Bitcoin Bounces Back ($)

View in Browser

Sponsor: Kraken — Sign up for an account and see what crypto can be.

- 🧡 Bitcoin bounces back. Crypto markets undid a couple grim days with BTC touching above $63K on Friday after a broader rally of risk-on assets.

- 🎰 ZKasino arrest. A 26yo man believed to be the founder of VC-backed crypto gambling startup ZKasino was arrested on suspected fraud charges and had 11.4 million euros in assets seized.

- ⬛️ Block buying more BTC. Dorsey’s payments company Block is planning to use 10% of gross profits from its crypto business to make BTC buys every month this year.

📊 Back already? Risk assets pumped this morning following weaker-than-expected employment with Bitcoin up 5%, a surge directly attributable to the increased probability of steeper and sooner interest rate cuts. Why is bad news good for your bags?

| Prices as of 5pm ET | 24hr | 7d |

|

Crypto $2.32T | ↗ 4.4% | ↘ 1.7% |

|

BTC $62,653 | ↗ 5.8% | ↘ 2.2% |

|

ETH $3,110 | ↗ 3.6% | ↘ 1.3% |

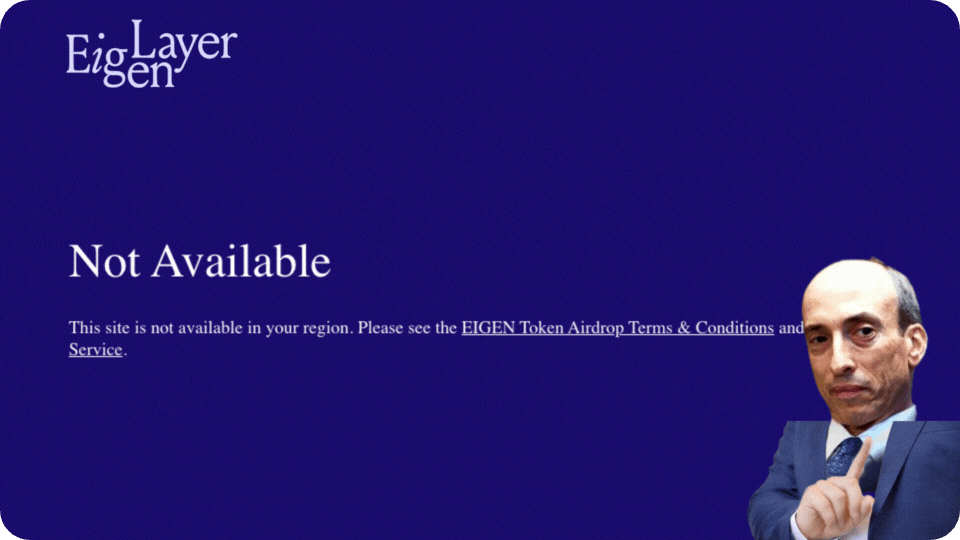

EigenLayer’s token drop was announced on Monday, but plenty of users across the globe were disgruntled that the claim page for EIGEN is "Not Available" to them.

Who can't claim? Not only are residents from a expansive list of nations including the U.S. banned from claiming EIGEN, the claims site explicitly blocks users from interacting with the frontend via VPN or other proxy technologies!

See why EigenLayer is blocking your bags 👇

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

Are crypto VCs and retail investors sworn enemies in this cycle?

Today we explore the frontier of Venture Capitalists vs Retail Investors, are they at war? That’s exactly what we debate on the show with crypto writer and VC Regan Bozman.

Bankless Citizens get Early Access to our Monday Podcast and an exclusive Debrief of the episode 👇

🧑🌾 Farming Alpha: Onchain yields are coming in yet again. Fixed returns on Ethena stablecoin assets are down on the week and yields on liquid restaking tokens tanked following the announcement of EigenLayer’s first airdrop, but Pendle’s fixed yield PT opportunities remain a sound investment for those worried that onchain yields will continue to compress.

Incentives from Aura are boosting yields for depositors into its stablecoin pools, meanwhile Angle Protocol is hoping to bootstrap demand for its recently launched USDA stablecoin by offering lenders rewards through Morpho. Variable rates for BTC on Fraxlend increased slightly week-over-week and the Protocol continues to offer the best bluechip returns on BTC.

Top Opps:

- 🟠 BTC: 9% APY with Fraxlend’s WBTC pool on Ethereum

- 🔵 ETH: 35% APY with Pendle’s pufETH PT on Ethereum

- 🔵 ETH: 31% APY with Pendle’s ezETH PT on Arbitrum

- 🟢 USD: 52% APR with Aura’s GHO-USDC pool on Ethereum

- 🟢 USD: 40% APY with Pendle’s sUSDe PT on Ethereum

- 🟢 USD: 40% APY with Pendle’s USDe PT on Mantle

- 🟢 USD: 36% APR with Aura’s sUSDe-sFRAX pool on Arbitrum

- 🟢 USD: 31% APY with Re7’s Morpho USDA vault on Ethereum

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.