Bitcoin and Trump ($)

View in Browser

Sponsor: Kraken — Sign up for an account and see what crypto can be.

1️⃣ Bitcoin Gives Up Its Gains

After a strong rejection off $70K earlier this week, Bitcoin attempted to stabilize at $65K, though it slumped back down to as low as $61.5K Friday after a weak U.S. jobs report. Adding to the bearish mood was the transfer of roughly $1.6B in BTC and ETH from wallets linked to the bankrupt Genesis Trading, likely for in-kind repayments to creditors – something that could lead to even more sell pressure. Overall, sentiment has whiplashed negative, which will need time to even out, especially ahead of election season.

2️⃣ Crypto Reconsiders All-In on Trump

As Kamala gains traction and her odds on Polymarket have surged to a new high, Crypto Twitter has been animated by discussion of the “unwinding of the Trump trade.” With $486M wagered, Harris' odds rose to 44%, while Trump's odds dipped to 54%. As a result, chatter about the industry betting its future on a Trump win has become a central topic. Understandably, many believe this alignment could be extremely risky in retrospect. Harris's campaign, now amassing substantial donations and increasing activity in key swing states, is rising in popularity in national polls.

3️⃣ Telegram Launches Web3 Browser and App Store

Telegram had a big week, releasing its previously announced new update that adds an in-app browser supporting TON Sites, as well as a mini-app store to the app. It also comes equipped with a new in-app currency called Stars for in-app purchases. Overall, this update now positions Telegram as essentially a Web3 super-app, clearly introducing crypto functionality to its nearly 1B users.

4️⃣ Coinbase and MicroStrategy Report Earnings

Wall Street had a tough week, but Coinbase's week was particularly tough. COIN stock is down 19% on the week despite surpassing revenue expectations in its Q2 earnings with $1.45B. The firm dramatically missed on earnings per share, 84% below analyst projections. While transaction revenues declined by 27% quarter-over-quarter, subscription and services revenues saw a 17% increase. Simultaneously, Coinbase's operating expenses rose by 26% to $1.1B as it looks to expand its infrastructure and headcount. Meanwhile, fellow crypto stock MicroStrategy reported a net loss of $102.6M due to an $180.1M loss as the value of its Bitcoin holdings dropped.

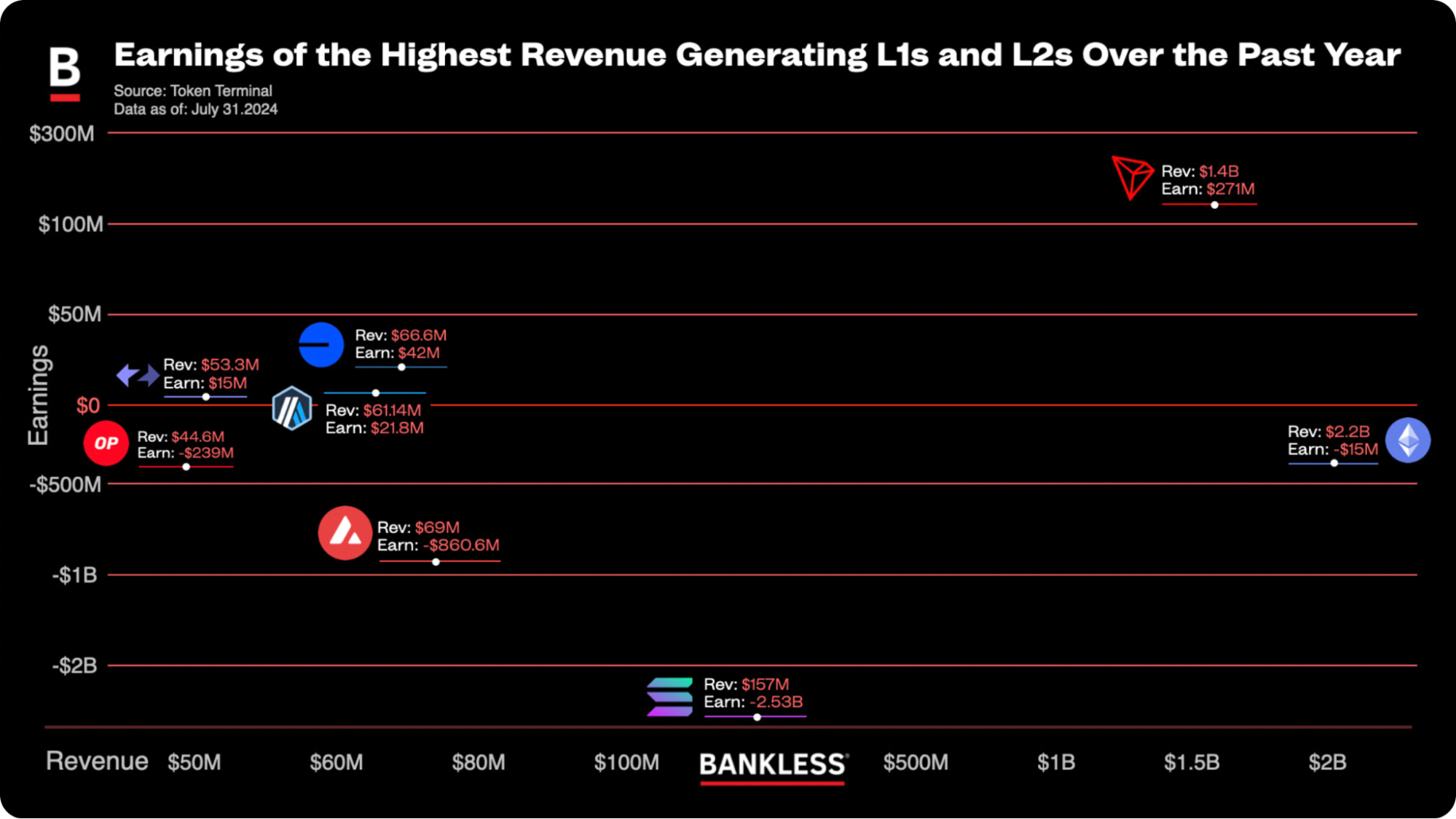

5️⃣ Solana Surpasses Ethereum in DEX Volume

For the first time, Solana outpaced Ethereum in monthly DEX trading volume, hitting $55.88B in July, compared to Ethereum's $53.87B. Further, on Wednesday, Pump.Fun beat out Ethereum in daily revenue, $867K vs ETH’s $844K. Ethereum’s revenue still far outpaces Solana’s for the past year, ~$2.2B versus Solana’s $157M. While memes have generated the chain significant activity, Solana has also recently seen more traction around RWAs, with Ondo’s USDY being integrated into DeFi, Jupiter’s GUM Alliance beginning its formation, and Brevan Howard launching a tokenized fund on the chain.

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

At The Bitcoin Conference in Nashville, Trump delivered a speech that resonated big time with the crypto community. What did he say that generated the loudest cheers?

Meanwhile, ETF flows continue unabated, with ETH seeing net inflows coincide with BTC net outflows – is this just noise?

And finally, California is transitioning car title transfers to... Avalanche?

Listen in! 👇

📰 Articles:

📺 Shows:

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.