Coinbase's Amazing, Terrible Week

View in Browser

Sponsor: Uniswap Labs — Unichain is live! Bridge & swap with Uniswap Labs' web app or wallet.

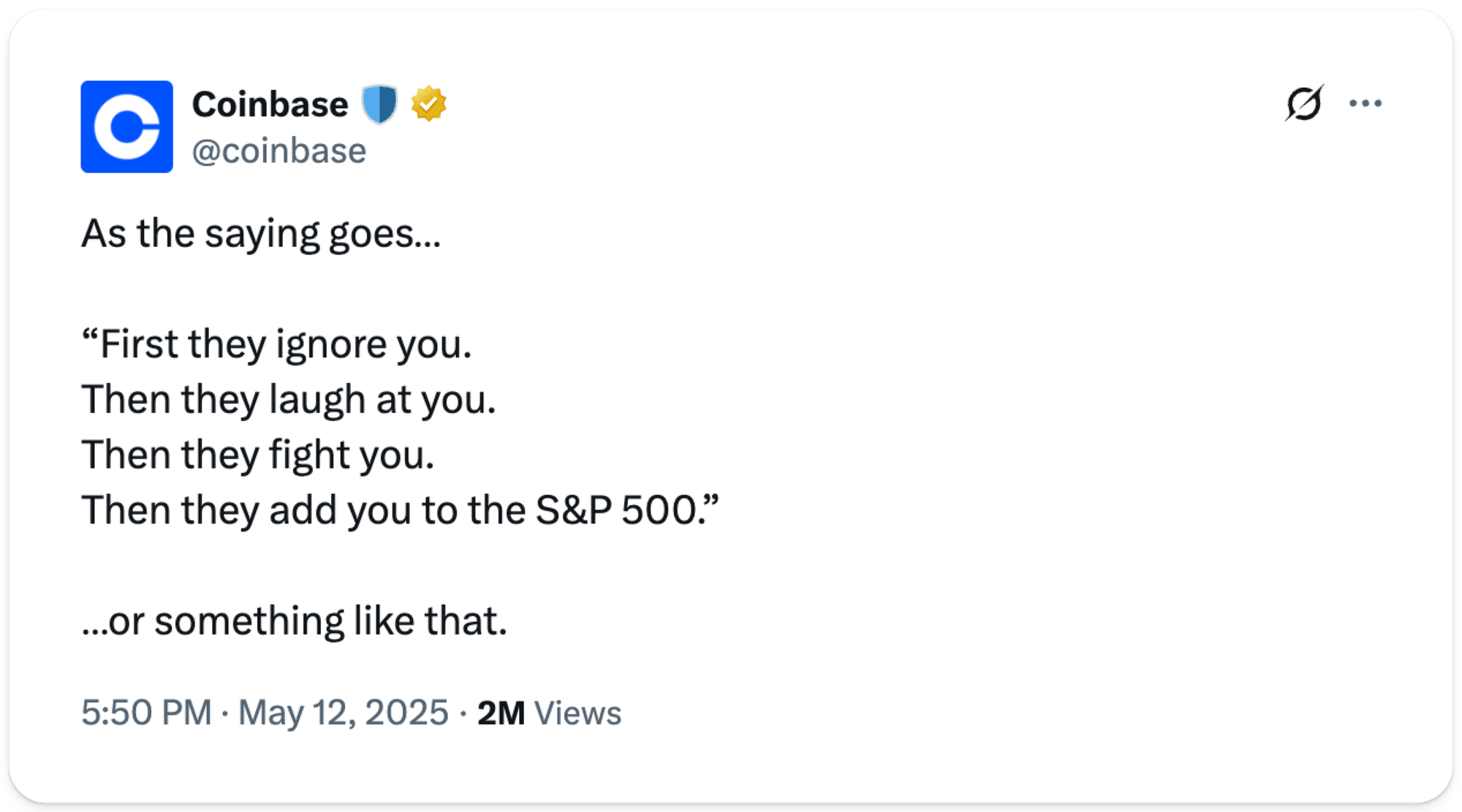

1️⃣ Coinbase’s Chaotic Week

Coinbase yet again dominated crypto news headlines this week.

After the U.S. stock market close on Monday, S&P Global announced that Coinbase (COIN) would replace Discover Financial Services (DFS) in its S&P 500 index, effective May 19. COIN’s inclusion in the capitalization-weighted index should trigger $9B of passive inflows, sending the stock soaring with 25% gains during Tuesday’s trading session.

On Thursday, the company’s fortunes deteriorated, with its stock selling off as much as 8.4% amid a concerning leak of the personal info of a large swath of customers including ID cards, contact info, and transaction histories. While the company said the total leak amounted to less than 1% of total customers, that's still a hell of a leak. Amid all of that ruckus, news also emerged of a long-standing SEC inquiry into alleged misstated user metrics in its 2021 IPO filing.

Despite the chaotic developments, Coinbase did end up recuperating the entirety of its Thursday losses and moving to new highs on Friday, the final trading day before COIN’s S&P 500 inclusion.

2️⃣ DOJ Won't Drop Tornado Cash Case

According to a memo penned by the U.S. Attorney for the Southern District of New York, former SEC Chair Jay Clayton, the Department of Justice will proceed with its case against Tornado Cash developer Roman Storm. This development comes despite an April release from the agency that it would pull back on regulatory charges involving digital assets, unless there is evidence that the defendant “willfully” violated licensing or registration requirements.

While charges against Storm for failure to comply with money transmitting business registration requirements have been abandoned, the original November indictment remains largely intact. Prosecutors are intent on trying the embattled crypto developer for conspiracy to commit money laundering, transmission of funds derived from criminal activity, and criminal sanctions violations.

The criminal case against Roman Storm will eventually yield a final decision, and the precedent it sets is bound to have profound implications for the crypto industry, open source developers, and internet freedom.

3️⃣ Yuga Offloads CryptoPunks IP

Bored Ape Yacht Club creator Yuga Labs has sold the CryptoPunks intellectual property (IP) and five associated JPEGs to the Infinite Node Foundation (NODE). While exact terms of the deal were not disclosed, it was reported that NODE paid approximately $20M.

Yuga Labs, which acquired the CryptoPunks IP rights and 423 individual Punks from creator Larva Labs in 2022 for an undisclosed amount, will retain 414 Punks in its treasury, worth over $50M at current floor prices.

Punk floor prices rallied 10% on the news and while most holders responded positively to the development, other would-be buyers felt short-changed by alleged terms – Pudgy Penguins CEO Luca Netz claimed he would have offered $75M for the rights.

Instead of transferring CryptoPunks to a profit-motivated corporation seeking to monetize the IP, the NODE deal transfers the collection’s valuable IP rights to a non-profit with intentions to establish a permanent exhibition in Palo Alto and maintain the brand as “the landmark collection of this century's defining art movement.”

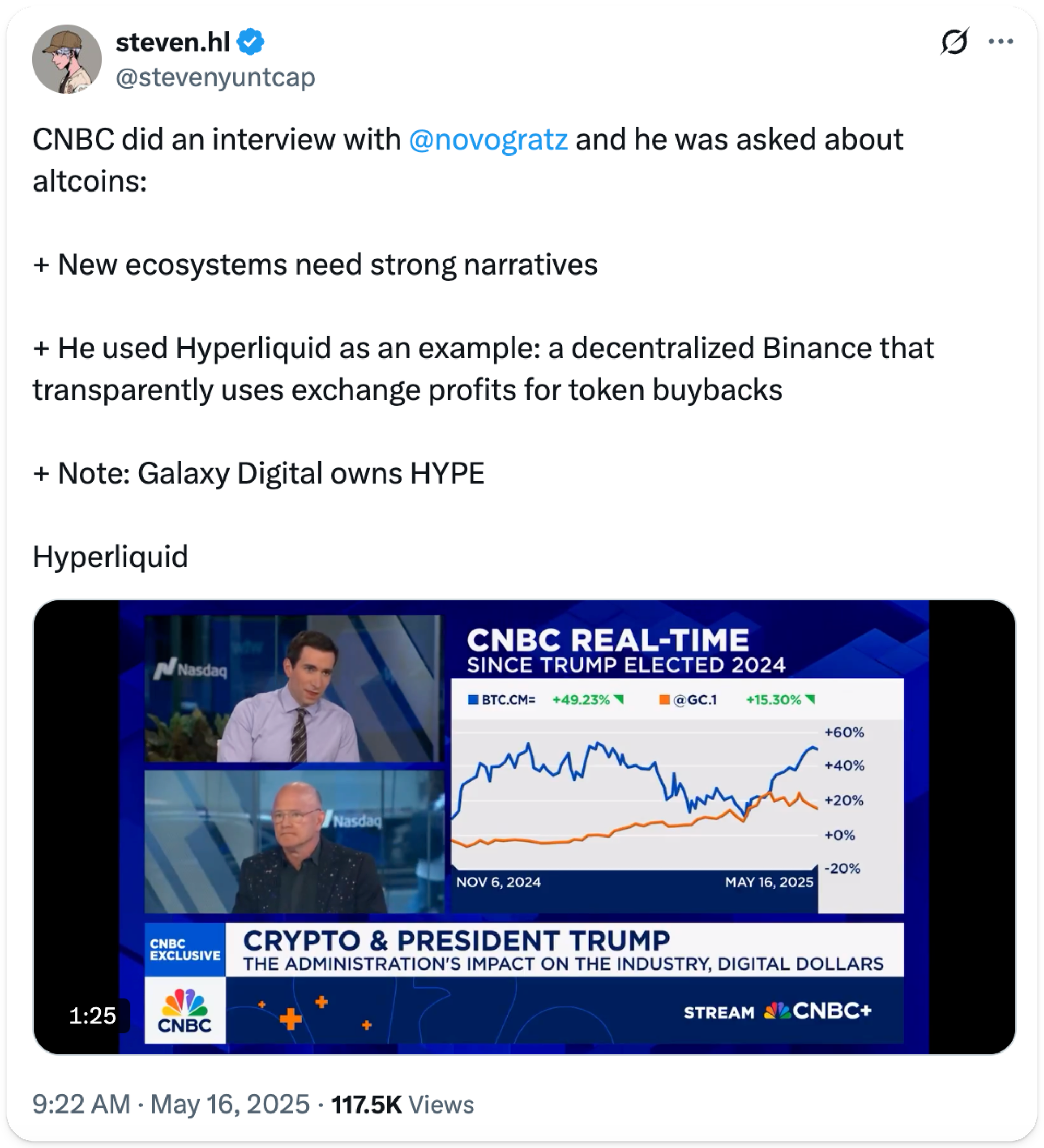

4️⃣ Hyperliquid’s Mainstreet Debut

During a segment about portfolio diversification released Tuesday by the Bloomberg Surveillance podcast, David Ballin (CEO of private equity firm CIO Capital) promoted Hyperliquid as a non-correlated bet with transparent revenues and the potential to become a game-changing financial product.

In an interview on CNBC Friday, Galaxy Digital founder Mike Novogratz – who previously ran afoul of the NYAG for publicly promoting Terra/Luna in 2022 while dumping hundreds of millions of dollars' worth of tokens on unwitting buyers – also lauded Hyperliquid for being a decentralized version of Nasdaq with strong growth potential and a token buyback program that could make sense for equity investors as a “next-generation token.”

Crypto natives were no doubt enthused to see one of their favorite tokens promoted to the investing public via multiple media outlets this week, but such high-profile publicity can mark local tops should whales be ensnaring liquidity to exit their positions.

5️⃣ MetaMask Token, Maybe?

OG Ethereum wallet MetaMask has been a leading “airdrop contender” since the term was first coined, and this week, the faithful who have continued to hunt this opportunity received confirmation that their efforts might one day be rewarded with an airdrop.

In an interview with The Block’s “Crypto Beat” podcast, MetaMask co-founder Dan Finlay confirmed that the popular crypto wallet is still considering a token launch, indicating one would be directly advertised through MetaMask and noting that an increasingly permissive regulatory environment under the Trump Administration provides “safety for far more kinds of token launches.”

Check out our top MetaMask airdrop hunt strategies.

Unlock the power of Unichain – a fast, decentralized Ethereum Layer 2 network built to be the home for DeFi and cross-chain liquidity. To bridge tokens to Unichain and start swapping today, get started with Uniswap Labs’ web app or mobile wallet.

This week, Ryan and David break down Ethereum’s explosive 50% surge and the surprising macro catalyst behind it: a U.S./China tariff deal that has markets ripping.

They cover Coinbase’s massive customer data leak (and Brian Armstrong’s $20M bounty response), Robinhood’s stealthy Layer 2 acquisition, and the rise of meme coins funding real apps. Plus, why Arthur Hayes thinks the bull market is just beginning.

Tune into this week's rollup 👇

📰 Articles:

📺 Shows:

Thoughts on how to make Bankless even better? Tweet me!

🧑💻 Lucas Matney, Bankless Editor