Uniswap Labs's announcement that they would be rolling out a small transaction fee on their popular front-end dapp caused a ruckus on crypto Twitter this month with some holders of the UNI native token seeing the fee rollout as a betrayal of holders.

Still, others feel that Uniswap Labs is simply operating within the regulatory realities of the moment and that they shouldn't be raked over the coals for trying to monetize a startup that is largely responsible for the future success of the protocol.

In today's article, Bankless analysts Jack Inabinet and 563 dig into the bear and bull cases for the UNI token.

Agree or disagree? Take it to the comments!

Let's kick things off with the bull case...

🐂 Bull Case

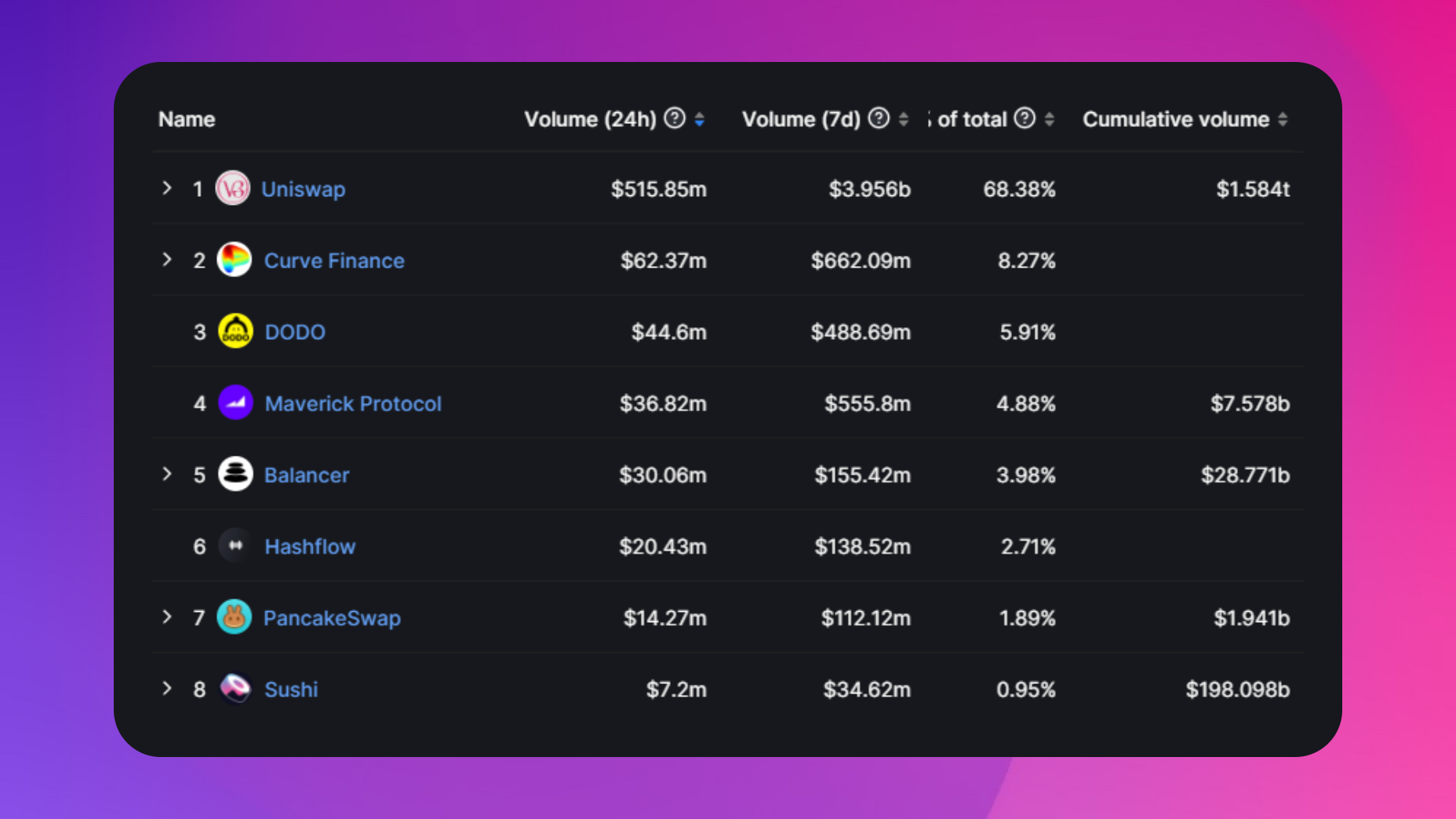

Uniswap's complete domination of the decentralized exchange (DEX) sector is already beyond reproach. Responsible for almost 70% of Ethereum swap volume and 44% of total onchain volume, its nearest competitors have been fighting over the remaining scraps for years.

"Hooks," a new feature in their upcoming fourth iteration, will allow protocols to customize Uniswap pool parameters, enabling a new wave of smart contract experimentation. This change in Uniswap's design encourages newcomers to build on top of Uniswap instead of forking their codebase to make a competitive product. In the land of DEXs, all roads are starting to lead to Uniswap.

Hayden's announcement of a front-end fee rustled the feathers of impatient "experts" on Crypto Twitter, who would prefer that Uniswap Labs, the main contributor to the protocol, never make a profit.

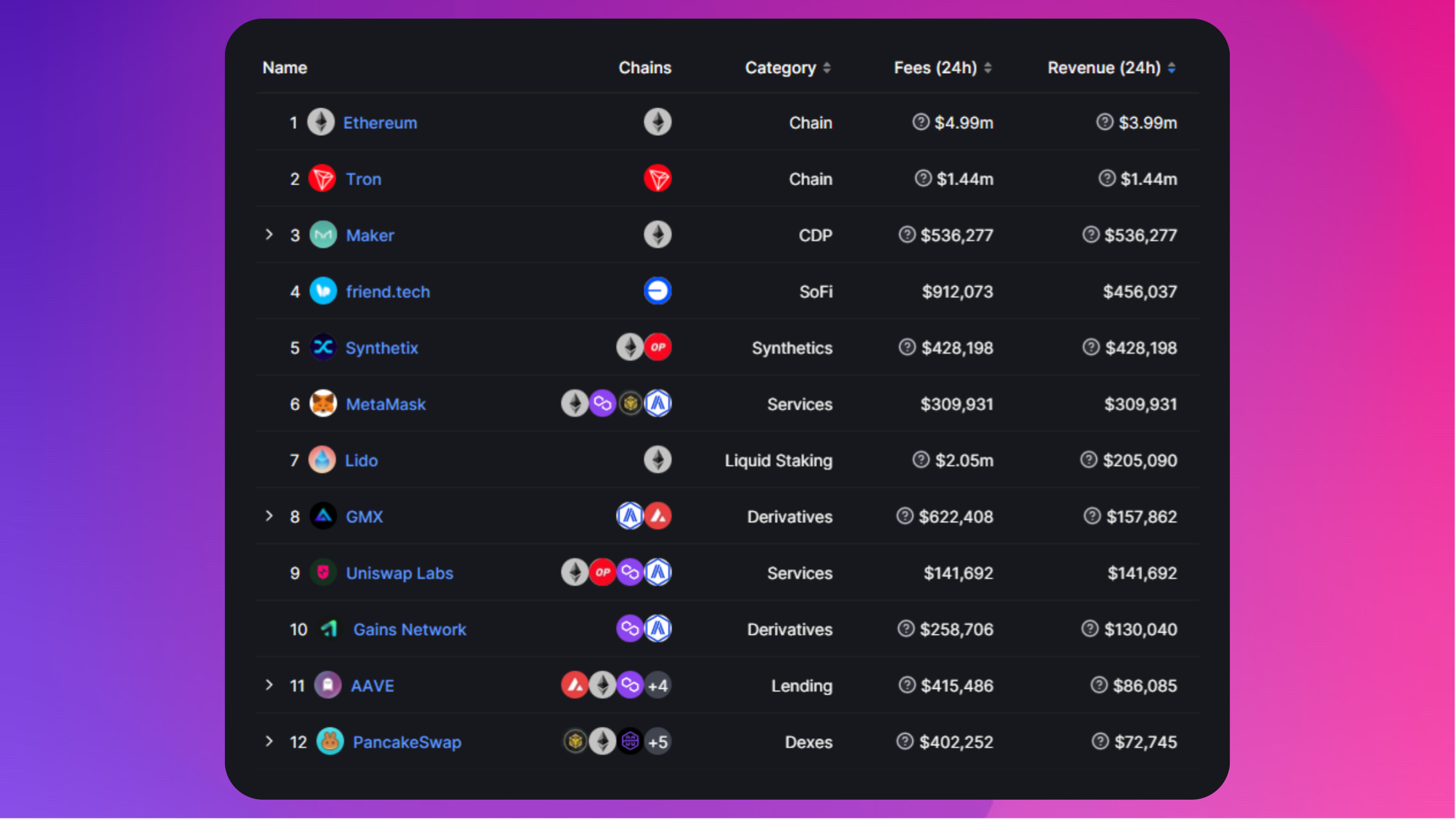

Note that the 0.15% swap fee is less than one-fifth of Metamask's 0.875% – a fee that has propelled Metamask to a level of consistent income that is often reserved for only the most-used chains and apps.

Not to mention that the fee is only relevant to users swapping via Uniswap's front-end. Using an aggregator that touches Uniswap pools? You aren't affected, my friend.

This means that people opting for the convenience of Uniswap's front-end (or mobile app) pay roughly $0.15 for each $100 swap. And in the grand scheme of crypto volatility, that's likely to be lost in the noise.

Uniswap is in the process of leveraging its advantage in the DEX space, building up a war chest to fund more development, ensuring that its moat deepens, widens, and becomes unassailable.

Holding the UNI token is a bet that Uniswap will cement itself as the market leader so that if the coveted "fee switch" is ever flipped, it is done from a place of power and not from peer pressure alone.

No one expects growth stocks like Google or Tesla to throw off a dividend, why should the UNI token? Sophisticated investors recognize the shortsightedness of this option (hence why a16z voted against it). There is a time and a place for a dividend, but a crypto startup is not Johnson & Johnson.

my view on @Uniswap is you're being hypocritical if you smear UNI as just a governance token but would own Nvidia, Google, TSLA, Cloudflare, or any tech stock with no dividend.

— guerilla artfare 🪷 (@BackTheBunny) October 18, 2023

what do you think you own exactly? because it isn't a claim on cashflows or company assets🧵 https://t.co/QbSSiKimJw pic.twitter.com/fwfjHaQFGP

By internalizing and compounding profits, Uniswap will be able to continue its growth trajectory, building out new features and a better user experience. Their objective is that the word "DEX" becomes synonymous with "Uniswap," and they are well underway towards this goal. And if 0.15% is the price for this level of absolute dominance, it is a small price to pay indeed.

- 563

🧸 Bear Case

If you believe that asset speculation is a major crypto use case, you should be bullish on "Uniswap," but the question remains: should you be loading your bags with UNI tokens?

Undoubtedly, Uniswap Labs equity HODLers are feeling good about their investments. With the launch of their proprietary wallet and the recent addition of front-end swap fees, Labs now has multiple revenue drivers and is on the way to establishing itself as one of crypto's rare profitable companies!

Turning on fees highlights Uniswap's pricing power over its users. It displays that it's possible for Uniswap to generate profits. Still, tragically, the decision to implement this front-end fee is a contentious development in the relationship between token and equity holders that highlights the differing incentives between these two competing groups of investors.

In web2, there is explicit misalignment in incentives. We all know that Facebook’s business is not aligned with users

— Nick Tomaino (@NTmoney) October 16, 2023

When a web3 protocol launches a token, alignment is assumed and reflected in the token distribution When it turns out not to be the case, the users and retail…

Given US regulatory uncertainty, it should come as no surprise that Uniswap Labs has been forced to monetize via a front-end fee rather than leveraging the in-protocol fee switch. Still, this development should spawn serious questions among UNI token holders of whether value will actually accrue to their investment from Uniswap's success!

Differing goals between Labs equity holders and UNI token holders could pose a barrier to turning on the in-protocol fee switch in the first place, seeing as some of these actors are one-in-the-same but enjoy greater marginal returns from profits earned via the equity-only front-end fee versus the more diluted in-protocol alternative.

The schism created by this decision shines a spotlight on the competition underlying the relationship between token and equity holders. Every dollar of fees extracted from the Uniswap front-end fee is a dollar of potential profitability from token holders (and vice versa).

Even if a regulator compliant path for implementing an in-protocol fee switch existed and received approval despite governance roadblocks, it would exist in contention with the front-end fee and be unable to extract maximum value.

Further, while UNI holders may control the IP rights of Uniswap's smart contracts, there are unanswered questions about the long-term value of these assets. Uniswap Labs is pivoting away from the AMM to construct Uniswap X, a request for quote (RFQ) system.

To provide the best possible price for users, Uniswap X will query the Uniswap pools and unaffiliated third-party fillers (read professional market makers), who then compete to fill swaps using onchain liquidity like AMM pools or their private inventory.

Ideally, Uniswap Labs would be fully aligned on a singular goal of providing value to the UNI token; instead, this privately held corporation is siphoning a portion of the profits away from token holders to build products in direct competition with the Uniswap AMM.

While crypto tokens serve to align incentives between their issuers and holders, the addition of offchain equity with incompatible incentives only serves to muddy this equation.

- Jack