Dear Bankless Nation,

January was huge for crypto. We saw plenty of pumps. One outstanding success story has been Coinbase stock rallying after a truly dismal 2022.

Are we back? What should you do about it? Bankless digs into the details today.

- Bankless team

$COIN has been one of TradFi’s highest fliers over the past week!

The crypto equity saw a sizable gain of 55% after the Wednesday open. This comes off of an impressive 80% run-up since its local bottom. All in, $COIN is up an eye-popping 179% after touching $31 on January 6!

Market participants are all asking the same question: $COIN gud buy?

Brian Armstrong’s bags pumped for two primary reasons:

- Dovish Fed speak

- Positive legal news

Powell Is Doing Slightly Nicer Things

Broader markets (including equities, crypto, forex, and bonds) rallied on non-catastrophic news from the Fed.

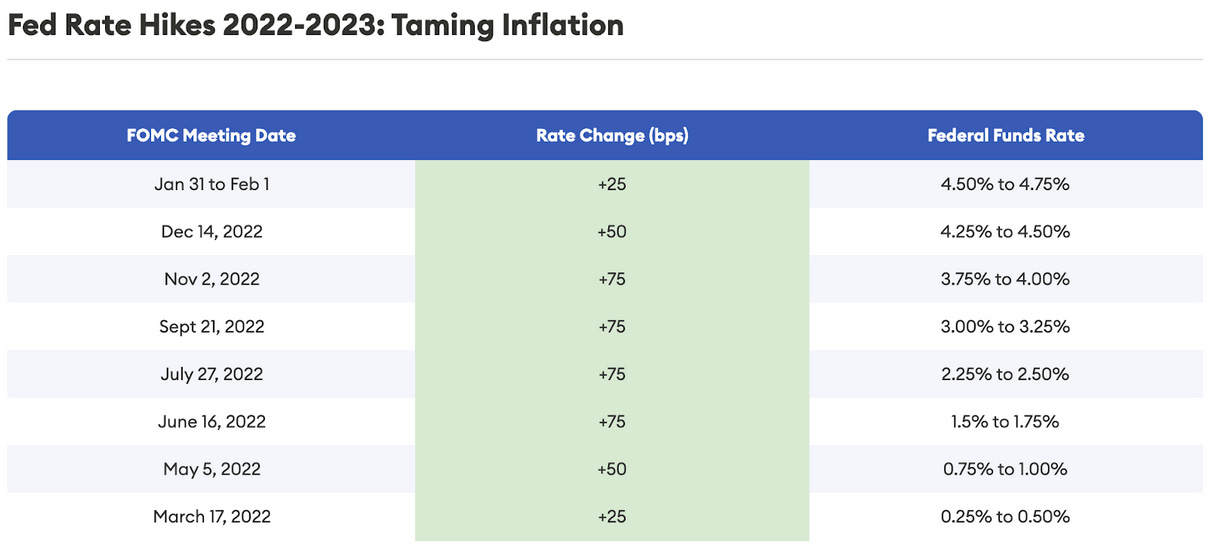

An eagerly anticipated 25 basis point increase to the FOMC’s targeted Fed Funds rate came to fruition, marking the smallest increase in the overnight lending benchmark since the Fed began fighting against inflation in March 2022.

While “ongoing increases” to the Fed Funds rate will likely be appropriate, the FOMC no longer sees public health or overseas conflicts as major factors contributing to inflation. Chair Powell cited that the disinflation process is underway, yet stated concern for the stickiness of core service inflation excluding housing. Despite disinflation observed in certain categories, Powell noted the cyclicality of commodity-driven inflation and highlighted the Fed’s resolve to crush inflation this hiking cycle to prevent entrenched consumer inflation expectations.

While certainly not a green light to bid risk assets, 25 bps in combination with a slightly dovish Powell was more than enough to make Michael Burry rage quit.

Michael Burry has now deleted his account, after tweeting this yesterday: pic.twitter.com/7yBMXDYJXR

— unusual_whales (@unusual_whales) February 1, 2023

Coinbase Lawsuit Dismissal

Markets received the bid and $COIN transformed into a rocketship🚀

Coinbase’s outsized gains can be attributed to the dismissal of a class action lawsuit brought against the CEX and its fearless leader, Brian Armstrong.

Big victory for @coinbase today. The court has dismissed all claims (fed w/ prejudice, state w/o) in a putative class action alleging Coinbase offered unregistered securities w/o registration as a securities exchange or broker dealer. https://t.co/lJELB6T20x

— Lawtoshi (@lawtoshi) February 1, 2023

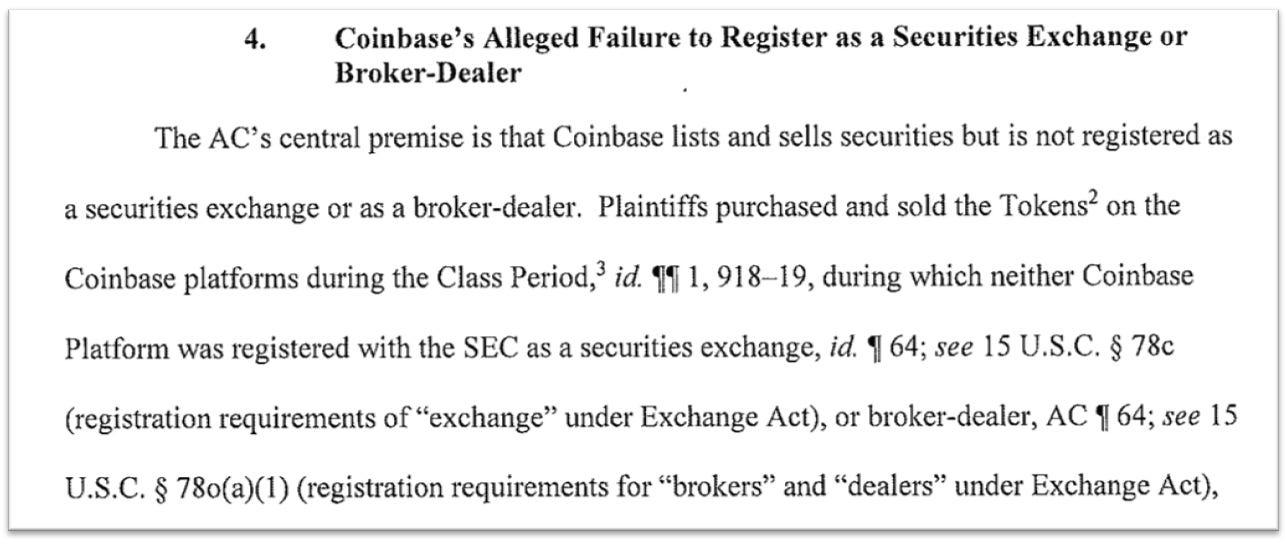

The suit alleged that the crypto exchange and Armstrong, in his capacity as control-person, violated multiple chapters of the Securities Act of 1933 and Securities Exchange Act of 1934 by failing to register as a broker-dealer and profiting from the sale of unregistered securities.

Central to the plaintiffs’ argument was that tokens listed by Coinbase are securities and trade occurred between consumer and exchange, as opposed to a peer-to-peer DEX.

For purposes of dismissal, the Court did not address the issue of tokens being securities. No determination on this classification was made, with the dismissal valid regardless of the security status of instruments listed and traded on the platform.

2/ Note the court did *not* decide whether the 79 tokens involved are securities or not.

— Ram Ahluwalia, crypto CFA (@ramahluwalia) February 1, 2023

The court dismissed the case because even if all the plaintiffs facts are treated as true (eg, tokens are treated as securities etc)

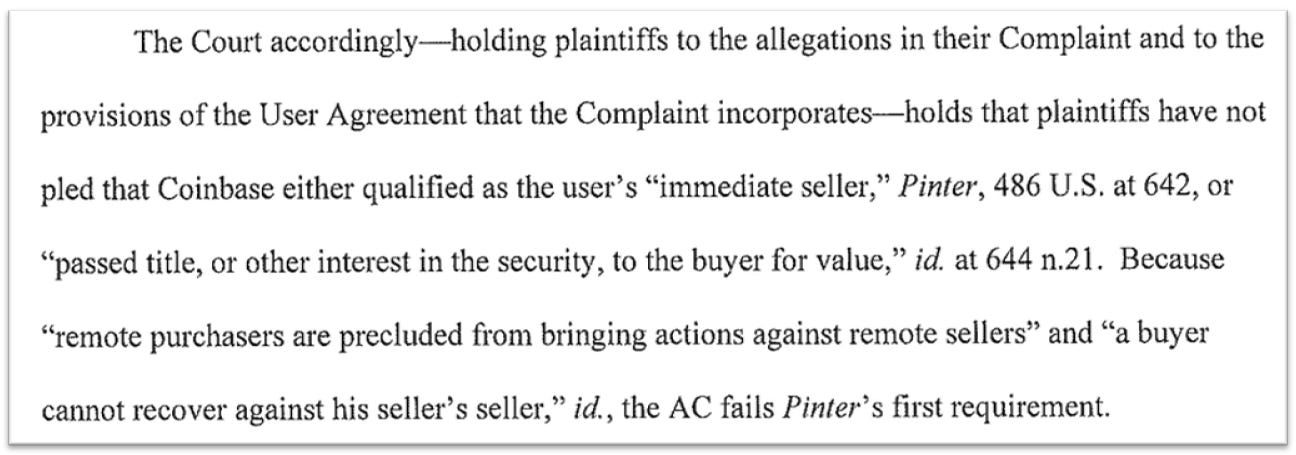

In its dismissal, the Court noted that revisions made by plaintiffs to the suit “added numerous allegations that directly contradicted their initial Complaint,” and that alterations of the Complaint “did not [identify] any concrete amendments or additions, let alone ones that might cure the deficiencies afflicting their Securities Act and Exchange Act claims.”

Essentially, the Court’s decision upheld the Coinbase user agreement that paints the exchange as an agent of users and maintains that the firm does not have any claim, title, or other interest to digital assets custodied by or traded on the platform.

Smash the Bid?

I know what you are wondering, anon: is $COIN a buy?

We hesitate to say yes…

- Powell reserves the right to reverse course and raise rates more aggressively than anticipated at the first sign of increasing or stubborn inflation.

- No information regarding the changes to terminal Fed Funds rate projections was provided. SEP dot plot projections will be updated at the next FOMC meeting in March.

- The dismissal of the suit did not provide clarity on the regulatory classification of tokens.

- The Complaint was dismissed without prejudice in state court.

- Coinbase faces multiple other class action lawsuits in various jurisdictions.

- SEC v. Wahi remains pending. This criminal prosecution charges a former Coinbase manager and collaborators with insider trading; a guilty verdict likely provides the SEC a backdoor to regulating tokens as securities.

Don’t get me wrong, Coinbase remains at generational buying levels!

FTX, a major Coinbase competitor, is no more. Not simply an exchange, Coinbase provides digital asset staking solutions, liquid staking derivatives, institutional custody solutions, non-custodial wallet products, integrated DeFi accessibility in-app and much more.

There’s always a but, however. If you are concerned about immediate volatility, $COIN is not your friend!

The future direction of monetary policy remains clear as mud and a host of legal issues still encumber Coinbase. Additionally, $COIN may be overbought after the dismissal of the lawsuit. In today’s era of technology enabled 24/7 at-your-fingertips trading, markets are increasingly volatile, with more traders attempting to capitalize on informational asymmetries than ever before.

Liquidity in markets remains thin, giving event-driven volatility the ability to move markets to the extremes. While Coinbase may be an attractive buy on a longer-term basis, additional downside may yet to be realized.

Did you hear those rumors that Coinbase may be deprecating its NFT marketplace?

Re: Coinbase NFT, please share & retweet 🙏🏼 pic.twitter.com/PXQXR2x5S9

— Jessica Yatrofsky ✡️ (@jyatrofsky) February 1, 2023

While they are (currently) unsubstantiated, when taken in combination with recent layoffs, the path ahead is not all sunshine and roses for Coinbase.

The dismissal of the suit did not substantially change the fundamentals of investing in $COIN and should not factor into your investment thesis! If you are a long term investor willing to shoulder volatility, December was your time.

🚨I am UBER bullish @coinbase🚨@sassal0x isn't a $COIN buyer here, but I certainly am!

— Jack Inabinet (@JackInabinet) December 30, 2022

🧵⬇️

At current prices, there is substantial risk of entering at a local top.

Remember: FOMO is not your friend, don’t ape, and DYOR! If you are looking to scoop up a bag for yourself, may we suggest waiting for a pullback?