Yearn is a decentralized finance (DeFi) protocol that functions as a yield aggregator, offering investors a way to maximize returns on their crypto assets.

Key takeaways

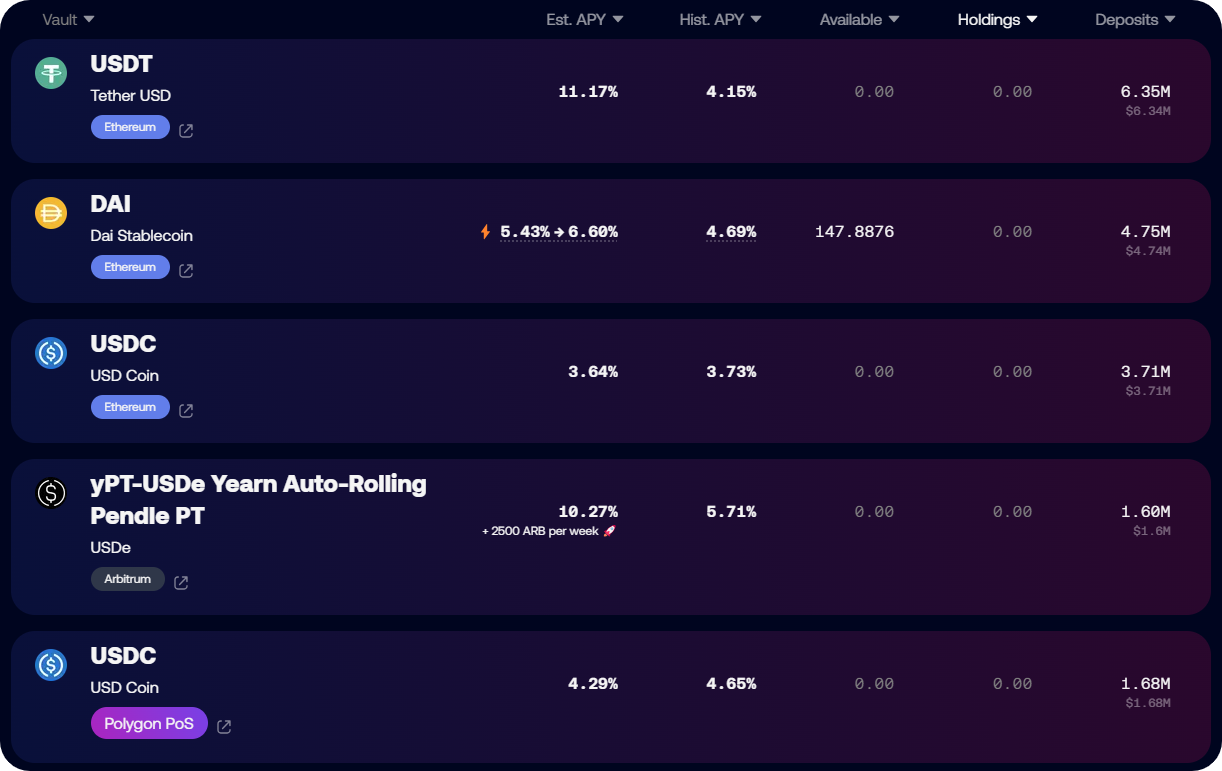

- Yearn simplifies the process of earning returns on crypto assets through its flagship product, yVaults. Users can deposit various cryptocurrencies into these vaults to earn passive returns.

- As of September 2024, Yearn managed over $213 million in total value locked (TVL) across its vaults.

- Notably, the protocol is governed by YFI token holders through decentralized voting.

What is Yearn?

Yearn’s main offering is its yVaults series, which are smart contracts that automatically move investors' funds between different DeFi protocols to find the best yield opportunities available.

For users, Yearn simplifies the complex world of DeFi yield farming. Instead of manually researching and executing strategies across multiple platforms, you can deposit your assets into a yVault and let Yearn's algorithms handle the rest. This makes it possible for both novice and experienced users to potentially earn higher yields on their crypto assets with minimal effort.

Additionally, unlike in traditional finance, all of Yearn's yield farming takes place non-custodially on public blockchains, meaning you are in control of your assets and can see where they are at all times.

Why Yearn Finance?

Compared to manual yield farming or traditional investment platforms, Yearn offers several advantages:

- Automation — Yearn handles complex yield farming strategies automatically, saving time and effort.

- Accessibility — Users can access sophisticated DeFi strategies without deep technical knowledge.

- Gas Efficiency — By pooling funds, Yearn can execute strategies more efficiently, reducing individual transaction costs.

- Continuous Optimization — Strategies are regularly updated to adapt to changing market conditions.

How to use Yearn?

Making a yVault deposit

- Connect your wallet using the button at the top right corner of the Yearn website.

- Select the vault that you would like to deposit into.

- Enter the amount of tokens you want to deposit into the vault.

- Click the “Approve” button and complete the approval transaction with your wallet.

- Next, confirm your deposit transaction, afterwards you will see your deposited balance in the vault's interface, which should appear at the top of the vault list.

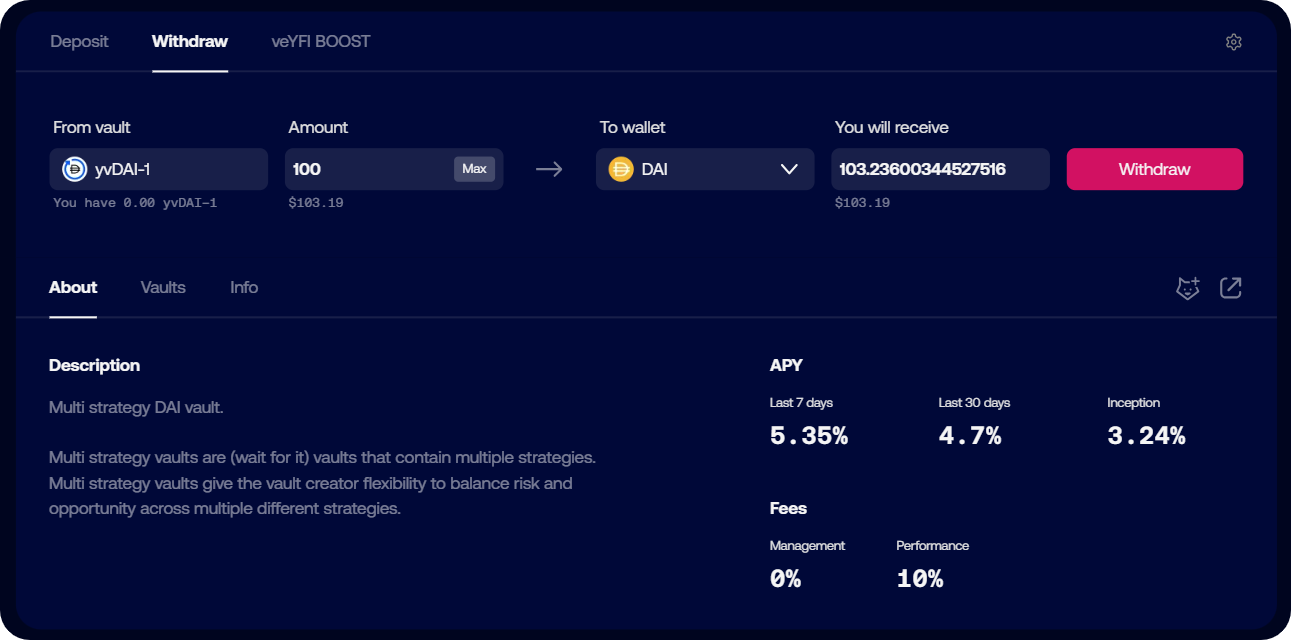

Withdrawing from a yVault

- Select the vault that you would like to withdraw from. Click the "Withdraw" tab.

- Enter the amount you want to withdraw, or click “Max” to withdraw the entire balance.

- Click “Withdraw.”

- Your wallet will ask you to confirm the transaction.

- When your transaction succeeds, your tokens will appear in your wallet again.

How to invest in Yearn?

The YFI token is central to participating in the Yearn ecosystem, with veYFI playing a crucial role in governance and rewards:

- veYFI Locking — Users can lock their YFI tokens for up to 4 years to receive veYFI. The longer the lock period, the more veYFI received, with a 1:1 ratio for a 4-year lock.

- Governance — veYFI holders can vote on YFI emissions distributions and other governance proposals through Snapshot.

- Yield Boosts — veYFI holders receive increased yields (up to 10x) when depositing and staking in certain "boosted" Yearn vaults. These boosted rewards are paid in dYFI.

- Protocol Incentives — veYFI holders earn a share of early exit penalties and unused boost rewards.

- Liquid Locker Options — For those who prefer not to manage locks directly, third-party liquid lockers like 1up, Cove, and StakeDAO offer alternatives that provide transferrable tokens while still accessing veYFI benefits.

- dYFI Redemption — Boost rewards paid in dYFI can be redeemed for YFI through Yearn's dApp or third-party services, with a variable ETH cost.

It's important to note that veYFI positions decay linearly over time, requiring re-locking to maintain benefits. Additionally, early exits from veYFI locks incur penalties. As of September 2024, YFI is trading at approximately $4,820 per token, with a market capitalization of around $161 million.