1️⃣ Bitcoin (Barely) Breaks All-Time Highs

Can BTC keep the momentum going? Bitcoin continued its climb this week, breaking all-time highs on two occasions, both times experiencing rapid corrections.

After its first ATH, the cryptocurrency dropped as low as ~$59k before recovering to break $70,000 on Friday. Interestingly enough, some have drawn parallels to Bitcoin’s previous breaking of all-time highs in 2020, when it also experienced sharp corrections twice and then ranged for a few weeks before melting up. We shall see.

Regardless, this rally, driven by speculations of easing inflation and potential interest rate cuts, marked a significant moment in crypto history, occurring uniquely before a halving event. On the topic of inflation, if adjusted for inflation, Bitcoin would need to break $78,905.45 to truly reach a new all-time high.

2️⃣ Do Kwon Extradition To South Korea

Another new development hit Do Kwon’s never-ending international legal drama. After previously having been set to be extradited to the U.S., a court in Montenegro pivoted, accepting Kwon’s latest appeal and deciding instead that the Terraform Labs co-founder be turned over to South Korea after March 23rd. While it does not seem Kwon will appeal this decision, the U.S. Justice Department vowed they would, continuing their quest to ensure that crypto's wild west offenders face the rule of law.

3️⃣ Derpy Memecoin Meta

The meme coin market witnessed an unexpected surge, with a coin named after U.S. President Joe Biden, $BODEN, netting degens insane returns. While this derpy trend started with jeo boden and doland tremp, it didn’t just stick to presidential candidates, expanding to include celebrities, historical, and non-historical figures too. Further, after breaking $1 last week, dogwifhat (WIF) rapidly ran to over $2 after landing a spot on Binance. All these dizzying highs and lows took place on Solana, further underscoring Solana’s ability to ignite speculative fervor with low fees.

4️⃣ Spain Bans Worldcoin, Worldcoin Sues

Worldcoin hit a speed bump recently as Spain joined a growing list of eyeball coin skeptics. Citing data and privacy concerns, they decided to temporarily ban Worldcoin, reflecting the broader, global apprehension towards the handling of sensitive biometric data. In response to the ban, Worldcoin filed a lawsuit, claiming the ban went around EU regulation and spread false claims.

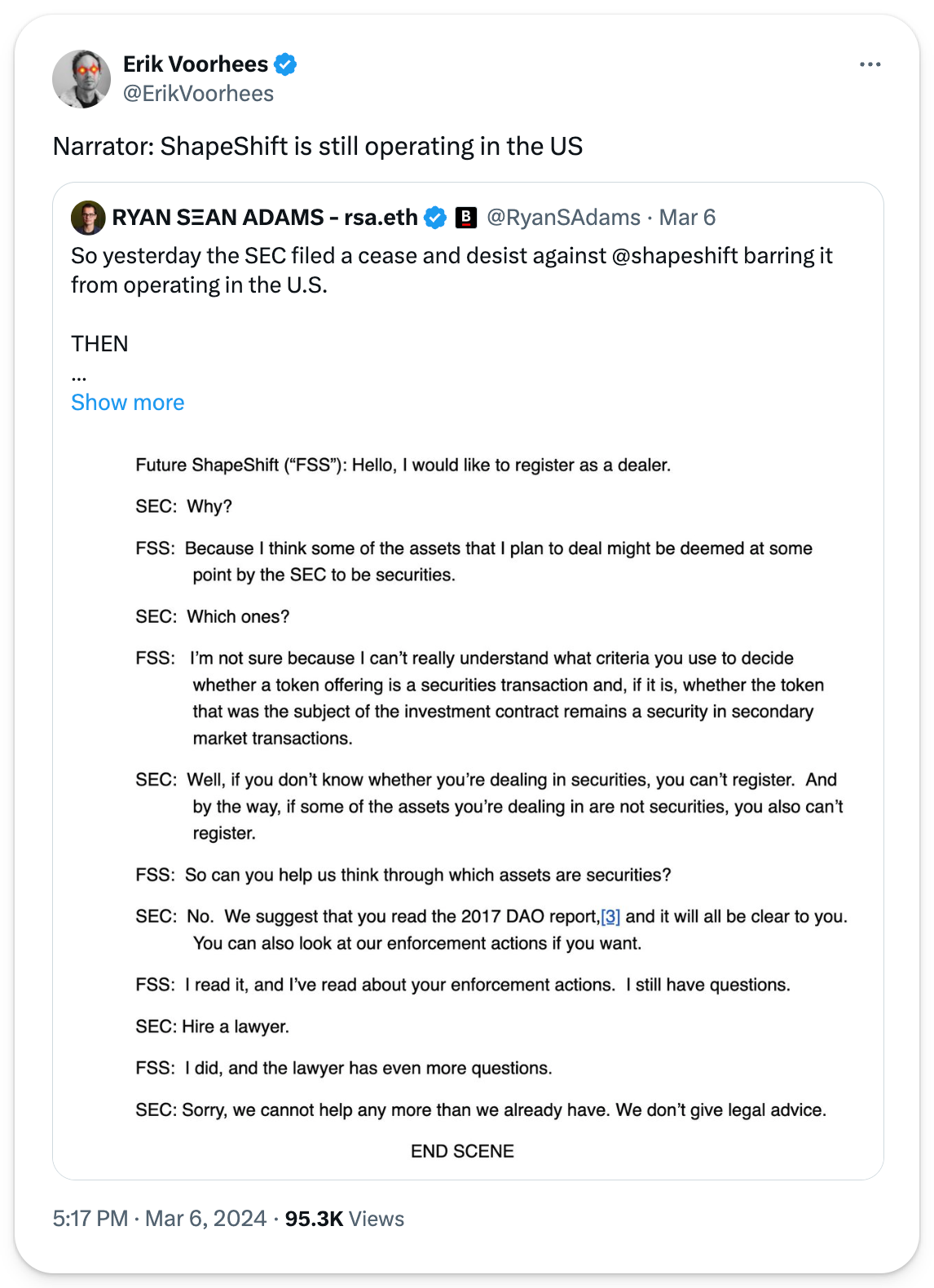

5️⃣ Shapeshift Settles with SEC

OG crypto exchange ShapeShift, settled with the SEC this week over allegations of acting as an unregistered securities dealer. Started in 2014, the exchange shuttered in 2021 when the SEC issued a cease-and-desist order on these charges.

To resolve these allegations, ShapeShift offered a settlement of $275,000 – which the SEC agreed to. This settlement marks a significant moment in the ongoing dialogue between the crypto industry and regulatory bodies, once again underscoring the complex terrain of compliance and governance in our industry.