Crypto Broke

Dear Bankless Nation,

When it rains, it pours.

Against a backdrop of high inflation, an economic slowdown, and a market that continues to grind lower, this past weekend in crypto was one of the most somber in recent memory.

In under 24 hours, we saw:

- A 7-hour network outage on Solana

- A multi-billion-dollar liquidity crisis on Fantom

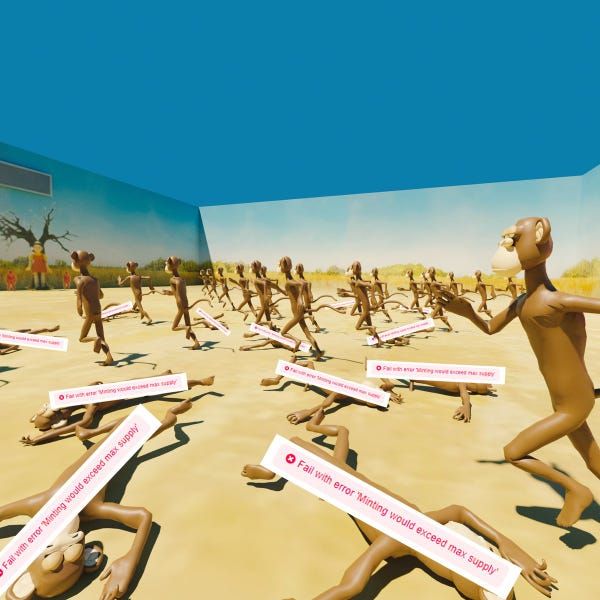

- A $100M gas war with the BAYC land mint

- Two 8-figure DeFi exploits on Saddle Finance and Rari Capital

With each happening one after the other, it felt as if—albeit briefly—crypto broke.

While each of these crises has been seemingly triaged, the weekend served as a sobering reminder of the numerous obstacles standing between crypto and mass adoption.

Web3 may be the “next big thing”, but if this weekend taught us anything, it’s that we’re not ready for prime time (yet).

Let’s go through each of the weekend’s major incidents and see what we can learn.

1. Solana Network Outage

Solana, the third largest smart contract platform by market cap, experienced a seven-hour outage, losing consensus after the network was overwhelmed by a barrage of NFT minting bots.

This is Solana's second complete outage in under nine months, as the blockchain experienced 17 hours of downtime following a similar incident in September 2021.

The network saw an additional nine days of partial outages in January 2022.

These incidents are a stark reminder of the importance of transaction fee markets for blockchains. While it can increase the cost of transacting (as we’ll see later), fee markets are a disciplinary mechanism that deter blockchains from being swarmed by spam attacks and transaction overload.

It remains to be seen whether or not Solana’s persistent performance issues deal long-term damage to its promising DeFi and NFT ecosystems, but are the latest demonstration of the design flaws present in monolithic blockchains.

2. Fantom Liquidity Crisis

While Solana experienced a “protocol crisis”, Fantom, another L1 blockchain with $3.19 billion in TVL, came close to experiencing a financial crisis.

The scare began when a well-known Fantom whale known as “Roosh” had more than $50 million FTM position in Scream, a money market, that was at risk of liquidation. This led to fears of a cascade across Fantom DeFi, with many speculating that the unwinding of the whale’s position, and subsequent decrease in the price of FTM, would led to a situation in which there was not enough underlying liquidity to close out all insolvent positions on-chain.

While gas on the network spiked to more than 35,000 gwei, and the price of FTM dropped 18% on April 30 as portions of the whale’s position were liquidated, the worst-case scenario did not ultimately come to pass.

Regardless, the incident is an indication of the systemic risks that are ever-present in DeFi.

3. APE Mint Gas Spike

Yuga Labs, the entity behind Bored Ape Yacht Club (BAYC), caused a stir with their highly anticipated mint for land in Otherside, an in-development metaverse project.

The sale raised $317 million, but not without causing massive gas spikes and congestion on Ethereum, with prices briefly hitting more than 8000 GWEI. In total, more than $172 million was spent on gas, with much of that figure consisting of failed transactions.

Aside from frustration over the high gas prices, Yuga came under further scrutiny due to the design of the mint. Despite having suggested that they would use the mechanism, the sale was not conducted via a dutch auction.

It was also revealed that Yuga used highly un-optimized contracts for the mint, which helped contribute to the extreme spikes in transaction fees.

In response to the events, Yuga Labs stated that it was “abundantly clear that ApeCoin will need to migrate to its own chain”.

Does Ethereum need to scale or are you just finding a narrative to pump your token?

Of course, Ethereum needs to scale. But we’ve also seen this playbook before.

Why don’t the apes migrate to an L2?

4. Fuse and Saddle Exploits

As if outages and congestion on three chains weren’t enough, Ethereum DeFi protocols also experienced two eight-figure hacks on Saturday.

The first was an $80 million exploit on Fuse, a protocol from Rari Capital and the Tribe DAO that enables the creation of isolated lending markets. Attacked via a flash loan and taking advantage of re-entrancy vulnerability, eight pools on Fuse’s Ethereum and Arbitrum deployments saw a portion of their funds lost.

Then Saddle Finance, a fork of the decentralized exchange Curve, lost $11 million through a flashloan attack that manipulated the price of sUSD/USDC/USDT/DAI, enabling funds to be drained from that pool.

These hacks, which combined to steal $91 million in user funds, are another in what has now become the worst year on record for DeFi exploits. Per Peckshield, In just over four months, DeFi has lost more than $1.57 billion to hacks. This is already $20 million more than all of 2021.

There is no risk without a commensurate reward.

DeFi has the potential to become one of humanity's greatest forces for good, but, as we often say, it’s the Wild West. This new financial system is a frontier and one that continues to be objectively dangerous for useres.

Please be cautious and exercise proper risk management—learn best practices and how to protect yourself against hacks.

Crypto Is Resilient

While things felt bleak over the weekend, the four events listed above are ultimately demonstrative of crypto’s anti-fragility. Despite a chain outage, a near-liquidity crisis, a gas spike that illustrated the desperate need for scalability, and multiple DeFi exploits, the world kept spinning without the need for government bailouts.

Bitcoin, Etheruem, Terra, Avalanche and other L1s still produced blocks, Arbitrum and Optimism submitted proofs, and DeFi continued to secure more than $150 billion in value.

The weekend highlighted the numerous hurdles that must be cleared before onboarding billions.

But like a boxer withstanding an onslaught of punches, crypto showed us that it still has an iron chin.

It bent. But it didn’t break.

- Ben