Believe: The Solana Token Launcher Coming for Venture Capital

As the token launcher wars are heating up in crypto, a new challenger is catching fire. Here's everything you need to know about Believe.

🪙 What Is Believe?

Believe is the April 2025 rebrand of Clout, a Ben Pasternak project that let users spin up social tokens for themselves. After the pivot, Believe is now focused on disrupting and democratizing venture funding.

The Solana-based “launch a coin in a tweet” app allows anyone to mint a token around any idea, project, etc. that is posted on X. Then, the crowd decides whether it deserves real runway via buys.

In other words, the idea is to turn the internet’s attention stream into permissionless capital markets:

- Founders can claim 50% of the trading fees of their project's token for funding their work, even if they didn't make the token themselves.

- Scouts who tokenize promising posts first can earn a 0.1% slice of the trading fees in perpetuity for spotting the signal early.

- Traders can speculate on and potentially earn from startup tokens that do well here.

Creators can now claim fees directly in the iOS app. Just link your X to your Believe account from the Settings page.

— Believe (@believeapp) May 3, 2025

We'll initiate payouts daily, and they'll automatically be sent to your Believe wallet.

DM's open for any questions. pic.twitter.com/sYP3ZDGSQK

📌 How Does Believe Work?

The mechanics of Believe are straightforward.

The first step is the "tag and mint." A founder can post an idea on X and tag the Launch Coin account with a name and ticker to kick off a token creation.

Alternatively, a scout can reply to an already existing idea with a tag + names to get the ball rolling. The original creator can claim the project and its fees anytime by linking their X account on Believe.

Next up is the release sequence. Each new Believe coin starts on a dynamic bonding curve. Early buys face a high anti-snipe fee that decays to 2% as liquidity builds.

At this point, if a new coin's market cap reaches $100,000 USD, it graduates to a Meteora pool for deeper, open liquidity.

The concept behind @believeapp is simple: it’s a the Kickstarter for ideas and projects.

— Imran Khan (@lmrankhan) April 28, 2025

Here’s how it works: a founder or scout can tag an idea post with @launchacoin, which automatically creates a coin tied to that idea. The market then determines the coin’s fair value based…

Going forward, Believe is looking at adding additional features for coin creators, like gated chats and gated investment opportunities, and vesting creator fees over time to better align incentives.

Here, though, it's worth underlining that Believe coins aren't tokenized equity. They don't offer company ownership, governance power, or revenue rights.

"Your coin should function like digital merchandise," Believe says in its Playbook guide. "Think of it as a way for supporters to back your project—not a security."

So while Believe coins aren't traditional investment opportunities, they do offer an avenue for speculative patronage where traders can earn from price action if they place their support right. People are flocking to try the app accordingly.

📊 By the Numbers

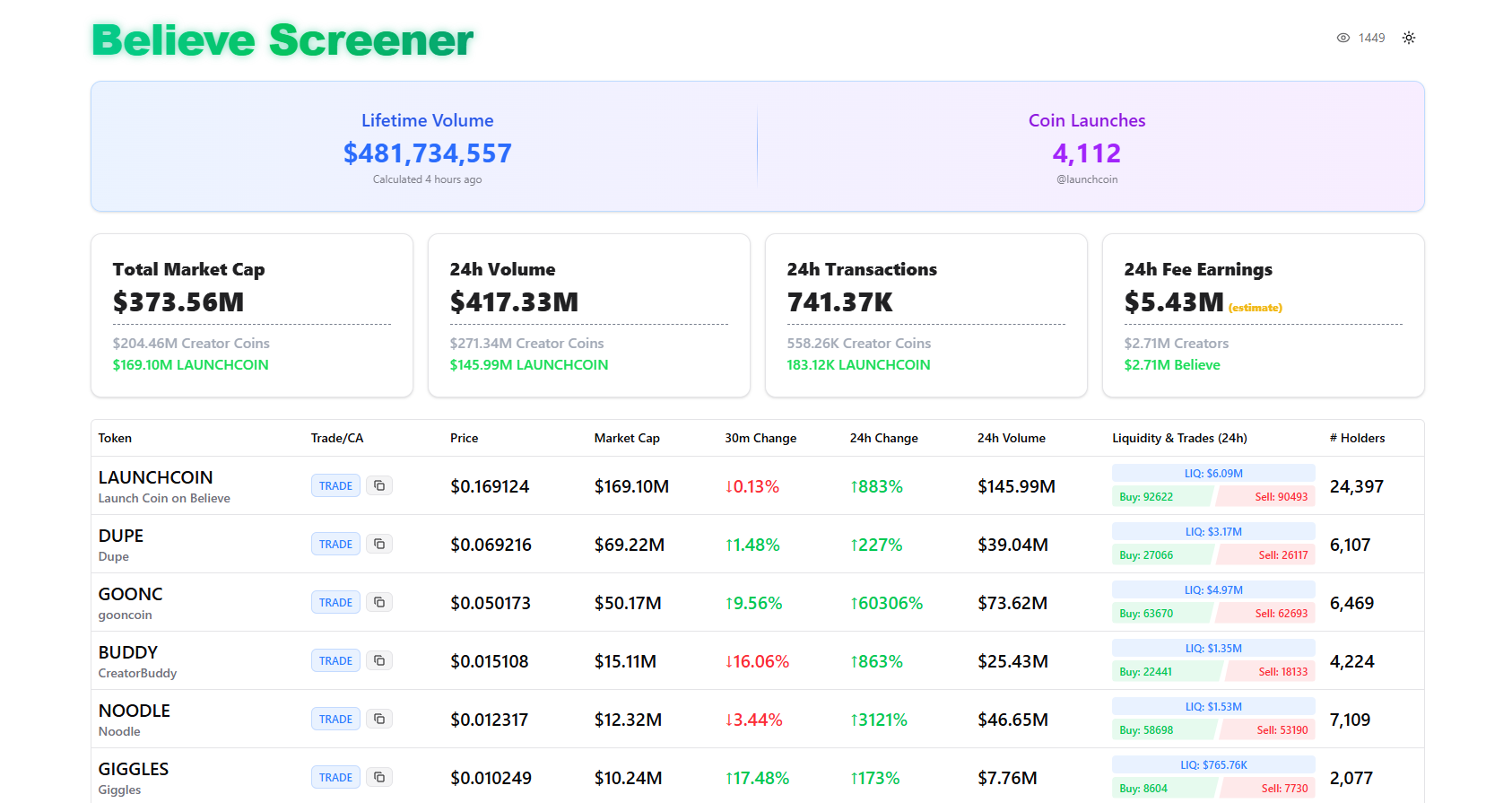

There is huge interest around Believe right now.

For example, Believe's main $LAUNCHCOIN token—which rebranded from the Clout-era $PASTERNAK on May 3rd—rocketed up 850% over the past 24 hours to a new all-time high over $0.15. That's incredible buy pressure.

In that same span, Believe coins facilitated more than $417 million in trading volume, bringing the platform's lifetime volume to $481 million, while creators earned $2.71 million in fees.

$3COIN Midday update!@believeapp by @pasternak is actual lightyears ahead of all the other platforms with $2627 with ≈ 400K in vol@pumpdotfun by @a1lon9 lagging behind $243 with ≈ 400K in vol@zora finally broke $4🫠

— doodlifts (@doodlifts) May 13, 2025

Safe to say that @believeapp is the winner for now 🫡 https://t.co/qGKTfPsFEL pic.twitter.com/PU4RdQ4aFk

All the top tokens here have been pumping hard, too. At the time of writing, Believe Screener showed all 28 of the largest Believe coins on the homepage had at least triple-digit percentage gains on the day!

📱 Diving In

The aforementioned Believe Screener is a great resource for finding and analyzing Believe coins, but you can also try the Believe app firsthand by downloading its mobile app.

Looking ahead, there are definitely outstanding questions. Will founders ship after the initial hype? And how far can the “digital merch” approach skate around securities gray zones?

We'll see what happens, but there's no question that Believe has the hot hand among token launchers right now. If the team can keep this momentum up, their app could be one of the year's big breakout successes onchain. Keep it on your radar accordingly.