Base World ($)

View in Browser

p.s. Thanks to Uniswap. Uniswap v4 is raising the stakes with a $15.5M bug bounty, the largest ever! Have what it takes to help secure the most anticipated codebase in DeFi? Learn more and join the bug hunt.

Sponsor: Cartesi — Tap into the power of Linux, the simple way to build in Web3.

1️⃣ BTC Corrects, ETH Outperforms

Bitcoin’s march toward $100k stalled this week, dropping as low as ~$91k on Tuesday. Driven by a mixture of factors, such as overdue corrections and slowing ETF flows, the drop quickly recovered, pushing BTC back to ~$95k.

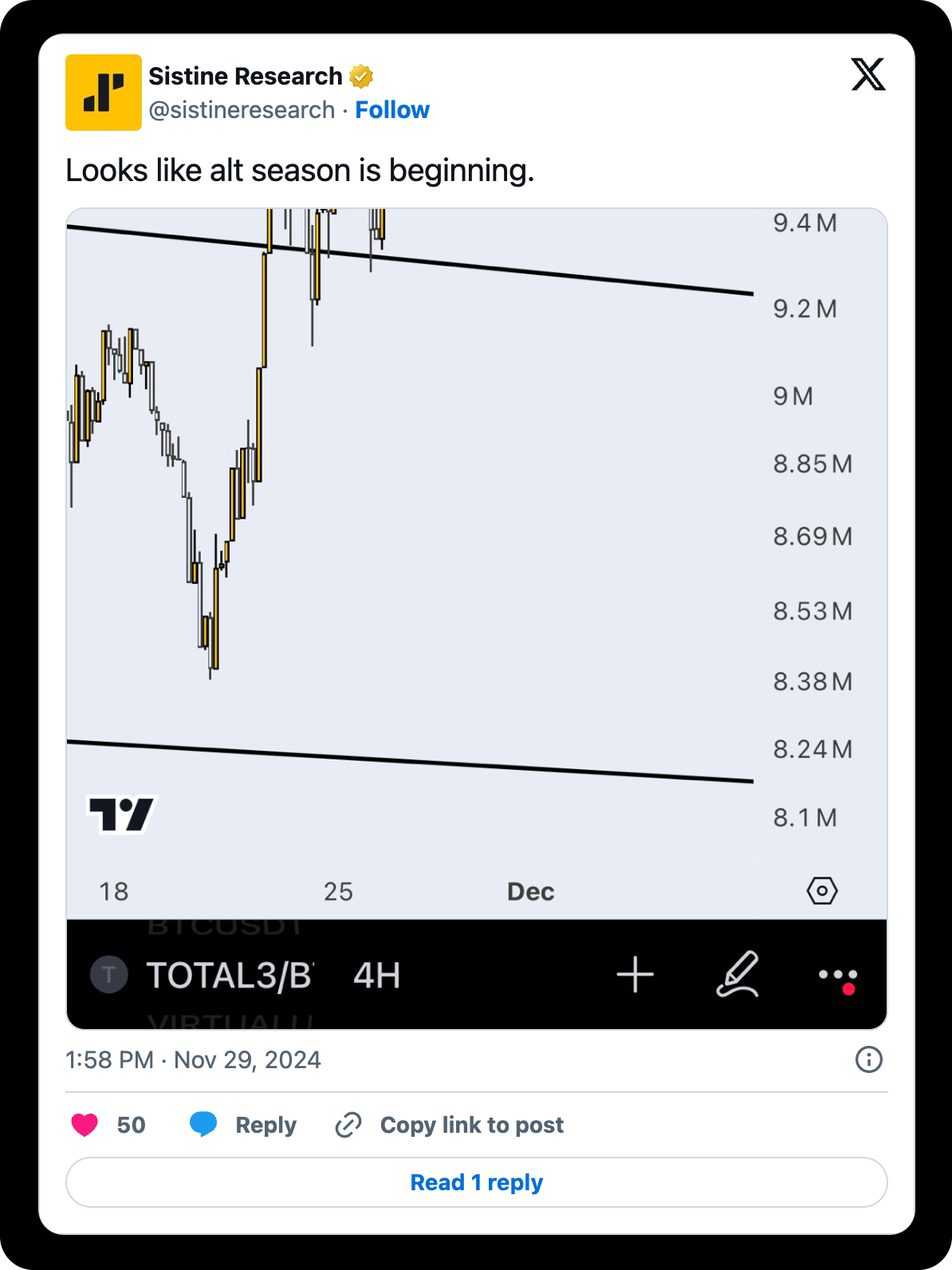

In the midst of this, ETH outperformed, up ~8% versus Bitcoin’s -2% on the week, breaking records in the process as blob activity surged onchain and open interest hit all-time highs in derivative markets. Many of its adjacent alts, like Ethena and Aave, also surged, finally having room to breathe. As a result, calls for the fated “alt season” have grown, with many saying this marks a paradigm shift in the market where Bitcoin may hover between $90-100k while altcoins finally get their outperformance.

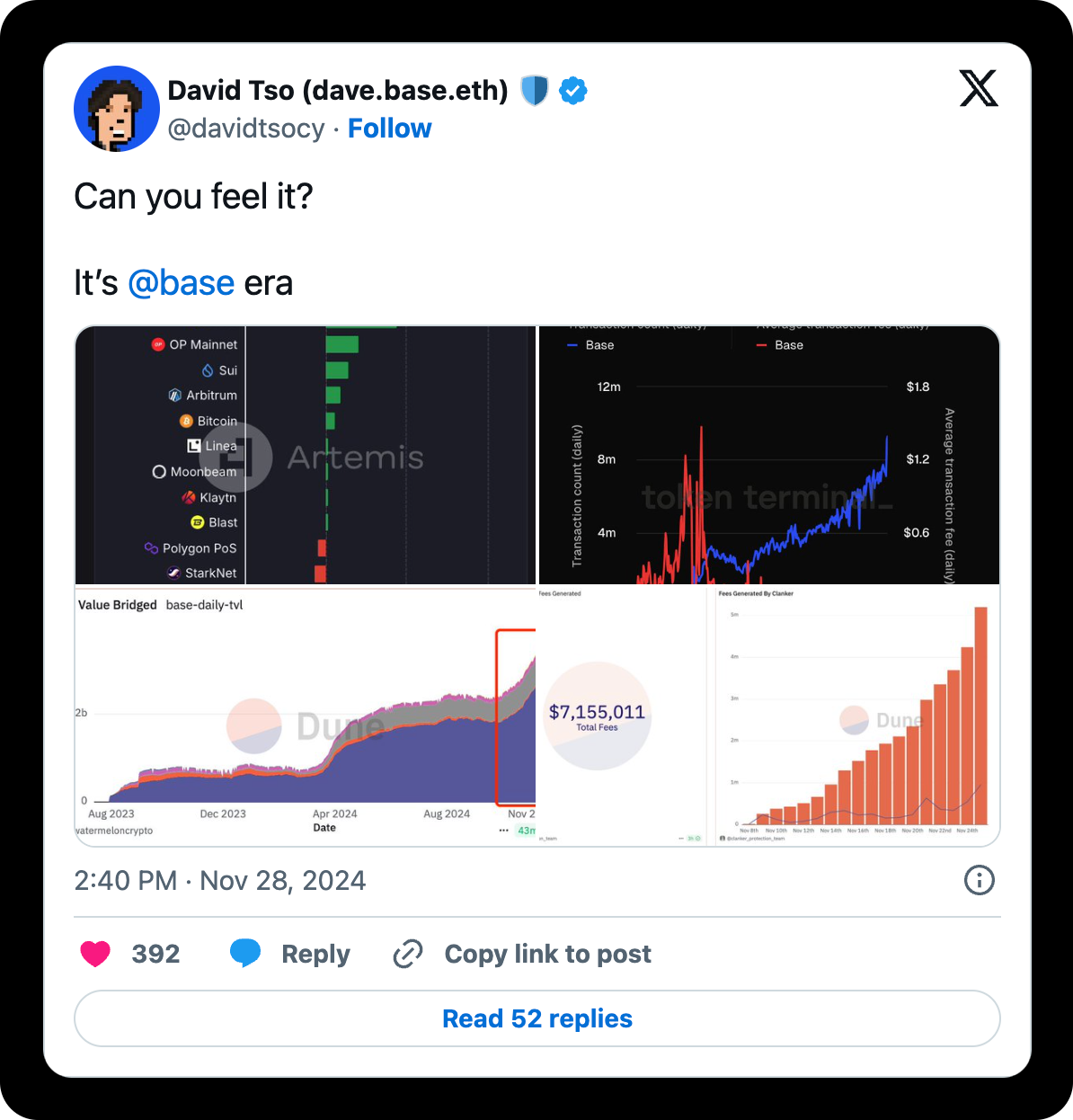

2️⃣ Base Season in Full Swing

As we called, Base is thriving. The network broke 10M transactions for the first time. Agents and their platforms — Clanker, Virtuals, and Spectral — have continued explosive growth, both in price and in activity. Clanker has launched over 4.6K tokens, while Virtuals continues to see agent launches in the triple digits daily.

One of its most popular agents, aixbt, which provides market and token analysis, now commands more mindshare than Ansem, essentially making it the top influencer on CT. Overall, if any metric signifies Base’s success right now, it’s the number of failed transactions, which has outpaced successful ones on some days, showing that all the most popular chains have growing pains.

3️⃣ Justin Sun Joins WLFI; Trump Ally Buys Tether Stake

On the Trump front this week, we saw major moves from what some may call crypto’s “black sheep.” Tron’s founder, Justin Sun, joined World Liberty Financial (WLFI) as an advisor, and Howard Lutnick, Trump’s Commerce Secretary pick, acquired 5% of Tether for $600M.

For Sun, his appointment came after a $30M investment in WLFI, becoming its largest investor in a move he called a bet on U.S. blockchain leadership. Tether’s deal with Lutnick and his firm, Cantor Fitzgerald, can be understood similarly. While the partnership revolves around a $2B Bitcoin-backed lending program, this deepening of ties also comes as Tether announced it will stop supporting its Euro stablecoin amidst the “evolving regulatory frameworks surrounding stablecoins in the European market.” In other words, these companies want to get a stake in the U.S.

4️⃣ Tornado Cash Wins In Court

In a positive twist, a U.S. Federal Appeals Court ruled that the Treasury Department’s sanctions against Tornado Cash exceeded its authority. The court determined that Tornado Cash’s smart contracts do not constitute “property” under the International Emergency Economic Powers Act (IEEPA).

This decision overturns a 2022 ruling upholding the sanctions, which were initially imposed over allegations of laundering stolen funds by groups like North Korea’s Lazarus Group. The court emphasized that decentralized software cannot be treated as an entity or individual under existing laws, a ruling that will indeed have strong regulatory ripple effects. The fight is not over, though. The same day, Roman Storm, Tornado Cash’s founder, shared that he had once again been debanked and needs more resources to continue the fight.

5️⃣ Pump.fun Suspends Livestreams

Pump.fun indefinitely suspended its livestreaming feature this week following alarming behavior on its platform.

“Devs” had increasingly turned to broadcasting shocking acts to boost token prices, prompting widespread backlash and calls for stronger moderation. This heat has likely contributed partly to the rotation towards Base. With a token launch on the horizon, it will be interesting to see if Pump.fun ties platform moderation into the token’s utility.

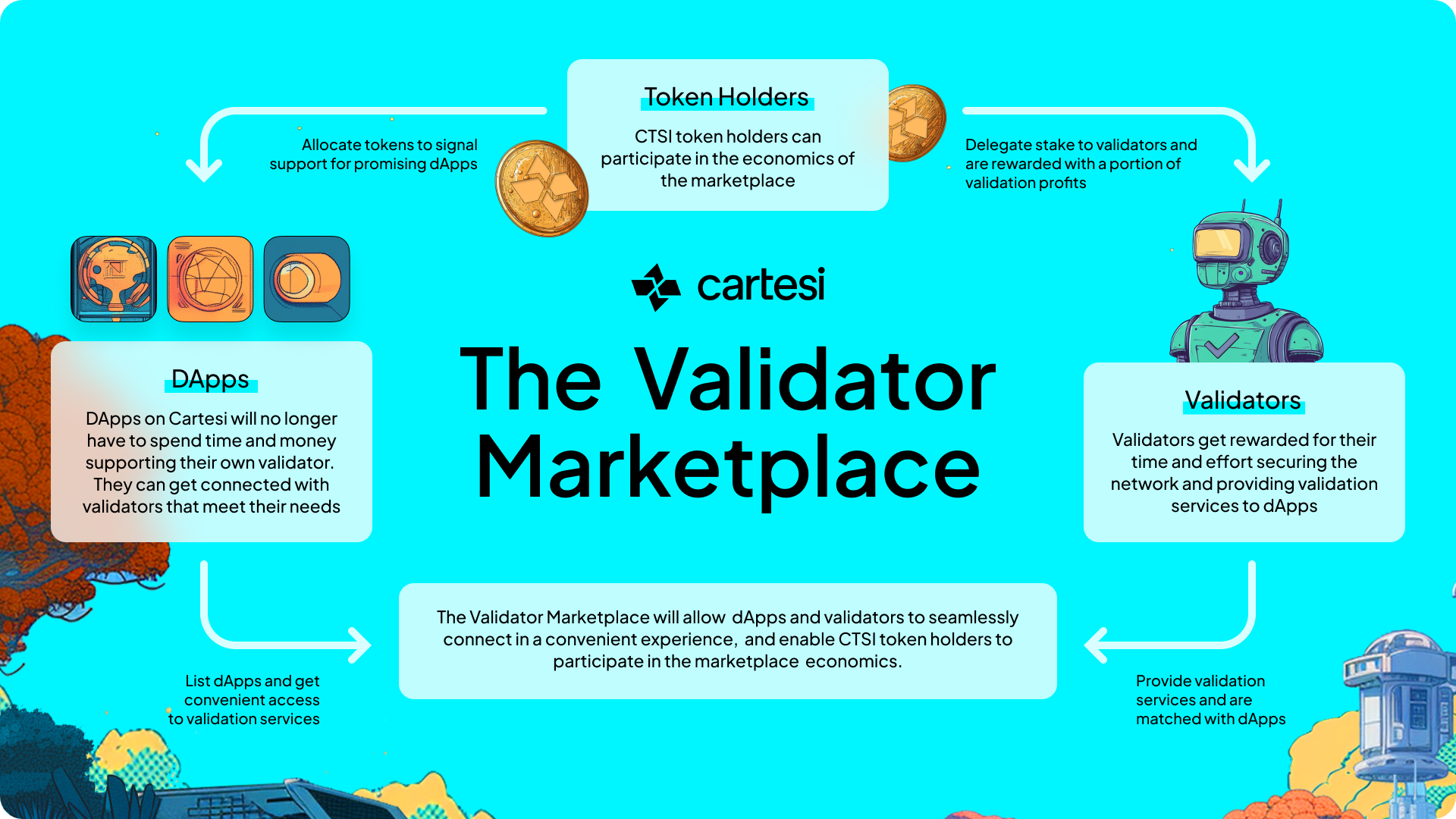

Cartesi has announced the addition of a Validator Marketplace to its roadmap—a decentralized platform connecting dApp developers with validators. This marketplace aligns incentives within the ecosystem, boosts CTSI token utility, and offers a solution for unlocking the full potential of appchains, even beyond Cartesi.

It's Bankless Weekly Rollup time!

This week, Ryan and David dive into the chaos of memecoins as Pump.fun’s livestream feature sparked big controversy. They also talk Tornado Cash's huge court victory, Donald Trump's pick for Treasury Secretary, Base's new TPS record, and where crypto markets go from here.

Tune in for all this and more to unpack the biggest stories shaping the cryptoeconomy right now! 👇

📰 Articles:

📺 Shows: