Bull Market Jitters

Dear Bankless Nation,

Another week in crypto, and another week of confusion in the markets. There’s ample supply of both bullish and bearish news, creating a sense of hesitancy for anyone to express meaningful levels of conviction about short and medium term price action.

I call these the bull market jitters. Let’s recap.

Bulls vs Bears

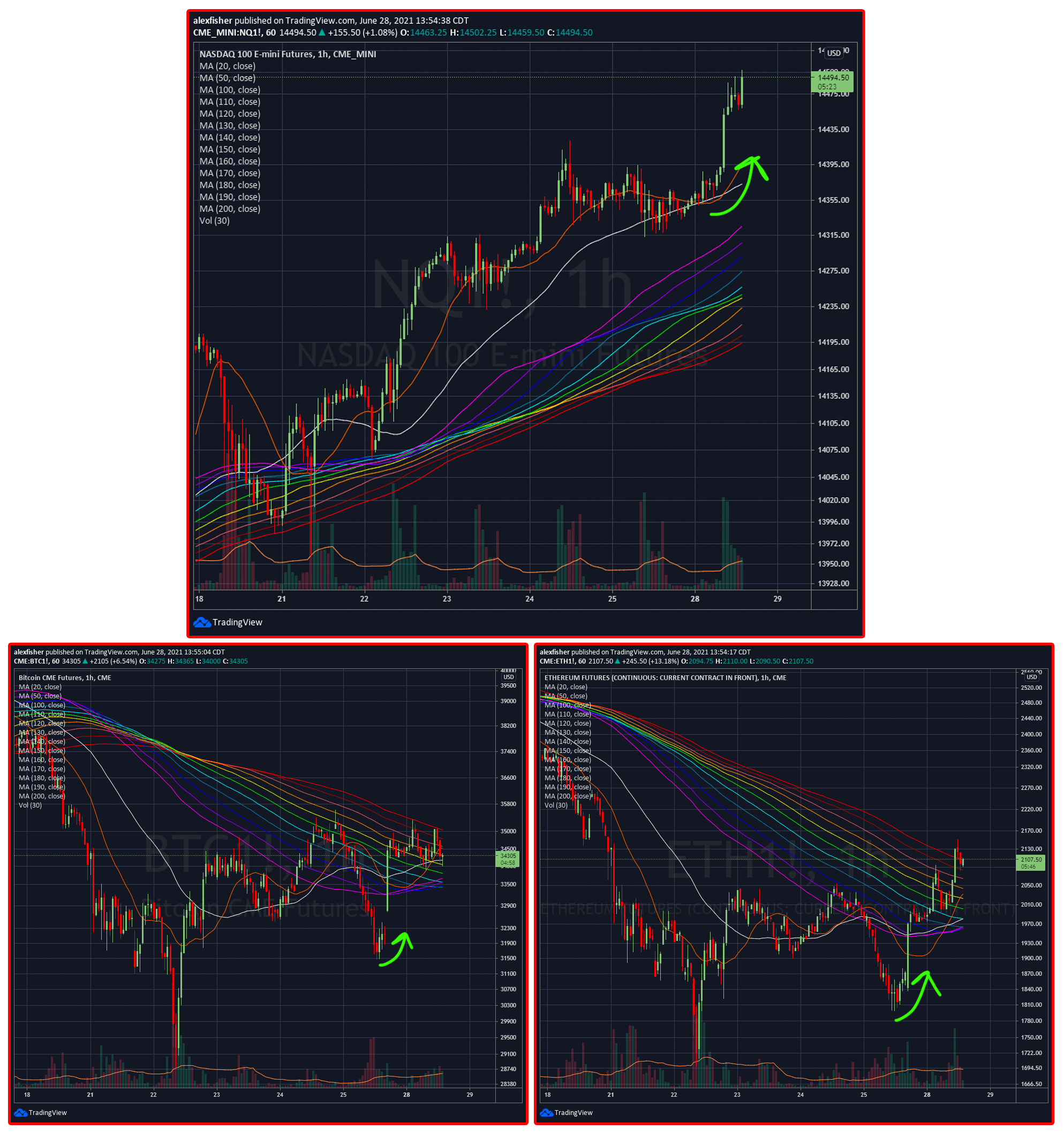

BTC fell below $30,000 for the first time since it originally crossed it in Dec/Jan of 2020/2021. It hit a low of $28,700, but quickly regained its $30,000 level inside the 1-day candle (pictured below).

Similarly, ETH touched $1700 twice last week before quickly regaining its $2,000 level.

The bulls see these assets at price floors—what a buying opportunity! If you look into the 2021 price action for ETH and BTC, there has been a healthy amount of time spent at these levels to give buyers some comfort that they’re buying at support-levels. 🚀

The bears believe that if we break through these levels…there may not be support found until previous ATHs—that’s $20,000 for BTC and $1,400 for ETH 😵💀😵💀

The bulls say that there are too many people betting that Bitcoin completes its massive Head & Shoulders formation its been printing for all of 2021. Too many people waiting to all make the same trade generally means that there are plenty of people with cash on the sidelines ready to buy the dip…and therefore the dip won’t play out.

The bears say that the momentum has reversed—they say the up-and-to-the-right trend of 2021 is sufficiently dead and that people usually don’t realize how far things can reverse against momentum once momentum has changed its course.

Correlated with Stocks again

Interestingly, both BTC and ETH jumped up last night, right at the same time that stock futures opened up very green.

For better or for worse, this at least gives us some clarity. As of lately, and maybe for the foreseeable future, we’re correlated with macro-markets.

We’ll likely remain correlated with the jittery macro market prices inflation concerns and interest rate changes. If the Fed turns hawkish on interest rates to counteract inflation, it’s generally unfriendly to risk-on assets like stocks (and crypto!), as it makes capital more expensive.

So we have Bull vs Bear price arguments. We have an uncertain macro backdrop.

How about we slap on a China Ban?

Bitcoin Miners moving out of China

We all know the China is Banning Bitcoin™️ meme. It happens multiple times every cycle, to the point where crypto veterans don’t even care to open these news articles.

But this one is different. China isn’t banning Bitcoin, but it is banning Bitcoin mining.

Bankless Editor Lucas Campbell put some great thoughts in the Saturday Weekly Recap, and Nic Carter once again does a phenomenal job breaking it down for us.

The tldr;

- Yes, China actually banned Bitcoin mining.

- No, it did not ban Bitcoin itself.

- This may be good for Bitcoin™️ because it removes the centralization of Chinese hash power and disperses it across the world. Maybe to more western nations, which might make U.S. regulators more comfortable.

- This also may be good for Bitcoin™️ because China was Bitcoin’s dirtiest energy source, and basically any other place outside China is likely to be more green energy sources for Bitcoin.

Perhaps these last two points will help Bitcoin overcome some narrative headwinds it’s faced in 2021. But overall, this offers a compelling rationale as to why Bitcoin’s chart has looked like 💩 in Q2 2021.

Moving Bitcoin mining operations is no small feat. These are gargantuan operations that must be migrated across continents. A capital intensive move.

And what liquid capital do Bitcoin miners have? Bitcoins, of course. Maybe what really killed crypto price momentum is Chinese Bitcoin miners selling BTC in order to cover their costs of migration capital.

Informed traders who are tapped into Chinese sources are able to also sell into this news, and front-run this before it gets to western news sources (this has been known in China for weeks if not months before becoming widely known in the west).

Overall, this event was enough to kill the momentum we found in the first half of 2021, and is a very likely culprit of the sideways 🦀 market we find ourselves in.

One bright spot amidst this jittery market is funding.

The money is flowing. Funding is 🚀.

Funding for Projects

Here’s a few things that happened in the last few weeks:

- A16z raises 2.2 BILLION DOLLARS in the LARGEST RAISE EVER for crypto.

- Blockchain Capital raises $300M in venture funding from Visa and Paypal

- BitWise raised $70M

- dYdX raised $65M

- 1 Confirmation raised $125M

- BlockFi raised $500M

- Ledger raised $380M

- Solana raised $320M

The list goes on….

This doesn’t even include any of Microstrategy’s debt-offerings, which apparently have infinite levels of demand, as well as the number of teams in DeFi who are raising between $3 and $50m which are simply too numerous to list here (but you can catch them on the Weekly Rollups!)

There is no👏shortage👏of👏money👏 to go around right now. So, even if we were to somehow see the most bearish version of price action over the next 6-12 months (the window for this timeline is closing IMO), at least all of the teams and companies that are building out the fundamentals of this industry have ample levels of cash to hold them through.

Also, honorable mention:

- While $ETH was dropping below $1,800, 100k more ETH was deposited into the Ethereum 2 deposit contract by a single entity. Someone is bullish 🚀

Price Determines Sentiment

On a recent Uncommon Core podcast, Su Zhu and Hasu talked about how price is a filter that can tilt how anyone perceives the state of fundamentals of a project. If the price is high, you can see the bullishness in the story that is told by certain fundamentals behind an asset. If price is low however, you can look at those same fundamentals and come to a bearish conclusion…even though you were looking at the same exact fundamentals as you were before, when you were bullish.

The point is that the price of an asset is often the thing that determines whether or not you are bullish or bearish, even though it should be the fundamentals that should be making you bullish or bearish.

Fundamentals not price.

How will you feel when EIP1559 flips on in early August?

How will it feel when you migrate your DeFi activity to Arbitrum soon? Or when Optimism launches and both these L2s are competing for your deposits 🤔

How will it feel when Ethereum has the UX of Robinhood, but with the super powers of DeFi?

Are you going to let the fundamentals determine how you invest, or are you going fall prey to the whims of short-term price?

Ryan and I recently just recorded with three of the biggest long term Ethereum bulls that we know for our second “Bull Case for Ethereum” podcast episode. If you need a reminder on the fundamentals behind Ethereum and DeFi, then listen to this episode.

The bull market is jittery but the fundamentals are strong.

So I’ll see you at $10k ETH…sooner or later. 🚀

- David

P.S. Ledger launched their Paraswap integration—allows you to swap any tokens at the best price directly from your Ledger Live app. Who knows….might be worth it