Coinbase Rallies the Troops

Dear Bankless Nation,

The traditional banking system is in shambles and yet government agencies seem keen to pin all of the blame on crypto whenever they can. Last week, Coinbase mounted a counteroffensive and sued the SEC.

Here's what you need to know.

- Bankless team

Coinbase Mounts Counteroffensive

Bankless Writer: Jack Inabinet

Just over one month ago, Coinbase received a Wells notice from the SEC, informing the firm of the regulator’s intent to bring an enforcement action against it. At the time, Chief Legal Officer Paul Grewal swore to duke it out with Gary and SEC staff.

Now, Coinbase is doing just that, releasing not only a response to their Wells notice, but also filing a complaint against the SEC, seeking to compel a response to a July 2022 petition asking for formal crypto regulatory guidance.

🥊 Swinging Back

Informationally, Coinbase is working at a disadvantage in fending off the Wells notice after receiving a bare-bones allegation that core business products and services violate the Securities and Exchange Acts.

Thursday’s written and video responses to the SEC served not only to inform the SEC of why Coinbase believes its products do not violate existing regulation, but also to highlight the company’s compliance-first nature.

CEO Brian Armstrong states that despite receiving early advice to base the exchange offshore due to the difficulties of navigating U.S. regulatory processes, he (perhaps erroneously) believed entrepreneurs could work in good faith with regulators to define clear rules for emergent industries.

Coinbase certainly believes that they have held up their end of the bargain. The CEX says it has fully complied with required regulatory disclosure practices and diligently cooperated with regulators, meeting with the SEC over 30 times to discuss potential regulatory frameworks for the crypto industry. The SEC, in turn, unceremoniously declared that Coinbase violated securities regulations.

❓ Forcing the Question

Back in July 2022, while crypto was still licking the wounds wrought by Luna’s implosion, Coinbase was actively seeking SEC clarity on what the agency classifies as digital asset securities.

Who better to display the need for formalized crypto asset security frameworks than SEC Chair Gary Gensler himself? While at MIT, Professor Gensler acknowledged that three quarters of digital assets had been declared non-securities by the SEC, including Bitcoin and Ether!

Flash forward a couple years and the agency’s head can no longer answer the simple question: is ETH a security?

Shocker: @GaryGensler changed his views on ETH pic.twitter.com/iE8Zf1AdDQ

— Bankless (@BanklessHQ) April 24, 2023

In the absence of formal frameworks, the SEC has opted for a game of “regulation by enforcement.” While the agency was unable to issue a timely response to Coinbase’s initial petition, it happily prosecuted crypto companies for violations of the Securities Act.

From an entrenched battle against Ripple and XRP to a better-late-than-never lawsuit against Terra’s UST and LUNA (and related tokens, including synthetic and wrapped assets), the SEC has sought the court’s remedy against a litany of asset issuers and listers it believes violate U.S. securities laws.

Gensler and the SEC operate in an ambiguous legal gray area and have declined to issue a response to Coinbase’s petition within a reasonable time frame, as required by the law. Failing to issue concrete guidance on whether the agency believes additional rules are required for crypto assets allows the agency to deprive the crypto industry of the ability to litigate against such a framework in court.

After nine months of waiting for a response, Coinbase’s patience has expired. For the second time in crypto’s history, an actor has filed a Writ of Mandamus against the SEC.

The complaint is a rare attempt to force the SEC’s hand, making the agency either walk back standing policy that maintains current frameworks are adequate to regulate crypto or engage in yet another legal battle it is likely to lose.

Today’s action, yet again, makes plain that the crypto markets suffer from a lack of regulatory compliance, not a lack of regulatory clarity. https://t.co/JurmBacpXw

— Gary Gensler (@GaryGensler) April 17, 2023

Government agencies avoid sinking time and resources into the positions they do not believe are defensible in court.

Despite grandstanding from SEC leadership that the agency can regulate crypto markets, it may be time to question whether the agency truly believes it can exercise the broad regulatory controls it claims to possess over the industry, or is simply stalling for time.

6/ While Coinbase's action does not directly affect pending SEC cases against @Ripple/ $XRP, Bittrex and others,

— MetaLawMan (@MetaLawMan) April 25, 2023

It does a great job of shining a spotlight on the SEC's contradictory positions about of its authority to regulate digital assets.

Other judges will take note.

♣️ High Stakes Game

Coinbase acts as a protector of the crypto industry and is one of the few organizations flush with enough cash to fend off the SEC’s army of lawyers.

By waging war on both legislative and regulatory policy fronts (in addition to fending off overreach and pushing for clarity in the court system) Coinbase is fighting to create binding positive-sum frameworks to the benefit of individual investors and the entirety of the crypto ecosystem, alike.

Unlike with Kraken’s SEC staking settlement, a mere one-off agreement, outcomes of paths pursued by Coinbase, both in the halls of Congress and courtrooms across America, are bound to shape compliance for all crypto actors.

Since the CEX’s inception, Coinbase has placed an emphasis on regulatory compliance, often at the expense of the bottom line, yet it has found itself the potential target of SEC enforcement action. Despite early indications Coinbase may be looking to forsake the US, evidenced by its eight-week international expansion drive, it's clear the firm is willing to play hardball with regulators to protect America’s access to crypto markets.

Coinbase is crypto’s last line of defense against regulatory overreach. If the SEC scores the win, is crypto truly safe in America?

Action steps

- 🛡️ Join the fight with Coinbase by minting the 'Stand with Crypto' NFT

- 📺 Watch Why Coinbase is Suing the SEC with Paul Grewal, Coinbase's Chief Legal Officer

Kraken, the secure, transparent, reliable digital asset exchange, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. Your account is covered with industry-leading security and award-winning Client Engagement, available 24/7.

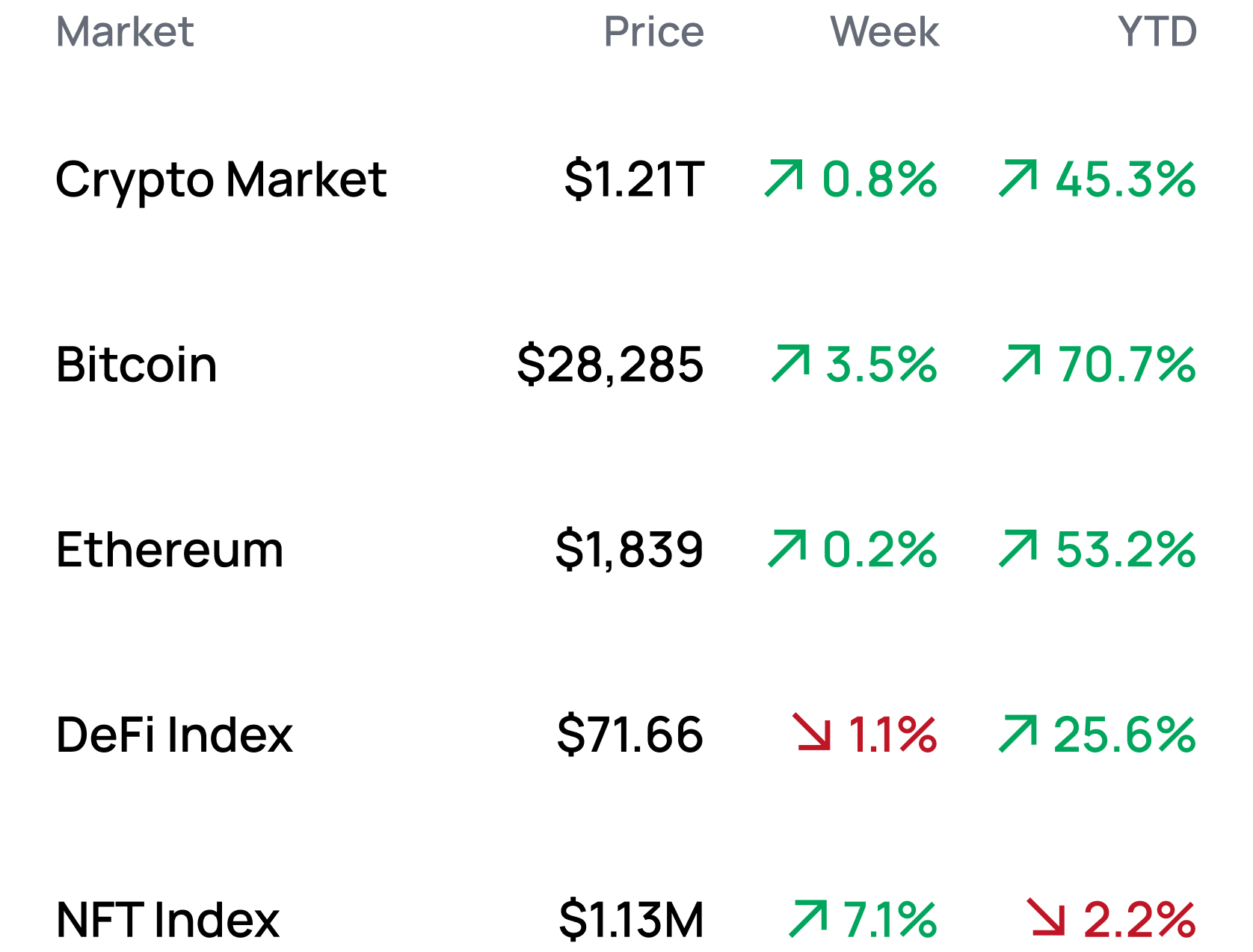

Market Monday 📊

*Data from 5/1 2:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Analyze protocol expenses with DeFi Llama’s new data tab

- LP on Uniswap with reduced risk of impermanent using Numeon’s new vaults

- Trade perps on Vertex Protocol on Arbitrum

- Mint Coinbase’s ‘Stand With Crypto’ commemorative NFTs

- Mint wrapped Beacon ETH (WBETH) on Binance

- Harness Aave V3's boosted pools in one LP position

- Trade on Magic Eden's new AMM pools

- Take advantage of greater liquidity and yield opportunities on Blur Lending

Yield Opportunities 🌾

- ETH: Earn 16% LPing the alETH-frxETH pool in Velodrome on Optimism

- ETH: Earn 16% staking rETH-ETH Curve LP tokens in Convex on Ethereum

- USD: Earn 19% LPing the USDT-USDC pool in Camelot on Arbitrum

- USD: Earn 14% staking NOTE-USDC LP tokens in the CLM on Canto

- BTC: Earn 5% compounding sBTC-wBTC Curve LP tokens in Beefy on Optimism

What’s Hot 🔥

- Binance terminates its agreement to purchase Voyager’s assets

- Ameen Soleimani announces HAI, an upcoming multi-collateral RAI fork on Optimism

- The US Congress is re-writing stablecoin legislation

- Swell launches on mainnet

- PayPal plans to rollout crypto transfers in June

- Iron Fish mainnet is live

- Introducing Dymension, the first IBC EVM rollup

Money reads 📚

- Comparing the top 5 chains by economic activity - Polynya

- What I Think Is Going On with China-US Relations - Ray Dalio

- State of Blockchain Gaming in Q1 2023 - Dapp Radar

- A Look Into Decentralized Social Networks - Xin Yi Lim

- Optimism Bedrock upgrade is coming - OP Labs

- Moneyness in the Digital Age - Paradigm

Governance Alpha 🚨

- QuickSwap moves to launch its perps product

- Olympus DAO explores launching a Gearbox lending AMO

- Uniswap weighs deploying on Taiko

- MakerDAO looks to invest in a money market fund

- Saddle explores starting an ARB incentive program

Trending Project: Cardano (ADA) 📈

Analyst: Ben Giove

- Ticker: ADA

- Sector: L1

- Network: Cardano

- FDV: $17.5B

Is there more than meets the eye with this L1?

- Cardano is a Layer 1. Cardano is unique among most smart contract platforms in that it utilizes a UTXO model and Haskell as its programming language. The native token of the chain is ADA, which is used to secure as well as govern over the network. ADA is currently the seventh largest token by market-cap and fully diluted valuation at $13.7B and $17.5B respectively.

- Cardano’s DeFi TVL has grown from $48.9M to $142.0M YTD, an increase 190.2%, as well as a 42.2% increase in DEX volumes over this period. For the former metric, this places the network as the 18th largest L1 or L2. Notably, Cardano’s ADA denominated TVL has surged 79.5% from 198.7M to 356.7M.

- This suggests that this growth is not just due to the price of ADA increasing, but from Cardano’s DeFi ecosystem seeing true capital inflows. Some of the protocols helping contribute to this growth are DEXs such as Minswap, WingRiders, and MuesliSwap along with lending protocols including Liqwid and Djed.

- Per data from Artemis.xyz, Cardano is currently the 11th largest L1 or L2 by Daily Active Addresses at 38,862. This places the chain behind a host of other networks that trade at lower FDVs including Solana ($12.1B), Polygon ($9.8B), Arbitrum ($13.4B), Fantom ($1.3B), Optimism ($9.1B), and Avalanche ($12.3B).

The Takeaway:

Despite being labeled by many as a ghost chain, Cardano does have some baseline of activity. Furthermore, the network’s overall activity level and DeFi ecosystem are growing. However, given that both are far lesser than L1 and L2 competitors which trade at larger valuations, Cardano seems overvalued relative to these other networks.

Refer a Friend, Get Some Bankless Merch!

Meme of the Week 😂

Living in the U.S. be like pic.twitter.com/5OQs1COgRp

— Earnifi (@Earni_fi) April 28, 2023