Crypto's Clarity Bill Hangups

View in Browser

Sponsor: Bitget — New ATH for Gold! Trade Gold, silver, and more directly on Bitget.

- 🚦 MegaETH's Public Mainnet Coming February 9. The L2's mainnet launch will follow a week-long stress test that aims to process 11 billion transactions at a sustained 15–35K TPS.

- 💸 Fidelity Selects Ethereum for FIDD Stablecoin Trial. The new stable token, dubbed Fidelity Digital Dollar, will launch on Ethereum in the coming weeks.

- 🔮 Vitalik Buterin Reveals His $70k Winning Prediction Market Strategy. In a new interview, Vitalik explained how he made a 16% return through Polymarket in 2025.

| Prices as of 5pm ET | 24hr | 7d |

|

Crypto $3.11T | ↗ 0.2% | ↗ 1.3% |

|

BTC $89,315 | ↗ 0.3% | ↘ 1.0% |

|

ETH $3,016 | ↗ 0.1% | ↘ 0.9% |

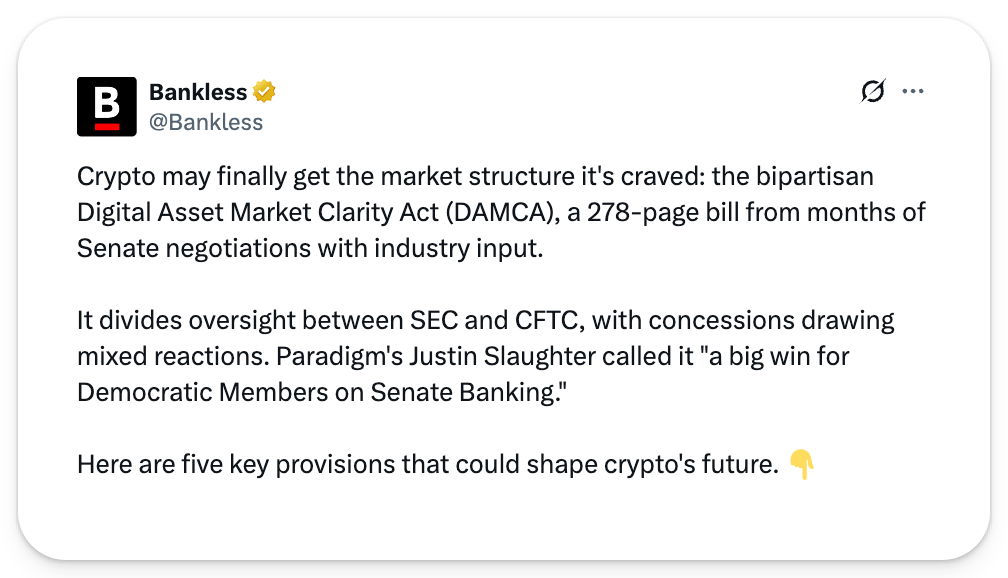

Crypto spent over a decade in regulatory purgatory. Now, clarity may finally be emerging on the world’s largest financial stage.

The Senate is actively considering two separate bills that are aiming to define how digital asset regulations will be enforced. One is sponsored by the Senate Banking Committee, the other by the Senate Agriculture Committee.

While many crypto commentators have focused their analysis on the upside potential for crypto adoption once legislative clarity is adopted (particularly within regulated financial contexts), few have paid attention to the problems that clarity risks creating for today’s crypto incumbents.

Today, we’re highlighting some of the red flags from these two Senate bills.

🥲 The High Cost of Crypto Clarity

Both the Senate Banking Committee’s Digital Asset Market Clarity Act (DAMCA) and the Senate Agriculture Committee’s Digital Commodity Intermediaries Act (DCIA) want to regulate crypto activity in America.

These bills' mere existence have excited many, but if enacted as written they could disenfranchise existing players from crypto’s regulated future.

🏦 DAMCA Challenges

Starting at the top of the Senate Banking Committee’s DAMCA, extensive amendments made to the Securities Act of 1933 by Title I would empower the SEC with the ability to unilaterally create guidelines for how securities laws should apply to digital assets.

This means allowing the SEC to decide when people who were involved in a token’s initial distribution (airdrop recipients, paid KOLs, team members, and investors) share liability with the token issuer and making the SEC the ultimate arbiter of when a digital asset is considered a security or commodity.

Progressing to Title II, DAMCA contains highly controversial provisions that would prohibit stablecoin issuers from distributing yield back to passive token holders, enshrining a perpetual advantage for the banking sector at the detriment of its crypto-native competitors.

Meanwhile, Title III of DAMCA adopts a purist interpretation of “decentralized,” and seeks to impose sweeping regulatory requirements on any blockchain-based applications accessible to American users that fail to meet its lofty bar.

🌾 Issues with DCIA

Turning to the Senate Agriculture Committee’s DCIA, the situation isn't looking much better.

With the Senate Banking Committee overseeing the SEC and the Senate Agriculture Committee overseeing the CFTC, achieving comprehensive crypto market structure reform requires legislative buy-in from both committees. Foreseeably, both bills will be reconciled to produce an omnibus proposal that gets advanced before the full Senate and approved with a single vote.

DCIA would expand the authorities of the Commodity Exchange Act to an unprecedented degree, granting the CFTC (a regulatory body tasked with overseeing commodity futures markets, not commodity spot markets) absolute jurisdiction over spot digital asset transactions.

It would subject any fungible digital asset that can be transferred person-to-person on a blockchain without intermediaries – including network tokens like ETH and memecoins like DOGE – to regulation, enforced by a comprehensive CFTC licensing and oversight regime that is just as likely to capture Coinbase and NYSE as it is Hyperliquid.

The end result will be the total elimination of free choice for anyone swept into DCIA’s requirements, compelling regulatory compliance by vesting the CFTC with novel authorities to regulate digital assets more stringently than it does any other asset class.

No Slam Dunks Ahead

We’ve been awaiting the arrival of crypto market structure clarity for years, and now that it has finally arrived, investors will have to get comfortable with the possibility that digital asset clarity will blunt the crypto industry’s rough edges.

Many less-than-scrupulous crypto projects will likely fall by the wayside once crypto clarity is finally delivered, making it more important than ever to prepare yourself (and your portfolio) for the prospect of a regulated digital asset future.

Despite months-long drafting periods that should have afforded crypto’s enmeshed lobbyists ample time to shape “favorable” clarity legislation, many major crypto firms now oppose DAMCA and DCIA. While the timelines for clarity enactment remain unclear, the final fate of DAMCA and DCIA now rests with Congress.

Gold and silver are printing fresh highs. Ride the momentum on Bitget: trade 79 macro markets—commodities, forex, and indexes—directly with USDT. Diversify in one app with deep liquidity, low slippage, and up to 500x leverage to match different risk styles.

In an age of increasing wrench attacks, I want to echo some simple advice from security professionals: if you’re a crypto investor working in public you should never have access to more than $1k in crypto from home.

Let's round it to zero – you should have zero crypto at home.

That means no access to crypto without multiple private keys, third-party in-person verification, and multi-day time delays. Not on your phone, not on your computer, not on your hardware device, not in your house, not with a phone call.

- No hot wallet at home with funds over $1k.

- No cold wallet at home, period.

- No exchange that allows you to move funds without verification and delays.

- Zero crypto at home – don’t break this rule.

Yes, this is inconvenient.

But, it’s a tradeoff in order to maintain the safety of those you care about. The increasing number of wrench attacks on leaked crypto holders is still rare but very real.

Watch this local news report from a case in September of 2025 where two brothers drive from Texas to Minnesota to wrench attack a family – while the attackers were captured, the remote orchestrator and mastermind are likely still active. Attacks like these are only becoming more common.

The data leaks, the AI tools, the increasing criminal sophistication, the lack of onchain privacy – I believe these factors will result in physical attacks getting worse before they get better. (I do have some confidence attacks will decrease in the long run as our world adapts to digital bearer assets and our privacy tech improves – but that’s not the world we live in today)

Would you keep briefcases of cash at home?

How about bars of gold bullion?

Here’s the thing: if you can access large amounts of wealth and send it somewhere in minutes, with no third party to confirm you’re not under duress, then alarm bells should be going off in your head – you’re not just your own bank, you’re the bank security guard.

Do you want the life of a 24/7 security guard? You want that burden of vigilance and risk? Your phone, your pocket, your computer, your house – these are not places to store access to tens of thousands of dollars. Bearer assets are tremendously powerful, and scary. Treat them with reverence.

You don’t have to keep crypto at home in order to go bankless.

There’s a growing set of solutions for holding zero crypto at home...

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.