Dear Bankless Nation,

Happy Labor Day! You don't need to work hard to get access to top notch cryptographic security. Today, we're showing you how to get onboarded to the Avocado Multisig from Instadapp.

- Bankless team

Setting Up an Avocado Multisig

Bankless Writer: William M. Peaster | disclosures

Instadapp is a team that specializes in creating infra that simplifies the complexities of DeFi. The project was initially best known for its Instadapp Pro and Instadapp Lite platforms.

Yet earlier this year the team made waves again in introducing Avocado, a next-gen smart contract wallet designed to streamline UX for people who want to use multiple blockchains from a single user environment.

In other words, with Avocado you can perform multi-network transactions without the hassle of switching between different chains, and thanks to account abstraction all gas payments are denominated in USDC rather than ETH.

Pretty awesome, right?

Well, what’s even better is Instadapp just introduced Avocado Multisig, a bespoke multisignature wallet service. Think Safe, but built directly atop the Avocado smart wallet system so it can leverage all the streamlined multichain capabilities.

What’s interesting about Avocado Multisig is you don’t have to personally generate an account because as soon as you create an Avocado Wallet you now have a Multisig address automatically created for you!

Additionally, instead of having to make multiple treasury deployments on different chains, the Avocado Multisig system automatically consolidates to a single address across all the supported networks.

Notably, this system also lets you make network-specific configurations — e.g. a 2/3 signing threshold on Ethereum, a 4/5 threshold on Arbitrum, etc. — and it employs a “USDC gas tank” for use across all chains, which is slick.

So let’s say you want to try this next-gen smart DeFi system, where to begin?

If you haven’t already created an Avocado Wallet, follow the steps outlined in my tactic write-up from earlier this year. It’s straightforward and the steps remain the same, and then once you’re finished your Multisig Account will be ready to configure.

- As for setting up the parameters of your Multisig, click on your account name in the upper right side of the Avocado web app and then click on your automatically generated Multisig address.

- Then press “Signers” on the left hand side of your Avocado dashboard, at which point you’ll be taken to your multisig signers management panel.

- Here, you’ll have two avenues to proceed: “Add New Signers” for manual configuration, or the “Setup Now” option to clone your Safe treasury over to Avocado.

- If you choose the manual route, one by one you can add new signers to your account by inputting a signer name, signer address, and the networks where the signer will be added. Then you’d choose your desired signing threshold(s) and confirm with your wallet to make the additions official.

- As for the Safe cloning option, here you’d begin by copying in your Safe’s address and the network it’s deployed on. This will automatically pick up the relevant signers, so after this just pick the networks you want to add the signers to and make the necessary wallet signatures to complete the migration.

That’s it! That’s all it takes to get onboard into the Avocado Multisig system.

I’m a longtime Safe user and fan myself, so having the ability to readily hop my setup over to Avocado’s system and tap into its multichain capabilities is really compelling. This is the sort of composability and openness that’s a net win for everyone in our space.

Of course, if you’ve never used a multsig you may be wondering if this sort of solution is right for you. To that I say... a multisig is right for anyone in crypto because it’s a fantastic way to create a digital vault to protect your assets! The cool thing about Avocado Multisig, then, is that you can protect your assets in style with a flexible system that’s custom-tailored for streamlined multichain DeFi!

Kraken, the secure, transparent, reliable digital asset platform, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. For the advanced traders, look no further then Kraken Pro, a highly customizable, all in one trading experience and our most powerful tool yet.

MARKET MONDAY:

Scan this section and dig into anything interesting

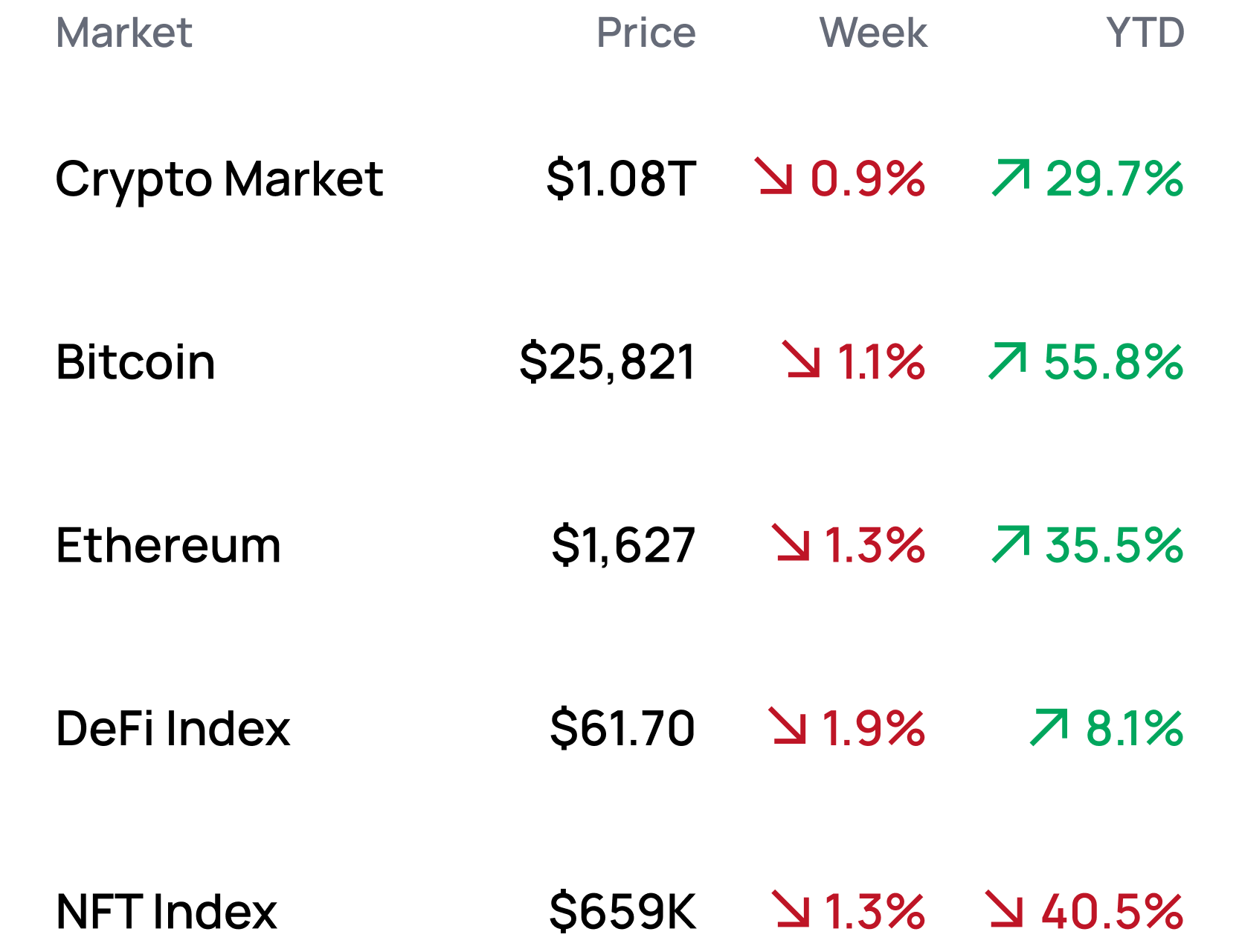

*Data from 9/4 4:30 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Prepare for the return of Euler

- Mint a LayerZero commemorative NFT on Holograph

- Explore Aerodrome, Velodrome’s official fork on Base

- Secure your crypto holdings with Avacado’s multisig

- Listen to a16z’s summer 2023 research seminars

Yield Opportunities 🌾

- ETH: Earn up to 19.0% APR with Umami’s WETH vault on Arbitrum

- ETH: Earn up to 16.2% APR with Aerodrome’s cbETH/WETH pool on Base

- USD: Earn up to 37.1% APR with Aura’s DOLA/USDC pool on Arbitrum

- USD: Earn up to 12.1% APR with Hop’s USDC pool on Base

- USD: Earn up to 19.4% APR with Umami’s USDC vault on Arbitrum

What’s Hot 🔥

- SEC delays spot BTC ETF decision for all applicants

- Offchain Labs releases code, public testnet for Arbitrum Stylus

- Grayscale defeats SEC, door opens for a spot BTC ETF

- Bloomberg analysts give 95% chance of approval for spot BTC ETF

- Court sides with Uniswap in class action lawsuit

- DCG reaches in-principle deal with Genesis creditors

- SEC files sealed motion against Binance

- Seed Club SC06 Demo Day is 9/28

- Polygon announces rollup stack for zkEVM

- X receives licenses in multiple states to process payments

- Argent and Starknet team up to form new venture studio

- Gravita unveils roadmap to redemptions

- Aerodrome becomes top protocol on Base

Money reads 📚

- Blobspace 101 - domothy

- What are funding rates? - CryptoCred

- Update on LastPass-related wallet hack - Tay

- Grayscale’s Victory is Massive - Jake Chervinsky

- 10 Things I’m Excited About in Crypto - Brian Armstrong

- What Does Dencun Mean for LST Protocols - Liquid Collective

Governance Alpha 🚨

- Arbitrum DAO votes against allocating additional tokens towards Camelot

- Rocket Pool community proposes adding rETH as collateral to Compound

- Polygon Labs seeks to address governance as part of Polygon 2.0 rollout

- MakerDAO votes to halt lending to Harbor Trade after $2.1M default

- The Future of Optimistic Governance

Token Hub: Euler (EUL)

Analyst: Jack Inabinet

We are initiating coverage of Euler with a rating of neutral

Catalyst Overview:

Euler tragically suffered a $200M hack in March of 2023 and while the Protocol was able to successfully negotiate for the return of all “recoverable funds,” it decided to return funds back to users and wind up V1 operations. On August 29, Euler posted an announcement on Twitter inviting followers to join Euler in crafting its comeback story; now may be an opportune time to invest!

The Euler team has promised that their modular V2 approach will be transformational for DeFi by taking a modular approach that abstracts away many properties of today’s lending protocols to empower developers, market creators, and end users to express themselves more. On top of Euler V2, the team intends to build a synthetic asset protocol and decentralized exchange.

Price Impact:

Despite rallying an impressive 130% since late June, EUL still trades at a considerable 60% discount to its pre-hack price levels, indicating that there is much further room for price to run. Unfortunately, crypto capital has trended increasingly mercenary and release is still “months away” according to Discord messages.

With Euler V2 on the horizon and substantial improvements promised by the team, it's time to start accumulating. Just don’t be surprised if the journey is not up-only…

See more ratings in the Token Hub.

Meme of the Week 😂