The first impetus that brings many degens onchain is a desire to speculate on tokens with leverage. Where better to begin your Solana exploration than with a protocol where you can put your speculation skills to the test and position yourself for a future airdrop?

While gains are never assured, traders likely rest easier transacting on Drift, Solana’s leading exchange, knowing that a partial rebate for losses or extra sweetener for profits in the form of an airdrop is likely on the way.

Multiple exchange and derivative platforms exist on Solana, but today, I'm digging into Drift’s product offerings and providing you with my take on the experience.

Here's what I think 👇

😁 The Good:

- Multiple Ways to Earn: Deposit collateral, provide liquidity, or stake to the insurance fund

- Always Earning: Trade using lending deposits as collateral

- Airdrop Candidate: Early users may qualify for an airdrop

- Referral Program: Earn 15% trading fees from referrals

😥 The Bad:

- Limited Leverage: Relatively low trading leverage on majors and even less on alts

- Not For Novices: Multi-collateral model presents extra complexity for beginners

- Poor Capital Efficiency: Long-tail assets (including SOL LSTs) have low asset weights

➡️ Takeaways:

Drift does not offer the most leverage on Solana – Jupiter offers 100x leverage on SOL, BTC, and ETH – but does give traders access to the widest array of assets of any exchange on Solana.

As a Solana-native exchange, Drift caters to its chain by providing perps pairs for popular ecosystem assets including BONK, JTO, and RNDR. Perpetuals exchanges only need an oracle price to list an asset, meaning Drift can also offer assets not native to Solana, including the Majors (ETH and BTC) alongside long-tail assets like INJ, SEI, and PEPE!

Drift’s native cross-margin capabilities provide traders with a unique experience, allowing them to fund trades using any combination of allowlisted assets as collateral (albeit at different risk weights depending on the asset supplied) while simultaneously allowing them to earn interest on deposits!

While cross-margin capabilities offer advanced traders greater flexibility in how they collateralize their trades, added customizability creates a greater number of variables, which could potentially make onboarding to Drift feel overwhelming to newer traders.

Despite the decreased risk weight for long-tail assets limiting the amount of leverage you can take out against them, and thus decreasing the capital efficiency of these assets, the ability to use long-tail assets as collateral is a novel feature not found on many decentralized exchanges, which often exclusively pair their assets with USD stablecoins.

Separation in responsibilities between insurance and liquidity providers is another desirable feature of Drift and creates two distinct avenues for users to passively earn yield.

While easily the top overall exchange on Solana, Drift lags behind more developed platforms on other chains, like dYdX and Kwenta, in terms of leverage and assets available. Thankfully, the Protocol makes up for its flaws with its native cross-margining capabilities and the greater degree of flexibility it offers to traders over more traditional USD collateralized only decentralized exchanges.

My Rating: 4/5

💸 Deposit Funds into Drift:

- Visit Drift’s lend and borrow page

- Connect your Solana wallet to Drift

- Deposit your assets to Drift

> Select the asset you wish to deposit

>> Note: A higher "Initial Asset Weight" means you can trade and borrow with more leverage on your collateral

> Input the amount of tokens you wish to deposit

> Click “Confirm Deposit” and approve the transaction

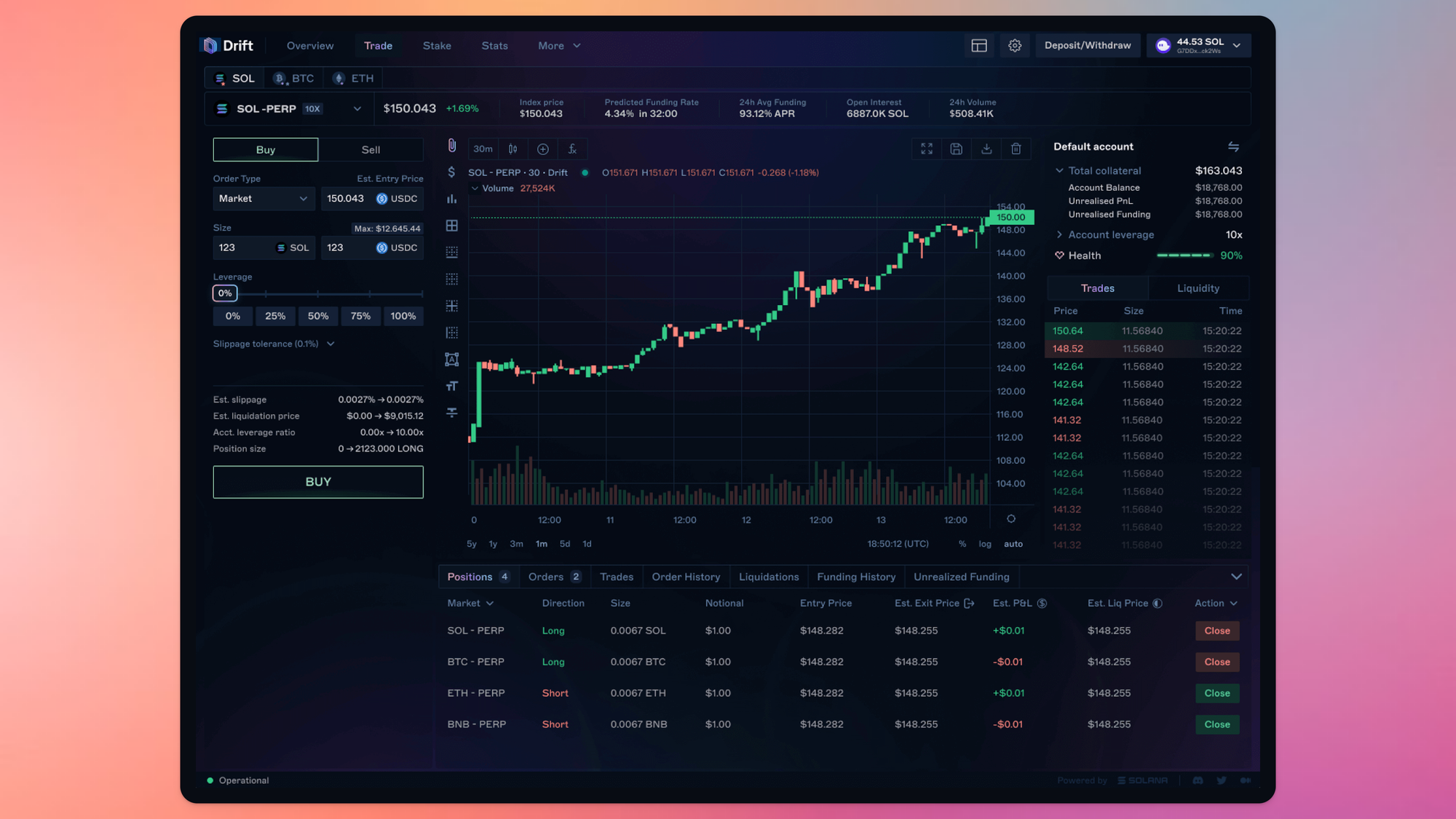

👏 Trade Perpetuals on Drift:

- Visit Drift’s perpetuals trading page

- Connect your Solana wallet to Drift

- Select the market you want to trade

> Click "SOL-PERP" in the upper left corner

> Scroll until you find the market you want to trade - Place your trade

> Select whether you want to go long or short

> Select your order type

>> Note: Use a market order to get filled immediately

> Select how much you want to lever your account

> Click “Long” or “Short” and complete the transaction

💧 Provide Liquidity on Drift

- Visit Drift’s liquidity provider page

- Connect your Solana wallet to Drift

- Add liquidity to your pool of choice

> Select the asset you want to deposit

> Input the amount of liquidity you want to deposit

> Choose the account you want to provide liquidity from

> Set the amount of leverage you wish to use

> Click "Add Liquidity" and confirm the transaction

🥩 Stake to Secure Drift’s Insurance Fund

- Visit Drift’s insurance fund staking page

- Connect your Solana wallet to Drift

- Add funds to insure the vault of your choice

> Select the vault you want to provide liquidity for by clicking “Stake”

> Input the amount of funds you want to stake

> Click “Confirm Stake” and confirm the transaction