View in Browser

Sponsor: Mantle — Mass adoption of decentralized & token-governed technologies.

1️⃣ Bitcoin Roars Back After Recession Scare

After a brutal selloff at the start of the week, bulls have regained ground, seeing Bitcoin surge past $62.5K on Thursday, buoyed by lower-than-expected U.S. jobless claims, which calmed global recession fears. Though Solana led the charge, running as high as $163 after reaching a bottom of $110, all three majors still are down over the past week. A few altcoins have shown notable strength — such as Helium, Celestia, Sui, and Bittensor, all up over the last 7 days, with the latter two also receiving Grayscale trusts. It may take some time for us to see if we’re truly back in an uptrend.

2️⃣ Navigating Market Sentiment

Despite the recovery, market sentiment remains decisively split between bullish and bearish, given the maelstrom of macro and industry-specific events behind last weekend’s crash. Here are key points from both camps:

Bulls:

- Despite the panic in equities, credit markets have remained stable, suggesting that the recent selloff may be more of a liquidity issue than a systemic one.

- Recent data, including the ISM Services PMI and updated employment numbers, show that the economy is stronger than the previous week's jobs report suggested, with robust GDP growth and low unemployment.

- Exchanges paint a positive picture, with Bitcoin stored on them reaching historic lows.

Bears:

- The VIX spiked to 65, a level comparable to peaks during the 2008 financial crisis and the March 2020 COVID-19 market crash, indicating extreme market volatility and investor panic.

- Auto sales are down, loan delinquencies are up, consumer spending is shrinking, and the housing market is strained, meaning rate cuts might not support an already declining economy.

- Given the size of the yen carry trade and the extent to which the Bank of Japan’s unexpected rate hike disrupted global markets, the blowback from its unwinding may not be over, bringing further volatility, especially in the short term.

3️⃣ Solana Shines, ETH Faces Challenges

As mentioned, Solana led the recent market recovery, reaching an all-time high against Ethereum at a 0.062 ratio. This, plus ETH’s continued underperformance, has indicators showing sentiment around Ethereum turning negative for the first time ever. Some doubt the positive impact of Ethereum ETFs on its price. Despite outperforming Bitcoin ETFs recently, analysts think Ethereum's appeal may not be as strong on Wall Street. Further bearish sentiment can be traced to Ethereum’s underperformance against Solana in terms of DEX volumes last month.

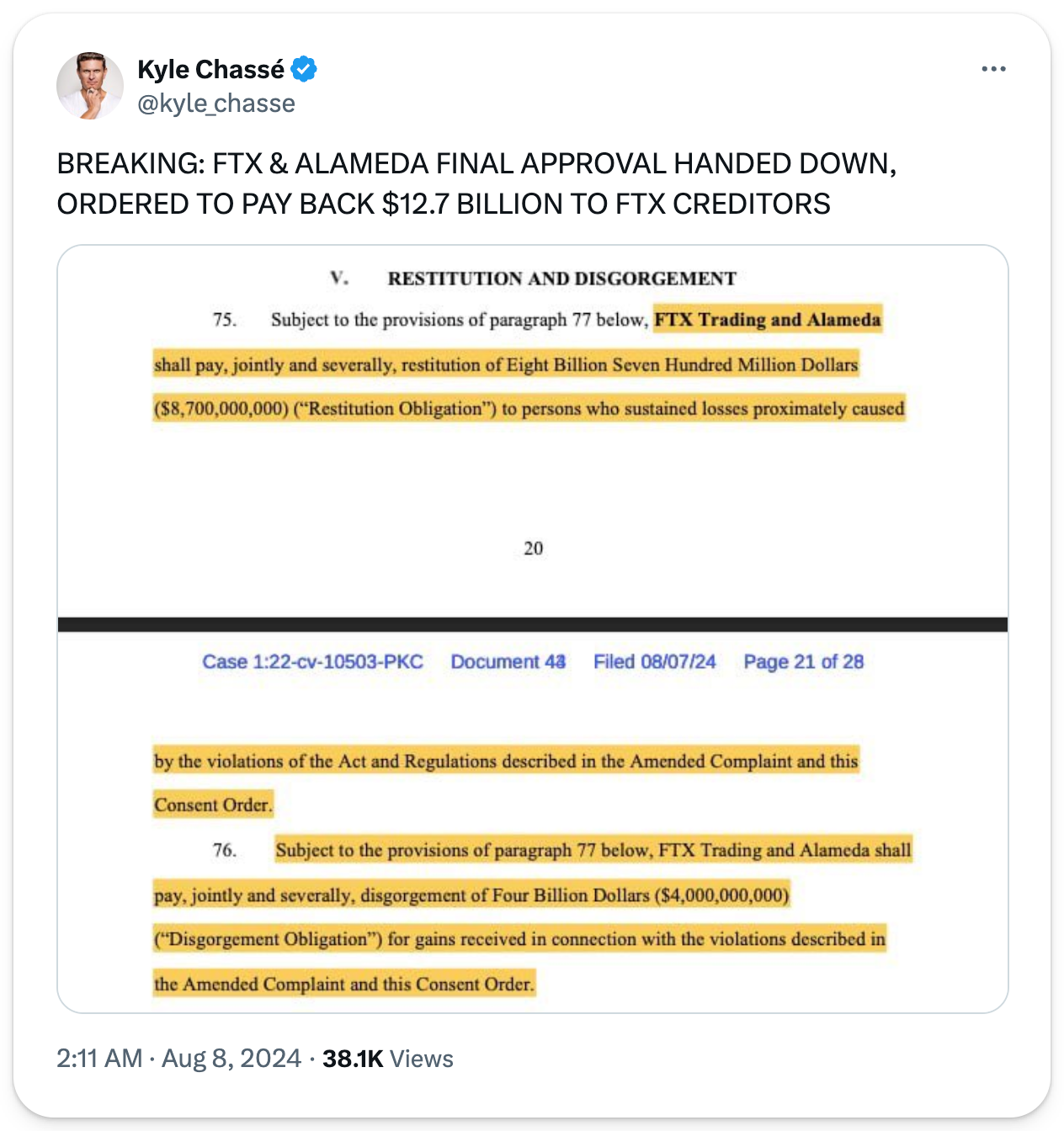

4️⃣ FTX Ordered to Pay $12.7B in Settlement

On Thursday, a U.S. judge ordered FTX and Alameda Research to pay $12.7B to creditors, wrapping up the 20-month lawsuit. While the order does not include additional civil penalties, it permanently restricted both companies from trading in the future. The market is divided on what this settlement may mean for the market. Some view it as a potential liquidity injection, though that depends on the market’s state when redistributions begin, likely in Q4. Creditors have until August 16 to decide whether they want repayment in cash or crypto, a decision that could significantly impact market dynamics.

5️⃣ Ripple Fined $125 Million

Ripple may have dodged a huge bullet this week when a federal judge ruled they only had to pay $125M in fines, rather than the $1B in disgorgement and $900M in civil penalties originally sought by the SEC. The fines were for violating federal securities laws in its institutional sales of XRP, though not for the sale of XRP to retail investors through exchanges, a key win for the company. While it may be too early to celebrate with the SEC expected to appeal the ruling, Ripple has wasted no time pushing forward, announcing on Friday the beta launch of their RLUSD stablecoin.

Mantle kickstarts Season 1 of Methamorphosis. Building on the success of their Liquid Staking Token, mETH, Mantle LSP announces plans for a new Liquid Restaking Token, cmETH, along with a governance token, COOK. With Methamorphosis, participants can now farm Powder for future COOK tokens and position themselves early for upcoming cmETH release.

This week was a doozy. ETH took a major hit earlier this week, as did pretty much every other asset, but things mostly shaped up by the end of the week despite the initial panic.

Meanwhile, the government is ready to declare on Polymarket and other prediction markets over election betting. This, even as the Trump family grows more intertwined with the crypto industry through personal deals...

A lot happened this week, let's dig in! 👇

📰 Articles:

📺 Shows:

Thousands of Bankless Citizens scored an average of $3,500 worth of tokens after Ether.fi's airdrop. Did you miss out again?

Ether.fi was in the Bankless Airdrop Hunter, and you could have gotten into the latest drop by following our quests! There are nearly 100 other crypto protocols in Airdrop Hunter waiting for you.