Dear Bankless Nation,

Earlier this year, a new form of Bitcoin NFTs exploded onto the scene with the arrival of the Ordinals protocol.

This system is used to “inscribe” or convert individual satoshis (the smallest BTC denomination) into Bitcoin-based NFTs.

Not long after Ordinals arrived, one experimenter used the protocol to create another system, BRC-20s, as a new way to make semi-fungible tokens on Bitcoin.

In recent days, the surge of memecoins like $PEPE on Ethereum has inspired a similar memecoin boom on Bitcoin via BRC-20s. Let’s catch you up on all the basics here for today’s post 👇

-WMP

Bitcoin Grapples with a BRC-20 Craze 💥

What are BRC-20s?

First proposed in 2015, ERC-20 refers to Ethereum’s official token standard for fungible tokens, i.e. tokens that are exactly alike and currency-centric. The dollars in your pocket are fungible, the UNI in your wallet is fungible, so on and so forth.

In contrast, BRC-20s — a much newer arrival in the cryptoeconomy — are not smart contract-based tokens like ERC-20s are, and they’re not completely fungible either. Rather, a BRC-20 token is roughly like a cross between a fungible token, e.g. MATIC or UNI, and a semi-fungible ERC-1155 NFT.

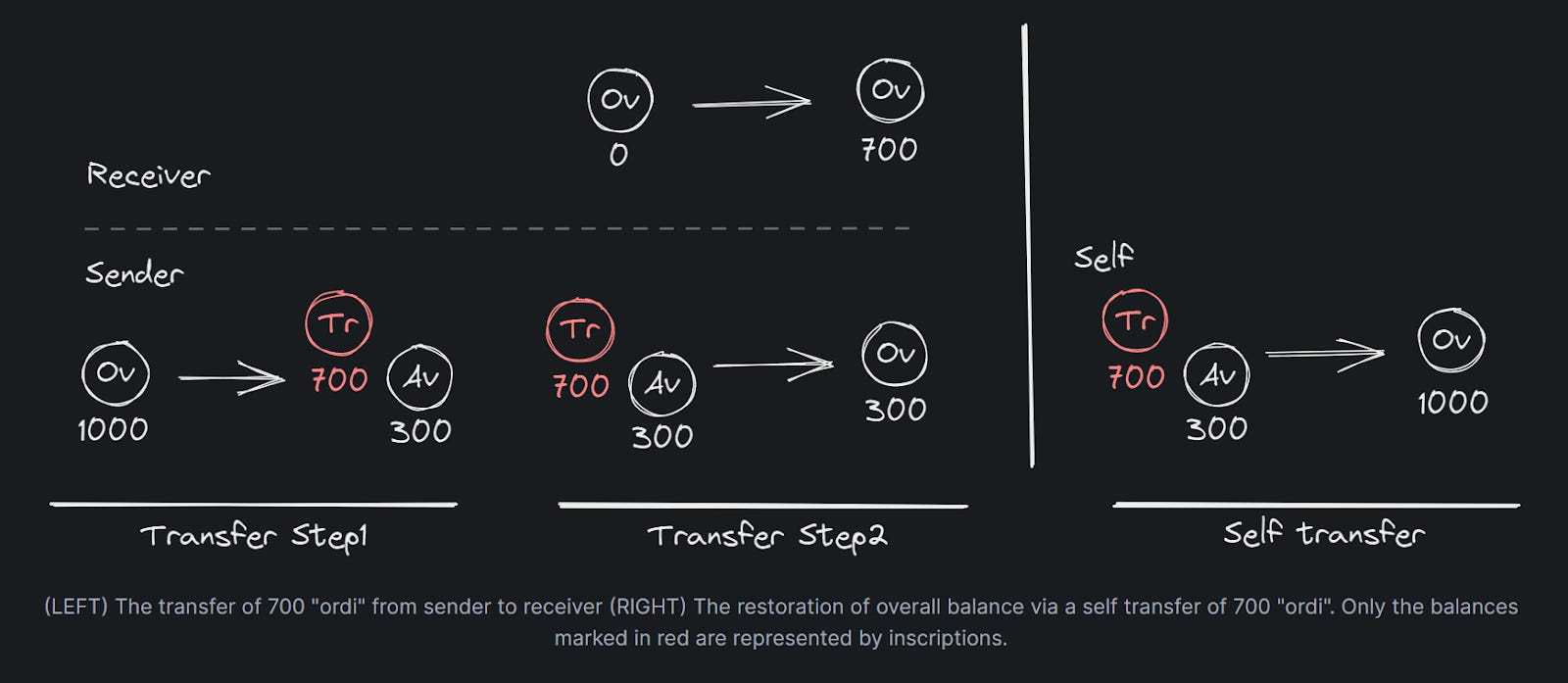

That’s because a BRC-20 is created by inscribing a snippet of JavaScript Object Notation (JSON) text into a Bitcoin NFT via the Ordinals protocol. This JSON contains a token’s basic information, like max supply, the token ticker, etc. For transfers or buys/sells, additional NFTs are inscribed that can be used to track the balance adjustments off-chain.

Accordingly, the BRC-20 model is an unofficial, experimental standard that outlines an NFT-based currency system built atop Bitcoin. As the creator domo has explained on GitBook:

“This is just a fun experimental standard demonstrating that you can create off-chain balance states with inscriptions. It by no means should be considered THE standard for fungibility on Bitcoin with Ordinals, as I believe there are almost certainly better design choices and optimization improvements to be made. Consequently, this is an extremely dynamic experiment, and I strongly discourage any financial decisions to be made on the basis of its design. I do, however, encourage the Bitcoin community to tinker with standard designs and optimizations until a general consensus on best practices is met (or to decide that this is a bad idea altogether!).”

Why BRC-20s matter

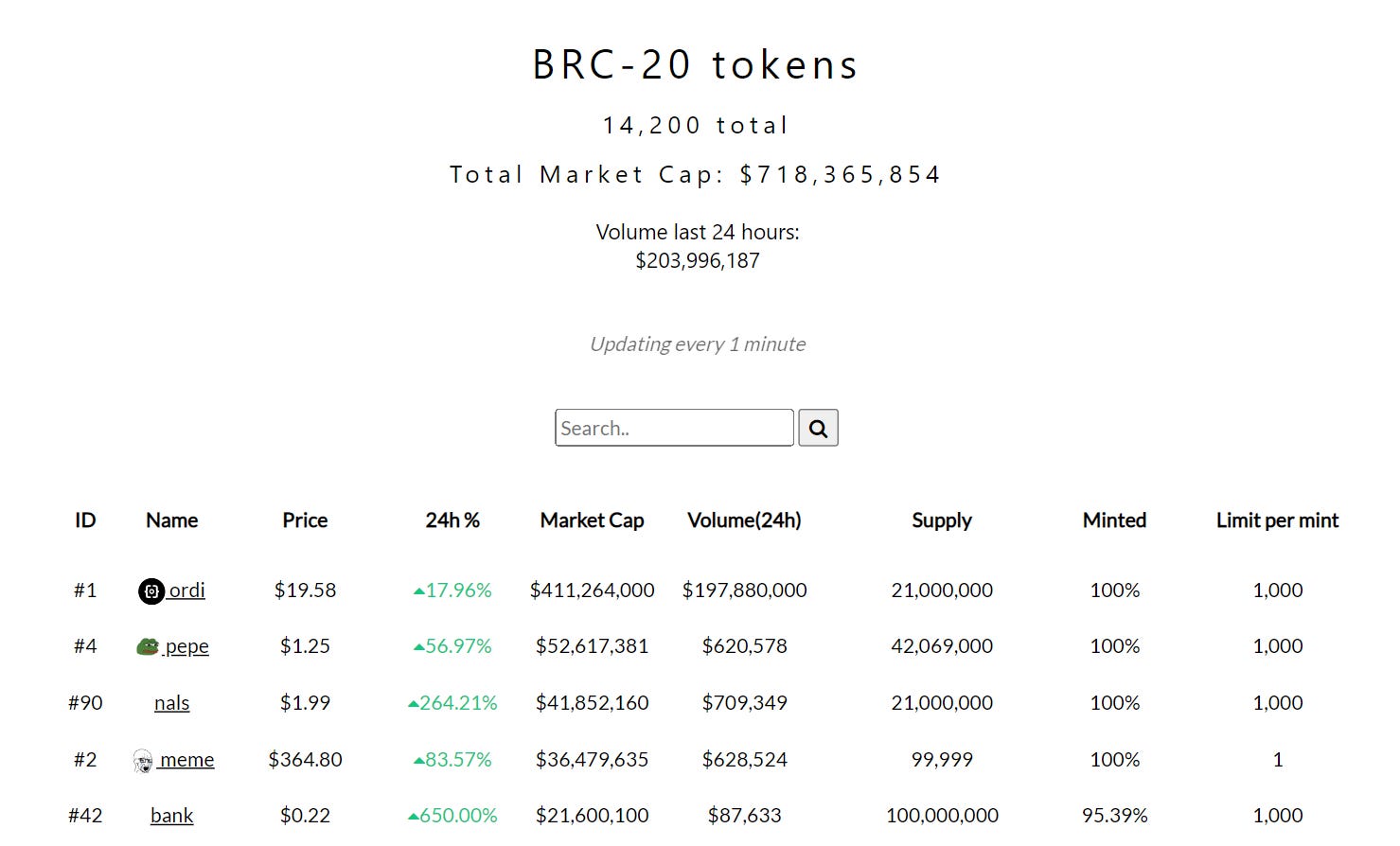

Experiments often take on a life of their own in crypto, and the BRC-20 system’s proven to be no exception here. In particular, over the past week BRC-20 minting and trading activity has boomed as the memecoin craze has started making its way to Bitcoin’s frontier.

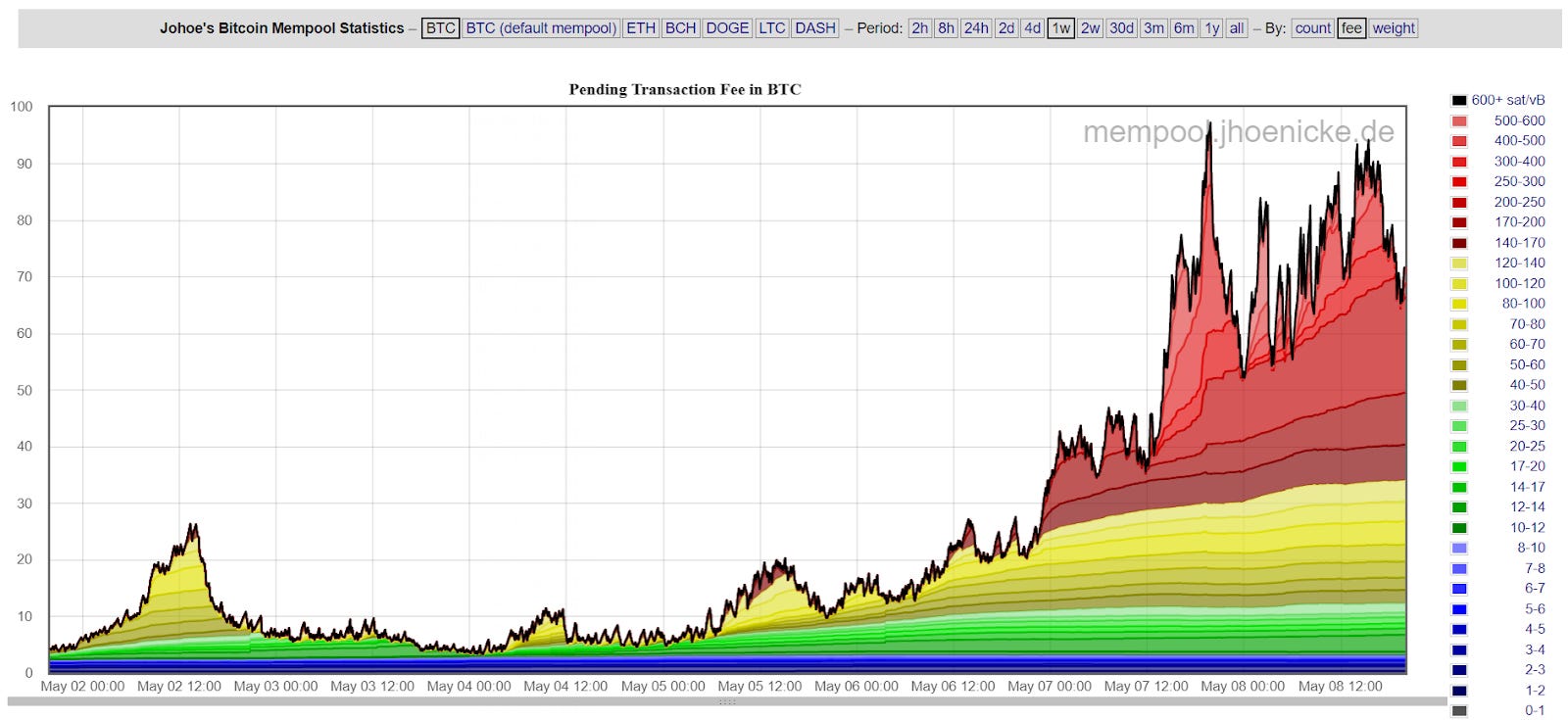

On the one hand, from an innovation standpoint it is interesting to see this sort of experimental standard opening up a new range of tokenization possibilities on Bitcoin. On the other hand, the rise of BRC-20s in recent days has caused controversy in the Bitcoin community due to an explosion of network congestion, with some hardliner Bitcoin maxis painting the activity surge as an outright attack against the OG blockchain.

It remains to be seen how the dust will settle accordingly, but one thing seems obvious, and that’s that tokenization experiments on Bitcoin are here to stay!

How to try BRC-20s

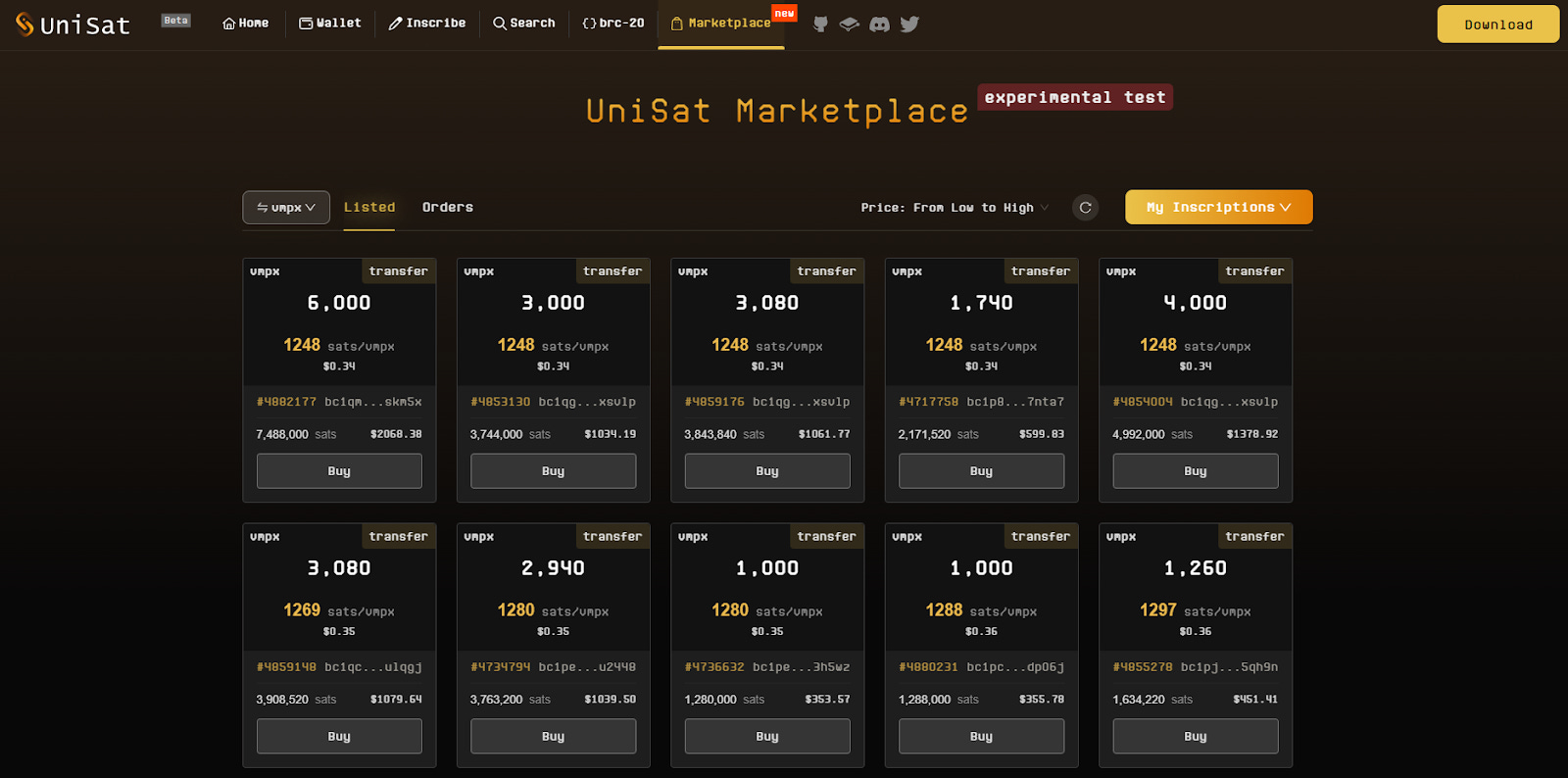

The BRC-20 scene is still relatively primitive, but one option has already risen to the fore as a popular Ordinals and BRC-20 wallet, and that’s UniSat. Both a platform and an open-source Chrome extension, the UniSat wallet makes it straightforward to mint, store, and transfer BRC-20 tokens.

The UniSat website also offers a BRC-20 marketplace where you can review and buy from listings of BRC-20 assets or make listings of your own. Of course, trade at your own peril in these early experimental days, and only with test sums at first if you do. But if you’re looking to dive in, UniSat looks to be the best starting place for beginners right now.

Additionally, keep in mind that you can’t use the UniSat marketplace until you’ve made at least 20 inscriptions through the platform, which is another dynamic that’s currently helping to drive the congestion on the Bitcoin network. Bitcoin transactions are expensive right now at least in part because many people are trying to get their 20 transactions in so they can start using the UniSat marketplace!

Zooming out

The advent of BRC-20 tokens has unleashed a big new wave of activity and controversy in the Bitcoin community. As this experimental system takes flight, it’s becoming a new hub for memecoins and is signaling a new era of tokenization possibilities on Bitcoin.

However, BRC-20s come with their own set of challenges and concerns, most principally network congestion. For us explorers, it’s also important to remember the experimental nature of these early systems and the risks involved, e.g. unforeseen bugs.

Nevertheless, for those curious to dive deeper here, platforms like UniSat offer a compelling starting point for testing out your first BRC-20 transactions. And if you’re keen to learn more, keep an eye out for an in-depth BRC-20 analysis post coming out in the Bankless newsletter tomorrow, it’ll cover stats, predictions, and more! In the meantime, this Dune dashboard by Crypto Koryo is one place you can explore early BRC-20 activity for yourself.