Circle's Rate Cut Conundrum

View in Browser

Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet.

- 🏦 U.S. to Publish Economic Data Onchain: Commerce Secretary. Details are scant, but U.S. Commerce Secretary Howard Lutnick apparently wants to start with putting GDP on the blockchain.

- 🦊 MetaMask Adds Social Login for Wallet Creation. The new feature lets users create, back up, and recover wallets with Google or Apple accounts.

- 💵 Aave Labs Debuts Horizon Platform with Major Partnerships. The new platform enables stablecoin borrowing against tokenized Treasurys with Circle, VanEck, and Chainlink on board.

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $3.89T | ↗ 2.3% | ↘ 0.5% |

|

BTC $112,277 | ↗ 0.9% | ↘ 1.7% |

|

ETH $4,601 | ↗ 0.1% | ↗ 5.8% |

Stablecoin issuer Circle turned heads earlier this summer when its stock opened at a stratospheric $69 during public market trading on June 5, doubling the money for early participants in its already-upsized initial stock offering.

CRCL went on to soar throughout the month of June, and the stock cemented its reputation as high-flying crypto equity when share prices neared $300. Unfortunately, as summer progressed, seasonal doldrums eventually took hold of this ticker…

While the stock popped 7% after Jerome Powell's rate cut comments last Friday, it has been down-only for the better part of a month and shares are trading nearly 60% below all-time highs.

Today, we’re exploring the stablecoin rate cut conundrum and weighing the implications of shifting monetary policy on CRCL’s future. 👇

😨 The Interesting Problem

Circle operates with a bank-like business model: it makes money from interest.

Over $60B of bank deposits, overnight lending agreements, and short-term U.S. Treasuries back USDC. In the second quarter of 2025, Circle earned $634M of revenue from interest on these stablecoin reserves.

This portfolio makes more interest per dollar of USDC reserves when rates rise. Conversely, it earns less when rates fall. Although market forces drive interest rates, the cost of dollars is also swayed by Federal Reserve policy, particularly for the short duration instruments used by Circle to manage its reserves.

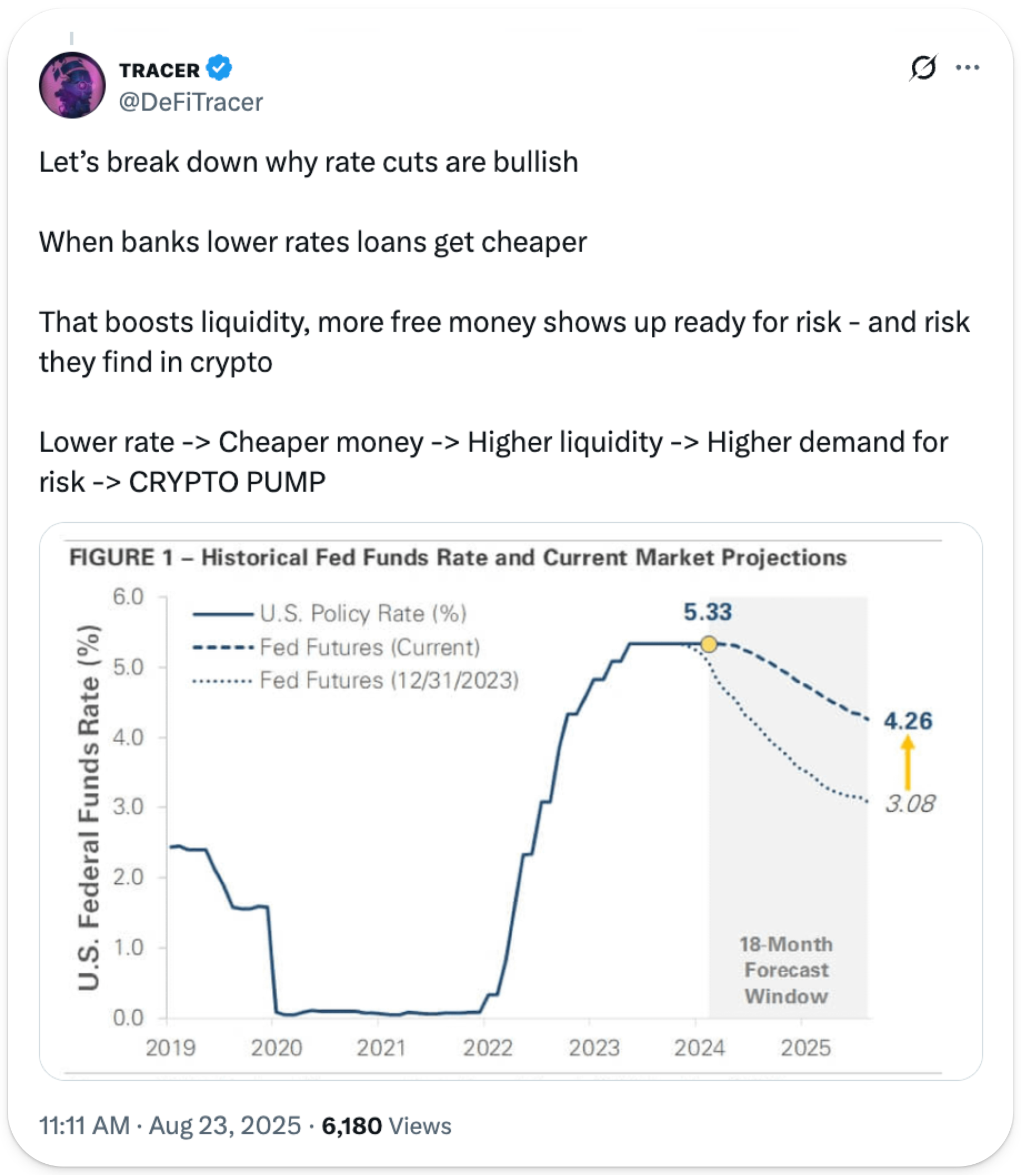

During his Jackson Hole address last Friday, Fed Chair Jerome Powell strongly signaled the possibility of interest rate cuts. We’ve seen rate cut fakeouts before, but this is the first Chair Powell himself has come anywhere close to endorsing the option.

Powell dismissed any residual inflation as one-time tariff spikes, highlighted a slowing labor market, and was defensive of potential rate cuts, which the market now expects to transpire from the Fed’s September 17 policy meeting.

The odds of interest rate cuts according to CME FedWatch and Polymarket both spiked on Powell’s speech, but the big move in probabilities came on August 1. Released payroll statistics on that day suggested poor job gains of 73k in the month of July and contained massive downward revisions for the two months prior.

Since August 1, both CME FedWatch and Polymarket have remained steadfast with majority projections for a 25 basis point (0.25%) rate cut, and in the likely scenario that the Federal Reserve proceeds with expected interest rate cuts, Circle’s revenue will decrease overnight.

According to Circle’s own financial projections, the firm expects to lose $618M of annual interest revenue for every 100 basis point (1%) decrease to the federal funds rate, equating to a $155M revenue hit for a “standard size” 25 basis point rate cut.

Half of these revenue losses will (fortunately) be offset by decreased distribution costs – in line with the Circle-Coinbase agreement that allocates about 50% of all USDC reserve interest income to Coinbase – but the fact remains that it becomes increasingly difficult for Circle to operate in a falling interest rate environment.

Although Circle’s staggering $482M reported net loss for Q2 vastly undershot analyst expectations, the bulk of this unexpected difference was driven by a $424M accounting write-off related to employee stock compensation upon IPO.

Even so, Circle’s financials underscore the fragility of a company hovering near break-even that cannot bear the impacts of materially lower interest rates at current USDC supply levels.

🦄 The Solution

Decreasing rates may cause Circle to earn less interest per dollar of reserves and harm profitability in isolation, but fortunately for CRCL bag holders, changing one simple variable completely reverses the outcome…

Jerome Powell and many financial commentators have espoused the belief that interest policy is already “restrictive” and that fine-tuned alterations to Federal Reserve policy rates can combat a weakening labor market while keeping inflation in check.

If these pundits are correct, interest rate cuts could usher in an economic upswing, during which employment levels remain elevated, the cost of credit falls, and crypto markets surge. Should this optimistic scenario materialize, the demand for crypto-native stablecoins may rise, particularly if they offer access to above-market DeFi native yield opportunities.

To neutralize the negative effects of a 100 basis point rate cut (the lowest level contemplated by Circle’s rate cut sensitivity analysis seen above), the amount of USDC in circulation will need to increase by about 25%, which requires a $15.3B cash infusion into the crypto economy.

Circle’s current price-to-earnings ratio of 192x against 2024 net income frames it as a high-growth opportunity. Yet while the stock market prices in optimism that CRCL can expand into expectations, the stablecoin issuer will need growth just to survive if the Federal Reserve delivers rate cuts in the coming weeks.

Assuming the Fed delivers a minimum step 25 basis point cut, Circle needs to grow USDC supply by approximately $3.8B to maintain current levels of profitability.

Said best by Circle, “any relationship between interest rates and USDC in circulation is complex, highly uncertain, and unproven.” There is no model for how USDC customer behavior responds to lower interest rates, yet history consistently shows that rate cut cycles occur at an aggressive pace once incited.

Although Circle can potentially outgrow a rate-driven deficit in an economic boom scenario, the company finds itself mathematically at odds with lower interest rate dynamics.

Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today.

ETHZilla wants to turn ETH into Wall Street’s new reserve asset, and they’ve built a plan to do it.

Ryan sits down with Avichal Garg (Electric Capital) and Mac Rudisill (ETHZilla) to unpack why ETH treasuries exploded this cycle, how credit markets (converts, preferreds, and debt) supercharge accumulation, and why stablecoins → DeFi → ETH forms a flywheel that turns Ether into high-quality collateral.

We dig into leverage discipline, mNAV premiums, operational security, and the business math that makes an ETH treasury look more like Berkshire than a hype trade. Plus: can this wave trigger a DeFi after-boom, and what does “winning” actually mean for ETHZilla?

Listen to the full episode 👇