Bullish Market Bounce ($)

View in Browser

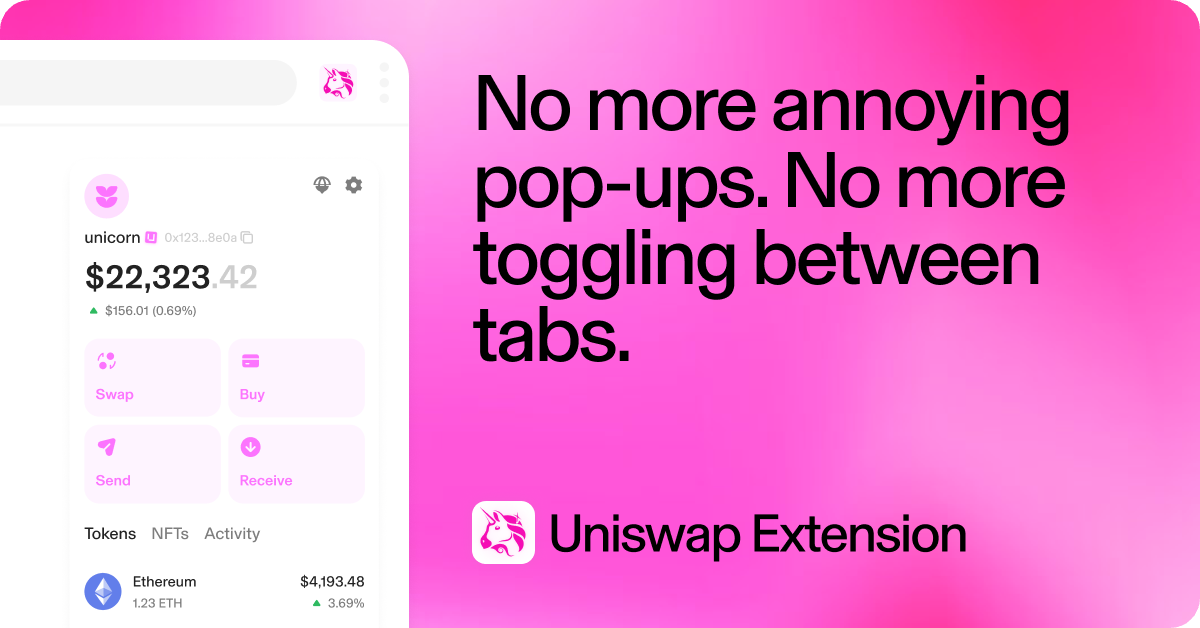

Sponsor: Uniswap Extension — Say goodbye to pop-ups. Download today.

- ✂️ Jerome Powell Gets Ready to Cut Interest Rates. At a Jackson Hole summit, Powell signaled it would soon be time to cut rates.

- 🚀 Sony Introduces Soneium Ethereum L2. It's one of the biggest mainstream names to launch its own chain this cycle.

- 🇮🇳 WazirX Starts Rupee Withdrawals Following Major Hack. Crypto withdrawals are still unable to be processed after the disastrous attack.

📸 Daily Market Snapshot: Markets finally got their long-awaited signal from Fed chairman Powell that interest rate cuts are coming. The news sent markets climbing higher, with BTC pushing toward $64K and ETH climbing over $2,750.

| Prices as of 5pm ET | 24hr | 7d |

|

Crypto $2.24T | ↗ 4.9% | ↗ 7.7% |

|

BTC $63,690 | ↗ 4.0% | ↗ 7.4% |

|

ETH $2,755 | ↗ 5.1% | ↗ 5.5% |

|

APT $7.15 | ↗ 11.0% | ↗ 20.2% |

This week, Magic Eden turned heads with its ME token announcement.

The NFT marketplace has had a crazy run challenging OpenSea's dominance, and we've been following along with it every step of the way. If you're new to the project, there's never been a better time to check it out than through our latest update to the Magic Eden Bankless Guide.

Check out the free guide 👇

Say hello to the Uniswap Extension, the first wallet to live in your browser’s sidebar. Swap, sign, send, and receive crypto anywhere on the web without dealing with pop-ups. Designed for a multi-chain world, with support for 11+ networks.

🧑🌾 Farming Alpha: Fortune occasionally favors the bold, and thankfully for risk-on degen lenders, Justin Sun’s controversial acquisition of the WBTC is causing some to reduce risk, spiking utilization rates on Fraxlend. Curve is offering an alternative source of BTC yield, albeit on less venerable assets. Meanwhile, yields on top ETH and BTC opportunities elevated slightly across the board this week.

Top Opps:

- 🟠 BTC: 16% APY with Fraxlend’s WBTC pool on Ethereum

- 🟠 BTC: 9% APR with Curve’s eBTC-tBTC pool on Ethereum

- 🔵 ETH: 13% APY with Pendle’s steakLRT PT on Ethereum

- 🔵 ETH: 13% APR with Hop’s ETH pool on Arbitrum

- 🟢 USD: 16% APY with Pendle’s sUSDe (Karak) PT on Ethereum

- 🟢 USD: 14% APY with Kamino’s PYUSD-USDC pool on Solana

- 🟢 USD: 12% APR with Hop’s DAI pool on Arbitrum