Getting Started with Bunni v2

Uniswap V4 is unlocking big things across DeFi.

Last week, we took a look at the more equitable future of launching memecoins on Flaunch, which leverages V4. Today, we're sharing a quick guide on the first decentralized exchange built on the V4 infra – Bunni v2.

The wait is over.

— Bunni (@bunni_xyz) February 1, 2025

Bunni v2 is LIVE on Ethereum Mainnet, @Base, and @Arbitrum! 🐰🥕

As the first DEX built on top of Uniswap v4, Bunni v2 offers programmable liquidity features that help LPs build yield-maximized, dynamic, and automated liquidity pools. Our rehypothecation hook… pic.twitter.com/OjkSaa7wLf

I encourage you to check out the docs to explore all the key concepts, but fundamentally Bunni v2 is designed from the ground up to optimize profits for liquidity providers (LPs).

Some of the main pillars it achieves this optimization through include:

- 🪸 Shapeshifting Liquidity — Liquidity positions can automatically adjust based on market conditions, reducing the need for active management.

- 🌊 Liquidity Density Functions (LDFs) — A new framework for liquidity distribution that allows precise control over how liquidity is allocated across price ranges.

- 🤖 Autonomous Rebalancing — Built-in automation ensures liquidity pools maintain optimal token ratios without relying on external bots or keepers.

- 💰 Rehypothecation — Idle liquidity isn’t wasted, pool creators have the option to deposit liquidity into yield-generating vaults to earn additional returns.

- 🔄 Optimized Swap Fees — Bunni uses volatility-based dynamic fees and an auction-managed AMM to maximize fee revenue while maintaining competitive pricing.

Thanks to these innovations, LPs now have a great resource in Bunni when it comes to maximizing capital efficiency, minimizing impermanent loss, and automating position adjustments with ease.

But let's say you're an absolute newcomer here. Where should you begin? I recommend adding some liquidity or creating a new pool to get your bearings.

To give you some context, let's walk through the basics of doing so on Base 👇

How to Add Liquidity on Bunni and Base

- Go to bunni.xyz/dashboard/positions/base and connect your wallet

- Press the "Add Liquidity" button

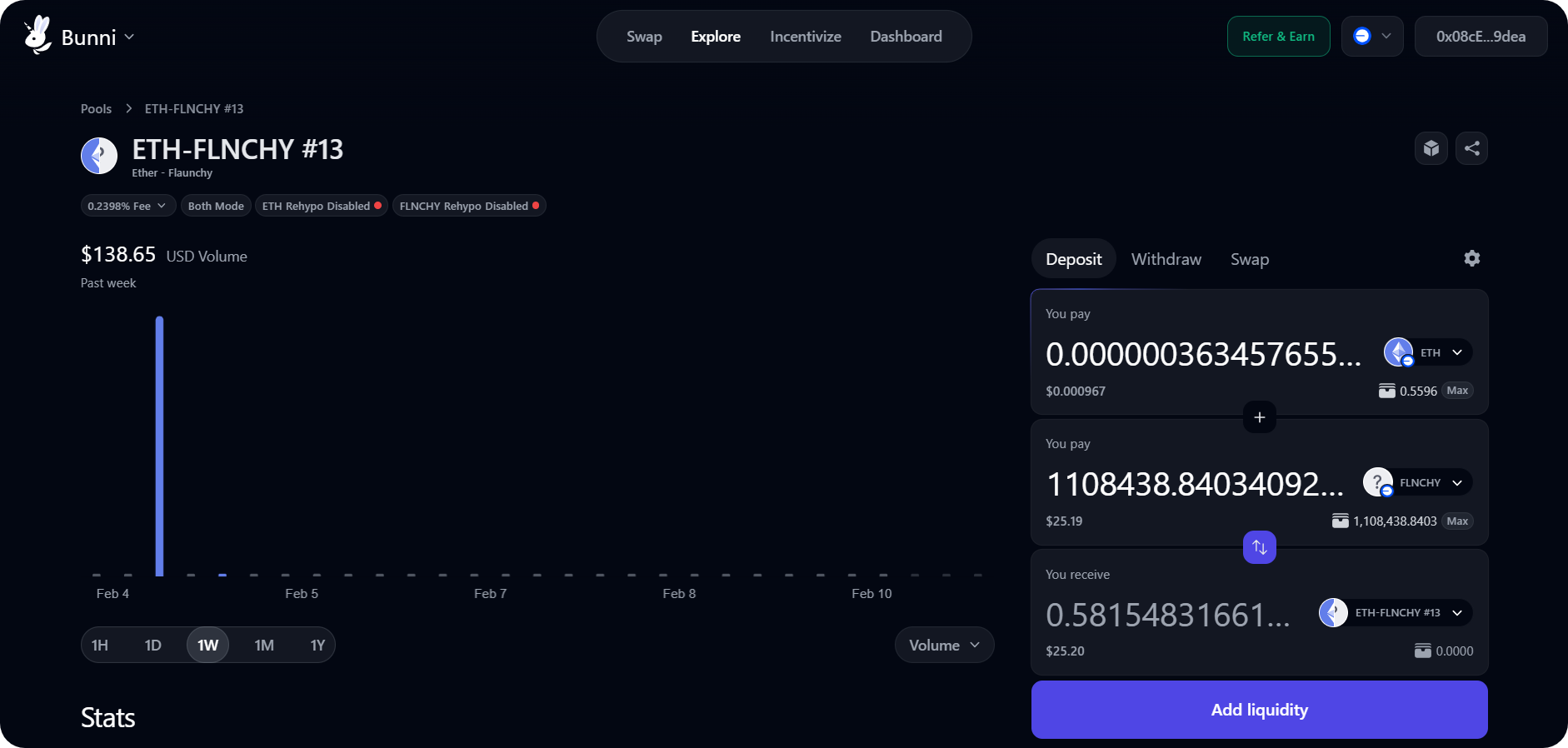

- Surf the available liquidity pools and click on your desired trading pair or press the "New pool" button

- If you click on an existing pair, use the provided "Deposit" interface to select how much liquidity you want to provide, then press "Add Liquidity"

- To finish up, press "Deposit" and sign the final transaction prompts with your wallet — now you'll be providing liquidity on Bunni

- If you opt instead for the "New pool" option, you'll next be asked to select from an Easy Mode, Standard Mode, and Advanced Mode — if you're just looking to get your feet wet, Easy Mode is perfectly fine here

- At this point, input your desired token pair and the pool initialization price, then input a Pool name, symbol, and description, then press "Next"

- Now select from the available pool style presets: Low Risk Stable Pair (for stablecoins), Volatile Pair (for regular coins), or Uniswap V2 (if you want to provide full-range liquidity)

- Lastly, you'll be asked if you want to enable ETH Rehypothecation; if you activate this mechanism, "idle liquidity will be deposited into a vault to earn extra yield for liquidity providers"

- Press "Create Pool" and complete the creation transactions with your wallet, and voila, you've set up your own Bunni pool!