Breakups, Bailouts, and Buyouts

Dear Bankless nation,

Here’s a recap of crypto news for the final week of June, 2022.

1. 3AC contagion

Last week, we witnessed two big players in crypto — Three Arrows Capital and Celsius — straight up imploding upon themselves.

This week, the contagion from 3AC continued to spread as linked companies BlockFi and Voyager Digital both took on heavy cautionary measures to stay afloat.

The latter lowered its daily withdrawal limits to $10K.

Things were looking pretty grim for either. But CEX giant FTX came to the rescue of BlockFi’s financial troubles, and VC firm Alameda Research to Voyager’s.

The cost? Coming up on a cool billion dollars all in.

And Celsius? Remember them? TradFi vultures are circling as none other than pantomime crypto villain Goldman Sachs is lining up $2 billion to purchase the firm’s assets if and when it does go officially bankrupt.

2. dYdX breaks up with Ethereum

This week, dYdX announced its intention to leave Ethereum and launch dYdX V4 on its own chain in the Cosmos ecosystem.

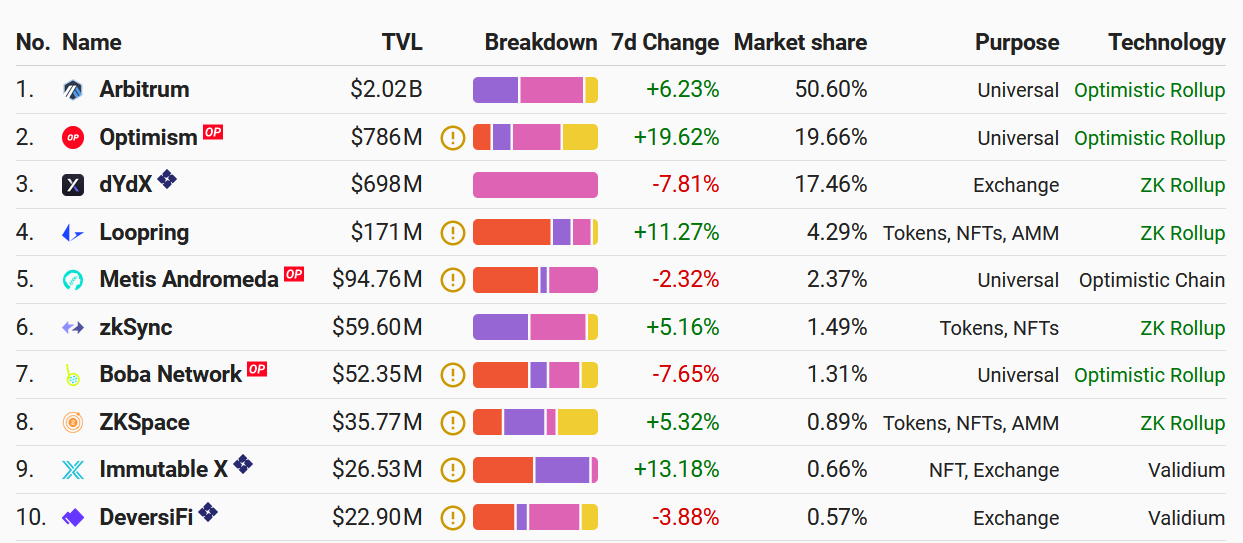

dYdX is the biggest perpetuals DEX in DeFi, and currently hosted on a Starkware-powered app-specific rollup — itself one of the largest rollups in DeFi.

dYdX’s official line is scalability:

The fundamental problem with every L1 or L2 we could develop on is that none can handle even close to the throughput needed to run a first class orderbook and matching engine. For reference, the existing dYdX product processes about 10 trades per second and 1,000 order places/cancellations per second, with the goal to scale up orders of magnitude higher.

This is where Cosmos comes in. A massive benefit of developing a blockchain dedicated to dYdX V4 is that it offers full customizability over how the blockchain itself works, as well as the jobs that validators perform.

This allows dYdX V4 to have extremely high throughput for the orderbook while remaining decentralized.

But there’s more to the story than just scalability. It’s likely also a CYA move for avoiding unwanted scrutiny from the SEC, and a bold-faced move away from consensus-based decentralization and towards complete control of its own blockchain apparatus.

Participate in this week’s Bankless open discussion on the topic here, and expect deeper dives into the topic this week as we dig out what’s really going on.

3. Uniswap acquires NFT metamarket Genie

Buying NFTs individually is a hassle for the most degen NFT shoppers among us. That’s where aggregators like Genie come in: to let users easily sweep them in bulk purchases across different NFT marketplaces.

Uniswap Labs — the venture capital arm of Uniswap — announced an acquisition of Genie this week.

Not only will NFTs be integrated with the Uniswap DEX product, Genie’s loyal users will also be rewarded with a USDC airdrop. Check out David’s State of the Nation interview with Uniswap CEO Hayden Adams this week for all the details.

In other NFT-related news, aging ecommerce juggernaut eBay is acquiring NFT marketplace KnownOrigin, which has been in operations since 2018. This has been received by some NFT artists as something of a betrayal.

William Peaster dove into the story in the Metaversal newsletter this week:

For the foreseeable future, look for more of what we saw this week, i.e. big crypto companies and big mainstream companies looking to reshape their businesses via opportune NFT ecosystem acquisitions. OpenSea recently bought Gem. Uniswap just bought Genie. And eBay certainly won’t be the last web2 titan to dip its hands in the NFT jar. These sorts of NFT-minded restructurings may be just a taste of what’s to come on the mergers and acquisitions (M&A) front over the next 6-12 months.

Solend goes whale hunting

The Solend protocol — an equivalent to Aave/Compound on Solana — is the Solana ecosystem’s second largest dapp by TVL at $238M, behind Marinade Finance.

Solend has a problem on its hands. One whale has a disproportionately large margin position (5.7M SOL/$170M). SOL price falling below $22.3 would cause a huge liquidation event that would further crash the price of SOL and negatively impact the whole Solana ecosystem.

A governance solution introduced would see the Solend team confiscate the whale’s account and execute a liquidation to save the platform. Yikes.

Here’s the timeline of events:

- After trying to reach the whale privately and publicly to no avail, a first governance proposal was passed with 97.5% vote approval to implement “special margin requirements for large whales that represent over 20% of borrows and grant emergency power to Solend Labs to temporarily take over the whale's account so the liquidation can be executed OTC.”

- The community wasn’t happy with how the first proposal went, so Solend passed a second proposal to invalidate the first and increase governance voting time.

- Then, a third proposal was passed to introduce a constitutional rule to cap per-account borrow limits at $50M (the whale borrowed $108M).

The optics here for “decentralized” finance are pretty bad. Code clearly isn’t law if developers can intervene to actively introduce changes. But tyranny of the majority is still better than the oligarchical “tyranny of stockholders” you’ll find in TradFi.

As much as it was not cool for Solend developers to go all nanny state, its team still had to seek approval from the community at large. The entire process was at the least publicly transparent.

The actual good news is that after a 30% price jump in the past week, the current SOL price is $42, buying the protocol some time to sort out this mess.

Web3 News Roundup

Arbitrum

Arbitrum’s Odyssey campaign kickstarted this week on 21st June.

Want a full guide? William Peaster’s got your back.

Bancor rugs impermanent loss protection

Bancor impermanent loss protection mechanisms were introduced as a way to curb liquidity provision risk. The protocol halted these mechanisms temporarily due to “hostile market conditions”.

Hasu has a spicy take:

New Lido Validators

Lido continues to decentralize with the addition of eight new node validators.

ZigZag DEX Airdrop

ZigZag drops its token.

Never a dull week in crypto, huh?

Here’s what we have lined up for the next one:

- William is dropping a Budget Ballers Guide to NFTs

- Ben is sharing June's monthly token report and rating yield strategies

- Matt Cutler joins us on the podcast to discuss Ethereum's Future Power Structures

See you next week.

— Donovan