Bankless Review: Kwenta

- Want to capitalize on the frothy market conditions by utilizing leverage to increase your potential returns?

- Are you looking to trade a variety of assets without exposing yourself to CEX solvency risk or turning over your KYC documents to a third party with questionable data security practices?

Then Kwenta may be the non-custodial trading solution for you!

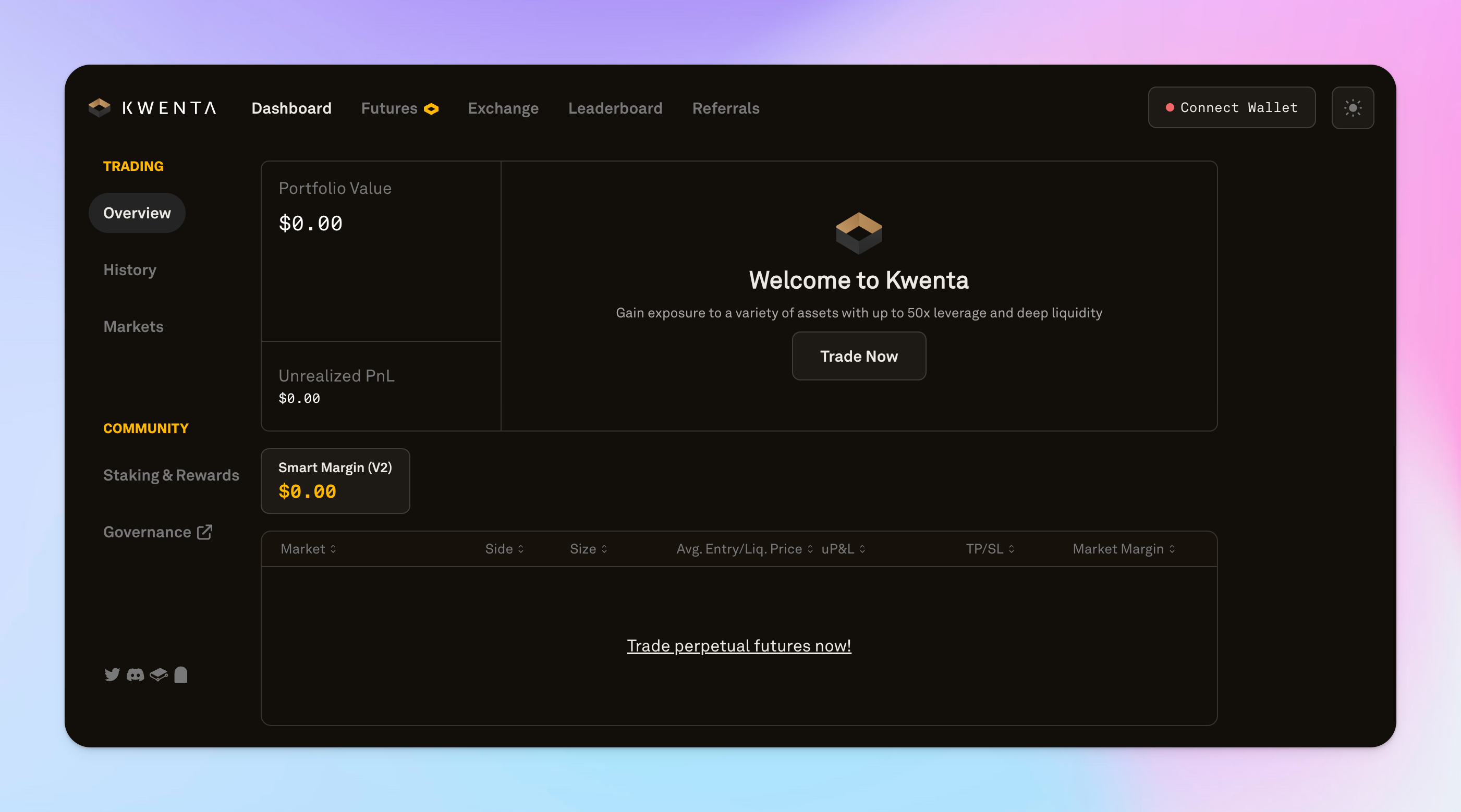

This decentralized perpetuals trading platform on Optimism was built by the Synthetix team to serve as the frontend for their synthetic asset issuance protocol. Kwenta’s “Smart Margin” engine allows traders to use cross margin, allowing excess margin from one trade to satisfy the margin requirement of another and helping to reduce the risk of liquidation.

While there are many decentralized perpetual platforms that offer traders an alternative to unsafe CEX, today, we’re digging into Kwenta to unveil the platform’s pros and cons and provide you with our take on the trading experience. 👇👇👇

🤔 What We Think:

Overall, Kwenta provides a trading experience on par with that of dYdX, the leading decentralized trading platform by volume, but the integration with Synthetix allows the platform to support a wider variety of available trading pairs and provide traders with higher leverage.

While some of Kwenta’s greatest strengths are derived from its integration with Synthetix – the reliance on synths, which are endogenously collateralized by SNX, also creates Kwenta’s most apparent risk vector. Positions could become undercollateralized in an environment where onchain liquidity for SNX is thin, and Synthetix is forced to liquidate positions at a loss.

Unlike exchanges that offer tiered fee structures that decrease with a user’s increasing volume, Kwenta charges a variable keeper fee to liquidate the position and a trading fee of up to 10 bps on all orders. Fees vary by the asset being traded and are higher on market orders (takers) than for limit orders (makers).

To sweeten the deal for users, however, Kwenta kicks back inflationary token rewards to traders and for its referral program. This KWENTA can then be staked by the recipient to have a say in the Protocol’s governance and to earn additional inflationary token incentives.

😁 The Good:

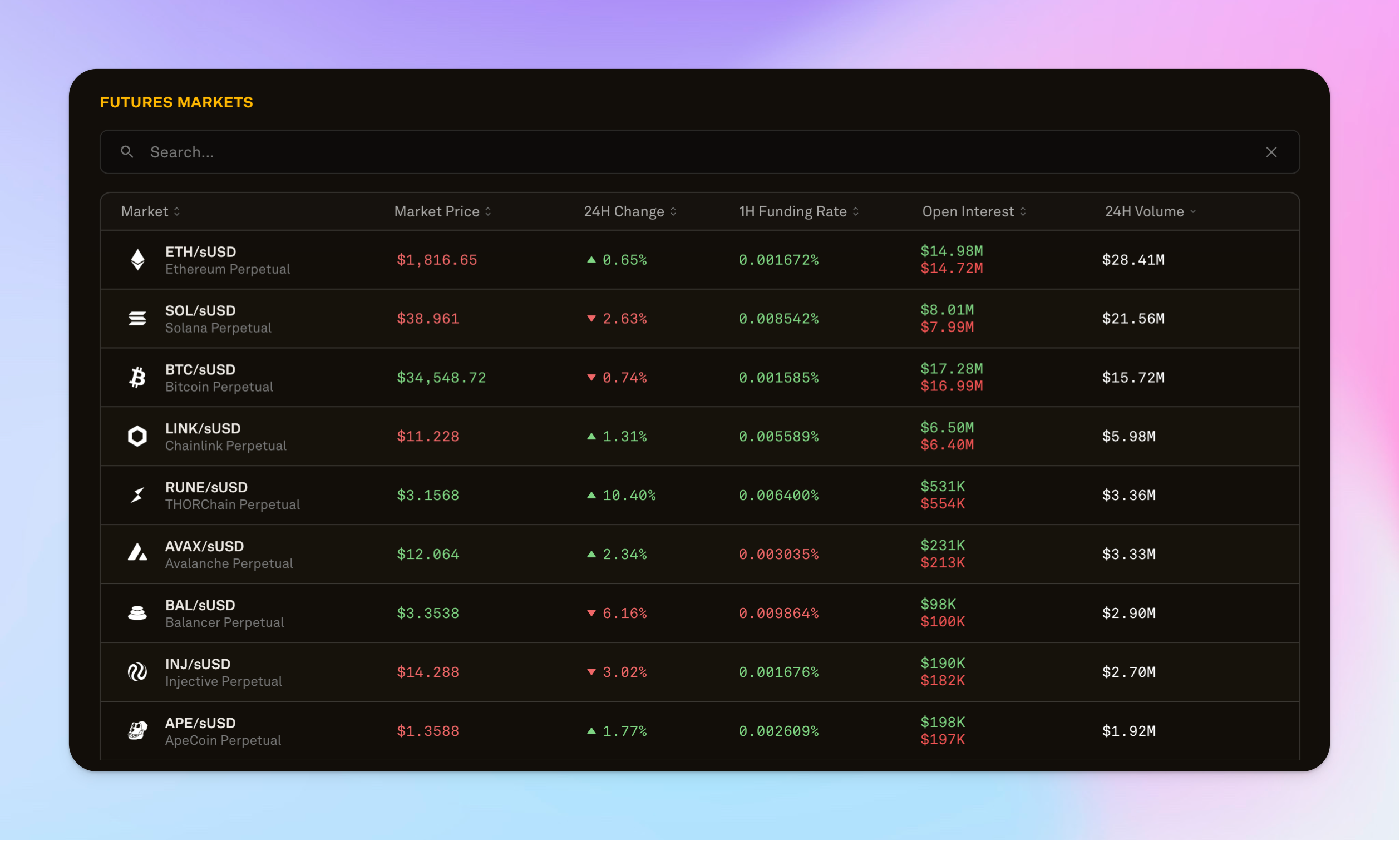

- More Assets: Access to non-EVM assets (like SOL)

- Margin Choices: Support for cross and isolated margin

- Multiple Order Types: Market, limit, and stop market

- High Majors Leverage: Up to 50x on ETH and BTC

- Token Incentives: Trading and Referral Rewards

😥 The Bad:

- High Minimums: Must deposit at least 50 sUSD

- Limited Pairs: Few crypto pair trade options

- Limited Leverage: “Only” 25x for non-major assets

- Endogenous Collateral: Synthetic positions are collateralized by SNX

- Flat Fees: No tiered fee structures, all users the same fees

➡️ Takeaway

Kwenta is a retail-friendly platform built for traders looking to use leverage to express price opinions on a variety of tokens while retaining custody of their assets.

While interacting with Kwenta may be more complicated than using a spot trading platform, the additional challenges come hand-in-hand with the added complexities and variables involved with leverage trading.

Want to get started trading with Kwenta? Follow these steps.

- Visit Kwenta’s website

- Connect your Ethereum Wallet to Kwenta

- Set Up and Fund your Smart Margin Account

- Click “Create Account” and approve the transaction

- Click “Deposit Funds” and navigate to “Bridge”

- Swap or bridge assets into sUSD on Optimism

- Click “Review Quote,” “Confirm Bridge,” and approve the transaction

- Navigate to “Deposit” and select sUSD as the asset you want to deposit

- Input the amount of sUSD you wish to deposit and confirm the transaction

- Trade Perpetuals on Kwenta

- Click on the “ETH/sUSD” ticker in the upper left hand corner of the screen

- Search for an asset pair you want to trade

- Choose whether you want to go long or short

- Select your order type

- Tip: Select a “Market” order to enter a position at the current market price

- Enter the amount of sUSD you want to use for this trade under “Margin”

- Choose how much leverage that you want to use

- Optionally, set stop loss or take profit targets

- Click “Open Position” and confirm the transaction