Big News from CEX L2s

View in Browser

Sponsor: Uniswap Labs — Unichain is live! Bridge & swap with Uniswap Labs' web app or wallet.

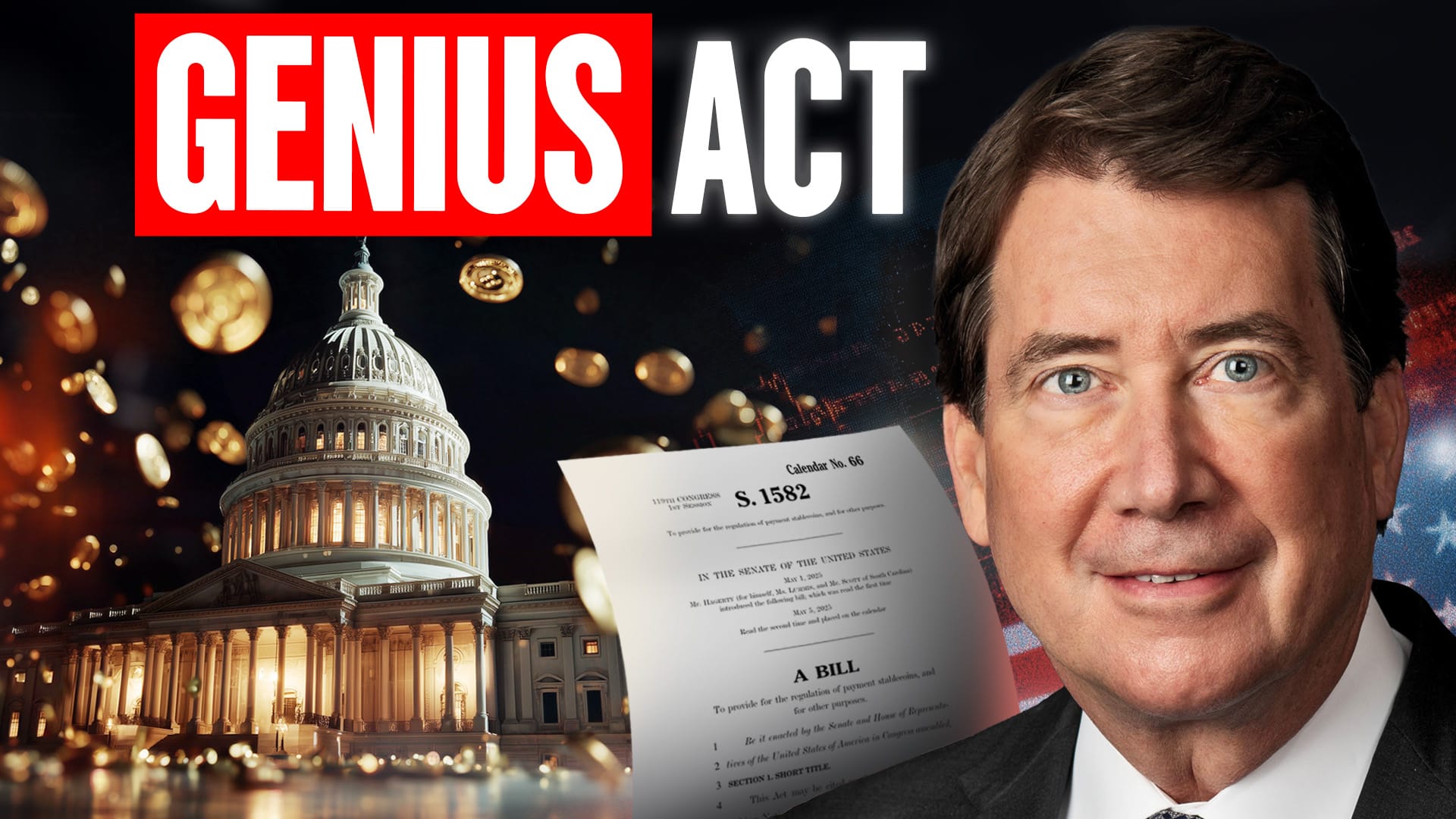

1️⃣ GENIUS Passes Senate

On Tuesday, the U.S. Senate passed the GENIUS Act with 68-30 bipartisan support, advancing the bill onto the House of Representative and marking the first crypto-specific legislative action in American history.

Short for “Guiding and Establishing National Innovation for U.S. Stablecoins,” the GENIUS ACT is a comprehensive stablecoin regulatory framework introduced by Tennessee Senator Bill Hagerty for “payment stablecoins,” or digital assets that are pegged to a monetary unit of account (like the U.S. dollar) and whose issuer is obligated to convert, redeem, or repurchase the tokens for a fixed value.

While the enactment of GENIUS into law may undermine Tether’s longstanding dominance of the stablecoin sector, it could also open the doors for registered institutions to treat stablecoins as cash for accounting purposes, post stablecoins as collateral for financial transactions, and conduct inter-bank settlement with stablecoins.

2️⃣ JPMorgan Digital Dollar

JPMorgan – the investment banking, asset management, and private wealth subsidiary of America’s largest bank – took a major step into the cryptocurrency world this week with the release of JPMD (a tokenized bank deposit) on Base. JPMD is available to approved institutional clients as part of a blockchain pilot program by digital asset arm Kinexys.

Kinexys executive Naveen Mallela confirmed the pilot program with Bloomberg and told the outlet that a fixed amount of JPMD tokens will be transferred to crypto exchange Coinbase in the coming days.

Compared to stablecoins, which will be prohibited from making interest payments to holders under the proposed GENIUS Act, tokenized bank deposits may serve as the yield-bearing payments alternative in a regulated blockchain future.

3️⃣ TRON Goes Public

Toy manufacturer SRM Entertainment became the latest publicly traded company to adopt a crypto treasury strategy on Monday, announcing its intention to raise up to $210M from a “private investor” to purchase TRX.

The deal will install TRON founder Justin Sun as an advisor to SRM Entertainment, which will change its name to “Tron Inc.” Additionally, the Company plans on implementing a dividend policy upon the “successful implementation” of a TRX staking program.

Although Donald Trump Jr. and Eric Trump sit on the advisory board of Dominari Securities LLC, the offering’s placement agent, Eric Trump refuted early Financial Times reporting claiming that he too would take a public role at SRM Entertainment.

Sun, who is estimated to have spent over $100M purchasing Trump-associated WLFI and TRUMP coins, received a temporary 60-day reprieve from a pending SEC fraud and market manipulation investigation in February.

4️⃣ Coinbase Seeks Tokenized Stocks

Coinbase Chief Legal Officer Paul Grewal informed Reuters this week that his company is seeking approval from the U.S. Securities and Exchange Commission to offer tokenized stock trading, a move that would place the crypto-native exchange in direct competition with TradFi brokerages like Robinhood and Schwab.

While firms that offer securities – like stocks – must typically register as brokerages with numerous federal and state regulatory bodies, CoinDesk indicated that Coinbase is looking to secure a no-action letter or exemption from enforcement from the SEC, which would preclude it from registration under the Securities Exchange Act.

5️⃣ INK Token Confirmed

Kraken’s Ink L2 confirmed its plans to release a token on Tuesday, and that it will soon mint a fixed supply of 1B INK. A portion of these tokens will be distributed as rewards to users of an Aave-powered “liquidity protocol” that will “provide a new critical building block in Ink’s DeFi stack, governed and incentivized through the INK token.”

Although the initial announcement offered few details, it is clear that INK token use cases will be limited to incentives; the project firmly denied any possibility holders receive L2 governance powers in multiple posts. Further information on the INK liquidity protocol airdrop and other potential airdrops for early ecosystem users will be shared at a later date.

Click here to view top INK airdrop hunt strategies.

Unlock the power of Unichain – a fast, decentralized Ethereum Layer 2 network built to be the home for DeFi and cross-chain liquidity. To bridge tokens to Unichain and start swapping today, get started with Uniswap Labs’ web app or mobile wallet.

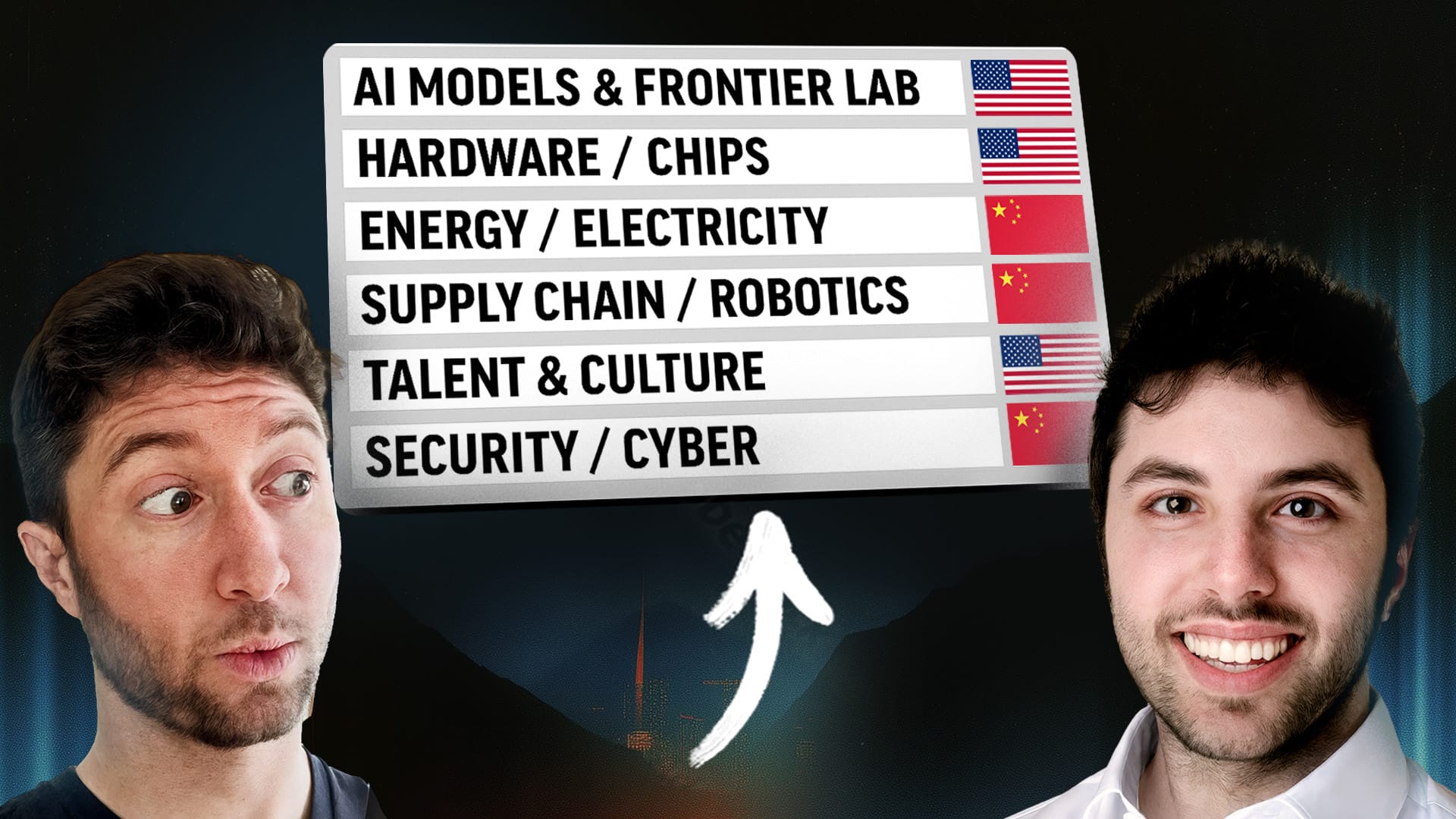

This week, Ryan and David unpack the implications of the GENIUS Act’s passage, positioning the U.S. to lead in digital assets and sparking stablecoin optimism with forecasts hitting $3.7T by 2030.

They break down JPMorgan’s surprise entry into the stablecoin market and Coinbase’s new product suite, including a Bitcoin cashback credit card. Geopolitical tensions raise questions about Bitcoin’s safe haven status, while the altcoin landscape continues to evolve.

Tune into this week's rollup! 👇

📰 Articles:

📺 Shows:

Thoughts on how to make Bankless even better? Tweet me!

🧑💻 Lucas Matney, Bankless Editor

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.