Bitcoin is Halved ($)

View in Browser

Sponsor: Cartesi — Build app-specific rollups with Web2 tooling without the constraints of Web3!

📊 Downside Deluge. Risk assets got hammered this week, experiencing unprecedented levels of selling, the likes of which had yet to be seen in 2024. What happened in markets this week?

1️⃣ Bitcoin's Halving & Rune Launch

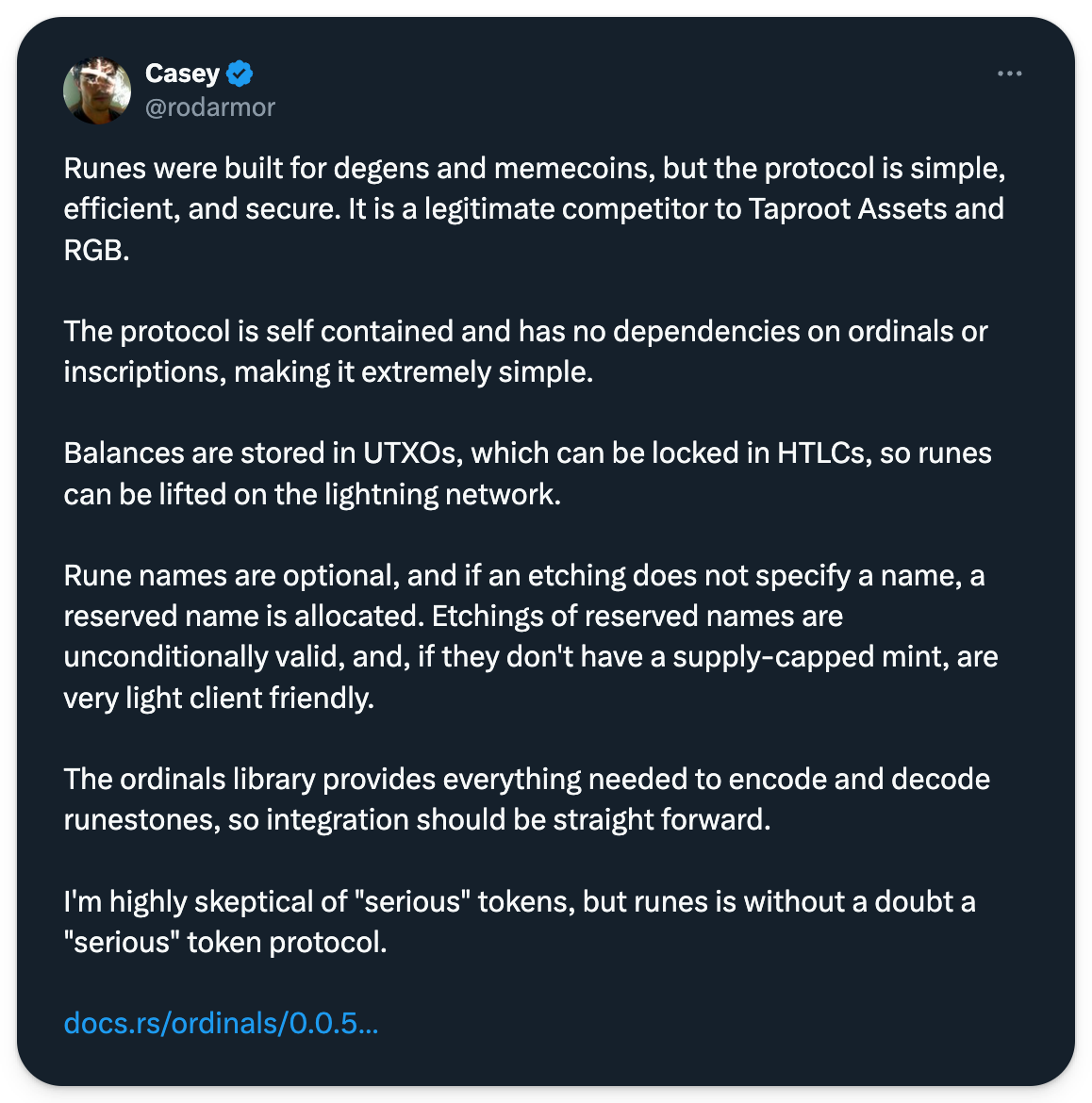

Last night, Bitcoin’s fourth-ever halving went live, bringing Runes along with it!

These new fungible tokens, created by Ordinals inventor Casey Rodarmor, have generated a lot of excitement and stand poised to accelerate DeFi and NFTs for Bitcoin. Built for degens, plenty of opportunities exist around Runes, from owning tokens like PUPS and WZRD to NFTs like Bitcoin Puppets and Runestones. Learn more about Runes here.

2️⃣ Whales Buy Amid Geopolitical Tension

Bitcoin had a rocky week, dipping down and even momentarily breaking $60K multiple times amid hawkish comments from the Fed and the tense standoff between Iran and Israel.

Whales were not bothered, though. Data shows that hodlers with at least 0.1% of supply stepped and bought the dip, adding 19,760 BTC (>$1.2B) to their holdings during the volatility. David Han of Coinbase Institutional notes, "While sellers appear to be derisking, there's also opportunistic buying between $60K-62K," highlighting Bitcoin's unique, dual role as both a risk-on and safe-haven asset.

3️⃣ Mango Markets Exploiter Found Guilty

A jury found crypto trader Avraham Eisenberg, who exploited Mango Markets in Oct 2022, guilty on charges of commodities fraud, manipulation, and wire fraud. Eisenberg faces up to 20 years in prison.

Eisenberg is the second hacker convicted within a week, with former Amazon Engineer Shakeeb Ahmed sentenced to 3 years for his $12M exploit of Crema Finance.

4️⃣ New Chains on the Block

- Worldcoin’s World Chain L2 will launch this summer. It comes integrated with WLD’s identity protocol and is designed to streamline DeFi and identity verification applications by prioritizing transactions from World ID-verified users.

- OKX's X Layer arrived as a ZK L2 built on Polygon. Using OKB, OKX’s token, to pay transactions, OKX looks to bring its 50 million users onchain while maintaining security via Ethereum.

- EY’s OpsChain Contract Manager will use ZK on Ethereum to manage enterprise contracts. Their announcement specifically cites public blockchains’ security, privacy, and cost reduction as clear benefits.

5️⃣ Binance Converts SAFU Fund

This week’s turbulence seemed to spook Binance, who converted all assets in its Secure Asset Fund for Users (SAFU) — totaling $1B — into USDC. Once essentially living outside of the law, the DOJ-hampered Binance has changed tunes recently, snapping into the role of impeccable rule-follower.

Cartesi has a challenge for all talented devs! Try to hack their Honeypot dApp. Compete in a bug-bounty initiative to test, scrutinize, and refine the underlying code of Cartesi Rollups!

The fourth-ever Bitcoin Halving has passed, now what's next for BTC?

In today's Weekly Rollup, Ryan and David unpack the Halving and it's impact. They also talk about Worldcoin's new blockchain and the latest happenings in the world of ETFs.

Hear their thoughts 👇

📰 Articles:

📺 Shows: