Crypto for good

Dear Bankless Nation,

If we want these problems to be fixed in our society, we have to be part of the solution. We can’t just lean back.

- Michael Seibel, CEO and Partner at YCombinator

Our world is going through an important societal shift. Inequality, climate change, and a variety of other ethical factors now play a role in our day-to-day decision-making.

When we go to the store, we might pick cage-free eggs. When we head to the city, we might use public transport. When we buy from our favorite brands, we consider their labor practices, despite the extra cost we may incur.

We’re moving towards an era of conscious consumerism.

Crypto needs to catch up.

The advantage that crypto organizations have over other companies is that we don’t have a legal obligation to maximize shareholder value. Instead, we can rally around a broader mission and execute on it.

So what happens when we set our eyes on making the world a better place?

Raffaela shows us a glimpse into a Solarpunk future.

- RSA

Guest Writer: Raffaela is a founder and investor at the intersection of blockchain and sustainability. Raffaela is an advisor to Popcorn DAO and a member of own.fund DAO

We’ve witnessed a phenomenal year in crypto. While more people continue to join the movement, we are still a small minority.

But ask anyone outside of crypto and one of the first things they might say is “Isn’t crypto bad for the environment?”

Not only does crypto still have a reputation for scammy internet money run by shadowy supercoders, but it also has a reputation for high energy usage and a negative impact on the environment.

It’s time we change this narrative.

The most valuable crypto companies will have values at the center that benefit the greater good and community.

Crypto-focused environmental social governance (ESG) projects will not only help to onboard the next 100m crypto users but also lead the next wave of innovation when it comes to a positive impact on the world.

And with that, we’d fulfill the promise of Web 3: Decentralise the power.

Let’s dig into why the most valuable crypto companies of the future will be ESG driven and how to find them early:

1. ESG focused companies see higher demand and higher returns

One reason that Tesla has become one of the most valuable companies on the planet is that the market nowadays pays a premium for companies that can make money and benefit the greater good.

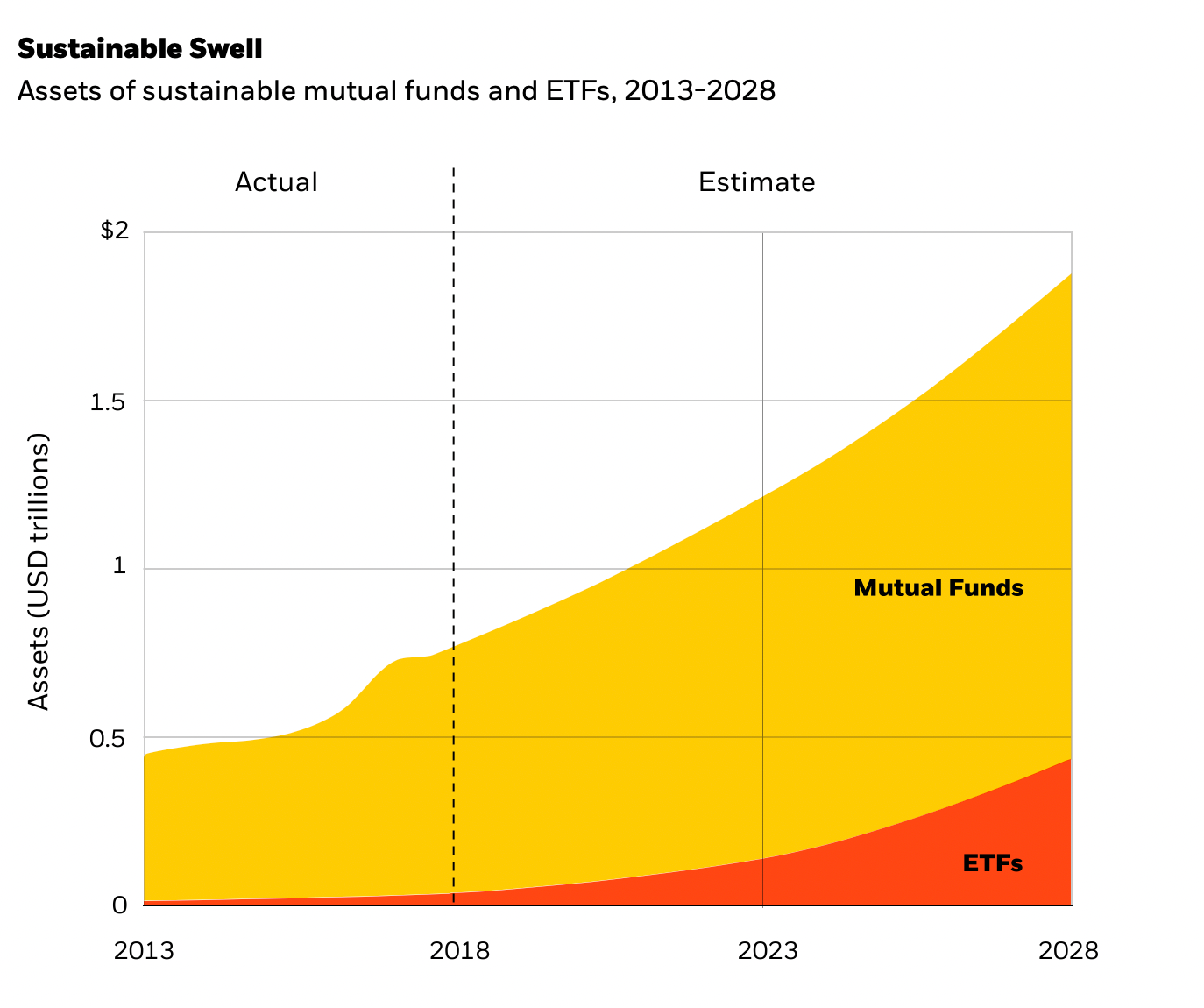

ESG stands for environmental, social, governance; broadly speaking, for companies with ethical behavior. In TradFi, $288bn poured into ESG related ETFs and mutual funds in 2020; that’s a 96% increase to the previous year.

Since super capitalist BlackRock CEO Larry Fink has jumped on the sustainability wagon, it has become clear that there is a new investor paradigm rising. Larry even admits that his strategy shift does not come out of the goodness of his heart, but because this is where he expects the biggest returns of the future.

Transparent, ethical behaviour is in demand.

People increasingly want to buy from sustainable companies, and therefore such companies will outperform their non-sustainable peers. It’s a smart investment rationale.

Moreover, big institutional companies such as BlackRock and Volkswagen have committed to only investing in sustainable finance options. This means they could not invest in crypto as it stands.

A rise in more sustainable crypto options could open the gates for these large institutional players and allow the next trillion dollars to flow into the industry.

2. WAGMI - We are all going to make it and we have the resources to do good

WAGMI says it all—if we are all going to make it, we are able to use the resources to do good.

Let us not forget, Bitcoin was born out of frustration with the existing financial system right after the financial crisis in 2008.

If crypto can change the financial system and if Web 3 has the power to change old power dynamics, then crypto is probably the best-placed industry and technology to tackle some of the most pressing issues of our time, such as climate change and equality.

In fact, this might be exactly what’s missing to achieve mass adoption and onboarding of the next 100m crypto users. Most people only know crypto from the classic headlines and avoid it due to the negative reputation of high energy usage and its impact on the environment.

With the next wave of crypto companies that are climate positive and impact-driven, this bad reputation should change and get people excited to join the crypto community—not just for the financial incentives, but for its impact.

It’s easy to forget that crypto was not born to bring financial gains, but for its decentralised, permissionless aspects. It was born to revolutionize so many problems with today’s internet.

Additionally, the success of Klima DAO shows that there is a real demand for blockchain projects with an impact on the greater good. Klima DAO, an Olympus-based stablecoin backed with carbon credits, is tackling carbon emissions.

In fact, there is an increasing number of organisations looking to make the industry climate positive, amongst them the Crypto Climate Accord, whose members pledge to achieve net-zero emissions by 2030. Major crypto players like the trading platform FTX have announced big commitments and budgets to become carbon neutral.

Famously, the crypto council for innovation, founded by ARK founder Cathie Wood and Square founder Jack Dorsey, argues that crypto can be a driver for renewable energies.

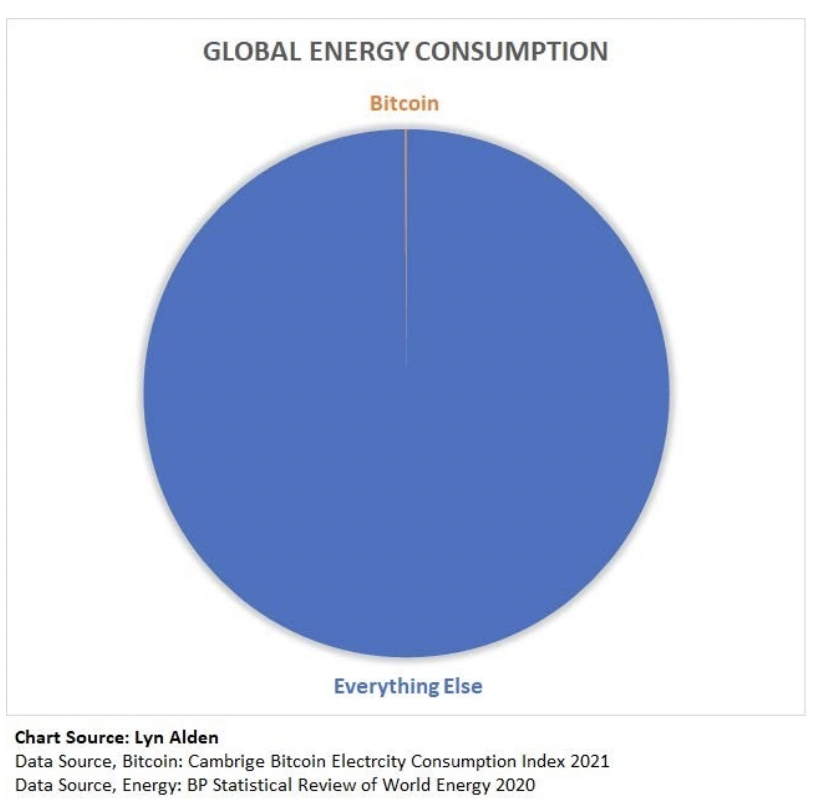

Lyn Alden’s energy report goes as far as saying that Bitcoin’s energy usage is not a problem. They show that if Bitcoin reached mass adoption with over 100m+ users, it would use about 0.1% of the world's energy consumption.

This is not that much for a network of such a scale, especially in comparison with similar services like Google, Youtube, Netflix, Facebook, Amazon, the cruise industry, Christmas lights, household drying machines, private jets... and basically any other sizable platform or industry.

“From that list, Bitcoin’s energy usage is the closest to that of the cruise industry’s energy usage, but bitcoins are used by more people, and the network scales far better.” Lyn Alden

The move towards more sustainability is growing in popularity, but the industry is still a long way away from becoming climate positive.

Additionally, when it comes to other ESG areas such as human rights, equality, diversity, etc. there’s not much around—yet.

Let’s look at the first crypto ESG pioneers—companies taking a wholesome approach towards the ESG framework—and the most innovative ideas to date.

3. Defi 4 Good - The most powerful ideas in the market today

Currently, there are not that many ESG-focused protocols that go beyond climate. But they’re coming. I’m particularly excited about:

- Popcorn DAO: Popcorn is a new paradigm for decentralized finance where yield-generating products simultaneously contribute to social impact. It is the first of its kind yield optimizer that gives investors great yields and donates a significant percentage of its management fees to impact initiatives, with a special focus on Environment, Free and Open-Source Software, Education, Reduced Inequality, and Free Press. The protocol is also carbon neutral. Earning yield never felt so good!

- Silta Finance: Silta is building the bridge between decentralized finance and infrastructure investments. Silta uses the power and resources of crypto to fund big infrastructure projects, such as the transition to clean energy.

- Grid singularity: A powerful idea that deserves attention. Grid singularity is building an energy exchange that provides an integrity solution in a major shift away from a traditional, centralized model of the energy market. If it works, it has the power to make energy markets more efficient and decentralized with many powerful application scenarios.

- Maker DAO going green: With The Case for Clean Money, Maker DAOs founder Rune Christensen has articulated a vision for how the issuance of its DAI stablecoin could be used to drive investment in clean energy sources at a global scale and turn DAI into the first green global currency.

These are just four of an ever-growing number of impact-driven, for-profit blockchain companies with real-world applications and impact.

Crypto investing can indeed be empowering. Watch out for an increasing number of companies that help you make yield while doing something positive for the world.

If you want to keep up to date, follow the hashtag #defi4good on Twitter.