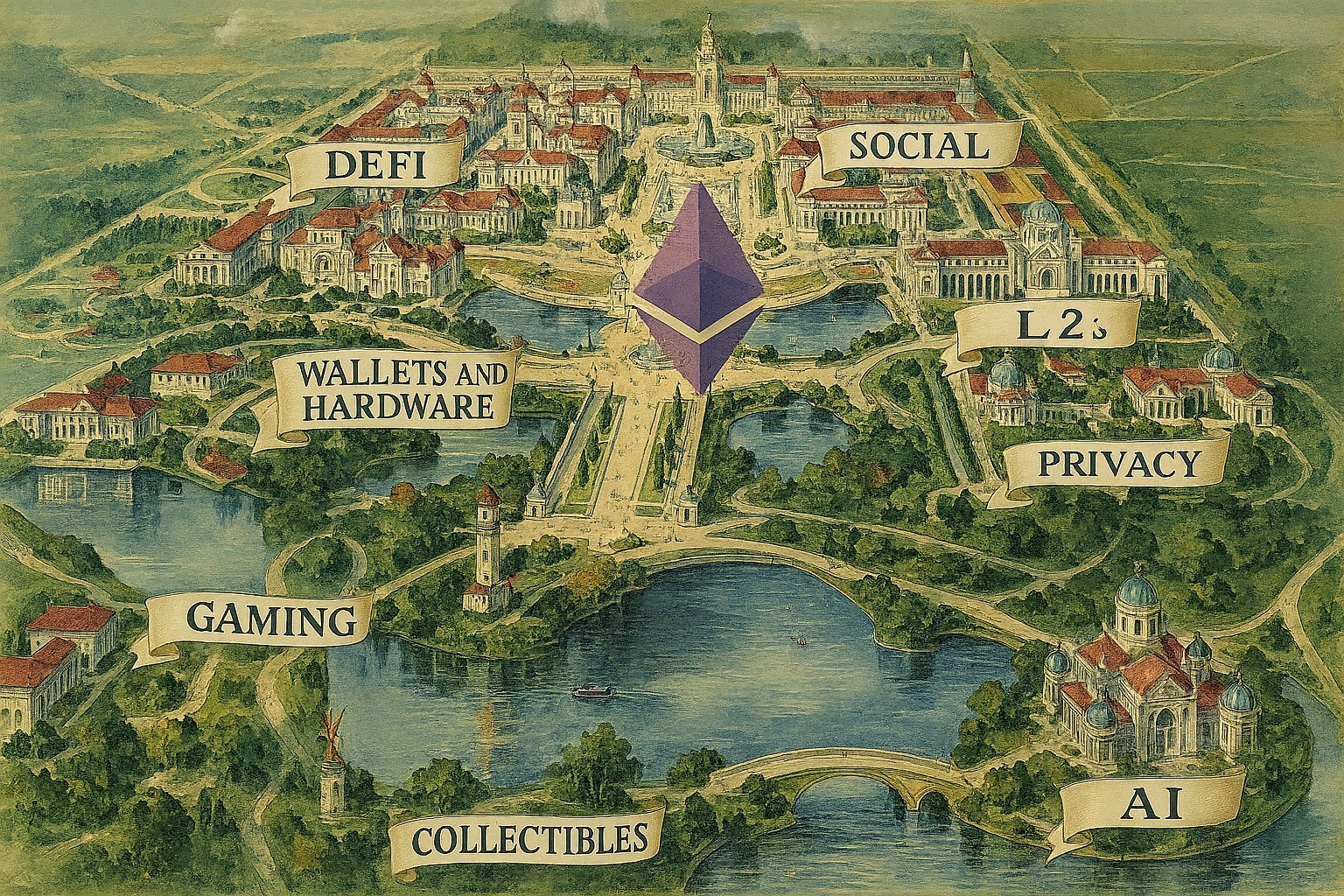

The games in this article utilize a wide range of L2s and infrastructure. Some leverage L2s like Ronin and Abstract to host onchain NFT collections. Others go fully onchain on Starknet, Initia, or Base. These games predominantly rely on infrastructure such as Cartridge, Dojo, Proof of Play, and Privy.

With a few exceptions I’ll explicitly call out, most of the games below were showcased live at Devconnect, and side by side – competing for attention in the most unforgiving environment possible. People walking up, sitting down, and deciding in under a minute if this was worth their time. Let’s get into it, shall we?

1) Stakes

The games that worked in 2025 didn’t lead with NFTs. They led with downside.

If “ownership” just means you own a JPEG, people shrug. If “ownership” means you might lose hours of progress, loot, or money, people lock in.

Something wakes up in you when there is a downside...

Cambria: Gold Rush

Cambria was the cleanest example of this approach all year.

It’s basically Old School RuneScape compressed into a 10-day season where everyone starts at level 1. You earn silver. Silver determines your share of an ETH prize pool. Rare artifacts and curios drop from casual activities, such as killing mobs or fishing. When they drop, a sound cue alerts nearby players, instantly painting a target on your back. When you get enough good loot, it’s time to make the call. Run. Hide. Bait. Call friends for help.

The tension comes from PvP and the fact that dying actually costs you. Die in a high-tier zone, and you drop your gear and loot. That directly affects your final payout at the end of the season.

Cambria also nails something older crypto games struggled with: pay-to-play without shame.

Like RuneScape, Cambria: Gold Rush comes with a free and paid version. Free players are capped at level 40 but still have access to most systems. You can stack silver, just more slowly. The paid version costs a few dozen dollars and unlocks endgame zones and higher-tier loot, where the real risk and reward live.

But here’s the important part: that’s not why people played, as player and creator Arulex pointed out in his X post.

As he states in his post, most players didn’t show up for the prize pool, the airdrop, or the play-to-risk economics. They played because Cambria is fun, brutally competitive, deeply cooperative, and high-dopamine.

It’s addictive in the way good MMOs are addictive. It’s really not rocket science. The economy reinforces that loop instead of pretending to be THE loop.

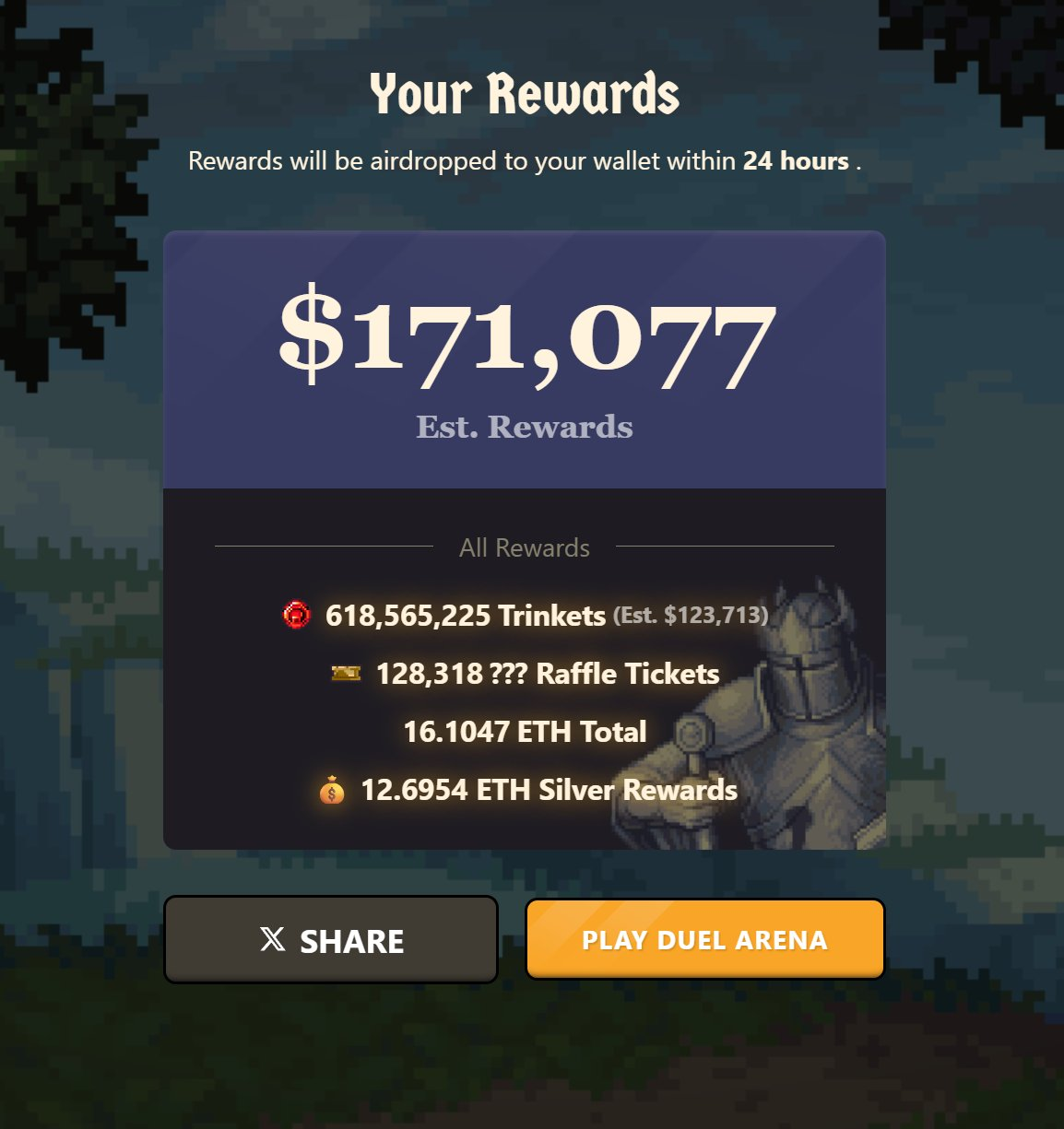

The Cambria team takes a small cut when silver is cashed out (2%). The money doesn’t leak out. It compounds inside the game. Player buy-in allowed for a large player-construed prize pool. In Season 3, this was $1.5M.

Realms Eternum/Blitz, and RAT.FUN

Realms Eternum showed that full-on RTS has a place in crypto. With the addition of Villages, the team secured over $20,000 in revenue during a 10-day season earlier this year. Think Civilization played over 10 days, hundreds of players, mandatory buy-ins via Villages or Realms Season Passes, and a persistent onchain economy where coordination, diplomacy, and timing actually matter.

The same principle shows up in shorter formats.

Realms Blitz compresses the season-based Eternum into fast buy-in matches. The map is smaller, the clock is tighter (2 hours), and the mechanics are simplified.

To get a sense of the thrill and the scope of the game, look no further than the esports-level match that took place at Starkconnect 2025 ... Commentary provided by Cumberlord!

RAT.FUN strips things down even further. You spawn a rat whose HP is real value. You enter player-written, AI-interpreted micro-dungeons where healing, damage, addiction, and death are enforced onchain. Trips are mispriced until players exploit them. Rats live or die by text, semantics, and economic pressure. Read more about it in my full article posted on Apix’s newsletter.

Different genres. Same principle.

Kamigotchi

Not all stakes need to be loud.

Kamigotchi proves that risk can be ambient and psychological. You send your Kamis to harvest and watch value accumulate while their HP drains faster and faster. The longer you wait, the more you earn and the closer you get to losing everything. Do you stop now and lock it in, or push a little longer and tempt fate?

That feeling, the creeping stress of knowing you’re fully responsible for the loss if it happens, is the point. I’m actually letting my Kamis harvest while writing this article. Their HP is already low. Hours of gameplay are at stake. I should stop. I’m not going to.

2025 takeaway: Real loss keeps players engaged at every scale. Bigger stakes can justify more prep and coordination, as Cambria’s top guild Plague Knights showed, but even small buy-ins are enough when outcomes are final (and often enforced onchain).

2) Finite games beat forever worlds

Another pattern became obvious at Devconnect as I watched people bounce between games: titles with clear endings held attention, ones that promised infinity didn’t.

Onchain games in 2025 are starting to look less like MMOs and more like sports. Seasons, rounds, matches.

Cambria resets every ten days. Eternum resets by season. Blitz resets by match. RAT.FUN resets by death.

It keeps the playing field more fair. It creates urgency. It gives newcomers a clean entry point instead of a permanent disadvantage. Infinite progression worlds, especially economic ones, fatten up fast. The rich get richer, the latecomers churn, and the game dies. At Devconnect, you could feel this difference immediately. People were far more willing to jump into games when they knew the commitment was finite.

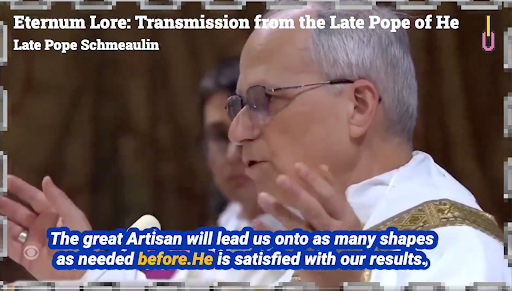

They also make drama possible. Alliances form because time is short. Betrayals matter because there’s no infinite tomorrow to smooth things over. Stories emerge because something actually concludes. One only needs to listen to the "Pope" player from the last Eternum season to see what I mean.

2025 takeaway: If your game never ends, it better be spectacular. Otherwise, do yourself a favor and keep it short. Finite games win (this year, at least 😈).

3) Gamified DeFi only works when it’s honest

One of the hardest games to pitch at the Gaming District turned out to be the stickiest.

Not because it hid the money part. Because it didn’t.

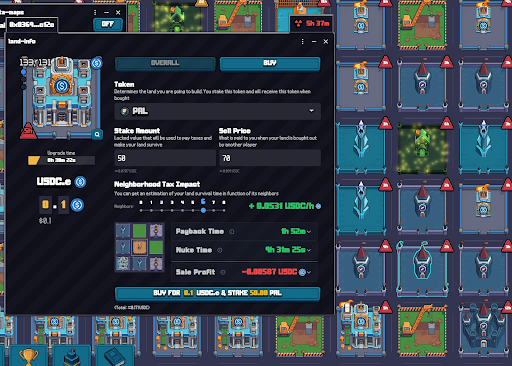

Ponziland

My Devconnect elevator pitch for this game was simple: “It’s gamified DeFi. You make money. But it’s not a ponzi.”

Everyone laughed. Then they sat down.

Ponziland is a map of tiles. Some produce yield. You rent land around them. Your land earns fees from nearby activity. As demand rises, rent rises. Stop paying rent, and your land gets auctioned. And then there’s the Nuke. It goes up for auction at a set cadence. Buy it, and you can instantly liquidate someone else’s land.

Nothing is hidden. Nothing is abstracted. Every mechanic is legible. Every consequence is enforced. The game is ruthless by design.

What surprised me wasn’t who tried it. It was who stayed.

One Devconnect morning, early in the day, two local teenagers walked in fast, like they were late for something. They dropped their bags. One pulled out a notebook filled with formulas and highlighted notes. The Gaming District was the only reason they came to Devconnect. They knew nothing about crypto. They had played Ponziland the day before and got obsessed.

One of them spent the entire evening reverse-engineering the system so they could come back and win. They loaded up their Cartridge Controller wallets with a few dollars and treated it like a fair casino they could actually understand.

That wasn’t an isolated case. Ponziland was also the only game that consistently pulled DeFi people into the Gaming District. Suits would gather behind the PCs. That never happened for any other game.

2025 takeaway: Gamified DeFi works when it doesn’t pretend to be something else. Because of that, players trust it enough to engage deeply. Not blindly. But deliberately.

I explored this in my interview with Ponziland’s cofounder, whose background in open-source Minecraft tooling shows up clearly in how transparent the game’s systems are.

4) Fully onchain stopped being an ideology and became a tool

For a long time, “fully onchain” felt like a belief system. Either you were all-in, or you weren’t “serious.” A lot of games tried to prove something rather than build something worth the effort.

Loot Survivor 2 and tradable runs

Loot Survivor 2 looks like a dungeon crawler. The innovative part is that your run is the asset.

Every playthrough is an NFT containing your position in the dungeon, your stats, your gear, and the decisions you’ve made so far. You can mint a fresh run, or buy someone else’s mid-run state and continue where they left off. That changes how people play. Some players push deep and sell their runs. Risk itself becomes tradable. Game sessions stop being ephemeral and start behaving like composable objects. This isn’t theoretical.

When an Adventurer dies, the NFT flips from green to red. The run is over, but the asset isn’t. Dead runs retain utility and can be used permissionlessly across the ecosystem. The same team is already building Summit, which utilizes Loot Survivor outputs directly. Adventurers and rare 1/1 Beasts carry forward. Kill a unique Beast, and it’s yours forever. Post it king of the hill style, let others try to take it down, even feed Adventurers to Beasts. Metadata matters. In some cases, how an Adventurer died changes what happens next.

Loot Survivor is COOL because it treats game sessions as a composable state. That lineage extends directly into games like O’Ruggin Trail, where entire storylines become tradable, remixable assets rather than disposable playthroughs.

Loot Survivor 2 generated over $400,000 in revenue in roughly three months, putting it among the most successful indie games of the year, onchain or offchain. When players buy Dungeon Tickets, 80% of the payment is automatically used to buy back $SURVIVOR onchain and deposited into a community-governed treasury. No discretion. No promises. Just contracts executing. Tickets are purchased either via the AMM or through the secondary market.

More than 16% of the supply has already been repurchased. 85%+ is in circulation. No lockups. More importantly, ($)SURVIVOR DAO governs live game parameters. Dungeon rules. Accepted tokens. Beast NFT mechanics. Ownership of the game itself is decentralized.

This is what fully onchain looks like when it’s used as a tool instead of a talking point.

2025 takeaway: Fully onchain is worth pursuing when it enables mechanics otherwise impossible.

5) Ship small, move fast

Instead of entering goblin mode and shipping the open-world MMORPG that Gigaverse is clearly capable of becoming, the team flipped the meta.

Gigaverse launched small

Earlier in 2025, Gigaverse launched with a dungeon crawler played through rock–paper–scissors. Players went in, came out with items, and very quickly an economy formed around assets whose utility wasn’t yet publicly revealed.

That ambiguity was the point. To me, the fun part was stacking them without knowing their true purpose.

By shipping in layers, the team gave themselves room to observe, adjust, and pivot. Items entered circulation. Markets and player-developed tooling emerged. And then came the obsession: the team became sink maxis. The team had a clear focus: tuning methods to regulate supply, eliminate excess items, and prevent value from becoming irrelevant.

From there, new loops arrived. Fishing, my personal favorite, became a calm but sticky layer I kept returning to. Variations on the original dungeon loop followed, alongside explicit risk-to-earn mechanics. Recently, a whole new game mode entered the playtesting: Conquest. Each addition plugged into the same economic backbone rather than bypassing it.

Only later did Gigaverse start actively teasing the larger world. EGG NFTs. Then the reveal: the eggs hatch into mounts, Gigasteeds. Hatching itself became a long-form game loop. You stockpile wood to keep eggs warm over weeks or months. You gather materials to influence rarity.

Systems first. Markets second. Fantasy last. Dith (founder) put it plainly in his recent X post: 2025 was about delivering the core. The next phase is about doing things that haven’t been done before.

2025 takeaway: Bootstrap your game through a fun metagame and simple, engaging loops before committing to a full world.

6) Onboard through tension, not education

One of the clearest lessons from the Gaming District had nothing to do with wallets, chains, or UX flows. It was about boredom.

There were a lot of locals hanging around. People who had never touched a crypto game before. Most of the time, if a game didn’t hook them immediately, they’d close it and open CS2 or Truco.

They weren’t rejecting crypto. They were rejecting dead time. If a game felt flat in the first minute, no explanation saved it. If it created tension quickly, everything else became negotiable. But two games cut through consistently.

Ponziland, because it felt like a fair casino you could actually understand. Gotchi Guardians, because it’s simply a good co-op tower defense game.

Different genres. Same effect.

In both cases, players didn’t need a lecture. They needed a reason to care. Once they had that, friction became secondary. For Ponziland players, that meant wallets, rules, and real losses. For Gotchi Guardians, it meant none of that at all.

That’s the inversion that many crypto games still miss. Onboarding doesn’t happen before engagement. It happens because of it.

2025 takeaway: If your game needs too much education before it creates tension, you’re shooting yourself in the foot.

Giving flowers

A lot of the progress in 2025 didn’t happen in a vacuum. Ecosystems showed up in a real way for games, not just with words, but with time, capital, and attention. Ethereum, Starknet, and Ronin showed up big time in 2025 when it comes to supporting games.

The Ethereum Foundation has been throwing support towards crypto games like never before. From Realms Eternum X Spaces to bankrolling the Devconnect Gaming District so indie gaming teams could be spotlighted free of charge, and much more that is still in the cookhouse as hinted at in my recent interview with Jason Chaskin, EF App Relations Lead.

Starknet continues to be the place for fully onchain games, not just because of the tech, but because of the culture around it. You can see that in the details. The internal obsession with Loot Survivor 2 among Starknet and StarkWare team members. The hands-on onboarding content. And hosting a live esports-level Realms Blitz tournament at StarknetConnect during Devconnect week. Fully onchain games aren’t treated like a novelty here. They get nurtured.

Ronin doubled down hard on what already works. Instead of spreading itself thin, the ecosystem focused on scaling proven hits (and did so very well). The support Jihoz and the Ronin team have given to Cambria and Fableborn shows that clearly. Creator programs, spotlights, guild grants. Straight execution.

Different ecosystems. Different approaches. Same mantra.

2025 takeaway: When games are taken seriously by their ecosystem (often L2), they get better.

Wrapping up

2025 wasn’t the year onchain games “made it.” It was the year they stopped trying to explain away blockchain, and instead just went for the W. Less whitepaper, more fun.

To the teams building right now: double down on it. The mindset is finally healthy. The space is leaner and more honest than it’s been since 2021. Crypto gaming went from being pitched as the Trojan horse for onboarding billions to being treated like the embarrassment at the family dinner. That swing was real. And it should piss you off.

If you’re still here heading into 2026, you should feel that chip on your shoulder. Use it. Let it kill bad ideas faster. Let it push you to ship games people play, not decks people explain.

Stop apologizing. Build games that take something from the player and give them a reason to come back anyway. Keep shipping.

And looking ahead...

My crypto gaming bookmarks for 2026

- Project O

- Axie MMO: Atia’s Legacy MMO

- Citadel

- Onchain Heroes: A New World MMO

- Chaos Agents / Surfers

- Blob Arena

- Boxing Cocks

At this point, though, I’ve yapped enough. I won’t go into why these concluding titles are interesting to me here. I’ll likely write about some of them in 2026. For now, know that they’re worth keeping an eye on for the same reasons that the games I mentioned above did well in 2025!