How a Few Banks Lost Everything All at Once

Dear Bankless Nation,

These last few days were a doozy – as bank runs played out in real time on Twitter and startup-land waited on bated breath for the government to come save their asses.

Today, we dig into what went wrong, and where we are now. Today's newsletter is a long one, but we've got some Market Monday goodies at the bottom to reward you.

- Bankless team

All at Once

Bankless Writer: Jack Inabinet

Four months after the fraud-induced collapse of FTX, crypto and tech-centric banks in California are crossing the River Styx on their one-way journey into the depths of Hades.

Anyone else want to roll back the clock to a time when the biggest fear was an alien invasion?

Today, we’re (trying) to touch on everything that is breaking over in the trad financial system🤮 – and how that is impacting the crypto markets. Bankless has got you covered with a rundown to help you navigate this difficult market and start your week off in-the-know.

A Humble 'Crypto Bank'

Our story begins in La Jolla, California, the former home of crypto’s once preeminent, but now defunct, banking institution: Silvergate.

After the collapse of FTX, depositors ran on the bank, with more than $8B withdrawn in Q4 2022 forcing Silvergate to realize a loss of $1B in the quarter from selling securities that declined in value as rates rose aggressively throughout 2022.

In an effort to preserve solvency, Silvergate cut its workforce by 40%. CEO Alan Lane vowed to “return [Silvergate] to profitability in the second half of 2023” and committed to maintaining a “highly liquid balance sheet with minimal credit exposure and a strong capital position” in January’s investor call, in a futile attempt to diffuse investor and depositor fears alike.

Liquidity came in the form of $4.3B in loan advances from the Federal Home Loan Bank of San Francisco, a government-backed wholesale funding program available to banking institutions. Unfortunately for Lane and Silvergate, unexpected security sales to repay these advances forced the bank to record additional losses in 2023, negatively impacting capital ratios and pushing the bank into “less than well-capitalized” territory.

On March 8, Silvergate made the difficult, yet responsible, decision to “wind down operations and voluntarily liquidate the Bank in an orderly manner and in accordance with applicable regulatory processes.”

My faith in (crypto’s) humanity is restored!

While 2022 was filled with bad crypto actors like Alameda and 3AC choosing to fight tooth-and-nail until the end, hoping to win it all back in that one ever-elusive trade, Silvergate took the high road, electing to protect depositors and other creditors at the expense of their institutional pride.

Silicon Valley's Finest

Like wildfires and FOMO, bank run fever spreads rapidly; landing a spot on Forbes’ “America’s Best Banks” and “Financial All-Stars” lists proved insufficient in saving startup banking darling Silicon Valley Bank (SVB) from the clutches of financial disaster.

After Silvergate’s liquidation announcement, SVB announced Thursday, March 9th, that it would raise additional liquidity à la $2.25B in share sales, with the offering consisting of $1.25B in public market common stock sales, $500M in depository shares, and an additional $500M in common stock sales directly to private equity firm General Atlantic (talk about a shit investment 😵💫). Earlier that day, SVB had been forced to sell $21B in US Treasury and agency MBS securities, causing the firm to record an after-tax loss of $1.8B in Q1 2023.

Potentially spooked by the failure of Silvergate, prominent venture firms, including Founders Fund, Coatue Management, Union Square Ventures, Founder Collective, Canaan, Y Combinator, and Activant Capital, advised startups to withdraw capital from SVB on Thursday, commencing a good ole’ fashioned bank run.

Attempting to shore up depositor confidence, SVB CEO Greg Becker held a 10-minute call, imploring the bank’s clients, including their venture capitalist backers, to continue to support the bank in the same way they had for the past 40 years.

It’s safe to say Becker’s request was a resounding failure and was met with $42B in withdrawals. Outflows were so significant, not even the bank’s $21B in asset sales provided sufficient liquidity, with SVB having a negative cash balance of $958M at the end of Thursday.

Enter Regulatoors

Despite SVB’s best efforts, with assistance from banking regulators, to transfer collateral from various sources, the bank was unable to meet its cash letter with the Federal Reserve, with “precipitous deposit withdrawals [having] caused the Bank to be incapable of paying its obligations as they come due” according to the California banking regulator that took possession of the firm Friday morning.

Regulatory filings paint a bleak picture of the bank's financial standing.

The Federal Deposit Insurance Corporation (FDIC) took receivership of the bank and spun up the Deposit Insurance National Bank of Santa Clara, transferring all insured deposits to the newly formed bank. Insured deposits were accessible as of Monday morning, however uninsured depositors who were unable to withdraw before the close of business on Thursday were initially stuck with “receivership certificates,” representing their claims on SVB’s remaining assets, with recovery rates subject to value received from the FDIC’s sale of SVB assets.

SVB is the first FDIC-insured bank to fail since 2020 and second-largest in history, landing a spot on the unenviable list right below Seattle-based Washington Mutual, which failed in the midst of the 2008 Global Financial Crisis.

We have just witnessed the second largest bank failure in U.S. history.

— The Kobeissi Letter (@KobeissiLetter) March 10, 2023

Silicon Valley Bank’s collapse marks the largest bank failure since 2008.

Just 24 hours ago, $SIVB was trading at $200/share.

When a bank collapses that quickly, something is wrong.

This is not healthy.

Across is the bridge you deserve: fast speeds, low fees, great support, no hacks, and we love our users. Try it once and you’ll understand why Across users love us back and have bridged $billions with it. Yield farmers will also find attractive yields for providing bridge liquidity! 👀

A Big Beautiful Balance Sheet

SVB, as a banking entity, is remarkable for more reasons other than its untimely demise.

Liabilities:

The bank’s primary liability: deposits, totaled to $173B at year end 2022.

For Silicon Valley’s startups, SVB was the go to banker. Half of all venture-backed startups have exposure to the collapse.

Many companies and funds have not commented on their exposure to SVB.

— The Kobeissi Letter (@KobeissiLetter) March 12, 2023

If a company does NOT have exposure, you would have already heard.

50% of all venture-backed startups in the US have accounts with SVB.

More than 2,500 funds have accounts with SVB.

Silence is a bad sign.

Post-COVID, startups valuations were sky-high, with venture firms fueling the fire and pouring a record $621B into these early-stage companies across the globe, with the majority going to Silicon Valley-based startups.

This surge in funding activity was a boon for business at SVB, with deposits increasing by 233% from just over $60B in 2020 to nearly $200B at the end of Q1 2022.

While fruitful in the bull market, the reliance on startup fundraising and revenue generation proved disastrous in later quarters of 2022 and at the start of 2023, as these firms began draining deposits for cash expenditures.

Venture funding hits 9 year low:

— Science Is Strategic (@scienceisstrat1) February 20, 2023

- VC firms raised $20.6bn Q4, a 65% drop from the year-earlier quarter and the lowest Q4 amount since 2013

- LPs invested in 226 VC funds in Q4 2022 compared to 620 funds in Q4 2021 pic.twitter.com/SvEwl0apBr

SVB even acknowledged these risks in their 10-K filing stating, “Decreases in the amount of equity capital available to our clients could adversely affect our business, growth and profitability.” The firm’s core business strategy was centered around banking and providing financial services to “companies, investors, entrepreneurs, and influencers in the innovation economy.”

Typical banks have many types of depositors, consisting of a mix of cash flowing corporates, income earning individuals, and other diverse clientele. SVB had a high concentration of depositors in one of the most interest rate sensitive sectors of the economy.

As financial conditions tightened, net deposits turned to net withdrawals, stressing SVB’s solvency.

Assets:

Concern was centered primarily around the bank’s $91B in held-to-maturity (HTM) securities.

GAAP accounting standards give favorable treatment to financial entities booking their assets as HTM. Opposed to SVB’s AFS assets, where losses from increases in interest rates were reflected in decreases to the fair market value on the balance sheet, HTM securities are recorded at their purchase price.

For SVB, this meant $15B in unrealized losses on HTM securities were not recorded on the balance sheet with insufficient equity capital to absorb losses, providing an illusion of stronger solvency than existed.

While SVB was unique in its vulnerability to unrealized security losses to wipe out it equity (CET1) many other US banks would have 1/3 to 1/2 of their capital wiped out if losses are realized. Even a modest run on their deposits will force them to sell some securities like SVB pic.twitter.com/p3Cumf4DPZ

— Nouriel Roubini (@Nouriel) March 12, 2023

Unfortunately, SVB is not the only banking entity sitting on massive unrealized losses on its HTM security portfolio. All major banking and financial institutions have significant exposure to fixed-rate instruments, and thus unrealized losses hiding behind favorable accounting treatment.

..as you earn coupons over time and don't face P&L volatility.

— Alf (@MacroAlf) March 9, 2023

The flipside is when you need liquidity.

Banks can only sell a small portion of HTM bonds before being ''tainted'' as non-compliant from regulators.

The large extent of HTM hidden losses is worrying some.

10/ pic.twitter.com/oCvxWel7PN

Bailouts-on-Demand

Sunday evening, the feds showed their cards.

Joint action from the Department of the Treasury, the Federal Reserve, and the FDIC laid out a path towards resolution. Regulators hope this will stymie additional bank runs.

In a statement, regulators confirm that all depositors, both insured and uninsured, of SVB and Signature will have full access to deposits as of Monday morning, with no losses of the resolution being borne by taxpayers. Any shortfalls from asset sales to cover uninsured depositor claims will instead be “recovered by a special assessment on banks, as required by law.”

Signature Bank was revealed to have been taken over by regulators in the announcement, with a similar program announced for their insured and uninsured depositors, marking the third bank to fail this week and the third largest ever in the United States.

Simultaneously came a new Fed program, called the Bank Term Funding Program (BTFP). How does this new alphabet soup lending program work?

The BTFP will offer term loans to banks, savings associations, credit unions, and other eligible depository institutions on US Treasuries, agency debt and MBS, and whatever “other qualifying assets” means as collateral.

The kicker? The Fed is lending out on these securities at par!

Forget about all those unrealized losses on HTM securities banks have accrued: the Fed is stepping in and lending not on the market value of these instruments, but on the future promised repayment.

Essentially, Jerome Powell is offering undercollateralized loans to banking institutions. Across the pond in Great Britain and absent the powers imbued by the American money printer, the UK’s Finance Minister scrambled to piece together a deal to protect the nation’s startup industry, disrupted by the collapse of SVB UK. Thankfully, HSBC’s UK division announced a purchase of the bank, for a meager £1.

Another Helping of Crypto Contagion

Crypto stablecoins and firms were swept out to sea in the Silvergate/SVB/Signature riptide, as well.

After the announcement of SVB’s receivership, it became immediately apparent that crypto’s golden boy stablecoin, USDC, was in trouble. Circle’s lack of transparency was of no help, with an official announcement of the amount of funds trapped in SVB, one of Circle’s reserve banks, not coming until Friday evening, when the stablecoin issuer announced that $3.3B of the approximately $40B backing USDC were trapped in the failed bank.

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

— Circle (@circle) March 11, 2023

Circle held reserve accounts not only with the failed SVB, but also with the (solvent) Silvergate AND the recently-placed-into-receivership Signature. Thank non-denominational Jesus the Feds announced that bailout plan!

it's nuts that 3/6 of circle's banks just disappeared over a weekend pic.twitter.com/nu49Yf9AIE

— Rooter 2️⃣ (@0xrooter) March 12, 2023

Liquidity vanished on-chain, as stablecoin HOLDers panic-swapped their USDC and USDC-backed DAI and FRAX stables for the once-suspect USDT.

USDC fell to an all-time low of $0.82 on centralized exchanges, with limited liquidity on-chain pushing price even lower in many on-chain pools.

Fundamentally representing claims on US dollars stored in reserve accounts with various depository institutions and money market funds, the weekend closure of the trad banking system presented a hurdle to USDC redemptions. Without credible threat-of-redemptions, fiat-backed stablecoins are essentially a game of trust; just like the banks (and UST), this category of stablecoin is also subject to runs and no one was looking to be to be the HODLer of last resort, causing panic selling.

Tl;Dr: While USDC can be used 24/7/365 on chain, issuance and redemption is constrained by the working hours of the U.S. banking system.

— Jeremy Allaire (@jerallaire) March 11, 2023

USDC liquidity operations will resume as normal when banks open on Monday morning in the United States. As a practical matter, our teams are… https://t.co/6Y3SGop4t2

During the chaos, while the status of the SVB deposits remained unclear, Circle announced that it would stand by its legal obligation as a money transmitter and backstop any shortfalls in USDC reserves.

While this proved unnecessary, Circle remains in the weeds. This weekend’s shenanigans have potentially given Greedy Gary Gensler an “in” to regulating crypto’s most prolific stablecoin offering.

I guess crypto is finally going bankless… At least the regulators kicked a bunch of our frens in Operation Chokepoint 2.0 a month ago!

The clear winner here appears to be BNY Mellon, who will be taking custody of all of Circle’s SVB (and presumably Silvergate and Signature?) deposits and serving as the stablecoin issuer’s sole settlement layer while they look to onboard additional transaction partners.

Hair-Trigger Depositoors

Perhaps one of the scariest lessons of the collapse of SVB is the realization that a technologically enabled society in times of economic panic is a massive threat to the stability of the fractional reserve banking system.

In the 2008 Global Financial Crisis, concerns of solvency were driven by the toxic quality of bank assets. While we haven’t (yet) seen defaults on loan portfolios, it is undeniable that banks are holding a massive grab-bag of mixed duration treasuries with significant unrealized losses.

Bank accounts are paying depositors close to zero, while those with uninsured accounts remain technically exposed to a complete loss of their funds. Sophisticated investors are quickly recognizing the ability to earn yield in money market funds, which exposes them to a fraction of the financial risk.

While BTFP has changed the paradigm, allowing banks to monetize the spread between the market value of certain securities and par, banks still hold loan portfolios they are unable to use as collateral assets, and are still susceptible to run risk.

Dodd-Frank, the last banking system overhaul, was written in 2010, a time when many tech companies were in their infancy or had not yet to be created. Online banking was nascent and cumbersome. Those banking habits would be considered antiquated by today’s standards.

Digital customer experience in banking was improving, but many people, certainly more than today, still relied on branches to deposit checks, met with their bankers and everything had a lot more friction. And communication innovations of social media were in their infancy.

— professorstam.eth (@ProfessorStam) March 12, 2023

When regulators set risk frameworks, even in max panic mode, significant drawdowns in assets would take time; an SVB-style bank run with a one-day 25% decrease in deposits would not have been possible.

Not only has the advent of online banking made withdrawing funds easier than ever before, but the ability for fear to sweep through social media like wildfire has become a clear and present danger. Regardless of whether or not the SVB panic was necessary, concerns of solvency from a few credible players proved sufficient to cause it.

There was no time for investigation, no time for nuance, it was time to move, and move fast. Pull out your phone, check twitter quick to verify, switch to your SVB app and conduct a wire transfer (I'm assuming its a similar process to my business account at Chase).

— professorstam.eth (@ProfessorStam) March 12, 2023

When your bank is making the rounds on Twitter as the next potential bank run candidate, will you sit idly by, crossing your fingers and hoping for the best, or decide to take action and preserve the security of your family or business?

While the FDIC’s recent coverage of uninsured depositors has provided one less reason to worry, there is no guarantee that this coverage will extend to future bankruns.

SVB presents an interesting case study of the havoc a technologically savvy, uninsured depositor base can wreak on their bank and adds another massive concern to regulators' plates.

It's scary to think, but the same types of tactics that can manipulate an election can be used to undermine the strength of a bank. This time around, it was pointing to unrealized losses on high quality assets to pile on and justify a panic. But it can manifest from anything.

— professorstam.eth (@ProfessorStam) March 12, 2023

How Much Worse Could It Get™?

Fact sets behind every bank run are unique; the most recent have been runs on technically insolvent banks with high amounts of unrealized losses on HTM security portfolios and limited equity capitalization.

The next bank run will likely be spurned by concerns of default.

As the United States and the world edges towards recession, the probability of loan portfolio defaults become more credible. Higher interest rates and potential for widespread layoffs are a deadly cocktail for borrower default.

On Sunday, the Fed stopped the bleeding and cauterized the financial system’s open arteries with BTFP. If defaults tick up, banks will be in a world of pain, with no bailout plan in sight as their technologically savvy buyers claw past each other on the way out the door.

Despite appearances, this is not a healthy market.

Bullish???

While central banking policy has kept interest rates artificially low for decades and financial entities remain propped on the crumbling foundations of unrealized losses in asset portfolios, I feel the tide has begun to shift.

Papa Powell has given the banks carte blanche!

Did i say 50bps? Oh no, sorry, I meant 50 trillion will be the bare minimum for the next QE. This rod? Oh, that's my switch. I use it on the bears when they begin to piss me off. Stop with the questions already. Just go all in on the index. You don't have long. pic.twitter.com/R9ndume8Ng

— Blerk (@Blerk52) March 13, 2023

When I say “the banks,” I mean all of the banks, including foreign ones.

Assuming that tomorrow’s CPI print can come in at or below expectation, Powell has minimal incentive to raise; things are beginning to break in the financial system and that is Powell’s sign to let his hands off the economy’s neck.

Quantitative easing is back, inflation is dying, and although Powell is going to wish he could have just choked off inflation now, doing so risks collapsing the financial system. That’s the funny thing though: in all reality, we are only kicking this can down the road. It will show up as inflation in a couple month’s time. For now, we very well appear to be risk-on.

Crisis averted; live again to fight another day, soldier!

Remember anon: the streets are tough out there! Staying informed is crucial in today’s fast moving environment. Don’t ape, DYOR, and as always, this article was in no shape or fashion any form of financial advice whatsoever.

MARKET MONDAY:

Scan this section and dig into anything interesting

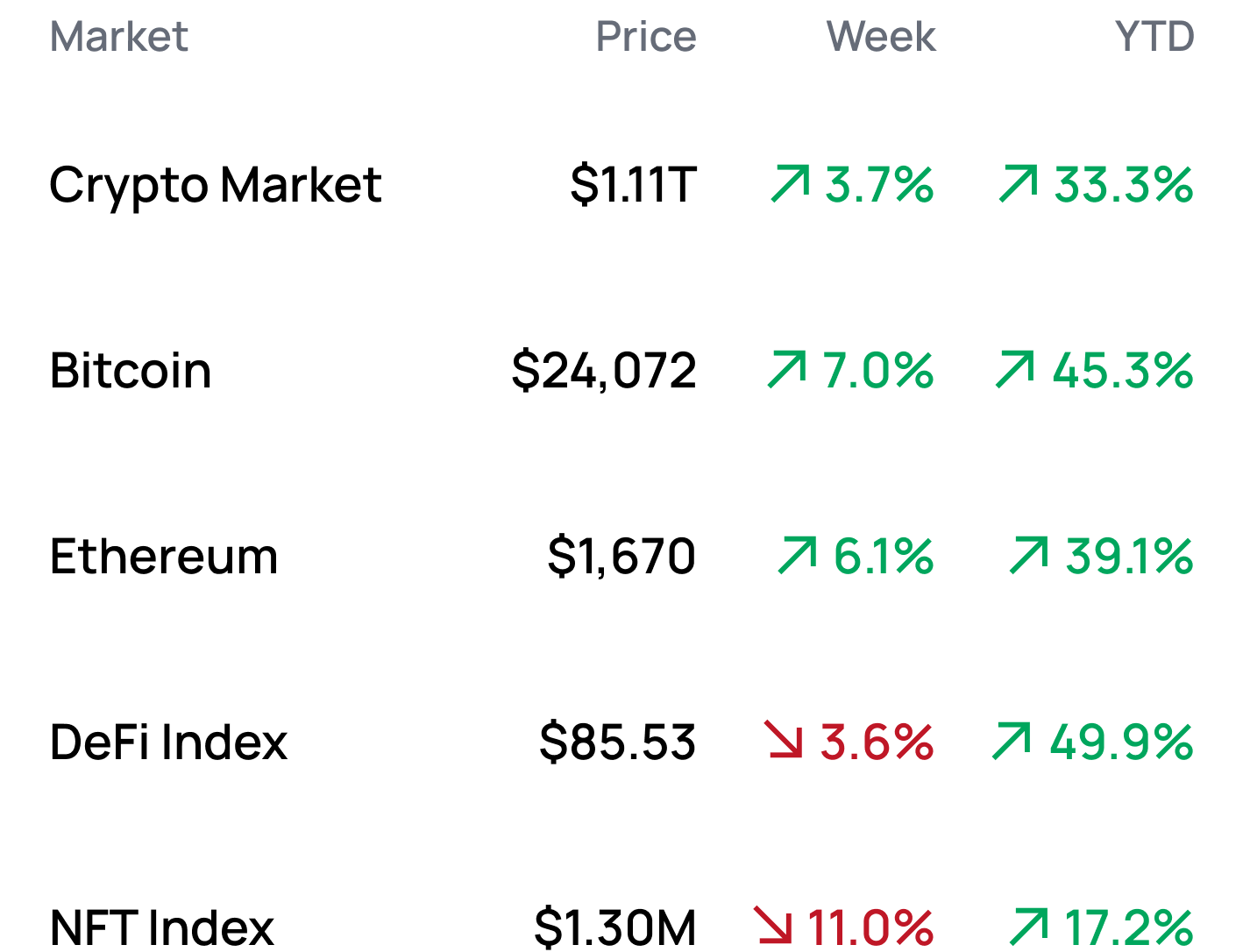

Market Numbers 📊

*Data from 3/13 1:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Try Rhino.fi Today 🦏

Market Opportunities 💰

- Monitor Curve Pool compositions on Parsec Finance

- Assess liquidity for your tokens with DeFi Llama’s Token Liquidity Dashboard

- Analyze DAI collateral backing on DAI Stats

- Monitor stablecoin peg deviations on Dune Analytics

Yield Opportunities 🌾

- USD: Earn 44% staking NOTE-USDT LP tokens in the CLM on Canto

- USD: Earn 27% LPing the sUSD-USDC pool in Velodrome on Optimism

- ETH: Earn 20% LPing the alETH-ETH pool in Velodrome on Optimism

- ETH: Earn 15% staking wstETH-cbETH Balancer Pool Tokens in Aura on Ethereum

- BTC: Earn 3% LPing the sBTC-wBTC pool in Curve on Ethereum

What’s Hot 🔥

- InstaDapp launches its Avocado Wallet

- Forkast Labs creates an NFT Index

- Berachain announces Polaris

- 0x releases its Tx Relay

- Coinbase releases its Wallet-As-A-Service solution

Money reads 📚

- Thread on the Solidity Developer Survey 2022 - @solidity_lang

- Silvergate Capital: Fall From Grace - DeFi Surfer

- 2023 Crypto Thesis - New Order DAO

- Thread on Silicon Valley Bank Collapse - Delphi Digital

- The Future of On-Chain Gaming - Alex Chen

Governance Alpha 🚨

- Maker looks to increase its US Treasury exposure

- Balancer moves to deploy on Gnosis and Avalanche

- Balancer looks to deploy on zkSync

- Aave looks to list wstETH on Polygon

- Frax explores partnering with Metronome

Trending Project: MKR 📈

Analyst: Ben Giove

- Ticker: MKR

- Sector: DeFi - Stablecoins

- Network: Ethereum

- FDV: $930.2M

- Hotness Rating: 🔥🔥🔥

- Maker is a decentralized stablecoin protocol. Maker is the issuer of DAI, a USD-pegged stablecoin which can be minted through various means such as collateralized debt positions, the peg stability module (PSM), and real world asset loans. DAI is the largest decentralized stablecoin and fourth largest overall, with a circulating supply of $6.2B. The protocol is governed by MKR holders, with the token also serving as a backstop for DAI in that it can be minted to cover losses in the event that the protocol becomes undercollateralized.

- Following the collapse of Silicon Valley Bank, DAI de-pegged from March 11 - March 12. This came following fears that Circle, the USDC issuer who disclosed that they had $3.3B at SVB, would experience a run if they were unable to recover their funds.

- During the height of the panic, the price of DAI fell to as low as $0.886, with users fearing the stablecoin could become undercollateralized due to being backed in part by USDC. In the PSM, users can deposit USDC to mint DAI against it at a 1:1 ratio. The balance of USDC in the PSM has soared 46.6% since March 10 from $3.0B to $4.4B, with users looking to use the PSM to exit their USDC. Currently, DAI is 48.9% collateralized by USDC, with 69.5% of the stablecoins outstanding supply being minted from USDC and USDC LPs.

- The price of MKR has also experienced incredible volatility over the past several days. The token fell 24.4% from $793 to as low as $599 from March 10 - March 11, with traders likely fearing that MKR would need to be minted to cover losses were DAI to be undercollateralized. However, MKR has since soared upon the announcement that the government would backstop deposits at SVB and Signature Bank, having rallied 54.3% off the lows to $928.

Hotness Rating (🔥🔥🔥/5): The price of MKR has soared following the announcement that depositors at Silicon Valley Bank will remain whole. While the protocol’s dependence on centralized stablecoins like USDC remains an outstanding, long-term risk, MKR may continue to experience a relief rally assuming fears around the health of the US banking system, and by proxy centralized stablecoins, subside.

Meme of the Week 😂

Went even further back!

— Bankless (@BanklessHQ) March 10, 2023

It's called being a trendsetter 💅 https://t.co/tEwdjhYZhb pic.twitter.com/ik2urd2kgT