Automating Onchain Portfolios with Glider

Onchain investing offers us the benefits of programmability, self-custody, and transparency. These pillars are empowering, of course, but on the flip side, manually managing many assets by yourself can be hard.

Enter Glider, a new DeFi automation platform that recently opened to everyone on Base and caught my attention.

Streamlined onchain portfolios

Glider makes it easy to create and invest in automated onchain indexes.

These indexes can be simple, like a basic 50/50 BTC and ETH portfolio that rebalances every hour, or they can be extensively customized across a range of assets, including onchain stocks and real world assets (RWAs).

At the heart of this system is Glider's "blocks." These blocks are the money legos that define the logic of every Glider portfolio. Namely:

- The asset block lets you add tokens from any chain.

- The weight block lets you size your token allocations.

- The filter block lets you screen tokens based on price, volume, etc.

- The If/Else block lets you set conditions, e.g. sell ETH if it hits $10k or buy BTC if it crosses over its Simple Moving Average.

These are the main blocks, but there are others.

For instance, the DexScreener block lets you set up a dynamic collection of tokens where you don't pick the assets, just the rules, and then your filters and DexScreener market data determines your inclusions on an ongoing basis.

Pretty nifty. And besides the vast customization potential here, Glider also sponsors all gas and DEX aggregator fees. The platform does charge a small volume fee, but these proceeds go to subsidizing users' gas costs.

Getting started

Glider hasn't announced plans for a native token, but the platform is currently running a points program where every $1 deposited earns 1 point per day. These points will be "used to reward [...] active users," so it's definitely an interesting time to dabble here.

Fortunately, it's also very simple to dive in – get started by:

- Heading to glider.fi and connecting your preferred wallet. Signing in will bring you to a 3-step onboarding flow.

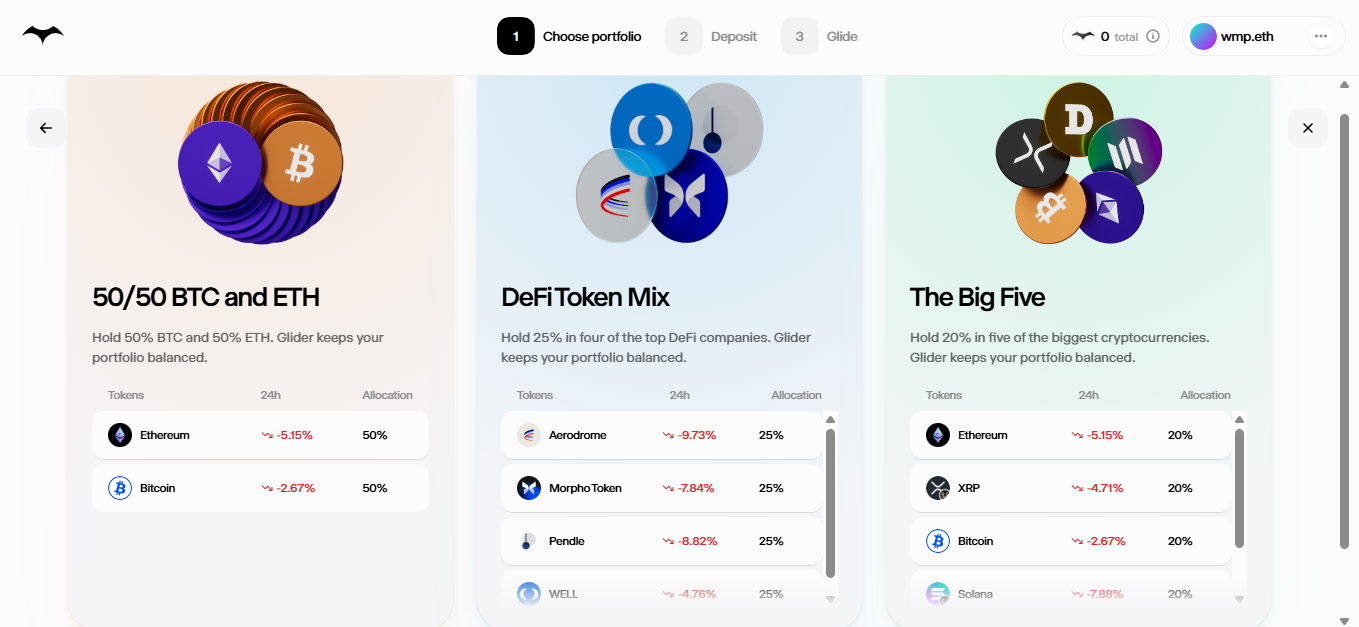

- Next up, you'll be asked to choose a starter portfolio. You can pick from the 3 presets: "50/50 BTC and ETH," "DeFi Token Mix" (AERO, MORPHO, PENDLE, WELL), or "The Big Five" (BTC, ETH, DOGE, XRP, SOL). Alternatively, you can scroll down and select the "Create My Own" option to immediately dive into a customized portfolio.

- If you start with one of the preset indexes, you'll next be asked to sign a transaction to create your portfolio, select a deposit asset (e.g. ETH) and complete your initial deposit sum, and "schedule" your portfolio to officially activate it. After doing this, your first portfolio will be live and earning points.

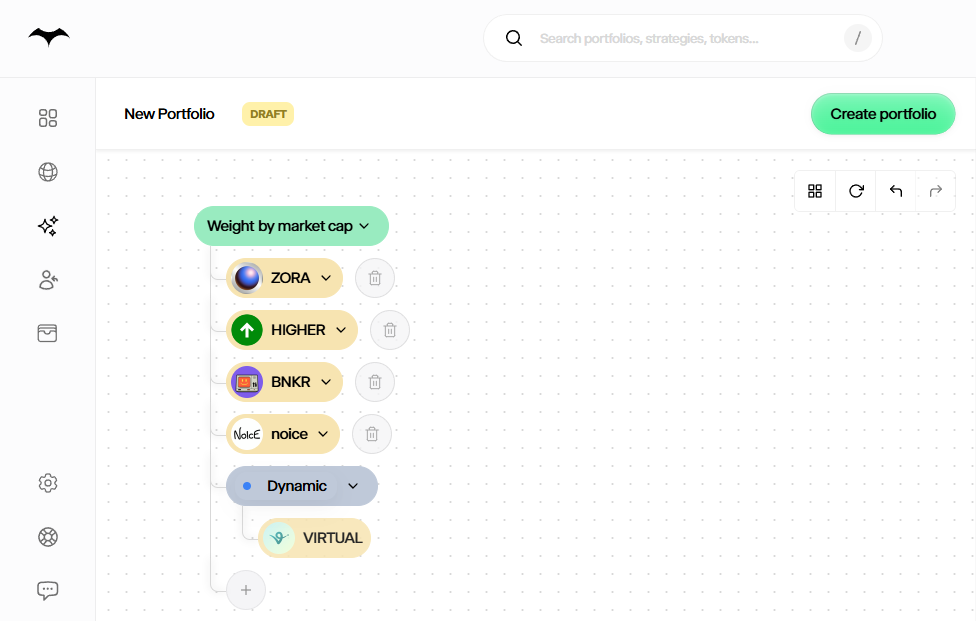

Those are the basics! You can also browse more portfolio options, including trending indexes, or head to the editor page and build your own portfolios by assembling blocks however you want. The editor is easy to navigate and will look like so:

All in all, what I like about Glider is that it makes managing assets feel more like designing than juggling trades. You assemble your strategies here, in visual and no-code fashion, and they can run indefinitely after that.

Zooming out, be sure to keep an eye on the progression of the platform's points program and for the integration of more chains. In the meantime, you can dive deeper in the FAQ and in the team's blog, which has multiple helpful primer posts!