Best of Bankless 2023 ($)

View in Browser

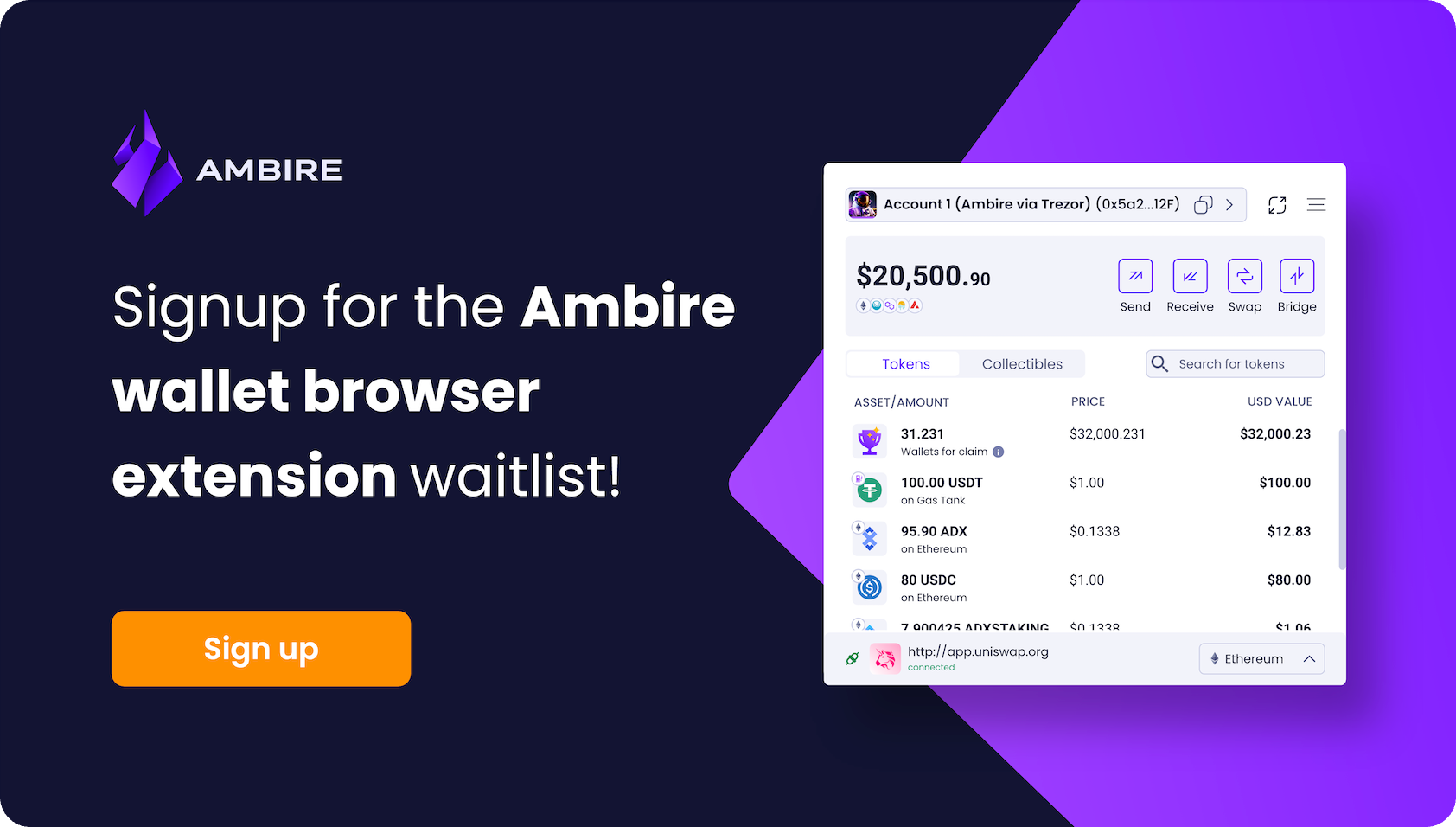

Sponsor: Ambire — Sign up for the Ambire wallet browser extension waitlist!

🎙️ Bankless Shows

The top 5 Bankless episodes from 2023.

🏅 1. We’re All Gonna Die | Eliezer Yudkowsky

This year, Bankless waded into the forefront of the AI alignment debate. Ryan and David’s interview with AI luminary Eliezer Yudkowsky took listeners deep down the superintelligence rabbit hole and sent everyone into an existential crisis!

Yudkowsky posits that humanity is on the brink of extinction, as we will soon develop a superintelligent AI that would be powerful enough to beat the entirety of human civilization in any cognitive task and will have its own desires to supplant the existing human order.

Worse yet, he gives the grim take that there is nothing we can do to stop its development. Dive deep with the full show!

🏅 2. The Dollar Will Hyperinflate to Zero | Balaji Srinivasan

After a string of bank failures in March and subsequent liquidity injections from global central banks, Balaji Srinivasan threw up the BitSignal, encouraging people to exit from the banking system and invest in crypto, specifically Bitcoin.

Balaji joined Bankless to discuss why he believes the dollar will soon hyperinflate and the motivations behind his million dollar wager that BTC would hit $1M within 90 days.

🏅 3. Chainlink’s CCIP | Sergey Nazarov

Chainlink co-founder Sergey Nazarov came on Bankless to discuss the launch of CCIP and tell listeners why his protocol aspires to be more than just a provider of price oracles.

Legacy traditional financial systems cannot directly interface with blockchain technology and the institutions that operate them have no desire to switch their infrastructure. With Chainlink CCIP, they won’t have to!

Not only does CCIP allow blockchains to interoperate between each other, it's also a gateway between onchain and offchain data sources. Sergey’s ambitious plans see the Chainlink network seizing on this opportunity and transforming into the de facto interoperability layer between all of TradFi and all of DeFi.

🏅 4. What This Commissioner Thinks About the SEC | Hester Peirce

Bankless listeners were yet again graced by the presence of SEC Commissioner Hester Peirce amid this year’s backdrop of an extremely hostile regulatory environment. She discusses what crypto could be if we had a sensible SEC and pushes back against her agency’s attempts to increase its jurisdictional reach.

While one of Crypto Twitter’s favorite pastimes is slamming regulators for arbitrarily encumbering the industry, Commissioner Peirce’s interview gives us hope for the future of crypto-regulator relations and has us salivating at all we could accomplish with aligned regulators basing their decisions on first principles.

🏅 5. The Blockchain Trilemma - ETH vs SOL vs ATOM | Mike Ippolito

Blockworks cofounder Mike Ippolito hopped on the pod to give his take on the Blockchain Trilemma, a set of tradeoffs all blockchains face when attempting to optimize for scale, security and decentralization.

So far, crypto chains have only been able to solve for two aspects of the Trilemma simultaneously, but convergent architectures between Ethereum, Solana, and Cosmos are emerging as each chain works to conquer the unsolved problem of conquering the Trilemma.

This episode will help you understand the strategy each chain is taking to complete the Trilemma on their path towards total dominance and give you a deep understanding of the current frontier of cryptoeconomic research.

📖 Bankless Newsletter

The top 5 Bankless newsletter articles in 2023.

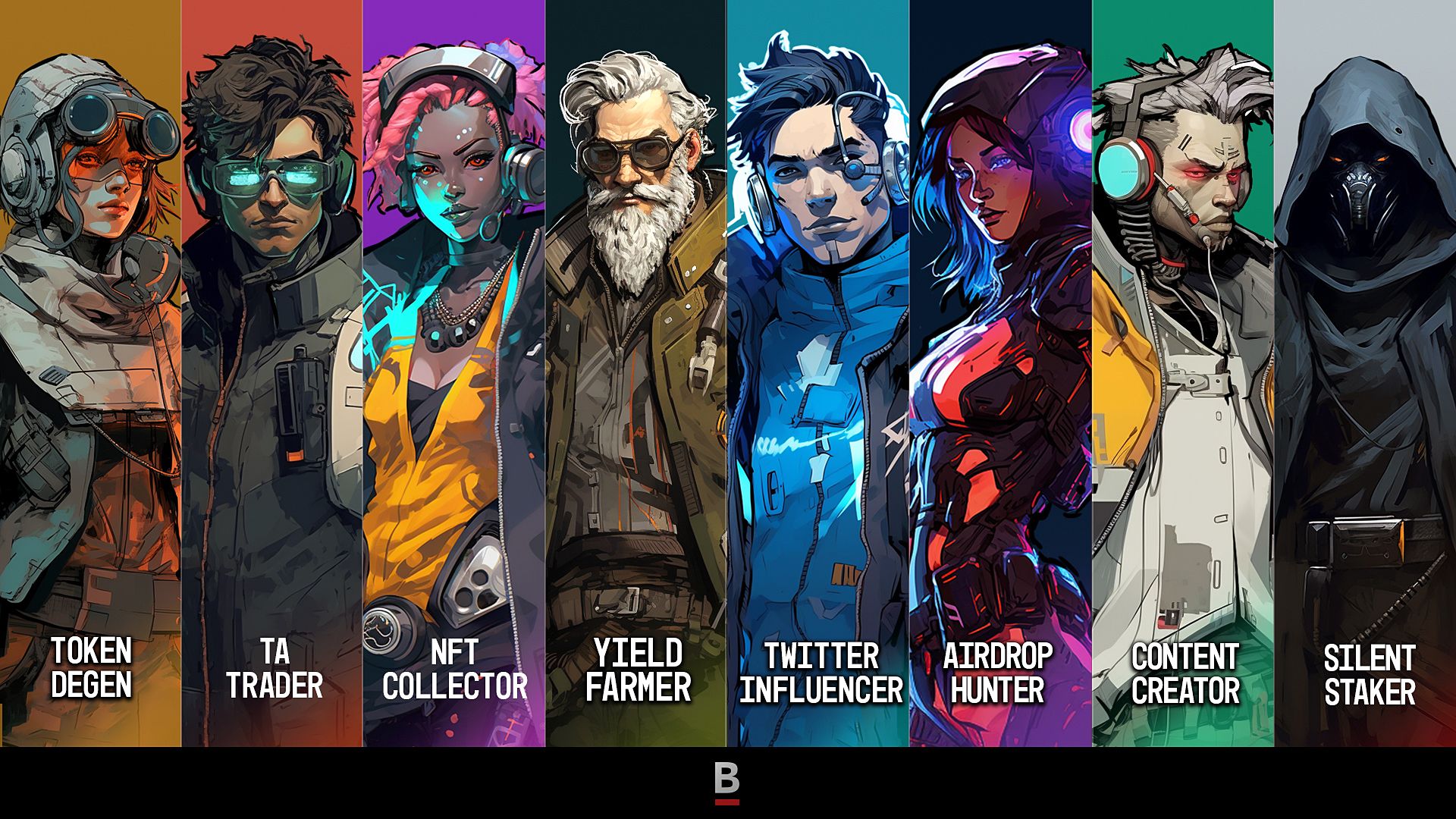

🏅 1. Choose Your Bull Market Character Class

Being in crypto is supposed to be enjoyable, so for this article, we took a break from the analysis to present you with Crypto™, a game concept that turns the various strategies you can implement to succeed in crypto into fun character classes you can identify with.

Each character has skills and abilities, and your personality type will likely resonate with some character classes over others. As you read through this guide to Crypto™ character classes, watch for the character that sparks joy!

Crypto™ Players are not confined to a single character class, meaning you can combine the abilities of listed character classes or create your own to create synergies between characters.

🏅 2. This Is the Last Cycle

Bankless co-host David Hoffman makes the case that while crypto will always have its Wild West, the industry is also evolving into a predictable, dependable, and regulatory-approved environment that can onboard the world.

Crypto scored major regulatory victories in 2023, TradFi giants are getting ready to enter the industry, and major brands continue to explore crypto avenues. Simultaneously, infrastructure is rapidly scaling and ETH has finally evolved into ultra-sound money.

Factors that previously limited crypto from achieving adoption will not hamper the industry’s growth this bull run; the industry stands ready to meet the demands of mainstream adoption!

🏅 3. Can OpenSea Bounce Back?

OpenSea, once the undisputed NFT marketplace juggernaut, has faced some serious headwinds lately–there's no denying that.

While it’ll take OpenSea making the most of its advantages to mount a resurgence against dwindling volumes and Blur competition, it’s possible for OpenSea to bounce back to its previous position of dominance in the NFT space!

The ability to launch a token and L2 are two metaphorical aces up OpenSea’s sleeve, but to win back creators, the marketplace will need to at least enable creator-set royalties on its main platform.

🏅 4. DeFi’s Contagion Curveball

After a Curve exploit left hackers with 8% of the circulating CRV supply, DeFi looked to be on the verge of a major contagion event: Curve founder Michael Egorov’s $110M in stablecoin loan was at risk of liquidation!

While it was the CRV dump that resulted from the hack that placed the position at risk in the first place, had the exploiter attempted to swap out of their tokens, it would have forced the liquidation of $290M of CRV. Given the inability of the market to absorb the sale of that much CRV, the protocols that had lent out funds against CRV were at risk of insolvency.

While Egorov managed to deleverage and avoid liquidation in the days following the hack, this saga serves as a reminder of the dangers of crypto and a reminder of why protocols must carefully assess risk when creating lending markets.

🏅 5. How Shapella Pushes Ethereum Forward

After successful implementation of the Merge in 2022, Ethereum had completed its long-awaited transition from Proof of Work to Proof of Stake, but staking was a one-way door. Withdrawals didn’t ship until 2023!

In “How Shapella Pushes Ethereum Forward,” we cut through the noise to break down Ethereum’s largest upgrade of the year and took a look at why you should care about the implications of Shapella.

Ambire V2 is the first smart contract wallet alternative to MetaMask to unlock the full power of Account Abstraction without any compromise on user experience or security. With more than 100,000 users on web and mobile, now Ambire is launching a browser extension and Bankless readers might have the chance to test it before everyone else.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.