Pokémon Cards Onchain: The Courtyard Surge

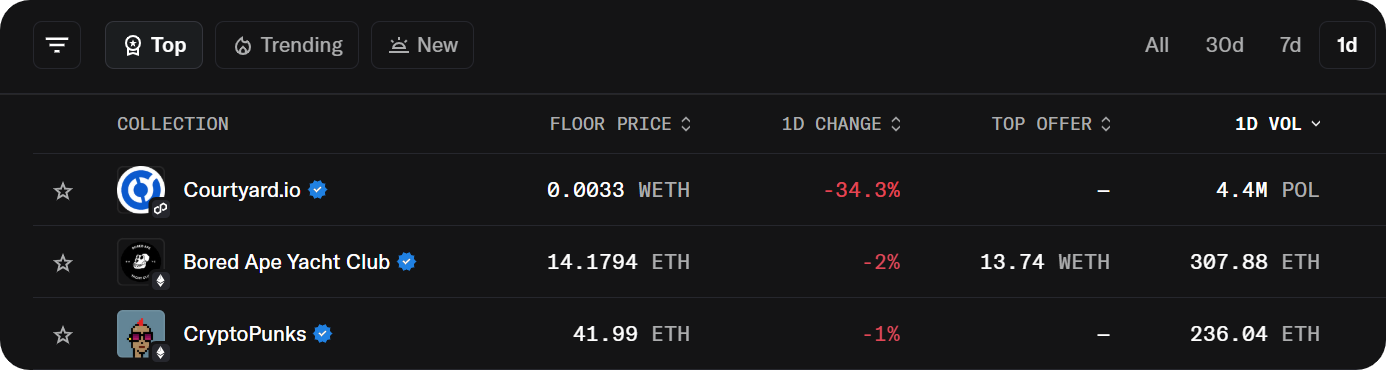

One NFT project has been routinely topping the biggest collections, like CryptoPunks and Bored Apes, in trading volume lately.

The project? Courtyard.

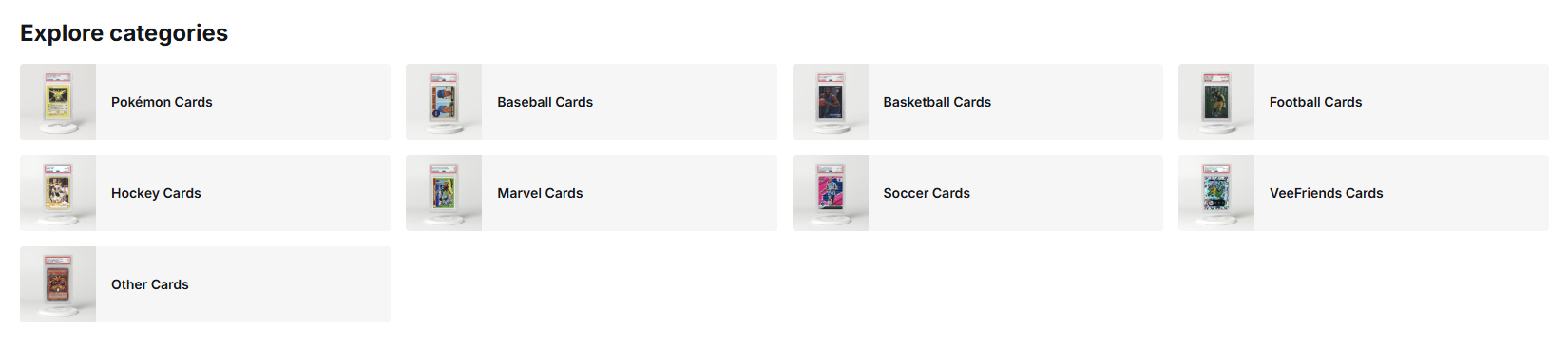

If you're not familiar with it, the platform lets you tokenize physical cards and rip digital packs of tokenized cards like Pokémon, etc. And it's showing considerable strength right now.

For example, over the past day Courtyard facilitated the most volume in NFTs according to OpenSea, which CryptoSlam backs up with even higher 24-hour volume stats.

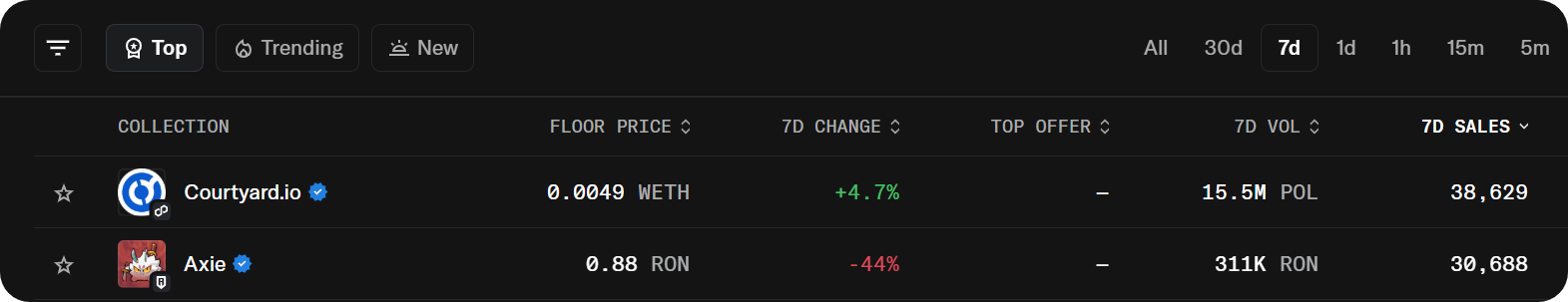

Then over the past week, Courtyard had +38.6k unique sales—the second-best project with +30.6k sales in that span was Axie Infinity, which boasts one of the largest user bases in crypto.

All that's to say, Courtyard is seeing serious traction right now.

And while "real world assets" may evoke DeFi projects like Maple Finance and Superstate for most people today, Courtyard is demonstrating what product market fit can look like in the culture side of this arena.

There are major tailwinds ongoing here, too. Sports cards and Pokémon cards are Courtyard's most popular items, and both of these markets are experiencing explosive growth beyond crypto.

For instance, Pokémon was reportedly the only toy brand to top $1 billion in US sales last year. The franchise's cards are hotter than ever.

In kind, Courtyard's window of opportunity has arrived. Its tokenized collectibles trading is bringing these cards online in a new compelling way, offering onchain liquidity, revenue sharing for tokenizers, transparent provenance, and vaulting-as-a-service.

In other words, it's a good time to dive in. If you're new to Courtyard, you can create an account and receive an embedded wallet by signing in with your email or Google account.

Deposit funds from your wallet or Coinbase Onramp, and you'll be ready to begin. Alternatively, you can just pay with a credit card at the checkout screen if you find anything you want.

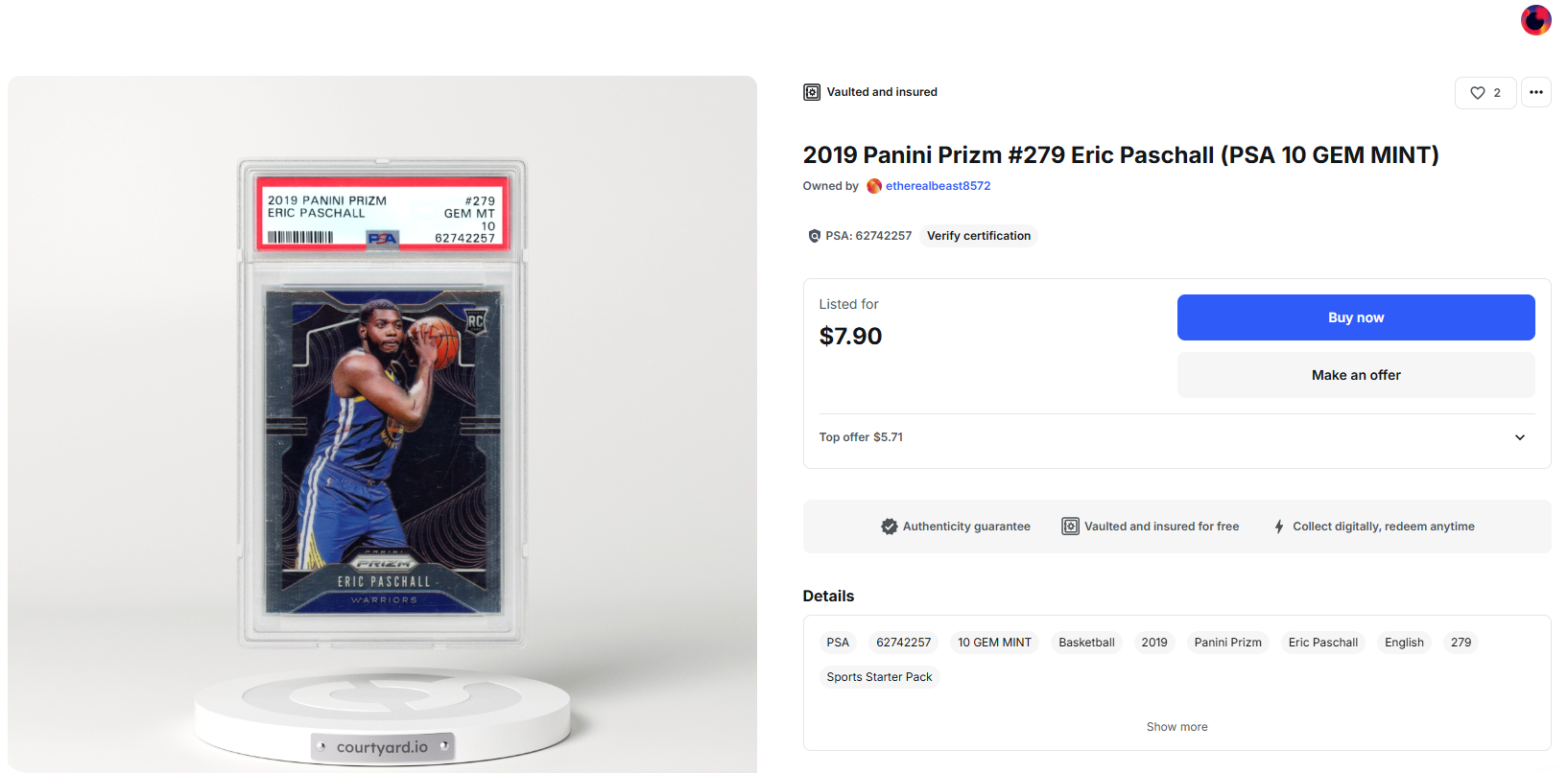

At this point, you can browse the main Marketplace and sort by filters like "Recently listed" or "Price: Low to high." For reference, the cheapest card at the time of writing was $8. You can also use the "Make an offer" option on cards if you want to try bargaining for better prices.

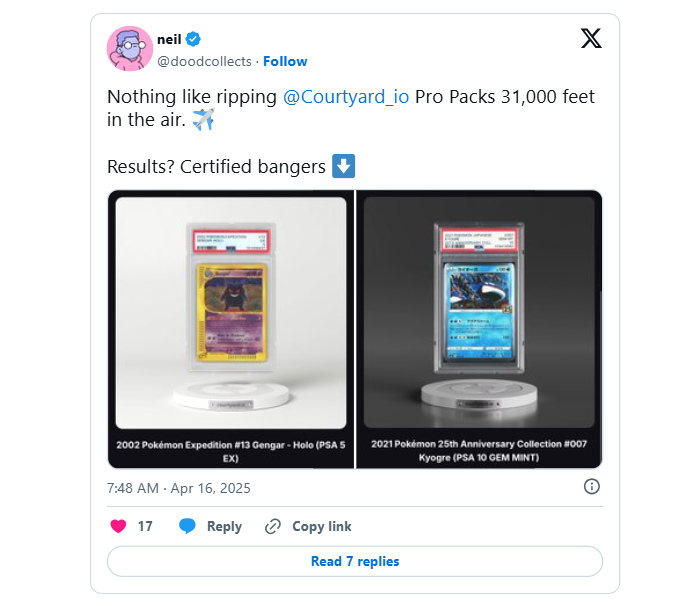

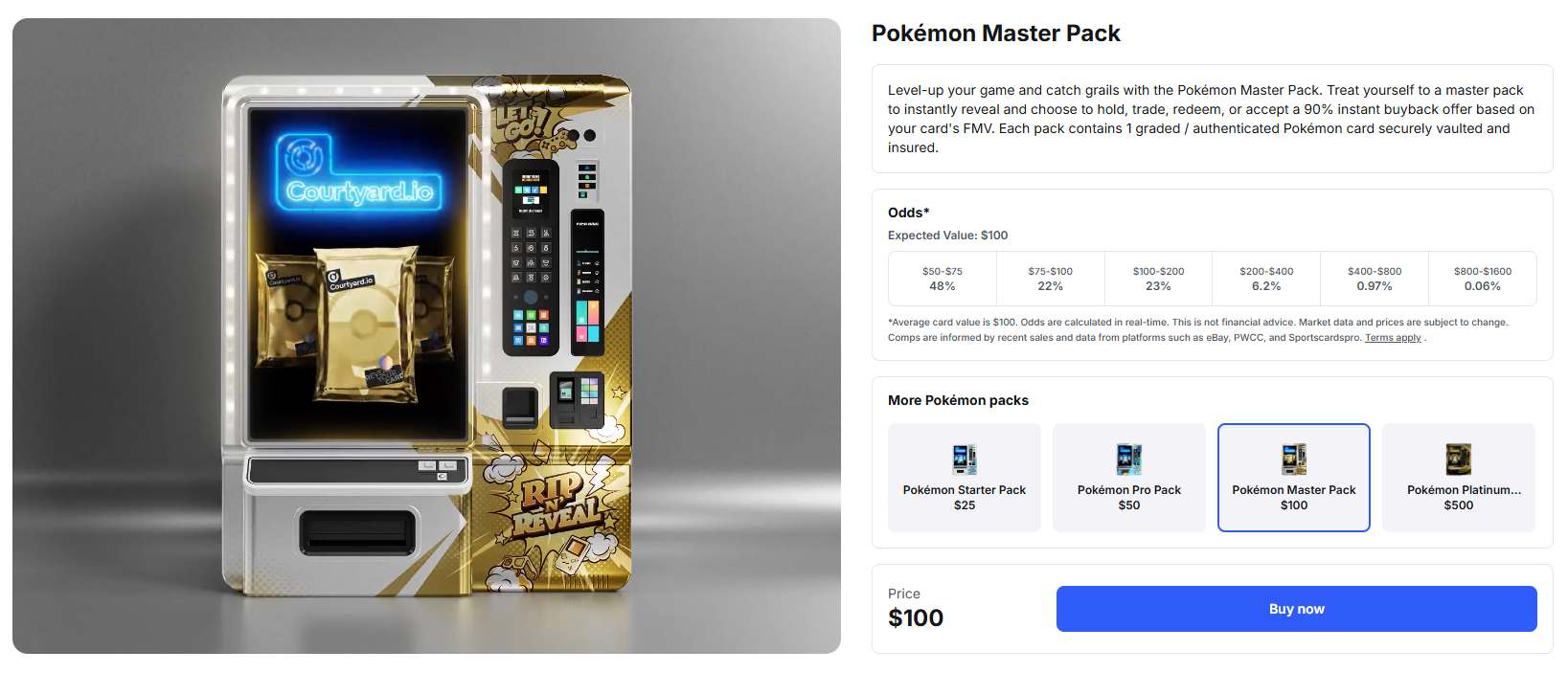

Another page to explore is the Vending Machine, where you can buy and open mystery packs of tokenized cards.

Every pack comes with one card and in different tiers. The cheapest are Starter Packs at $25, while the most expensive are Platinum Packs at $500.

On the actual pack pages, you can review the odds of your pull's expected value. For example, if you buy a $100 Master Pack, you have 48% odds of pulling a $50-$75 card, but you also have a small chance of pulling a $800-$1600 card. Luck of the draw, right.

And let's say that you try ripping a pack, but you don't love your pull. Courtyard will give you a 90% instant buyback offer on your new card if you want to quickly move on. Not bad.

All in all, Courtyard's showing us that the future of physical collectibles doesn’t have to stay locked in closets or binders. It's delivering something that resonates, and it's easy to use and gaining real traction.

Whether you're a flipper or a diehard collector or somewhere in between, this app's a must-try right now in my opinion!