Dear Bankless Nation,

Last week, we published “5 Reasons to be Excited about the Bear Market”.

Since then, ETH & BTC are up 6%, to $2,700 and $38,500. Not bad. The bear has stayed away for at least another week.

But you know what’s up way more than 6%?

NFTs.

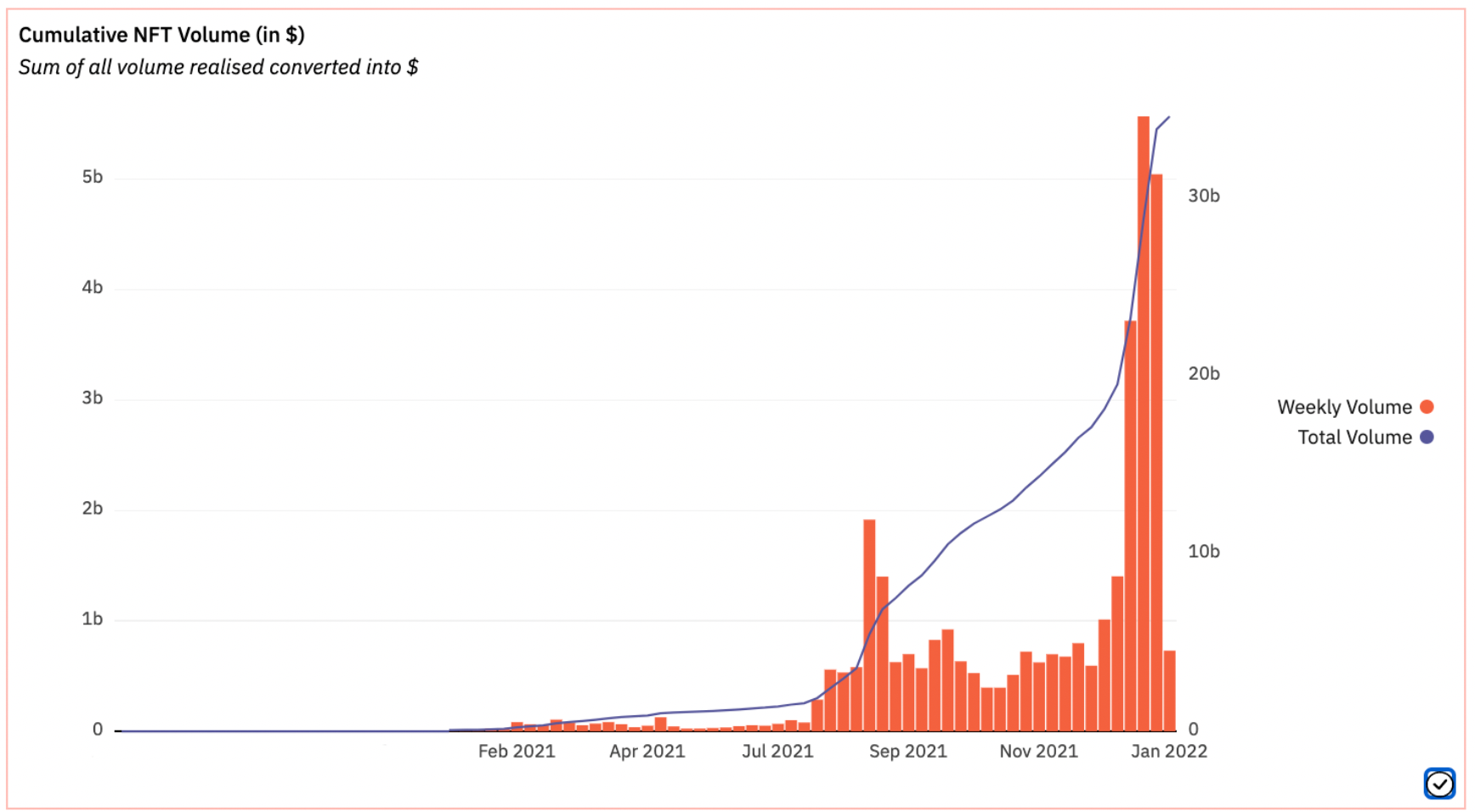

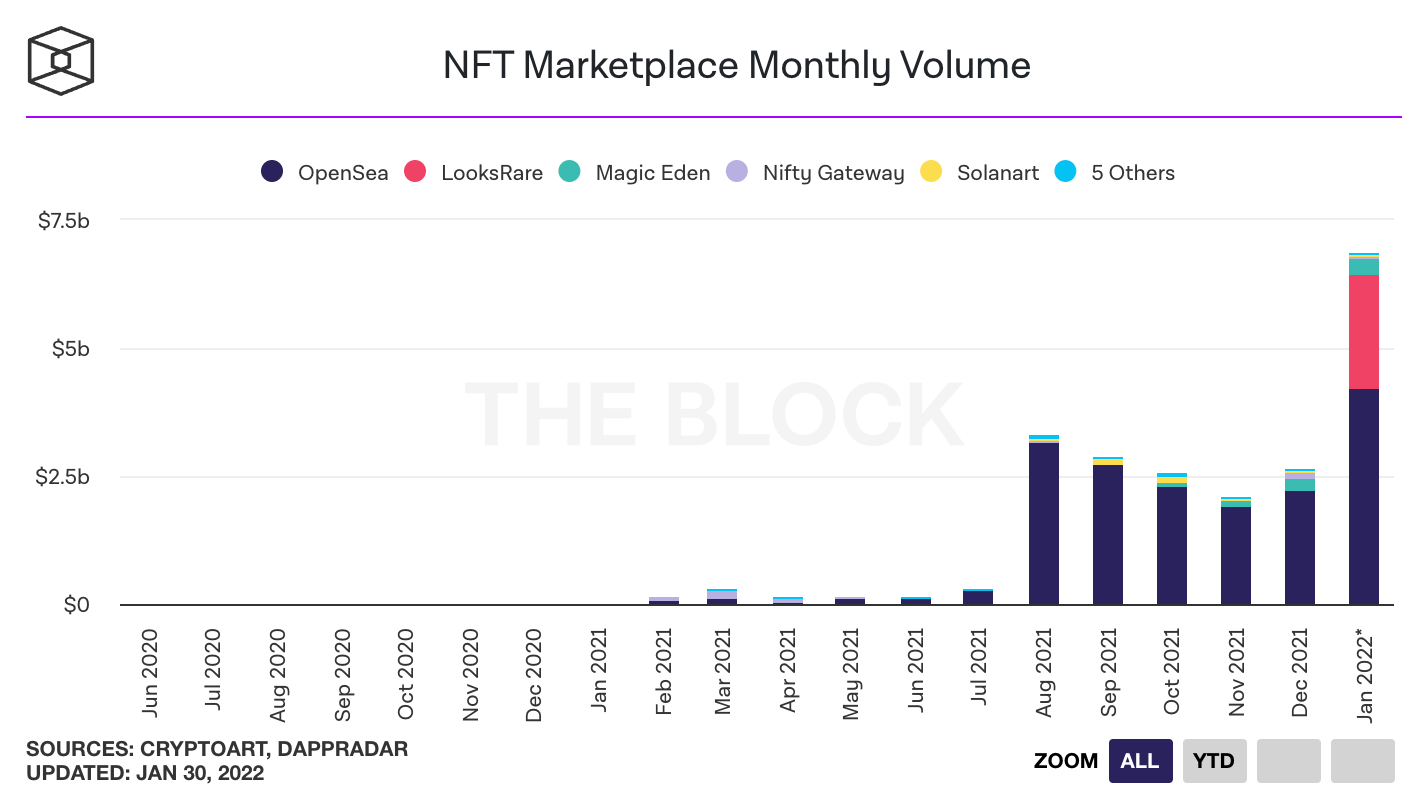

NFT’s have broken records in January.

It just goes to show… Crypto has fragmented into niche markets: L1s, DeFi, NFTs, GameFi, DAOs, etc.

And there’s always a bull market somewhere.

Every time I see the red “-20%” numbers on CoinGecko, I open up OpenSea and peruse the JPEGs as a coping mechanism to distract from the pain.

Apparently, I’m not alone. January NFT volumes have absolutely dominated all previous months, even after you take out the NFT wash-trading from LooksRare.

Why are NFTs going up while crypto’s going down? Simple: NFTs have net new buyers right now—the rest of crypto does not.

A few NFT collections have hit record floor prices, so let’s dive into a few of them!

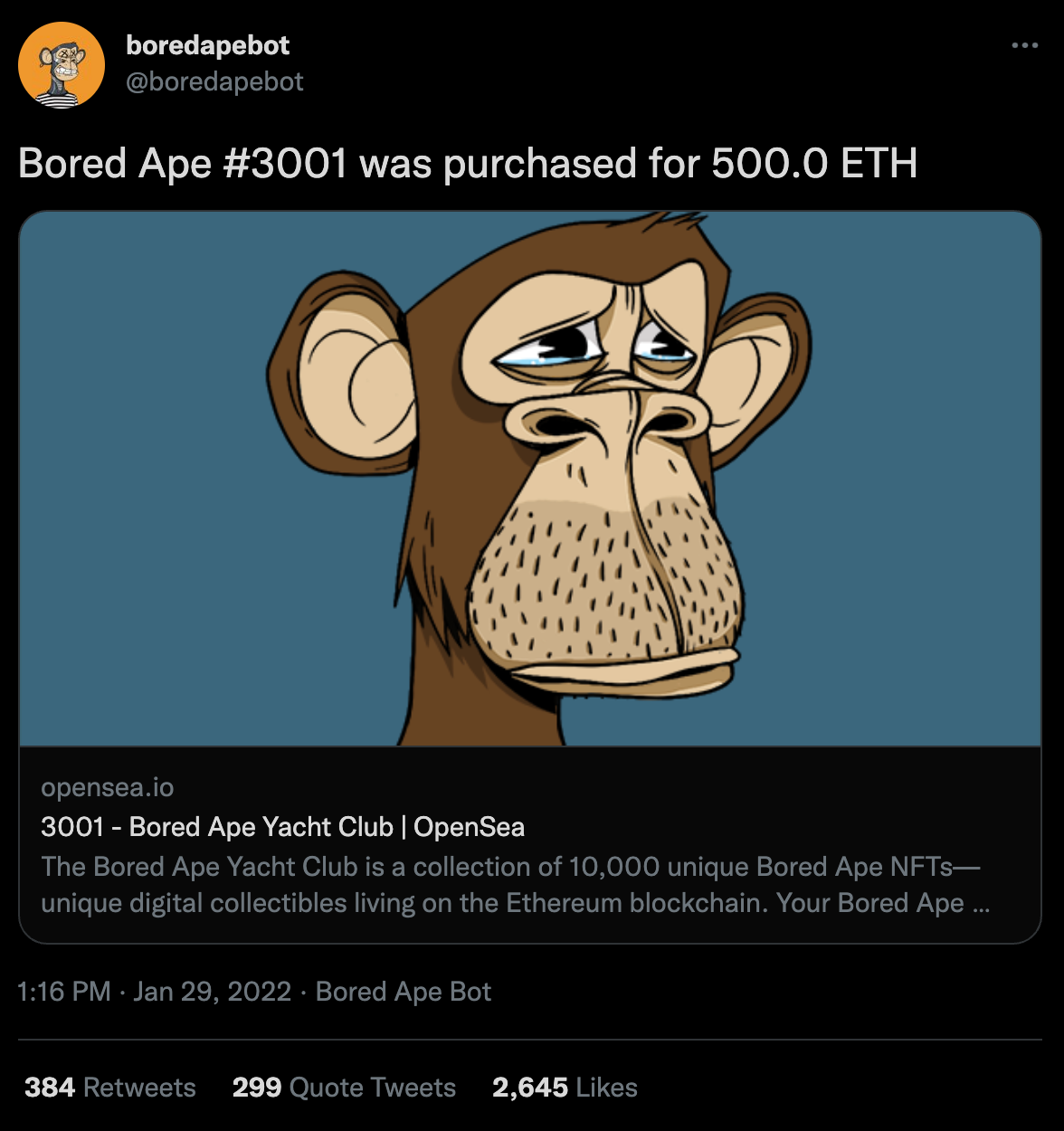

1. Bored Apes

The BAYC floor is at an astonishing 115 ETH. That’s $300,000+. 🤯

Absolutely mindblowing. I’m actually highly skeptical that this is organic demand; there are definitely some handshake deals between BAYC and celebs who are donning them as PFPs, making it hard to discern what’s true demand and what’s marketing, but that’s a topic for a different day.

Justin Beiber bought BAYC #3001 for 500 ETH, a purchase that has left many speculators perplexed as to why Justin would pay $1.3M for an ape that’s worth something closer to $250,000.

I guess it’s pretty on-brand for BAYC to be messing things up like this tho 🤣🤭

2. Doodles

Doodles have hit a 15 ETH floor, up from just 2-3 ETH a few weeks ago. Their unique art has attracted many believers claiming that they’re the next big thing!

I tried my best to get on the Doodle train, but I just couldn’t find resonance with them. Eric Conner told me to HFSP.

Justin Beiber disagrees, and also hopped on the Doodle train.

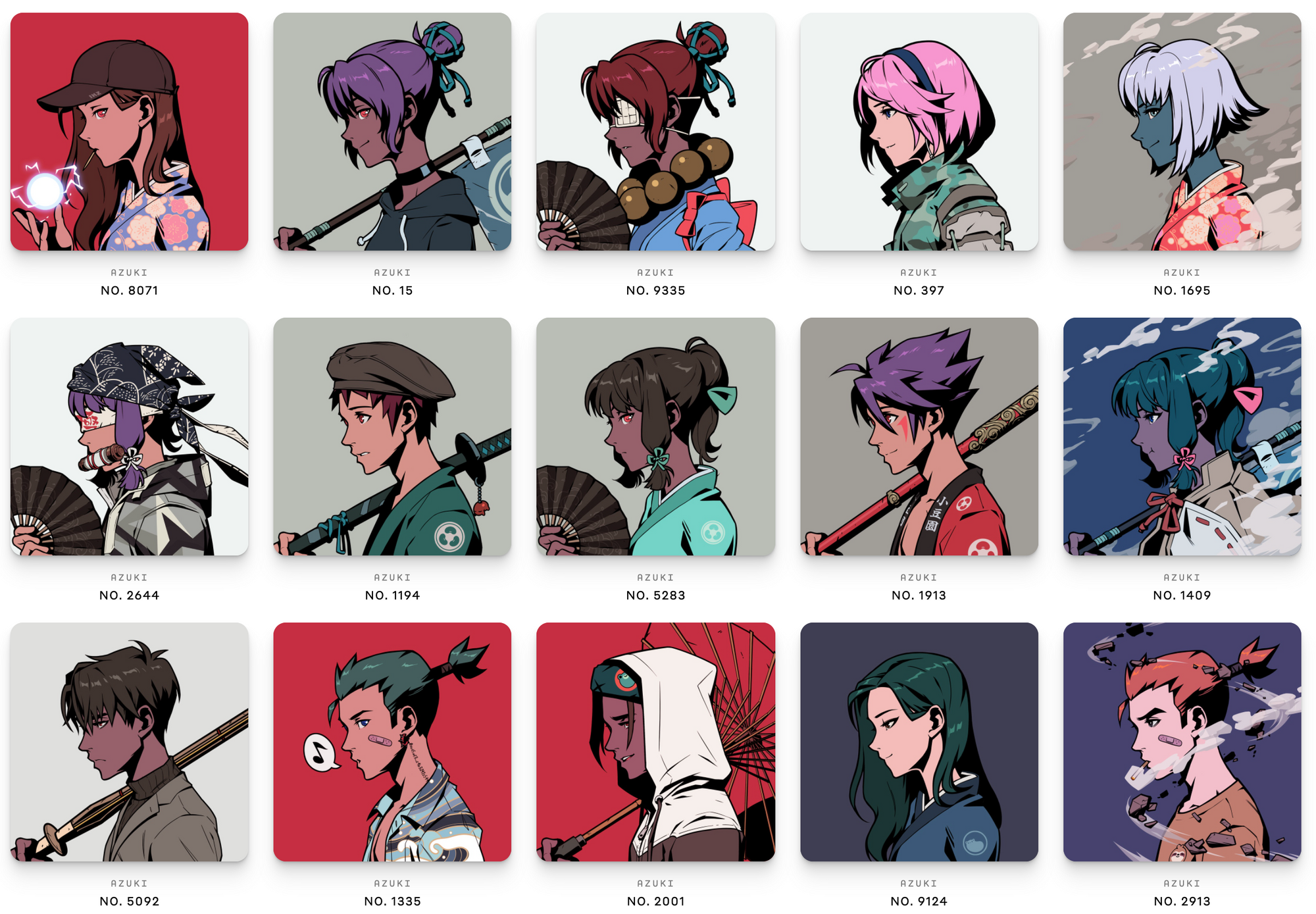

3. Azuki

Azuki’s are new on the scene. Just 21 days old, and have risen to a 10 ETH floor.

These PFP NFTs have found resonance with anime and Asian-culture lovers, but also with 3x NBA champion Andre Iguodala.

Absolutely no clue why he chose a snot-bubble Azuki to flex on his 1.3M followers… but… Hey, to each their own.

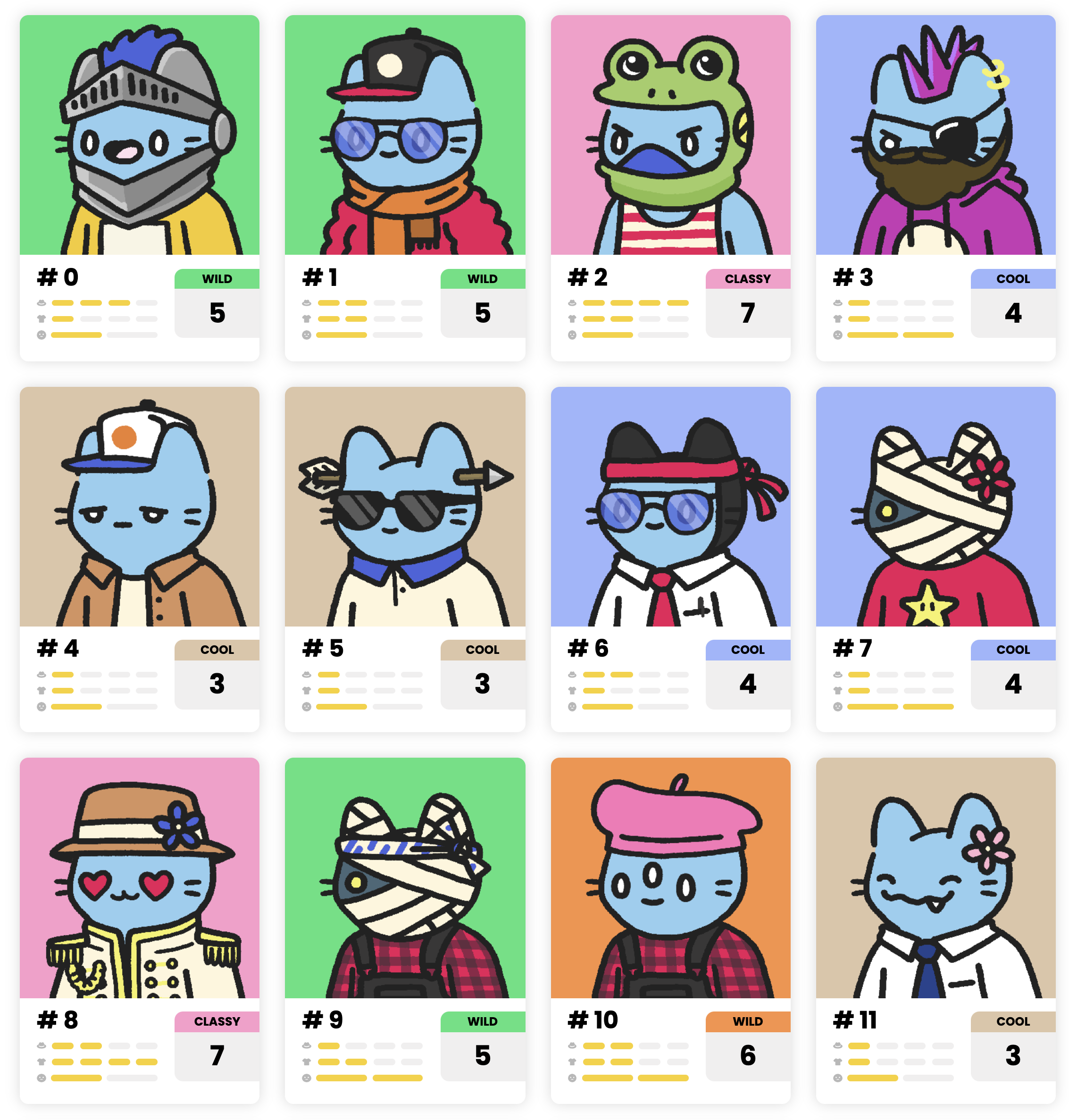

4. Cool Cats

The Cool Cat floor is at 15 ETH! The whole cat community is very excited about Cool Pets, which is like a Bored Ape Kennel Club addition to the cat’s ecosystem but also has a Neopets element, where you can engage and care for your pet.

Innovation like this has become the new table-stakes for an NFT ecosystem, as attention is always fleeting. High-touch things with hyped announcements are definitely driving attention to Cool Cats and are one of the main forces behind the rising floor price.

Also, they’re just so damn cute!

We like the cats ¯\_(ツ)_/¯

(disclaimer, I own 1 cat)

Not-Pumping NFTs that are also my bags

There are a few NFT projects out there that have strong highly engaged communities that have captured my attention lately!

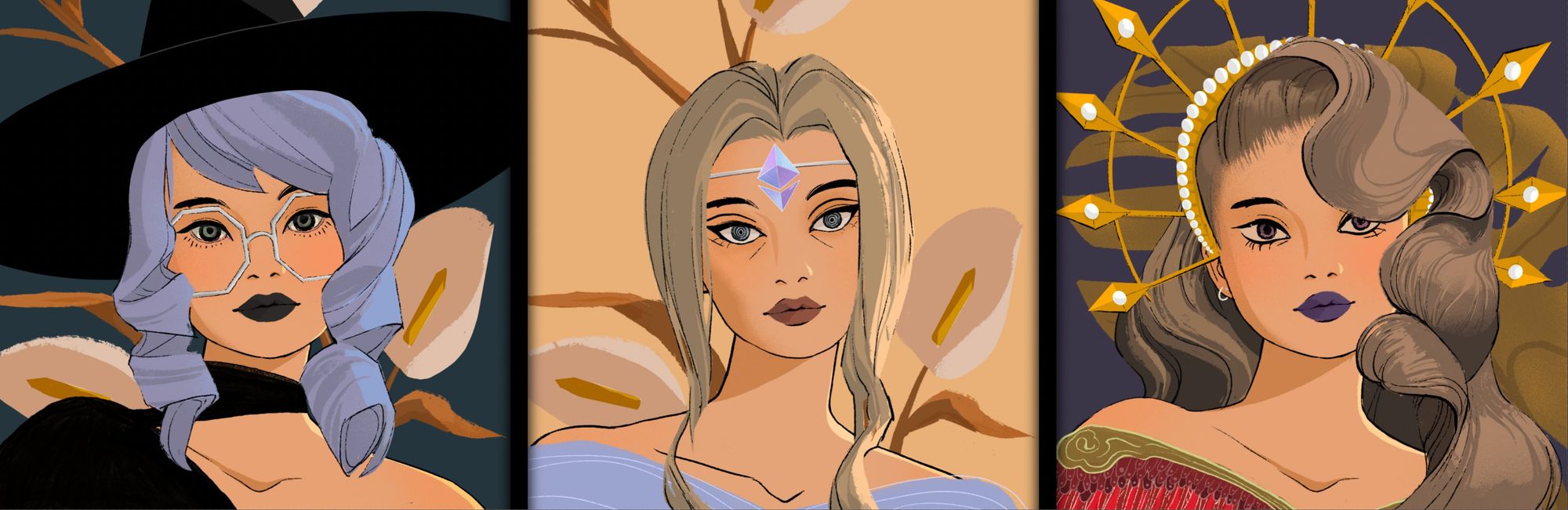

1. Crypto Covens

I’ve fallen in love with Crypto Covens lately. It’s a female-led NFT project featuring various witches. The art is super unique and the community is very grounded and wholesome!

The play is that this becomes the lady-beloved NFT project, shoulder-to-shoulder with World of Women. Most of my Web3 lady friends love this project and the endless permutations of hairstyles and looks.

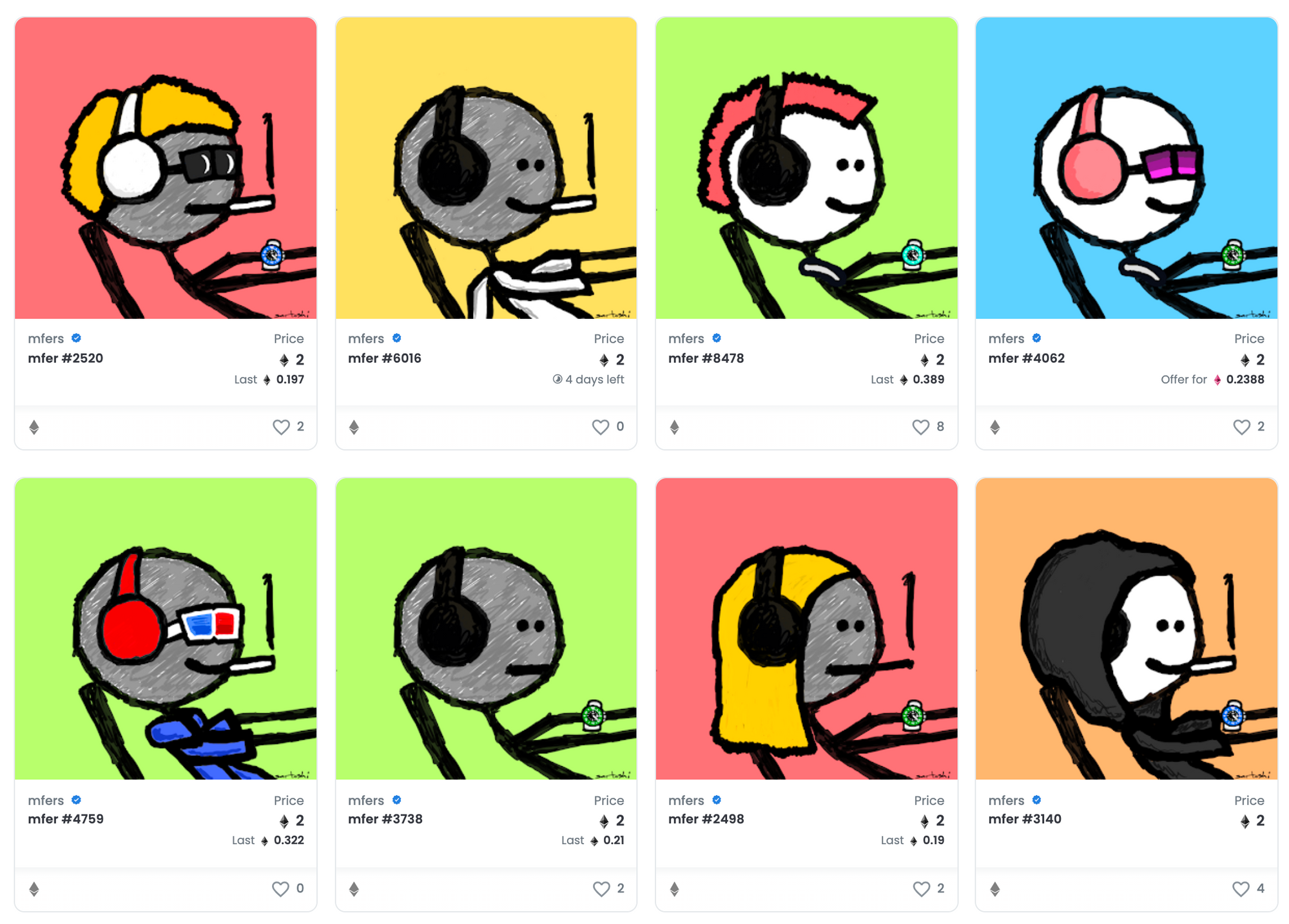

2. MFers

MFers are hard to hate.

They’re the perfect level of facetiousness but also good vibes. They’re not as egregious as CryptoDickButts when it comes to ‘sticking it to the man’, but they’re still so offensively simple.

Concluding Thoughts

People are leaning into the ‘fun’ aspect of NFTs lately. NFTs are helping us collectively recover from the gut-punch of this year’s price action.

It’s been impressive to watch floor prices go up almost universally in ETH terms, while the USD value of ETH falls.

The crypto markets continue to segregate and mature into better versions of themselves!

Markets are reeling, but communities are vibing. Which begs the question that I posed in last Market Monday’s piece: Does it feel like we’re in a bear market?

- David