Best of Times, Worst of Times

View in Browser

Sponsor: Mantle — Mantle is pioneering "Blockchain for Banking,” a revolutionary new category at the intersection of TradFi and Web3.

1️⃣ Tornado Cash Dev Found Guilty

Tornado Cash developer Roman Storm has been convicted of conspiracy to operate an unlicensed money transmitting business for running the Tornado Cash frontend. Although Storm has expressed optimism about winning on appeal, the guilty verdict may set a disastrous precedent for the crypto industry at large.

Storm’s conviction carries a maximum sentence of five years imprisonment, would result in the forfeiture of all assets gained from his operation of Tornado Cash, and (most importantly) could be used as the model case to convict other permissionless DeFi developers of related offences.

Jay Clayton, the Trump-appointed District Attorney overseeing the prosecution of Storm, hailed the outcome as a victory over criminality. On the very same day Storm was convicted, the founders of crypto mixing service Samourai Wallet pleaded guilty to similar charges.

2️⃣ SEC Greenlights Liquid Staking

The Securities and Exchange Commission’s Division of Corporation Finance has confirmed that liquid staking tokens backed by non-security crypto assets, like Lido’s stETH, are exempt from U.S. securities regulations.

Previously, on May 29, the SEC clarified that certain staking activities, including “custodial arrangements” in which a third party holds crypto assets and administers staking operations, are exempt from registration under the Securities Act.

This most recent guidance expands the staking security exemption to include “liquid staking,” however, the SEC emphasizes that providers cannot engage in managerial efforts, such as advertising explicit rewards rates or determining whether to stake depositor crypto assets. Additionally, this statement does not cover the security implications of “restaking.”

3️⃣ Pendle Launches Boros

Yield swapping protocol Pendle launched Boros this week, its long-awaited platform for the onchain trading of perpetual funding rates — the small, fluctuating fees exchanged between traders in these markets to keep prices in sync with the underlying asset. Deployed to the Arbitrum L2, Boros offers funding rate markets for Binance BTCUSDT and ETHUSDT.

Boros matches users who want to pay a fixed rate and receive the market rate with others who want to receive a fixed rate and pay the market rate until a specified future date. The platform can help traders hedge the costs of their positions or lock-in high funding rates as part of a basis trade.

Although Boros currently limits maximum leverage to 1.4x and only offers two distinct markets, limitations that make it difficult to profitably speculate or efficiently hedge, the Protocol remains in the early stages of public access and will likely expand functionality as it matures.

4️⃣ Trump Approves Crypto 401(k)s

President Donald Trump has signed an executive order that will open up $9T in 401(k) plan retirement savings to alternative investments, including crypto, precious metals, and private equity.

The executive order instructs various regulatory agencies to investigate and remove any hurdles that prevent such investment categories to be included in professionally managed funds used by 401(k) savers.

In May, Trump’s Department of Labor reversed Biden-era guidance that encouraged 401(k) plan managers to exercise “extreme care” before adding cryptocurrency to investment menus, claiming, “investment decisions should be made by fiduciaries, not D.C. bureaucrats.”

While certain 401(k) plan managers already offer crypto exposure to their clients, the vast majority of all investments made through these retirement savings accounts are concentrated in stocks and bonds.

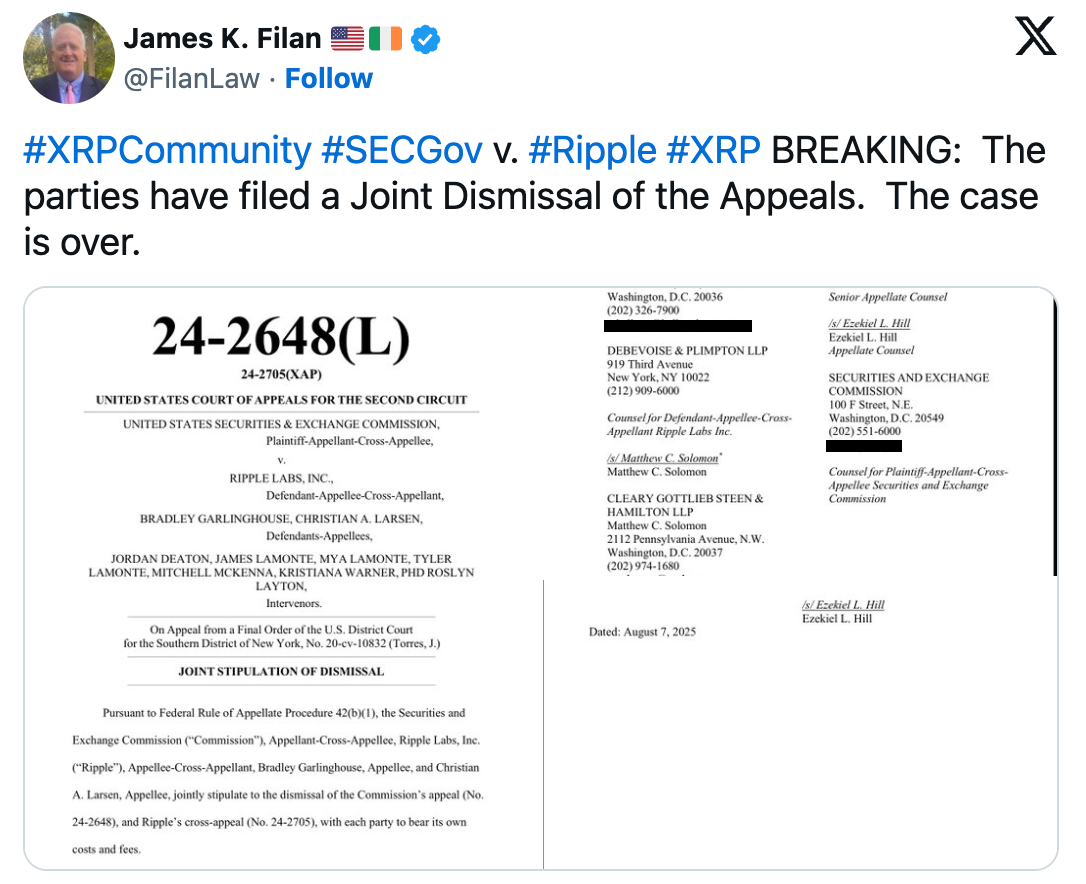

5️⃣ SEC and Ripple Drop Appeals

After nearly five years, the Securities and Exchange Commission and Ripple Labs have jointly agreed to drop their appeals, putting a decisive end to one of the crypto industry’s most significant legal battles. In late June, Ripple CEO Brad Garlinghouse hinted at this possibility, stating Ripple will drop its appeal and that he expected the SEC to do the same.

Judge Analisa Torres’s July 2023 verdict in SEC v. Ripple Labs will stand as the final decision in this case. The ruling fined Ripple $125M for making direct XRP sales to certain institutional investors in violation of federal securities laws, but deemed secondary market programmatic XRP sales through crypto exchanges as lawful.

UR, the world's first money app built fully onchain, transforms Mantle Network into a purpose-built vertical platform — The Blockchain for Banking — that enables financial services onchain. Mantle leads the establishment of Blockchain for Banking as the next frontier.

On this week’s Weekly Rollup, Ryan and David cover Tom Lee’s $3B ETH buying spree at 12x Michael Saylor’s pace, the race to become the top Ethereum treasury, and whether these companies are a buy or not.

They also discuss the Roman Storm verdict, Trump’s surprise $8.7T 401(k) crypto order, and Arthur Hayes selling millions in ETH.

Plus, Base’s 33-minute outage, the launch of Succinct’s ZK prover network, and the SEC declaring liquid staking tokens are not securities.

Tune into this week's rollup! 👇

📰 Articles:

📺 Shows:

Thoughts on how to make Bankless even better? Tweet me!

🧑💻 Lucas Matney, Bankless Editor