Chasing 'Sticky' Liquidity

Dear Bankless Nation,

As altcoins continue to reel after last week's SEC action, more investors are looking at the staying power of the token incentive models powering their favorite dApps and networks.

Today, we dig into alternative token models that are chasing sustainability.

- Bankless team

The Search for More Sustainable Token Models

Bankless Writer: Paul Timofeev

In DeFi, liquidity is king.

Liquidity refers to the ease of which an asset can be converted into cash. The more liquidity an asset has, the easier it is to cash out, and vice versa.

In DeFi, liquidity is measured by price slippage, which refers to the difference between the expected price and the executed price when trading assets on automated market makers (AMMs) like Uniswap. Greater liquidity reduces price slippage, making trading more efficient and benefiting all participants involved. Therefore, projects in DeFi are motivated to create deep liquidity for their native tokens in order to accrue value and attract more users.

However, a lot of TVL charts for L1s and dApps look the same – a rapid burst of liquidity and growth, followed by an imminent decline. DeFi has learned the painful lesson that capturing and retaining liquidity over time is a much greater challenge than building it up in the short term.

As top market makers like Jane Street and Jump Trading cut down on their involvement in the crypto markets, the need for designing sustainable token models becomes much more significant.

Liquidity comes… liquidity goes

Liquidity mining refers to the mechanism of incentivizing users to provide liquidity for a token with native token rewards. Pioneered by Compound and Synthetix, it has been the go-to mechanism for bootstrapping growth for DeFi projects.

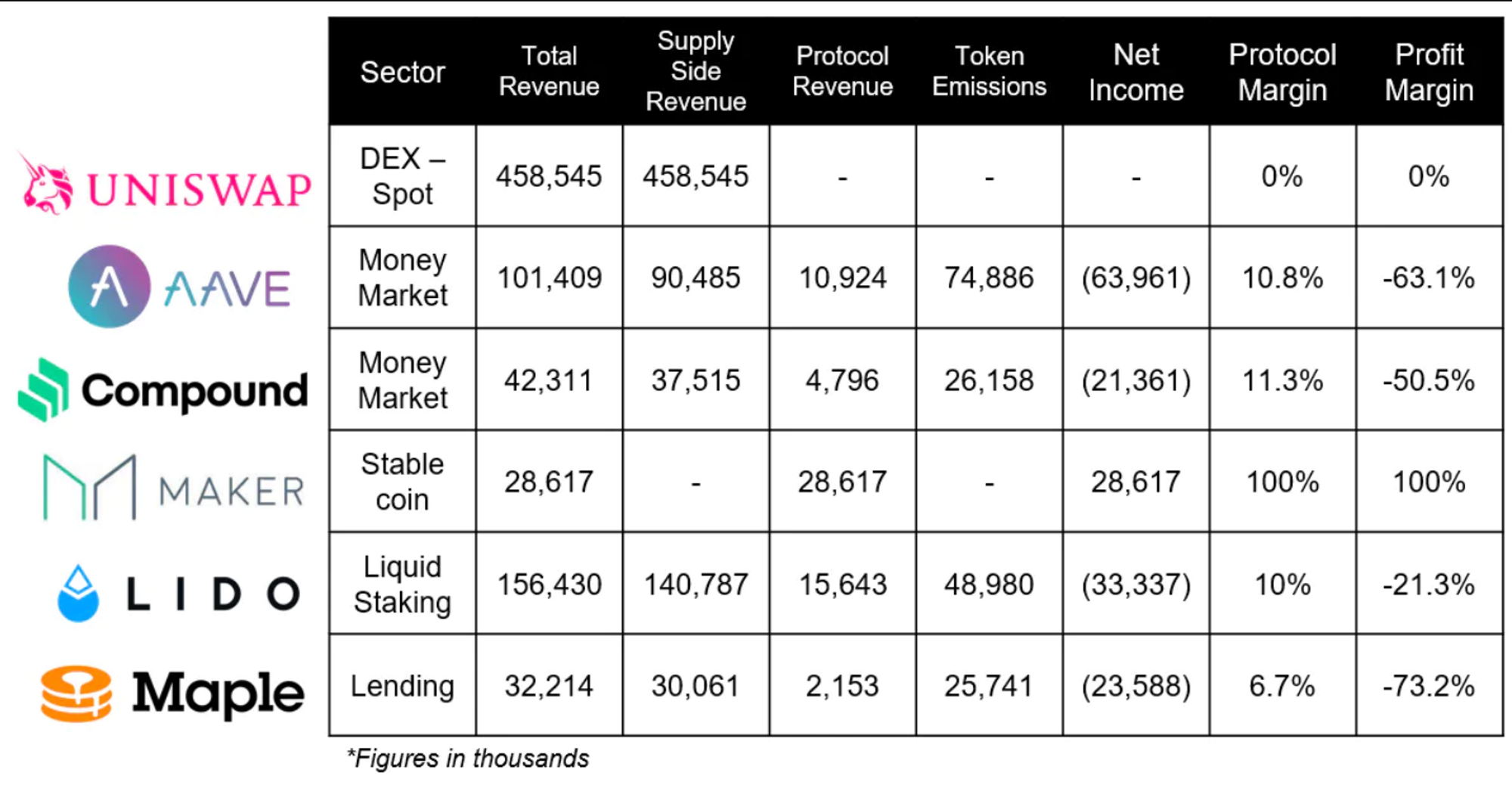

It doesn’t take long to observe that this practice is highly unsustainable over time – and a poor business model. Protocols are constantly fighting an uphill battle as they need to generate enough revenue to cover the costs associated with emissions. Observe the below profit margins for a handful of DeFi bluechip protocols from Jan - July 2022.

Take Aave, with the third-largest DeFi TVL, for example. Although they generated $10.92M in protocol revenue, they also paid out nearly $75m(!!) in token emissions, resulting in a $63.96m loss, or a -63.1% profit margin.

DeFi needs to evolve away from the unsustainable designs that have failed to retain liquidity, and embrace stickier token models which incentivize long term participation and growth. Let’s examine some of the models which aim to optimize the state of liquidity today ⤵️

LP Gauge Tokenomics ⌛🔒

Curve Finance introduced the VoteEscrow model, which allowed $CRV holders to lock up their tokens to receive $veCRV, granting holders governance rights and boosted yield.

While this model offsets short-term dumping and encourages long-term participation to an extent, it also reduces the liquidity of $CRV as many of the tokens are locked up (some even up to 4 years!)

Rather than locking up native tokens, some protocols have built models which focus on locking LP tokens (these are receipt tokens which directly represent an LP’s share of a pool).

The LP Gauge Model incentivizes liquidity providers to lock up their LP tokens in exchange for boosted rewards and greater governance power. In this model, traders benefit from this safety net of “locked” liquidity, LPs benefit from governance rights and greater rewards, and the ecosystem benefits from deeper liquidity.

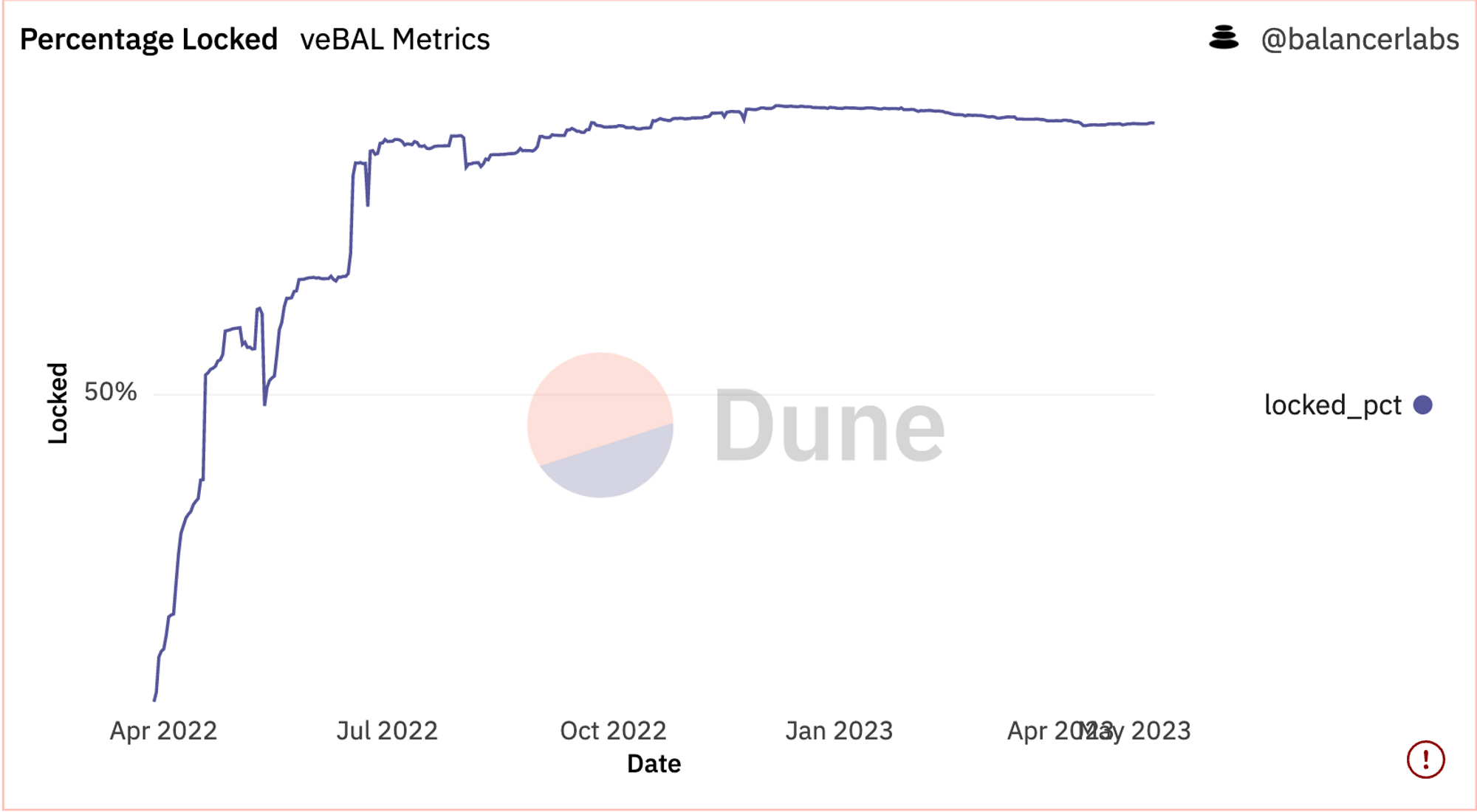

One project which has adopted this model is Balancer, with the launch of $veBAL tokenomics. Here, users who provide liquidity in the BAL/WETH pool receive $veBAL , which they can lock for up to 1 year. $veBAL holders earn 65% of protocol fees and can vote on pool emissions and other governance proposals.

The growth in percentage of veBAL locked over time indicates strong demand for utilizing the system.

Options Liquidity Mining 🔺🔻

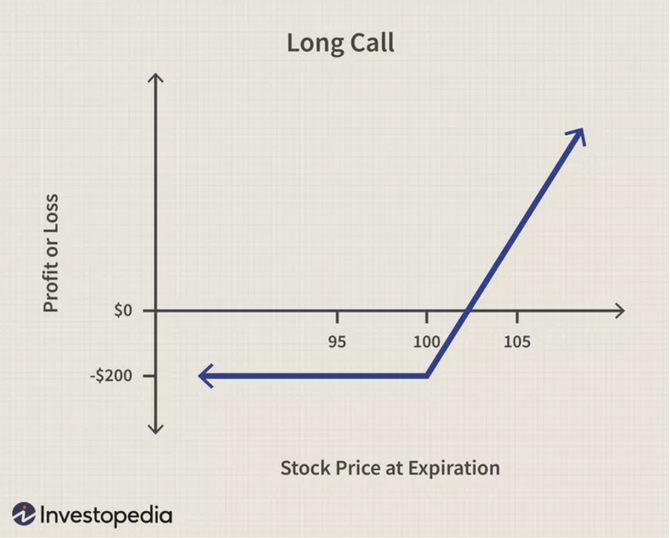

Another alternative token model to ‘vanilla’ liquidity mining is options liquidity mining. Simply put, this is when protocols distribute liquidity incentives in the form of options, as opposed to native tokens.

Call Options are financial instruments which allow users to buy an asset at a defined price (the Strike price) within a specific timeframe. If the price of the asset goes up, the buyer can use their option to buy the asset at a discount, and redeem it for the higher price, profiting from the total difference in price.

With Options Liquidity Mining, protocols can distribute liquidity incentives in the form of call options, as opposed to the native token. This model intends to better align incentives between the users and the protocol. For users, this model allows them to purchase the native tokens at a greater discount in the future. Meanwhile, protocols benefit from reduced sell pressure, and can customize the incentive conditions to align with their specific goals. For instance, creating long term incentives by setting longer expiry dates and/or lower strike prices.

Options Liquidity Mining poses an innovative alternative to traditional liquidity mining. This model is still fairly new and untested, but one protocol looking to lead the way is Dopex. They recently announced that they would be testing out a Call Options incentive model for their structured products, claiming that this model will bring greater flexibility, price stability, and longer term engagement compared to traditional incentive models.

There is concern, however, that the process will discourage users overall. After all, DeFi has been conditioned to liquidity mining for so long, that introducing these extra steps can discourage users and draw them away from a project, especially if they don’t believe the token will actually perform well in the future.

Will OLM help projects attract more long-term participants, or will the additional steps in the redemption process discourage users and, in turn, draw liquidity away?

Berachain 🐻⛓️

Although the examples above present some interesting models for sustaining liquidity and users, they focus on the application layer. So what if liquidity incentives were addressed on a consensus layer?

Berachain is an upcoming project which aims to do just that – build a sustainable incentive structure within the chain itself.

This all starts with a “tri-token model” – a gas token ($BERA), governance token ($BGT), and native stablecoin ($HONEY).

The novel Proof-of-Liquidity consensus mechanism enables users to participate as validators by staking their assets with Berachain in exchange for earning block rewards and LP fees.

When users stake their assets, their deposits are automatically paired with $HONEY, the native stablecoin, on the native AMM. Users who also stake their gas tokens ($BERA) will receive governance tokens ($BGT). $BGT stakers receive protocol fees in turn and over time gather influence over emissions and other incentives within the ecosystem.

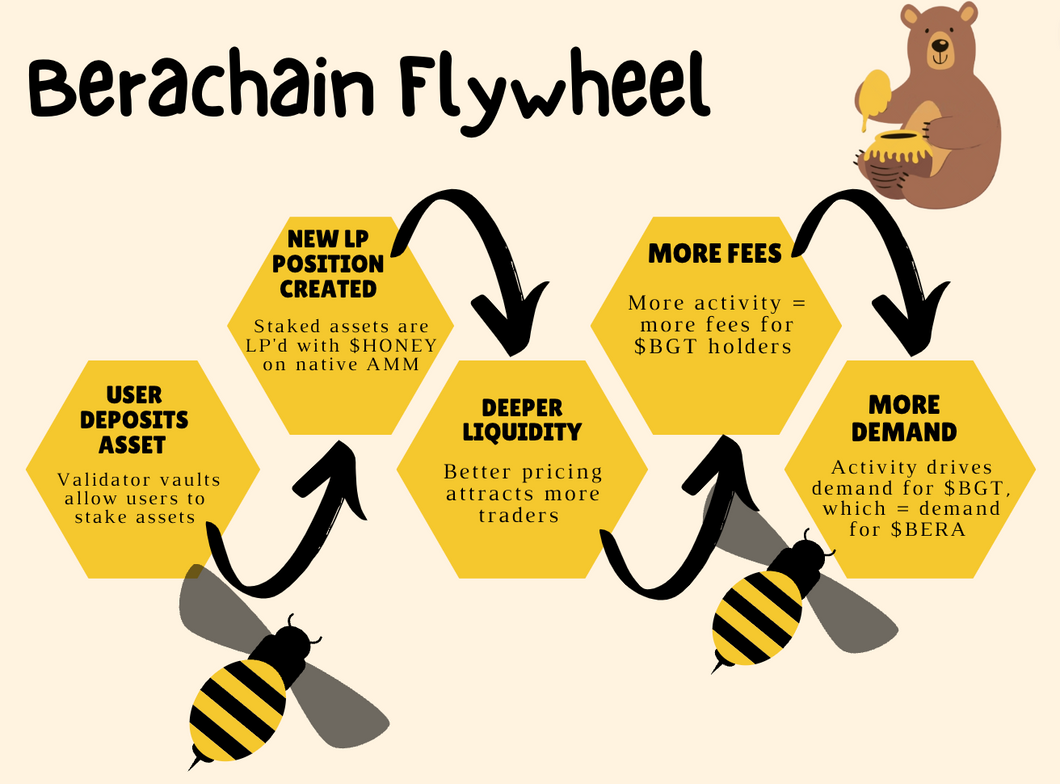

So what is the magic here? In theory, this creates a positive flywheel effect where:

- more deposits = deeper stablecoin liquidity

- deeper liquidity = more traders will come to use Berachain

- more traders = more protocol fees = more rewards for $BGT holders

- better $BGT rewards = more demand for $BGT

This model incentivizes users to keep their assets within the Berachain ecosystem, as there are greater opportunities to earn yield than elsewhere. The beauty of this model is that the main beneficiary of the value generated by the chain is the ecosystem itself, rewarding committed long-term participants. Users begin to contribute to the liquidity of the native stablecoin as soon as they deposit, creating a natural liquidity mechanism off the bat. Furthermore, users who stake the $BERA they earn in block rewards, can earn the fees generated by activity on the chain, by holding $BGT. Protocols may start to accumulate $BGT in order to gain voting power for directing incentives to their specific assets, setting the stage for a potential Curve-Wars style ecosystem boom.

The Curve Wars helped grow Curve into the DeFi behemoth it is today- will Berachain see a similar effect?

Keep in mind Berachain has not launched yet, so this is all theoretical.

Moving Forward 💭

DeFi is still young and primitive, and there is a lot of work to be done in its current state. Creating sustainable economic frameworks is an important part of the process.

One could argue that given how fundamental liquidity mining has been to DeFi, it’s impossible to move away from it completely.

However, alternative frameworks like the ones described here demonstrate that liquidity mining can be optimized to sustain liquidity and users, and actually benefit the ecosystem for the long term.

Next time you look to ape into a yield farm for your favorite DeFi project, make sure you take the time to understand the source of yield and whether or not it is sustainable for the long term. As a word of advice, if you don’t understand, you are the yield.

Action Steps:

The web3 ecosystem is an expansive world, full of endless opportunities for those curious enough to explore them! Head over to MetaMask Portfolio to get started, where you can view your assets in one place and discover other features such as Buy, Swap, Bridge, and Stake.