1️⃣ Coinbase and SEC battle continues

Despite Crypto's hopes and expectations that the SEC's case would get tossed, Coinbase's legal battle with the SEC will instead continue following a court decision that allowed most claims to proceed while dismissing those against Coinbase Wallet — a big win for self-custodial wallets. Ever the optimists, the exchange sees this as a way to gain insights into the SEC's stance on crypto regulation. Their Chief Legal Officer, Paul Grewal, stated they stand ready to continue the proceedings while emphasizing the importance of developing clear digital asset legislation in the US.

2️⃣ Sam Bankman-Fried Sentenced to 25 Years

The story of Sam Bankman-Fried's rise and fall ended this week with a final sentence of 25 years in prison. Despite Bankman-Fried's apology and appeals, Judge Lewis Kaplan saw no remorse for the $8B misappropriated from FTX customers and emphasized the severity of SBF’s crimes against the industry and its investors. With the sentencing over, the only question that remains: where will he serve his time?

3️⃣ April Showers Bring Airdrop Flowers

April looks like it will be a monumental month for degens, with several significant airdrops poised to inject billions into the market over the month. Hitting the ground running next week, Ethena will airdrop 5% of its total supply (~$600M in ENA) to participants of its first campaign on Tuesday, April 2nd. Wormhole will then distribute 17% of its supply ($3B based on current pre-market prices) to its users the following day, April 3rd.

Then, later in the month, airdrops from Solana protocols Parcl and Kamino will drop over another $200m in the ecosystem overall. With April historically being a strong month for Bitcoin, this additional stimulus may have us in for quite a ride.

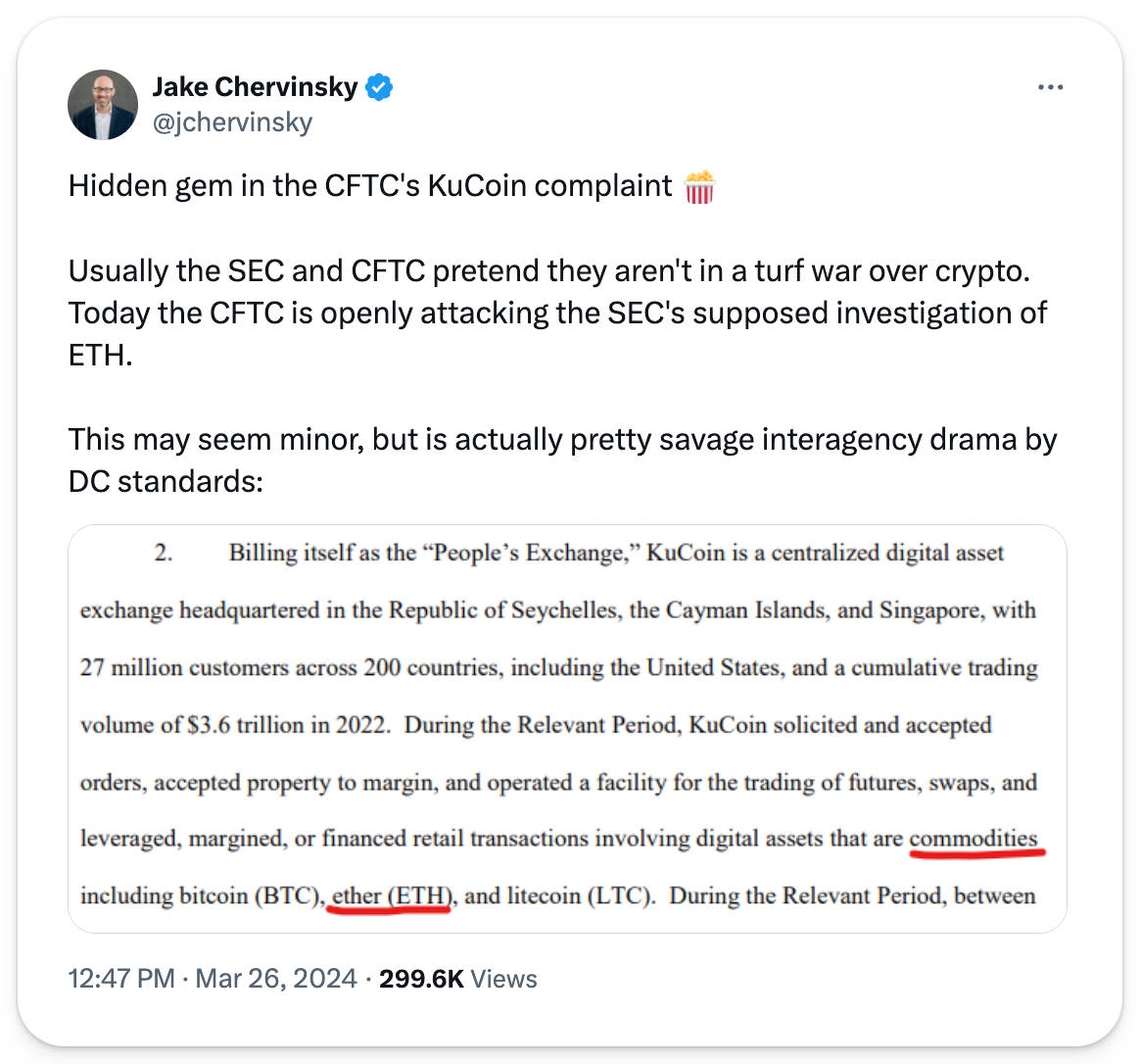

4️⃣ Kucoin Founders Charged Amid Regulatory Clampdown

Last Tuesday, the Department of Justice charged offshore exchange KuCoin’s founders with violating anti-money laundering laws and concealing that they had many US customers. For years, KuCoin operated without KYC requirements, adopting them only after coming under federal investigation. After the DOJ announcement, KuCoin users experienced substantial delays in withdrawing from the exchange — an inconvenience KuCoin decided to compensate users for with an airdrop announcement the next day for those who had delays. Amid this news, an interesting easter egg came from the complaint document, which defined Ethereum as a commodity in their suit — potentially weakening the SEC’s case.

5️⃣ ETH ETF Updates: Filings and Fink Comments

More updates for ETH ETFs this week, with new filings from Bitwise and Fidelity (a $4.5T asset manager) and comments by Blackrock CEO Larry Fink, who said the ETF is still possible even if ETH is a security. Both ETFs also included staking, following the trend of ETFs being updated to include this feature. Currently, Polymarket's prediction market gives the approval of these ETFs by May 31st only a 21% chance, indicating that approval would indeed be an unexpected development.