Dear Bankless Nation,

Despite a rather tumultuous week for CeFi players, the market pumped.

Sure, layoffs hit exchanges, the SEC sued some major crypto powers and we were subjected to more SBF musings, but the market is up around 20% week-over-week. We’ll take what we can get.

For our weekly recap, we dig into:

- Cameron vs Barry Part II

- Sam Bankman-Fried the blogger

- CEX rumblings

- Ethereum powering up

- DeFi happenings

- Bankless Team

📅 Weekly Recap

Here’s a recap of the biggest crypto news from the second week of January.

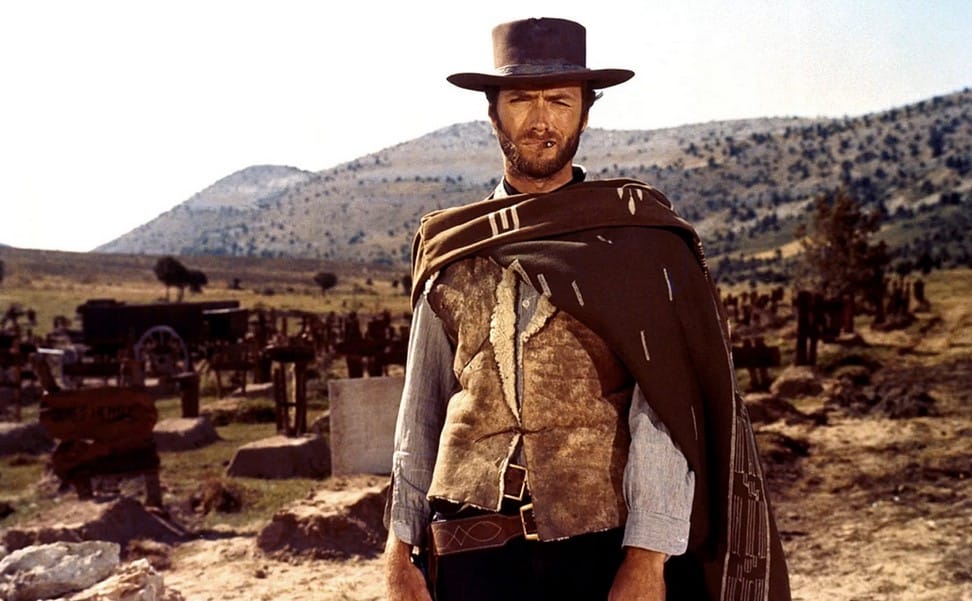

1. Barry vs Cameron Part II

Cameron Winklevoss is doubling down on his open letter to Barry Silbert last week that accused the Digital Currency Group (DCG) CEO of straight-up fraud.

Winklevoss penned a second open letter this week to the Board of DCG that urged them to "remove Barry Silbert as CEO, effective immediately, and install a new CEO, who will right the wrongs that occurred under Barry's watch".

In the letter, Winklevoss alleges that both DCG and Genesis misrepresented the latter’s financial health. They did so by pretending to fill the $1.2 billion hole from Genesis’ loan to Three Arrows Capital when they really didn’t.

DCG hadn’t given Genesis so much as a penny of actual funding to make up for the 3AC losses. Instead, DCG entered into a 10-year promissory note with Genesis at an interest rate of 1% — due in 2032.

This promissory note didn’t actually cover the Genesis hole because:

… as a matter of generally accepted accounting principles… a promissory note with a principal repayment due in 10 years falls outside the definition of a “current asset” by a country mile. Second, there is no market on earth that would value an unsecured long-dated promissory note at face value. The net present value of this note would be heavily discounted (approximately 70%) to reflect its value as of today (perhaps $300 million).

On top of that, prominent ex-employees of Genesis gave assurance that Three Arrows Capital losses were covered.

On July 6th, ex-CEO of Genesis Michael Moro tweeted that “DCG has assumed certain liabilities of Genesis related to [3AC] to ensure we have the capital to operate and scale our business for the long-term” and ex-Head of Trading and Lending Matthew Ballensweig assured Gemini in an email that ““Losses predominantly absorbed by and netted against DCG balance sheet, leaving Genesis with adequate capitalization to continue [Business As Usual]”.

This gave the illusion of Genesis’ solvency, which misled Gemini into continuing its Earn program.

Earn Update: An Open Letter to the Board of @DCGco pic.twitter.com/eakuFjDZR2

— Cameron Winklevoss (@cameron) January 10, 2023

DCG last week shut down its wealth management division “due to the state of the broader economic environment and prolonged crypto winter” and announced staff cuts of 30%.

Barry hasn’t responded directly, but he’s penned some reflections that will calm absolutely no one involved:

As this new year unfolds, we are hunkering down with our “lean and mean” mindset, and we are making meaningful changes to position the firm for long-term success.

This is all perhaps the least of DCG’s problems, as regulators are swooping in.

Bloomberg reports that the DOJ is “conducting an investigation” into the transfers between DCG and Genesis. On Thursday, the SEC filed a lawsuit against both Genesis and Gemini claiming that the Earn program represented an unregistered securities sale.

2. Sam Bankman-Fried the blogger

Sam is taking some time out of house arrest to… blog.

In a 2,300-ish word Substack post, Sam explained why and how FTX and Alameda imploded.

TLDR: He continues to deny stealing funds, blames it on Alameda failing to hedge against a series of unforeseen market crashes, with CZ lighting the fuse. He still claims he hasn’t been involved in Alameda for years. You can read the full post here.

Among the myriad of illiquid and worthless assets that FTX + Alameda had on their books pre-collapse (FTT, MAPS, OXY) was a sum of 56.3M actually liquid and valuable Robinhood (HOOD) shares worth ~$455M.

Sam was trying to access those shares for his legal fees on Jan 6 only for the U.S. DOJ to seize it two days later.

But Sam’s lawyers want their payday and are filing for those shares to be returned: “Mr. Bankman-Fried has not been found criminally or civilly liable for fraud, and it is improper for the FTX Debtors to ask the Court to simply assume that everything Mr. Bankman-Fried ever touched is presumptively fraudulent”.

Meanwhile, FTX has apparently recovered a whopping $5B in assets according to its bankruptcy attorney. On-chain sleuths disagree, so take that with a barrel of salt.

$5B? 🤷♂️

— Conor (@jconorgrogan) January 11, 2023

I went through every wallet I can find that the FTX estate owns. Biggest positions:

•$700M+ of $SOL (Most locked, so not sure why they would count it)

•$575M of FTT

•$371M of MAPS

•$127M OXY

•$90M WBTC

•$82M BONA

•~$500M in other random SPL tokens pic.twitter.com/OjaqD6pGRb

3. CEX rumblings

In an official blog post, Coinbase announced continued layoffs of about ⅕ of its workforce (~950 jobs) this week. This comes after a ~18% staff reduction in June. The announcement also confirms that Coinbase “will be shutting down several projects where we have a lower probability of success.”

Crypto.com CEO Kris Marszalek announced a cut of 20% of its staff.

Crypto brokerage Blockchain.com which loaned $270M to Three Arrows Capital is also laying off 28% (~110) of its staff. ConsenSys announced plans to lay off 100 of its headcount.

Binance, on the other hand, is embarking on a hiring spree in the new year, it claims. At the Crypto Finance Conference in Switzerland, CEO Changpeng Zhao said the exchange is planning to increase its headcount by 15-30% in 2023.

Over the years, we have turned down a lot of business because Nexo never makes compromises with regard to our very stringent anti-money laundering and know-your-customer policies. But we have always known that this is how you build a sustainable business. 1/

— Nexo (@Nexo) January 12, 2023

4. Ethereum powering up

Optimism overtakes Arbitrum in daily transactions and daily active addresses this week.

The flippening no one is talking about 👀

— Westie 🟪 (@WestieCapital) January 10, 2023

Optimism overtakes Arbitrum for Daily Active Addresses and Transactions per day. Very interesting pic.twitter.com/YdQVJr1xaV

OpensSea announces support for Arbitrum Nova!

We’re excited to now support Arbitrum Nova!@Arbitrum's chain dedicated to social and gaming!🎮

— OpenSea (@opensea) January 6, 2023

We’re also strengthening Nova’s ecosystem by joining the Data Availability Committee (DAC) to provide access to on-chain data and help ensure data accuracy 🤝 pic.twitter.com/Zio4pkDWaw

Coinbase Ventures joins Rocket Pool’s Oracle DAO as a member. Oracle DAO is a decentralized network of nodes that relays data from the Beacon chain to Rocket Pool’s smart contracts.

ETH finally breaks resistance right as @Rocket_Pool announces the new oDAO member being proposed.

— jasperthefriendlyghost.eth | jasper.lens (@Jasper_ETH) January 11, 2023

None other than @coinbase through their venture arm 🤯🤯

The oDAO is a trusted group that allows @Rocket_Pool to remain a permissionless system.https://t.co/BnpdLBApri pic.twitter.com/zxlPnQmn5h

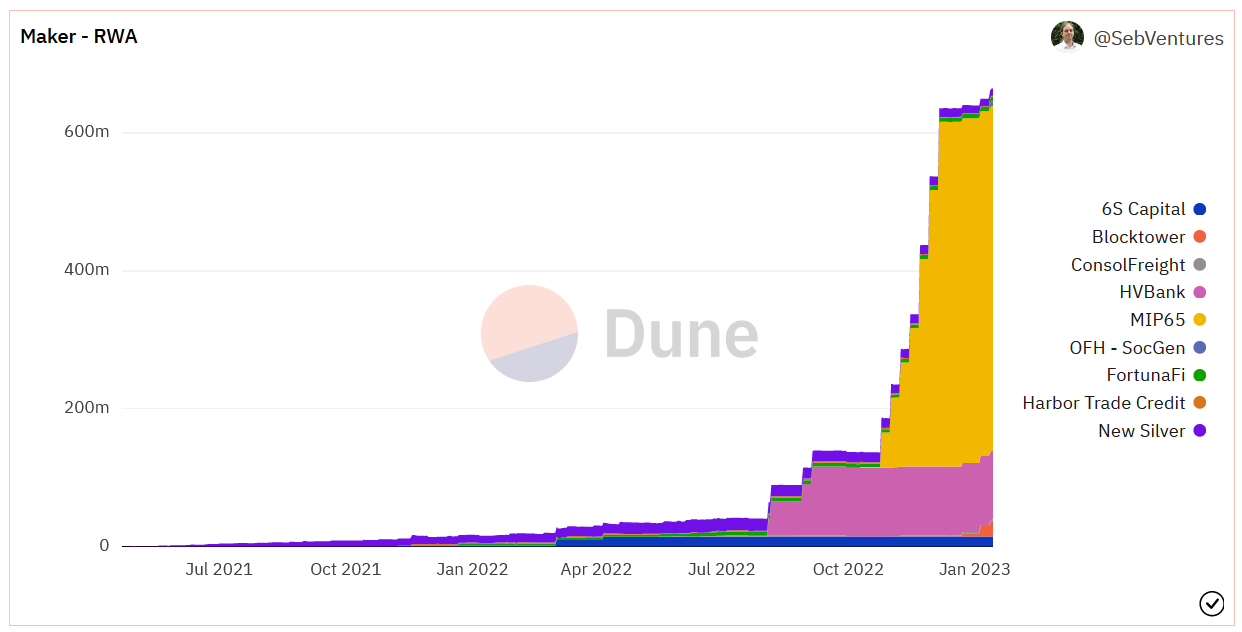

Maker has significantly increased its real-world-asset collateral in the past few months.

5. DeFi and CeDeFi news

Polygon is proposing a hard fork of its PoS chain on Jan 17th that aims to achieve two main objectives: reduce gas spikes and reduce the frequency of reorgs to improve translation finality.

More CeDeFi integration incoming. Ondo Finance is launching a feature that lets stablecoin depositors on its protocol invest directly in U.S. Treasuries and bonds. These are done through Ondo on-chain tokens that are invested in BlackRock ETFs with Coinbase as the centralized custodian.

1/ 🚨 @OndoFinance is bringing US Treasuries and institutional-grade bonds on-chain 🚨

— Nathan Allman 🌊 (@nathanlallman) January 10, 2023

We are making it possible for stablecoin holders to invest in US Treasuries through a daily liquid, bankruptcy-remote, tokenized fund with regulated service providers.https://t.co/9D6qYpZyg3

This is a big deal. It's not your grandfather's "AWS partnership announcement." Let me explain in plain English. https://t.co/va8sepRv6h

— Emin Gün Sirer🔺 (@el33th4xor) January 11, 2023

Remember when the story broke about two brothers using a series of anon identities to fake billions of TVL data through Solana-based dapps back in August? The U.S. DoJ is now officially investigating the matter.

El Salvador passes a law to issue Bitcoin-backed bonds, called Volcano Bonds.

Finally, Amazon Web Services is partnering with Avalanche Labs to streamline the deployment of nodes in Amazon’s cloud infrastructure.

This is a big deal. It's not your grandfather's "AWS partnership announcement." Let me explain in plain English. https://t.co/va8sepRv6h

— Emin Gün Sirer🔺 (@el33th4xor) January 11, 2023

Other news:

- Lens Protocol launches token-gated publications

- Blocknative launches free Auction RPC endpoint for Searchers to get MEV bundles on-chain

- MetaMask is adding a liquid staking feature to MetaMask Portfolio

- Top NFT Artists are selling out projects on Instagram in seconds

- How I turned 2 eth into a CryptoPunk in 5 days playing Wolf Game

- Rolling Stone launches Pussy Riot NFTs on Coinbase

- PROOF partners with United Talent Agency to mainstream Moonbirds

- Nifty’s Game of Thrones “Build Your Realm” NFTs sells out

- Azuki introduces Hilumia, an interactive game for holders