View in Browser

Sponsor: Kraken — Sign up for an account and see what crypto can be.

📊 Bullish Reversal. Crypto assets rallied to safely secure a green week as TradFi stock indexes marched upwards to new all-time highs! What happened in markets this week?

1️⃣ Big Bitcoin ETF Holders

Bitcoin saw a ~10% rally this week, breaking through $67K on Friday due to positive CPI readings and notable ETF holdings disclosures.

- Millennium Management, one of the world’s largest hedge funds, disclosed $2B in Bitcoin ETF holdings from BlackRock's iShares Bitcoin Trust and Grayscale Bitcoin Trust.

- Bracebridge Capital, a hedge fund managing Yale and Princeton's endowments, announced $262M in ARK 21Shares ETF and $81M in BlackRock’s IBIT.

- Point72, the Knicks Owner Steven Cohen’s $34B hedge fund, held $77.5M in the Fidelity BTC ETF (FBTC) as of Q1.

- The Wisconsin Investment Board reported $162M in Bitcoin ETF holdings.

Research from River, a Bitcoin brokerage firm, shows 13 of the top 25 U.S. hedge funds bought BTC ETFs in Q1. While these holdings might be a long-term bet on Bitcoin, they could also be for market making, hedging, or short-term flipping.

2️⃣ Tornado Cash Dev Sentenced

Privacy was deemed a crime this week when Alexey Pertsev, a Tornado Cash developer, was convicted of money laundering and sentenced to 64 months by a Dutch court. The sentence alleges Pertsev laundered billions through Tornado Cash between 2019 and 2022. Pertsev's co-founder, Roman Storm, faces similar charges in the U.S., with his trial set for September.

3️⃣ Senate Votes to Overturn SAB 121

The Senate voted 60-38 to repeal the SEC’s SAB 121, which required firms to record customer digital assets as liabilities instead of as traditional holdings — a major point of friction for adoption. The resolution now heads to President Biden, who has threatened a veto. This marks a significant step for crypto legislation, with bipartisan support reflecting growing interest in thoughtfully developing crypto policy. If Biden vetoes, Congress may attempt to override, challenging the SEC’s stance on crypto in the process.

4️⃣ Pump.fun Exploit

Pump.fun, a popular Solana memecoin launcher, paused operations after a flash loan exploit took 12.3K SOL (~$2M). Former employee staccoverflow claimed responsibility, citing disdain for his former bosses and personal troubles. The exploit involved accessing a private key and using flash loans to manipulate memecoin bonding curves, then withdrawing liquidity meant for Raydium pools. The platform generated $1.9M in revenues over the two days preceding the exploit, which would cover 95% of the losses, and also flipped Solana in revenue. While, yes, pump can compensate users, this incident highlights, as always, the importance of private key security.

5️⃣ Roaring Kitty Sparks Meme Coin Frenzy

Keith Gill, aka Roaring Kitty, known for leading the GME short squeeze in 2020, resurfaced on Twitter this week. Following his post, over 14,500 new tokens on Solana were created on Sunday, setting a record. Gamestop’s stock GME nearly quadrupled as well before dropping. Gill’s return has reignited interest in meme stocks and crypto, generating millions in profit for traders. Yet, some question if he is actually back, as his YouTube and Reddit accounts remain inactive.

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

Memestock mania on Wall Street brought some action to memecoin markets too.

In this week's rollup, David & Ryan talk about what happened in the markets this week, but they also dig into the big topic of the month: politics and crime.

Hear their thoughts 👇

📰 Articles:

📺 Shows:

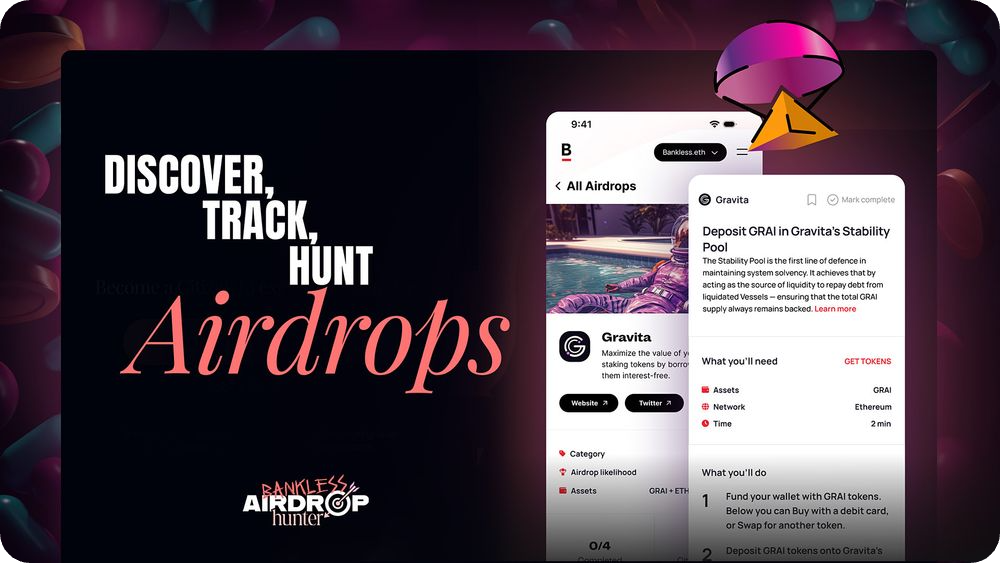

Thousands of Bankless Citizens scored an average of $3,500 worth of tokens after Ether.fi's recent airdrop. Did you miss out again?

Ether.fi was in the Bankless Airdrop Hunter, and you could have gotten into the latest drop by following our quests! There are nearly 100 other crypto protocols in Airdrop Hunter waiting for you.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.