Dear Bankless Nation,

It was a funny week in the crypto space. Memecoin fever struck, and this time, Bitcoin got in on the action.

For our weekly recap, we dig into:

- BTC plays dress-up

- Tether opens its books

- Ethereum Beacon chain hiccups

- Lido level-up

- The IRS rugs

- Bankless team

📅 Weekly Recap

1. BTC plays dress-up

The latest hype in Bitcoin is the arrival of the fungible BRC-20 token format.

Hardline Bitcoiners love to deride much of what Ethereum enables as useless, so it is more than a little ironic to see “Ethereum things” spontaneously emerging and capturing the attention of that community.

BRC-20 tokens are created by inscribing code onto Bitcoin NFTs that are created via the Bitcoin Ordinals protocol.

In the past two weeks, BRC-20 tokens have exploded in a frenzy of meme tokens, reaching a market cap of $529 million. 63% of that market cap is made up of the current top token ORDI ($332 million), which is now being listed on centralized exchanges like Gate.io.

As of Saturday, 5.9 million inscriptions have been made. Total fees from Ordinal are at $32.1 million. UniSat makes up more than half ($2,408,033) of trading volumes.

Read more in this week's Bankless piece:

2. Tether opens its books

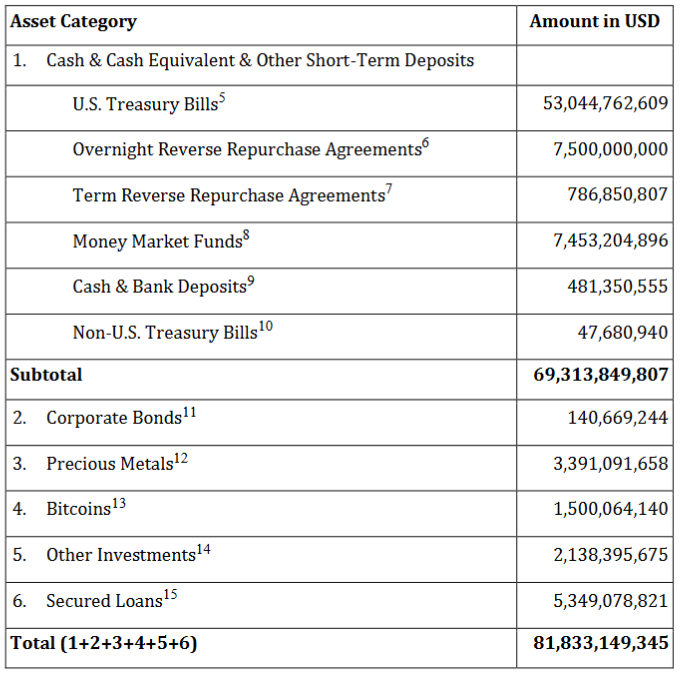

Tether has been less than transparent over the years, but we got some new details from the firm after the release of its Q1 2023 attestation report this week – audited by the BDO Italia accounting firm.

Tether’s excess reserves are at an all-time high of $2.44 billion today, the company says. The majority of USDT’s reserves (85%) are invested in U.S. Treasury Bills, cash and other short-term deposits. For the first time, Tether also reported its gold and Bitcoin holdings, which make up 4% and 2% of its total reserves.

As of May 9 2023, Tether’s total assets are $81.8 billion, exceeding its total liability of issued tokens in $79.3 billion. Tether also claims to be “reducing its reliance on pure bank deposits as a source of liquidity and instead leverage the Repo market as an additional measure”. The report points to Q1 2023 as an “excellent quarter”, having improved its net profits by $1.48 billion and increased USDT’s circulating supply by 20%.

3. Ethereum Beacon chain hiccups

The Ethereum Beacon chain suffered some hiccups this week that left developers scratching their heads.

Thursday evening saw the Beacon chain halt block finalization, only to resume 25 minutes later. Finalization refers to a permanent state of on-chain transactions being set in stone. Not finalizing is not the same as the chain being halted, since blocks continue to be produced. However, this can cause the chain to enter an emergency mode of “inactivity leak” which would stop attestation rewards and slash validators for non-participation.

It's not clear what the root cause of the problem is yet, but most suspect it is due to consensus clients being stressed, in particular the majority-used Prysm client. Prysm has since released a patch.

Yesterday close to 8pm UTC the Ethereum network lost finality for 25 minutes. Around that time, several valid, but untimely attestations were broadcast in the network. This typically happens when a node that is struggling to be synced, attests with an old view of the chain. 1/8

— Potuz (@potuz1) May 12, 2023

4. Lido level-up

Lido is conducting its final on-chain vote to launch its V2 upgrade, which would finally enable ETH withdrawals.

The vote started May 12 and will conclude three days later on May 15. If the vote passes, stETH holders will be free to withdraw a total of ~270K ETH. Lido withdrawals are expected to be much quicker than Beacon chain withdrawals, approximately less than 24 hours for stakers holding under 1000 stETH.

A Lido V2 update:

— Lido (@LidoFinance) May 8, 2023

The final on-chain vote for the V2 upgrade is scheduled for this Friday, May 12th.

If no last-minute findings are surfaced and the vote is successful, Lido V2 will be live after the vote enactment on May 15th 🏝️

As of Saturday morning, the vote is 100% in favor of the V2 upgrade. A previous Snapshot vote on March 1 also voted overwhelmingly in favor of the upgrade, suggesting that V2 is likely to pass.

5. The IRS rugs

The IRS is looking to claw back $44 billion worth of claims from the now-bankrupt FTX crypto exchange. The largest claims were a $20.4 billion claim against Alameda Research for “unpaid partnership taxes.”

These claims would take priority before the claims of institutional and retail creditors.

Imagine getting rugged by SBF.

— Jameson Lopp (@lopp) May 10, 2023

Then, just when you think you're gonna get half your money back...

...the IRS steps in to rug the rest.https://t.co/3pFGzOV0zl

📺 Bankless Weekly Roll-Up

Other news:

- Tessera AKA Fractional is shutting down

- OpenAI CEO Sam Altman’s Worldcoin launches its World App crypto wallet

- Uniswap continues to surpass Coinbase in trading volumes for 4th consecutive month

- Lens Protocol launches SDK

- Seattle-based crypto exchange Bittrex files for bankruptcy

- Silvergate lays off 230 employees

- Stripe releases fiat-to-crypto onramp

- Su Zhu gets a restraining order against Arthur Hayes for “harassment”

- Paypal customers are holding near $1 billion in crypto

- DAOs on Arbitrum can claim rewards from transaction fees soon