Solana, launched in 2020, is designed to offer much higher “base layer” transaction throughput capabilities compared to other popular Layer 1 (L1) blockchains like Ethereum and Bitcoin.

The network's ability to facilitate near-instant transactions at extremely low costs and with significant energy efficiency has made Solana an attractive platform for developers and users alike, driving its major resurgence since 2023.

Key takeaways

- Solana currently processes around 3,000 transactions per second (TPS) and can theoretically support up to 65,000 TPS.

- Solana has seen over 29.7 million fee-paying accounts to date. The network's median fee per transaction is $0.00064, with block times of around 400 milliseconds.

- Solana's ecosystem includes a thriving DeFi sector with $4.5 billion in total value locked (TVL), memcoins worth a combined market cap of $6 billion, and a prominent NFT scene with over 340 million NFTs minted so far.

What is Solana?

Solana is a high-performance L1 blockchain that uses Proof-of-History (PoH), a variant of Proof-of-Stake (PoS), to optimize transaction processing.

PoH assigns a timestamp to each transaction, allowing the network to process transactions as they arrive rather than organizing them into blocks. This method, combined with the Tower Byzantine Fault Tolerance (BFT) algorithm, ensures a secure, efficient, and speedy transaction process.

Additionally, Solana employs the Solana Virtual Machine (SVM) to execute "programs" written in the Rust programming language and compiled to WebAssembly (WASM). This architecture enables Solana to achieve high performance and parallel processing capabilities, distinguishing it from Ethereum's use of the Ethereum Virtual Machine (EVM).

What are Solana's latest developments?

New Node Clients

Solana is evolving with new node clients to enhance scalability, efficiency, and robustness. Two notable examples include:

- 🔥 Firedancer: Developed by Jump Crypto, this validator client uses modular architecture, advanced networking, and hardware acceleration to improve performance.

- ✨ Mithril: Developed by Overclock, this full-node client written in Golang aims to lower hardware requirements and improve accessibility for running Solana nodes.

Solana Blinks

The recently introduced Solana Blinks, powered by Solana Actions, allow builders to integrate crypto transactions directly into any website. Blinks are shareable, metadata-rich links that enable users to initiate onchain actions like buying NFTs, swapping tokens, or sending payments with a single click, all without leaving the app they were already using.

ZK Compression

Helius and Light Protocol have introduced a Solana primitive called ZK Compression to address state bloat and enhance scalability. This technology groups multiple accounts into a single, verifiable summary called a Merkle root, reducing storage costs while maintaining data security and integrity.

Solana L2s and Rollups

To experiment, the Solana community is exploring Layer 2 (L2) solutions and rollups. These advancements aim to modularize the Solana Virtual Machine (SVM) and improve scalability. Key developments include:

- 🌱 Grass – a browser-based DePIN project using ZK proofs for data verification

- 🏦 Iron Bank – developing an institutional onchain bank using the SVM

- 🪄 MagicBlock – introducing Ephemeral Rollups for scalable onchain games

- 🎮 Sonic – building a modular SVM chain for games

- 🪙 Zeta Markets – launching a DeFi rollup to improve user experience and transaction speeds

Why Solana?

One of Solana's standout features is its focus on atomic composability. This allows multiple smart contracts and operations to be executed together as a single, indivisible transaction on a single chain.

In contrast, in being spread out, Ethereum's early L2 scene has faced challenges related to interoperability and fragmentation, making it difficult for smart contracts and applications to interact seamlessly across different networks.

In focusing predominantly on its base layer, Solana bypasses these issues with its atomic composability, allowing for smooth and efficient interactions between smart contracts within its ecosystem. This ensures a more cohesive and unified user experience without the complications of bridging assets.

How to invest in Solana?

SOL is Solana's native token that is used for various purposes within the network’s ecosystem, such as paying for transaction fees, participating in Solana staking, and as a medium of exchange for memecoins and NFTs.

At the time of this guide's latest update, SOL was trading around $136 per token with a market capitalization of $63 billion, making it the 5th-largest coin in the cryptoeconomy currently.

SOL can be purchased or sold on various cryptocurrency exchanges, including large centralized exchanges like Coinbase or Kraken as well as decentralized exchanges like Raydium.

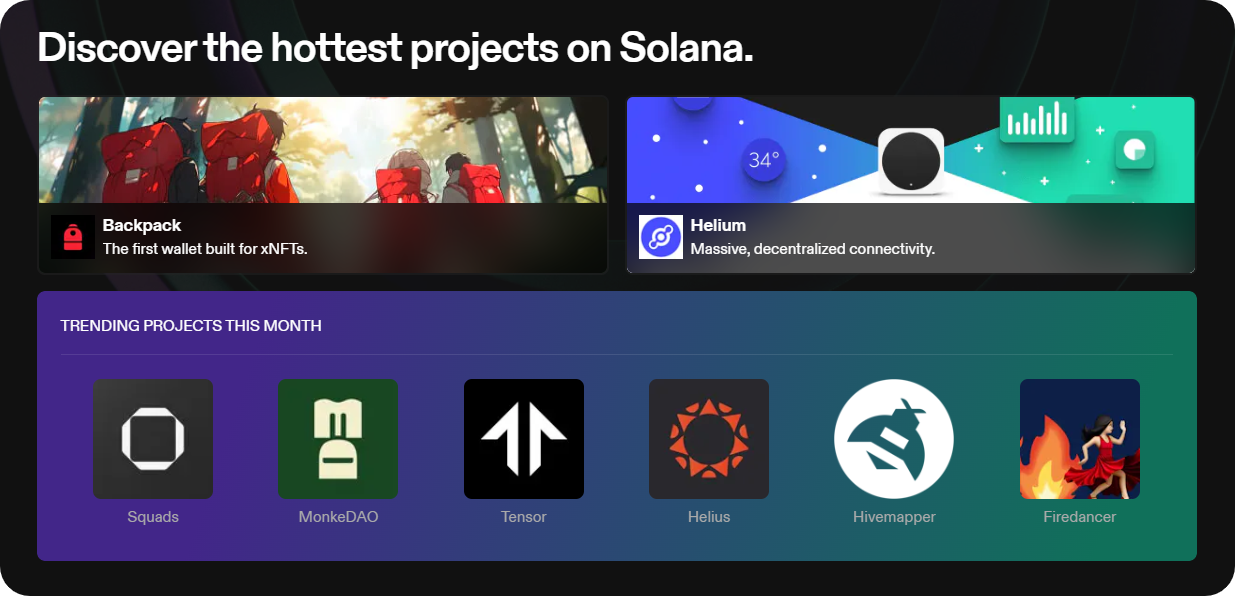

Top Solana projects

The Solana app ecosystem features hundreds of different projects today. Some of the top experiences to explore here include:

- 💎 DRiP – a digital collectibles subscriptions platform

- 🪙 Jito – Solana's most popular liquid staking protocol

- 🪐 Jupiter – the leading Solana decentralized exchange aggregator

- 🎴 Metaplex – a DIY NFT minting and storefront platform

- 🛒 Magic Eden – a multichain NFT marketplace with premier Solana support

- 👻 Phantom – the most popular Solana wallet

- 🎉 Pump.fun – a leading memecoin launchpad platform

- 🌐 Squads – a popular Solana multisig deployer

- 😶🌫️ Sanctum – a liquid staking tokens platform

- 🚀 Star Atlas – a first-person space shooter game on Solana