Circle's Narrative Arc

View in Browser

gm Bankless Nation,

Is the USDC issuer's proprietary stablecoin chain the unlock that public market investors have been banking on?

Today's Issue ⬇️

- ☀️ Need to Know: Banks + Crypto

The OCC confirms U.S. banks can hold crypto. - 🗣️ Analysis: Circle's Arc Advantage

Arc charts a more profitable future for CRCL.

Sponsor: Bit Digital — ETH treasury that combines the two greatest assets of our time: ETH & AI.

- 👏 U.S. Regulator Green-Lights Banks Holding Certain Crypto Assets. The OCC has confirmed that banks can hold crypto assets to pay network fees.

- 📡 DappRadar Shuts Down Operations. The onchain analytics platform said it's closing due to 'financial unsustainability.'

- 🌵 MegaETH Mainnet Beta Coming Next Month. Its beta 'Frontier' is expected to be live for one month starting early December.

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $3.18T | ↗ 2.0% | ↘ 8.6% |

|

BTC $92,951 | ↗ 1.5% | ↘ 9.7% |

|

ETH $3,123 | ↗ 4.7% | ↘ 9.2% |

Circle’s stock price has been slipping. While down 75% off its post-IPO highs, CRCL still trades at more than twenty times its annualized earnings.

The USDC issuer remains tasked with justifying a lofty $18B market cap in the face of a stablecoin supply that's been stagnant since October while lower future interest rates loom – a toxic combination of variables that is guaranteed to harm company revenues.

Enter Arc – a proprietary stablecoin-centric blockchain that represents one of Circle's boldest bets to level up its future gains in a stablecoin-centric economy. The public EVM-compatible network uses stablecoins for gas, features opt-in configurable privacy, and offers direct integrations with Circle’s tech stack.

Arc presents plenty of clear opportunities for Circle, but what's in it for end users? Today, we’re overviewing Arc, discussing the network’s unique qualities and exploring how Circle might leverage the chain for its own gain.👇

⚡ The Arc Advantage

One part marketing and one part Ethereum fork, Arc is the latest EVM-compatible blockchain that aspires to conquer the crypto industry. The project is also rumored to be launching a token.

Arc is currently on testnet and is conceptually similar to Plasma and Stable, two emerging stablecoin-centric blockchains backed by Circle competitor Tether. The major distinction between Arc/Plasma/Stable and other blockchains is their use of stablecoins instead of volatile cryptocurrencies (e.g.; ETH or SOL) as gas.

At its core, Arc operates on “Malachite,” a high-performance implementation of the Cosmos-native Tendermint BFT consensus protocol with subsecond finality. Unlike many mainnet L1 networks, Arc will utilize a permissioned Proof-of-Authority (PoA) validator set; this feature increases transaction speeds at the cost of decentralization guarantees.

To further maximize network performance, Arc uses Reth (a fast, modular, and user-friendly Ethereum execution client developed by Paradigm). This setup will result in upward of 3k transactions per second (TPS) assuming 20 network validators, and could produce over 10k TPS with smaller validator sets.

Arc also aims to enshrine privacy. The network’s roadmap calls for opt-in privacy features, which will shield transaction details while preserving the ability for authorized parties to access confidential data via “view keys,” empowering users to conduct private financial transactions onchain with ease.

Together, these technical decisions are intended to make Arc the “Economic OS for the internet,” a unified infrastructure layer designed to power the next generation of onchain lending, capital markets, and payments primitives.

🔵 Circle’s Connection

Fundamentally, Arc is just another commoditized alt L1 deployment; stablecoin chains do not unlock any new design spaces, they simply offer a different payment rail for the same types of onchain activities.

The technical justifications for users to migrate to Arc may be limited (besides promised privacy features with no implementation details), but Circle is financially incentivized to support Arc, making the company likely play an ongoing developer role within the ecosystem.

Under its “Collaboration Agreement,” Circle is obligated to share a significant percentage of its off-platform USDC revenues with Coinbase. The amount paid is variable, however, and the easiest way for Circle to increase its share of USDC revenue is to increase the amount of stablecoins held on-platform.

Similar to how Coinbase receives nearly $200M per year in interest payments from this agreement for the $4.3B USDC held on its Base L2, Circle can retain more revenue by driving USDC stablecoin supply onto Arc, unlocking superior unit margins and strengthened company financials in the process.

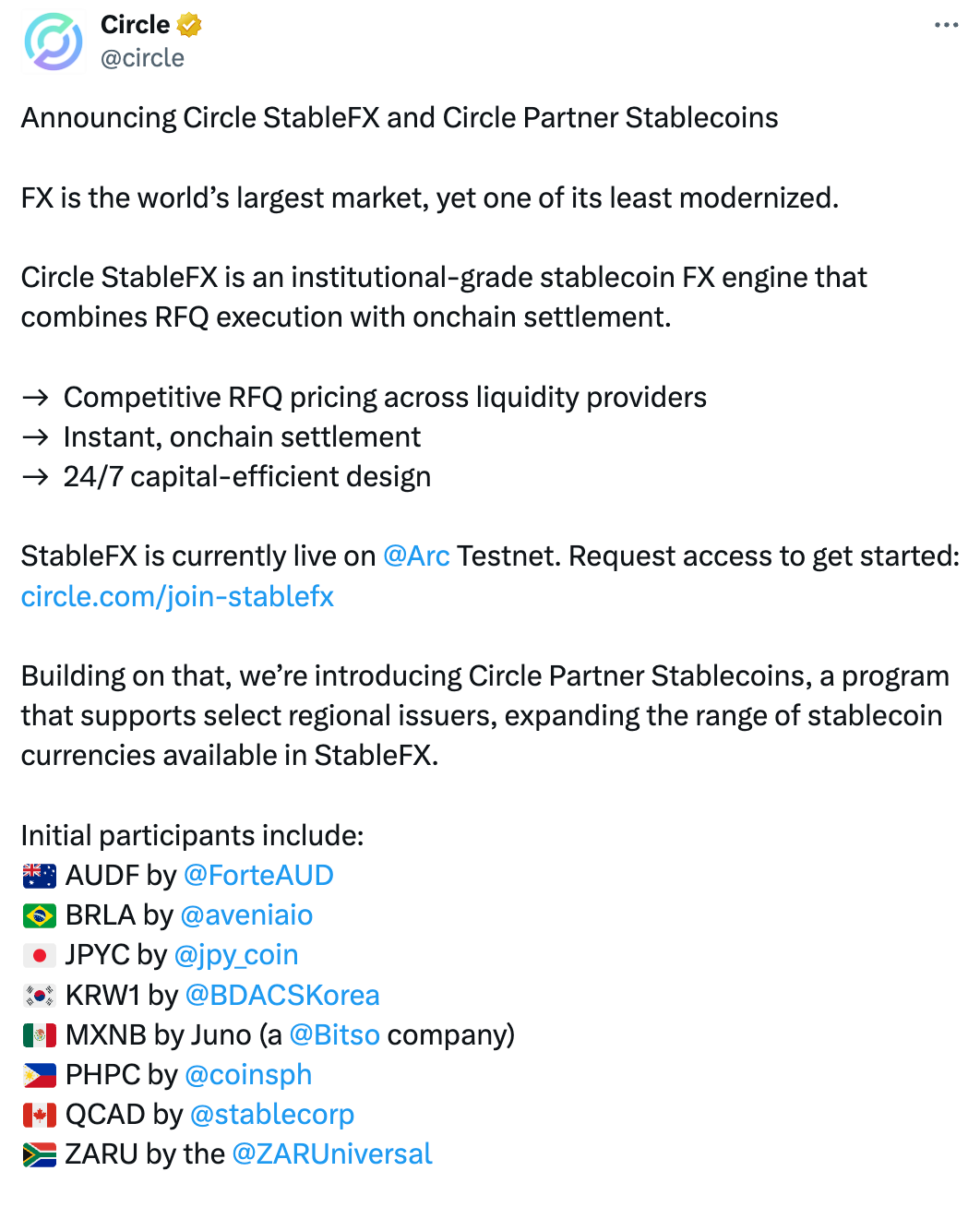

At the infrastructure layer, Circle’s Cross-Chain Transfer Protocol (CCTP) and Gateway will enable seamless crosschain interoperability between Arc and other blockchains. Meanwhile, the recently announced StableFX exchange (Circle’s first foray into the application layer) will help Arc users convert between tokenized currencies.

🧐 Opportunity to Watch?

Although serious crypto capital is unlikely to onboard to Arc without a compelling incentive, Circle has every reason to manufacture one.

The stablecoin issuer is financially motivated to grow USDC supply directly on Arc, and (as previously demonstrated by Plasma) fresh token incentives remain the fastest way to bootstrap liquidity and attention! Assuming Arc follows a similar incentives playbook, the chain could quickly become a hotspot for incentive-driven onchain activity upon its mainnet launch…

Bit Digital: The premier ETH treasury that combines the two greatest assets of our time—ETH & AI compute. Harness massive Ethereum holdings with institutional-grade staking for optimized rewards, while powering cutting-edge AI infrastructure for unparalleled innovation. Unlock the future of digital assets where blockchain meets intelligent computing.

*We’re being compensated by Bit Digital (NASDAQ: BTBT) for this ad promoting their company and BTBT. The compensation is paid in cash as a one-time payment. You can find additional information about Bit Digital and BTBT on their Investor page at bit-digital.com/investors. Not investment advice.