Battle of the Billionaires

Dear Bankless Nation,

It’s the Battle of the Billionaires. CZ and SBF, the CEOs of centralized exchanges Binance and FTX, are facing off.

Crypto twitter regulars may have noticed the CEOs trading passive-aggressive barbs for the past several months.

But things have escalated dramatically over the past several days with CZ announcing that Binance was planning to sell the entirety of their stake in FTT (FTX’s native token), while FTX has experienced mass-withdrawals over the last 48 hours.

This chaos comes following SBF’s debate against Erik Voorhees on Bankless and a CoinDesk report on the balance sheet of Alameda Research, a trading firm founded and owned by the FTX CEO.

It’s unclear what exactly prompted the bad blood between the two crypto titans.

Despite being competitors, Binance was an early investor in FTX. However, we may have some clues based on recent CZ tweets, as he alludes to industry players lobbying against one another.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

This saga has had so many twists and turns that it could make your head spin.

So let’s break down the situation so we can see what, if anything, may come of it.

The Opening Salvo

On November 2, CoinDesk published their report on the composition of Alameda’s balance sheet.

In the article, CoinDesk claims to have reviewed a “private financial document” which showed that on June 30, Alameda had $14.6B in assets, including holdings of $3.6B in “unlocked FTT,” and $2.6B in “FTT collateral,” against $8B in liabilities.

Despite being light on details, this caused rampant speculation that Alameda could be in trouble should the price of FTT fall. Given SBF’s close ties to the trading firm, many wondered whether or not FTX would be caught up in any sort of Alameda-related contagion.

While it is noted that we do not have any insight into Alameda’s books, there are large on-chain CDPs on protocols like Abracadabra that are being collateralized by FTT.

Sunday Not So Funday

Things escalated further on November 6 when Alameda CEO Caroline Ellison tweeted that the CoinDesk report showed an incomplete picture of the firm's balance sheet.

A few notes on the balance sheet info that has been circulating recently:

— Caroline (@carolinecapital) November 6, 2022

- that specific balance sheet is for a subset of our corporate entities, we have > $10b of assets that aren’t reflected there

Shortly after, CZ struck back with a tweet that Binance was looking to offload the entirety of their remaining FTT holdings over the next few months.

Caroline’s response to that was as follows:

@cz_binance if you're looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!

— Caroline (@carolinecapital) November 6, 2022

This back-and-forth caused significant volatility in the price of FTT, which has since stabilized around ~$22.

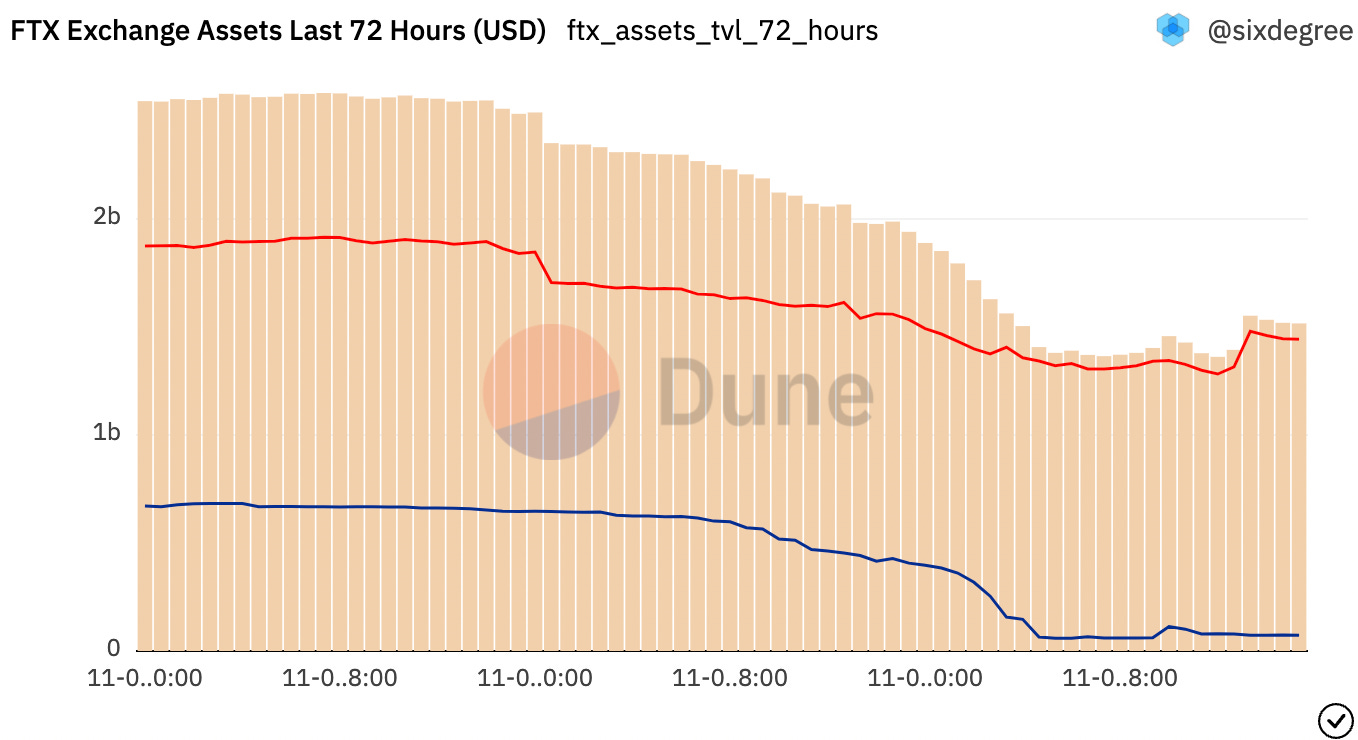

However, the situation created enough uncertainty to trigger a “run” on FTX, with greater than $790 million in net-withdrawals from the exchange over the past day and a half.

The situation has prompted SBF to take to Twitter, assuring users that the exchange was fully solvent and capable of processing user withdrawals while suggesting that the panic was caused by an unnamed competitor.

The Implications

It’s unclear what, if any, long-term implications this feud will have on the industry as a whole.

It’s certainly not a great look to have the CEOs of two of the largest exchanges fighting on Twitter, especially when crypto is in the crosshairs of regulators.

With that said, there’s always a silver lining.

For instance, the mass withdrawals from FTX has prompted prominent figures like Cobie to call for exchanges to publish cryptographic proof of reserves. This way, customers would be able to verify at all times that exchanges had enough assets on hand to satisfy withdrawals, rather than trust the words of the exchange operators themselves.

Furthermore, the situation demonstrates the stark differences between DeFi and CeFi. DeFi has built in transparency as users can monitor risk in real-time and always tell whether or not a protocol is solvent.

Imagine saying Aave is insolvent and getting instantly caught.

— samyakjain.eth 🦇🔊 (@smykjain) November 6, 2022

DeFi unironically fixes this. So perhaps the saga will encourage CEXs to emulate their decentralized counterparts.

But in the meantime, we may just have to wait for this billionaire battle to play out.

And remember… not your keys, not your coins.