Back to Blast? ($)

View in Browser

Sponsor: Uniswap Labs — Uniswap Labs launched a $15.5 million bug bounty to help secure V4.

- 📈 Bitcoin Surges as Fed Maintains Interest Rates. The Fed delivers on analyst expectations despite Trump calling for further cuts.

- 🐙 Kraken Relaunches Staking in the U.S. The exchange's new staking offering goes the non-custodial route.

- 🗳️ Danny Ryan Garners Community Support in Bid to Lead Ethereum Foundation. The long-time researcher earned support in an informal onchain vote from wallets holding over 50K ETH.

| Prices as of 7pm ET | 24hr | 7d |

|

Crypto $3.57T | ↗ 2.1% | ↗ 0.6% |

|

BTC $104,461 | ↗ 0.9% | ↗ 0.6% |

|

ETH $3,239 | ↗ 4.4% | ↘ 2.7% |

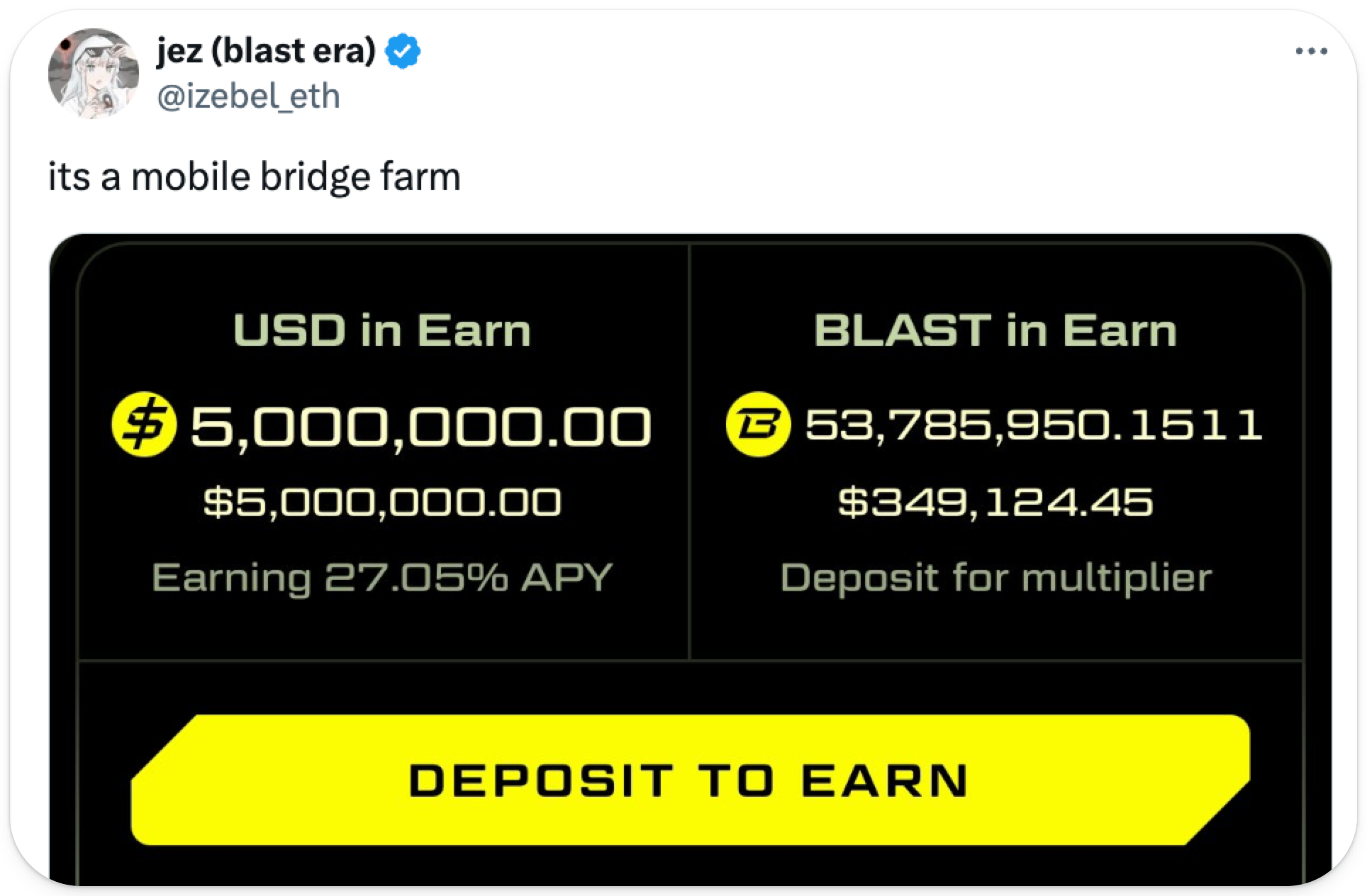

Crypto Twitter has been buzzing with critiques over Ethereum L2 Blast’s lackluster mobile app launch, but with an advertised 79% APY on USD, the tool is serving up some of the juiciest stablecoin yields available!

Today, we’re unpacking Blast Mobile to better understand the risk and reward profile of this brand-new onchain yield opportunity! 👇

💥 Blast Mobile Basics

Blast is an Ethereum L2 built around the concept of “onchain rewards,” a unique focal point that its developers hoped would be a competitive edge to outpace rivals.

Despite lofty pre-launch ambitions for this project, Blast has done little besides disappoint since June, when the launch of its BLAST token at a dismal valuation shattered airdrop farmer ambitions and caused its points program to fall out of favor with depositors.

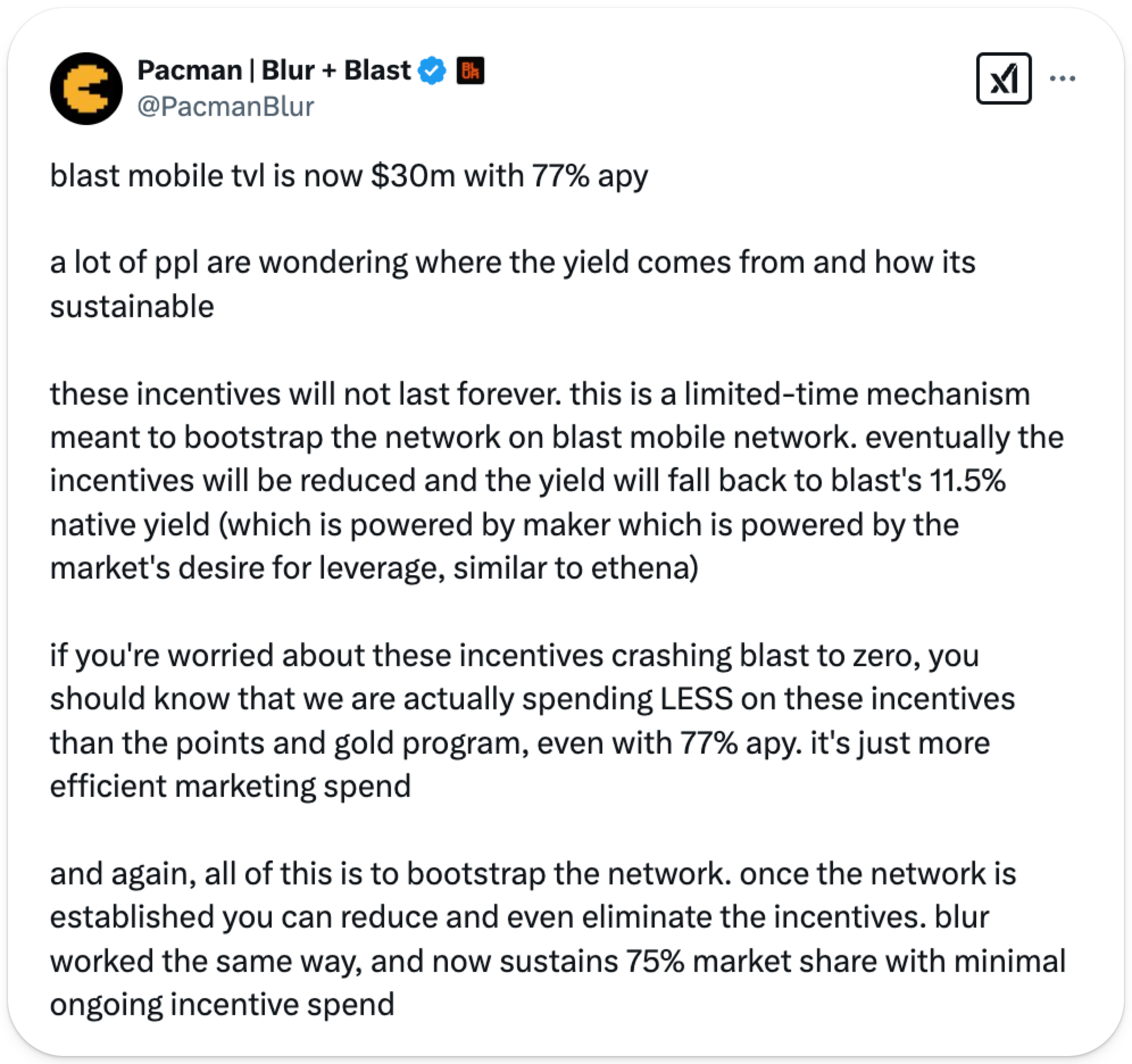

Although Blast has provided automatic yield to ETH and USDB holders since its inception, the network has struggled to combat its declining token prices and tumbling user metrics. In an effort to reverse this trend, Blast’s long-awaited mobile app (launched on January 23) introduced revamped tokenomics and replaced the faltering points program with liquid BLAST token rewards.

As its moniker suggests, the “Blast Mobile App” can be accessed through iOS and Android mobile devices. Once Blast Mobile has been installed, users are prompted to create an account that is secured via “passkey,” a user-friendly wallet seedphrase format that is stored within the physical device and can be backed up to the “cloud,” making user login credentials twice-secured and extremely difficult to lose.

⚠️ It is worth noting that storing your seed phrase within a mobile device or cloud storage could result in the total loss of funds if a malicious actor compromises your device/account.

The rudimentary Blast Mobile interface is equipped with only four functions, and while it cannot be used to access third-party crypto protocols at this time (devs promise additional connectivity with Blast apps that should be easy to enable in the near future!), Blast Mobile’s “Earn” tab is the only button you’ll need to access lofty double-digit returns on stablecoins!

All USD stablecoins sent to Blast Mobile are converted into USDB – a Blast-native representation of MakerDAO’s staked DAI product – meaning that all depositors earn Blast-standard stablecoin yields (amounting to ~13% at the time of this analysis).

To boost their rewards rate, Blast Mobile users can optionally deposit BLAST tokens and receive up to a 6x yield multiplier. Achieving the maximum multiplier requires users to deposit at least 30% of their USDB balance in the Earn App worth of BLAST. This strategy returned ~78% annualized at the time of this analysis.

Every 6 hours, Blast Mobile Earn distributes liquid BLAST rewards to USDB depositors; USDB deposits and accrued BLAST rewards can be withdrawn at any time.

While allowing BLAST to accumulate will help increase the rewards rate for USDB depositors below the maximum boost threshold, their returns become stored in BLAST tokens, and therefore dependent on fluctuations in token price. There are no specifics on how long the Blast Mobile Earn incentives program will last, but lead Blast developer Pacman has disclaimed that they will not last forever.

🧐 Risks

Blast Mobile’s Earn program dangles market-leading yields in front of depositors but requires them to hold BLAST, a token which has fallen in price by over 80% since it was airdropped just 6 months ago. Although this design may work for the few BLAST bulls out there, it comes with an unknown length and imposes directional price risks that could seriously complicate depositor dollar-denominated returns if BLAST can't hold it together.

Market Plays:

- 🔄 Trading through Slingshot on Abstract

- 🪙 Borrowing $BOLD via Liquity V2 on Ethereum

- ✨ Minting Abstract XP achievement badges

- 🤖 Claiming and staking Venice $VVV tokens

- 🚀 Checking out the new Jupiter Spot V2 platform

Hot Reads:

- 📱 How Farcaster Trades - rch

- 🚅 Ethereum Acceleration - Paradigm Research

- 🤝 Rough Consensus: Post-Pectra - nixo.eth

- 🦄 How Flaunch Is Revolutionizing Liquidity - Uniswap Foundation

- 🔮 Scaling Ethereum L1s and L2s in 2025 and Beyond - Vitalik

Farming Opps:

- 🟠 BTC: 37% APR with Aerodrome’s tBTC-cbBTC pool on Base

- 🟠 BTC: 16% APY with Pendle’s liquidBeraBTC PT on Ethereum

- 🔵 ETH: 49% APR with Aerodrome’s weETH-WETH pool on Base

- 🔵 ETH: 25% APY with Pendle’s USR PT on Base

- 🟢 USD: 27% APR with Convex’s crvUSD-sUSDe pool on Ethereum

- 🟢 USD: 8% APY with Aave’s USDC pool on Base

Airdrop Hunter:

- 🌊 OpenSea: Interact with OpenSea V2

- 🤖 Venice: Claim VVV airdrop

- 🟢 Abstract: Bridge to Abstract

Uniswap Labs is offering the largest bug bounty ever: $15.5M for critical bugs in Uniswap v4! Built with community contributions and rigorously audited, v4 will be one of the most audited codebases ever to be deployed onchain, and continues Uniswap’s commitment to security.

Catalyst Overview

On August 28, the Bankless Analyst Team issued a bearish rating for BLUR, concerned that future SEC actions against NFT exchanges and issuers would negatively impact the sector, which was already seeing a decline in prices and volume.

OpenSea recently launched its points program, which looks almost identical to Blur’s. This is going to negatively impact Blur as many users transitioned away from OpenSea to farm Blur’s points program. Now, with OpenSea launching its own points program, users have a strong likelihood of transitioning back to OpenSea in order to farm its new points program.

In November, SplitCapital proposed a Blur fee switch and veBLUR tokenomics. Unfortunately, the proposal failed to gain traction and appears to have missed the boat, with fees collected by the Blur platform having plummeted by 40% over the past 30 days.

Price Impact

The Bankless Analyst Team is reaffirming its bearish rating for BLUR, citing OpenSea launching its own points program and the decreasing amount of fees collected from Blur.

See 45+ other active token ratings in the Citizen-only Token Hub 🔥