Betting on Crypto Clarity ($)

View in Browser

Sponsor: Consensus — Consensus Miami | May 5-7 | Save 20% with the code BANKLESS

- 👨⚖️ BitGo Prices IPO Above Range, Starts Trading at $2B+ Valuation. BitGo priced its IPO at $18 per share, looking to raise $212M in the first major crypto listing of 2026.

- 🚜 Senate Agriculture Committee Publishes 'GOP-Only' Crypto Clarity Draft. Critics warn of expanded CFTC oversight and custody requirements.

- 🤑 Superstate Raises $82.5M to Scale Onchain Equity Issuance. Crypto startup Superstate has closed a large Series B round led by Bain Capital Crypto.

| Prices as of 6pm ET | 24hr | 7d |

|

Crypto $3.01T | ↘ 0.8% | ↘ 7.5% |

|

BTC $89,446 | ↘ 0.4% | ↘ 6.3% |

|

ETH $2,950 | ↘ 1.8% | ↘ 10.8% |

Market Plays:

- 🧮 Deploying chase orders on Synthetix

- 💻 Trying Nansen’s new trading platform

- ⛲ LPing in Morpho’s USDC/wsrUSD market

- 🎒 Making no-fee swaps on Backpack

- 🌊 Earning Morpho V2 vault rewards

Hot Reads:

- 💸 Permissionless Bonds — ETH Strategy

- 🪙 Introducing sPENDLE — Pendle

- 🏦 Reforming ETH Public Goods Funding — Kevin Owocki

- 🌄 SummerFi and the Evolution of Auto-Vaults — Serenity Research

- ⚔️ External Bridges vs. Rollups’ Security Councils — donnoh.eth

Farming Opps:

- 🟠 BTC: 6% APR with Aerodrome’s cbBTC-LBTC pool on Base

- 🟠 BTC: 6% APR with Ekubo’s LBTC-WBTC pool on Starknet

- 🔵 ETH: 10% APY with Convex’s ETH-ETHx pool on Ethereum

- 🔵 ETH: 5% APY with Pendle’s Lido GGV PT on Ethereum

- 🟢 USD: 12% APY with Pendle’s sUSDai PT on Arbitrum

- 🟢 USD: 10% APY with Convex’s PYUSD-USDC pool on Ethereum

Airdrop Hunter:

- ⛽ ETHGas: Claim GWEI airdrop

- 🦉 Owlto: Claim OWL airdrop

- 💱 Seeker: Claim SKR airdrop

- ⚽ Football.fun: Claim FUN airdrop

Is your portfolio clarity-ready?

Although crypto market structure clarity remains hotly contested stateside, if the recently proposed Senate crypto bill serves as any indication, future regulatory frameworks are likely to adopt a more heavy-handed approach, one which potentially risks alienating crypto’s existing incumbents…

Today, we’re exploring Nasdaq-listed Interactive Brokers (IBKR) and why it could be one of the top crypto-adjacent stocks to capitalize on the prospect of a regulated digital asset future.

What Makes IBKR Unique?

Similar to popular online stock trading platform Robinhood, Interactive Brokers is also a “brokerage,” or a special type of regulated financial intermediary that helps people buy or sell assets (like stocks).

However, beyond their shared primary function, these two brokerage houses diverge in meaningful ways. Whereas Robinhood caters toward casual retail traders seeking a straightforward exchange experience, Interactive Brokers is designed for active, high-volume professional users across the globe.

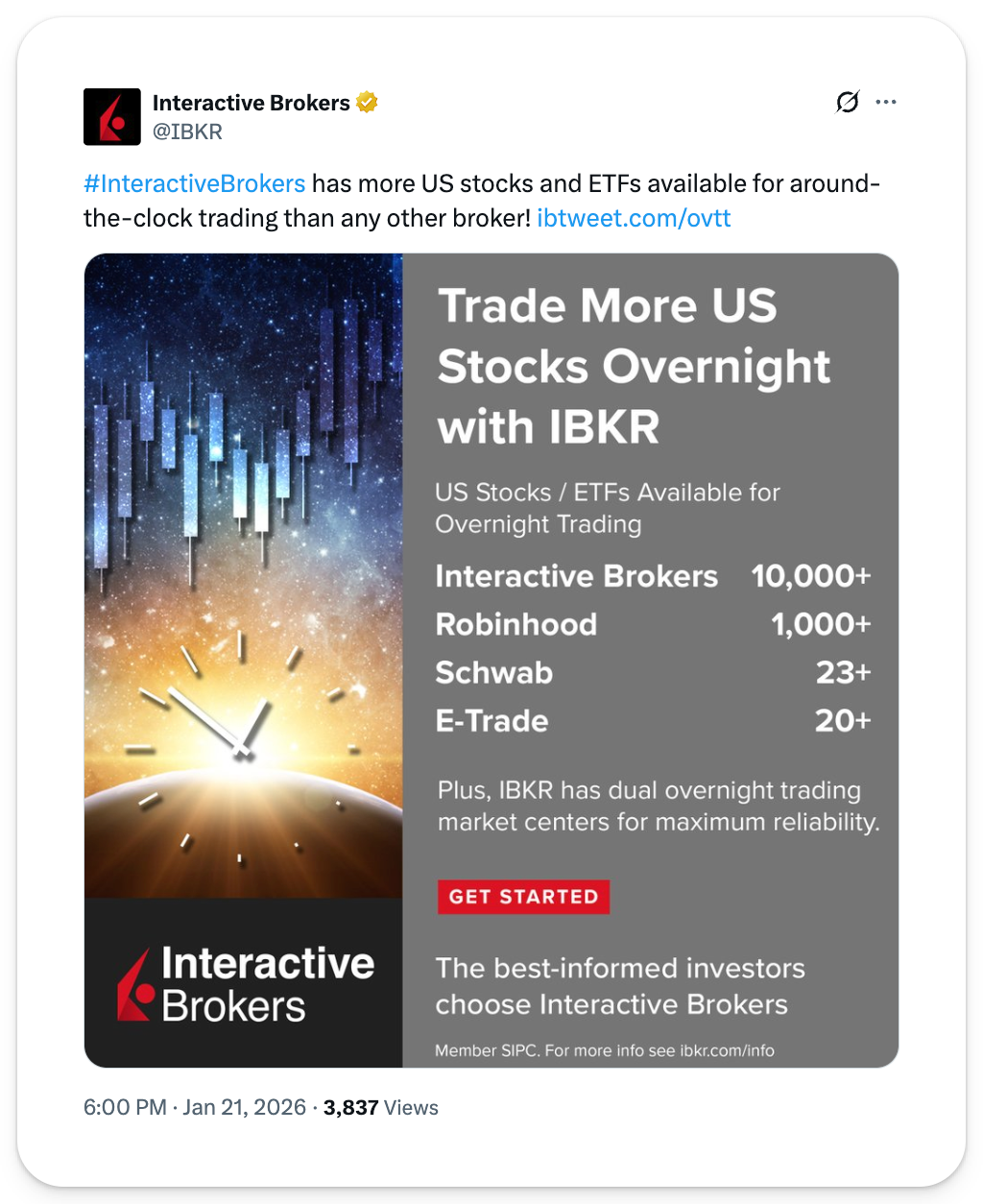

While Robinhood’s more sophisticated users might make overnight trades or dabble in S&P 500 futures, IBKR’s clients enjoy unified access to over 200 different global exchange venues, empowering them to trade more than one million distinct financial products.

At the expense of simplicity, IBKR prioritizes ultimate flexibility for clients, unlocking granular controls over features like data streaming, global market access, and precise order routing.

Like Robinhood, IBKR was an early adopter of prediction markets, launching 24/7 event contract trading to eligible account holders in May 2025. However, unlike Robinhood, which outsources its prediction markets to third-party Kalshi, IBKR’s event contracts are proprietary products issued through a wholly owned subsidiary.

According to IBKR Chair Thomas Peterffy, IBKR’s strongest traction has come from temperature-based prediction markets. The firm plans to add electricity and natural gas contracts soon, pushing prediction markets beyond speculation and toward real utility by enabling utility companies to hedge energy costs.

Despite hesitation among many traditional financial institutions to adopt blockchain technology ahead of formal regulatory clarity, IBKR has taken a more proactive stance, offering crypto to clients in partnership with infrastructure provider ZeroHash, an Interactive Brokers portfolio company.

While IBKR’s crypto trading feels admittedly clunky and fragmented compared to the seamless experience offered by Robinhood, the platform has been methodically expanding its feature set. Most recently, IBKR added stablecoin account funding, allowing clients to fund their TradFi investment accounts in seconds, with 24/7 availability (including weekends and banking holidays) using USDC on Base, Ethereum, or Solana.

Looking ahead, IBKR’s banking and payments capabilities appear poised for further growth. Following news that five digital asset companies had secured national trust bank charters from the OCC in December, Interactive Brokers applied for the same license.

Assuming it is eventually issued, a national trust bank charter could be instrumental in helping IBKR custody client assets directly, operate payments infrastructure, and bring more financial operations in-house (particularly in a regulated blockchain future).

🐂 The IBKR Bull Case

Should some similar form of the existing crypto market structure legislation from the Senate get enacted into final law, existing crypto investors may be facing a new class of headwinds for assets in their portfolio that struggle to adjust to the new rules.

For investors looking to maintain crypto exposure while positioning to outperform in a future defined by regulation, IBKR may make for a good portfolio diversifier. The brokerage is crypto-adjacent enough to benefit from blockchain adoption, but regulated enough to survive (and thrive) once regulation is finalized.

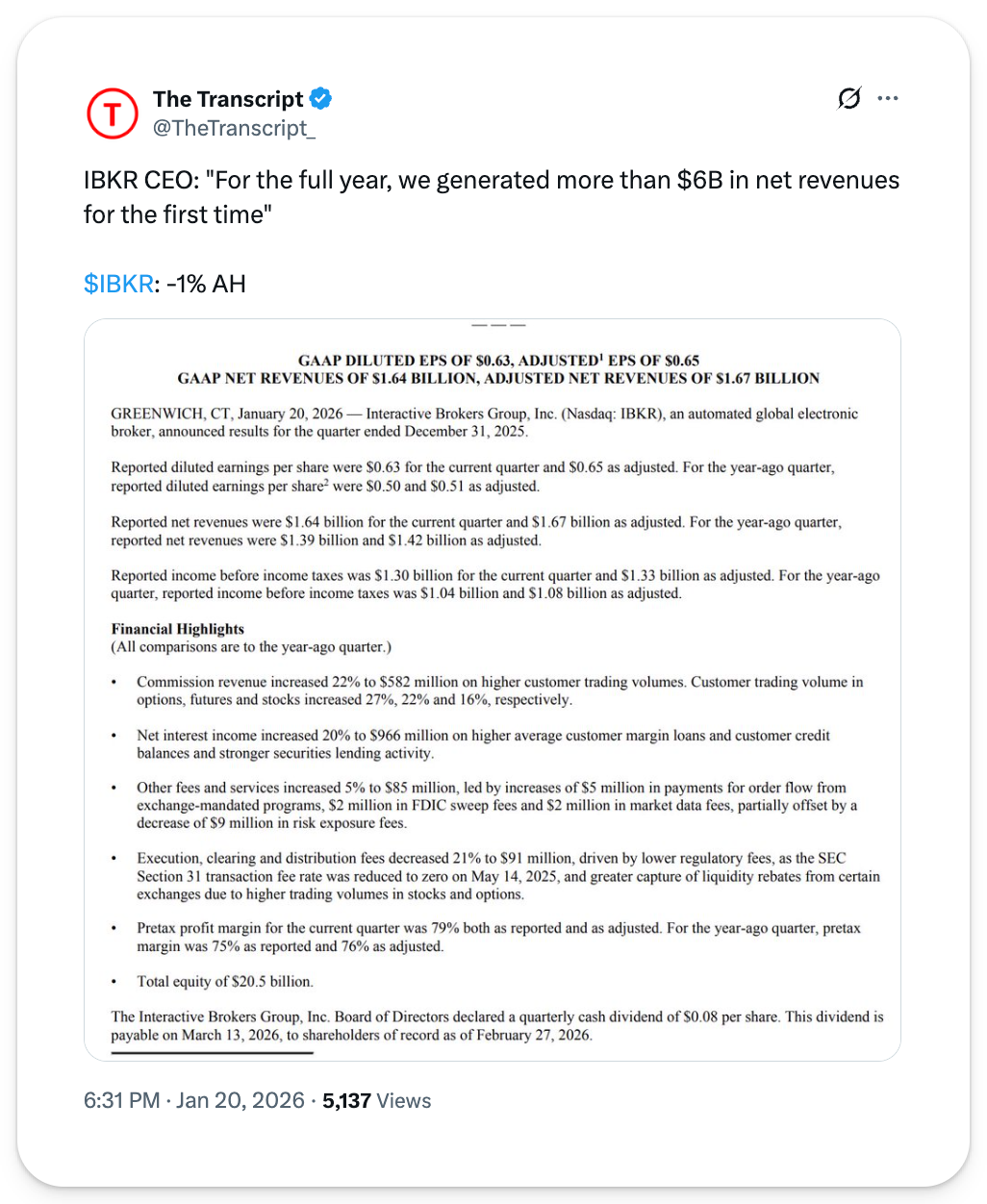

With a market cap of $130B, customer equity of $780B, and annualized revenue growth of 23% over the past five years, IBKR’s valuation also stacks up favorably from a fundamentals perspective against Robinhood, which trades at three-quarters of the valuation with half as much on-platform customer equity and a slightly higher growth rate.

In a future where crypto may find itself more constrained by regulatory supervision, IBKR doesn’t need to reinvent itself to succeed; it simply needs to continue going with the flow.

Consensus Miami • May 5-7 — Crypto’s most influential event arrives in Miami’s electric epicenter of finance, tech and culture. Join 20K+ decision-makers representing trillions in capital for market-moving intel, dealmaking rocket fuel, and epic parties to match. Save 20% with the code BANKLESS.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.