August's Top Farming Opps ($)

View in Browser

Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet.

Market Plays:

- 🔄 LPing on Ekubo

- 📱 Exploring Blind

- 🌊 Trying Jupiter Lend

- 💲 Depositing to EulerEarn

- ⚙️ Earning with Gearbox x Pendle

Hot Reads:

- 🪙 Stablecoin Infrastructure Wars - stablewatch

- 🏦 Don’t Save Your Money in a Bank - RSA

- 📈 My Biggest Insight from Trading Crypto - Spicy

- 💸 A Short History of Free Money on the Internet - katexbt

- 🔮 If You’re in Memecoins Pivot to Predictions Markets - confugen

Airdrop Hunter:

- 💱 DeFi App: Unlock HOME airdrop

- 🔱 Avantis: Hunt AVNT airdrop

- 🏦 OpenEden: Hunt EDEN airdrop

- 🟠 Lombard: Hunt BARD airdrop

Whether markets are green, red, or sideways, smart money is always compounding. That’s where this monthly guide comes in!

Today, we break down five of the best crypto yield plays right now, built for those looking to earn yield without chasing memecoins or timing the market.

Read on for onchain yield opportunities you can’t afford to ignore 👇

Meanwhile, check out what we're cooking up with the Bankless Yield Hunter (beta) where we're experimenting with auto-generated yield opportunities.

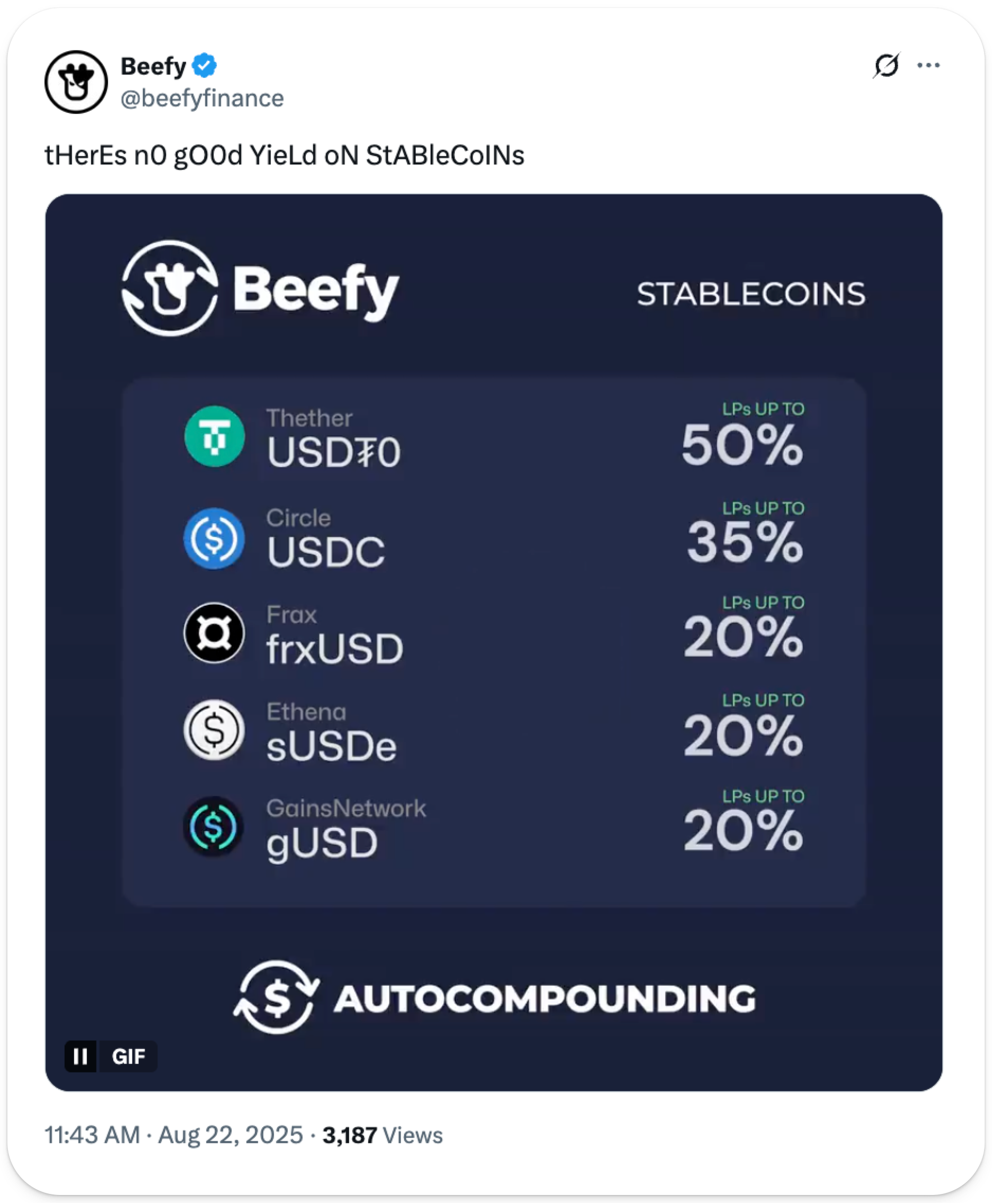

🥩 Beefy Finance

Website | Twitter

Best For: Compounding yields

Risk Level: Low

About:

Tried and true DeFi yield aggregator Beefy Finance allows users to earn compound interest on their crypto holdings, producing heightened yields for investors with safety and efficiency at the front of mind.

Using smart contracts that automatically claim, swap, and redeposit rewards (autocompound), Beefy automatically maximizes the yield from various DeFi deposit opportunities, such as automated market makers (AMMs) like Aerodrome and Uniswap. Beefy helps farmers harvest beefier yields from their crops by saving time, increasing efficiency, and circumventing risk compared to manual yield farming.

Top Yield Opps:

Receive 13% APY on stablecoins by depositing into Beefy’s Balancer GHO-USDC vault on Base, or enjoy Ether upside plus 15% APY by depositing into Beefy’s Uniswap weETH-WETH vault on Base.

🟢 Gains Network

Website | Twitter

Best For: Real stablecoin yield

Risk Level: High

About:

Gains Network is a collection of perpetual exchanges deployed to Arbitrum, ApeChain, Base, Polygon, and (most recently) Solana. Traders receive up to 4x leverage on stocks and indexes, 250x leverage on commodities, 500x leverage on cryptos, and 1000x leverage on foreign currencies.

At the core of this system are gToken vaults, which act as the counterparty to all trades placed through Gains. These liquidity pools provide synthetic leverage by making offsetting bets against user positions. In addition to earning fees for facilitating trades, gToken vaults profit when traders lose (and lose when traders profit).

Top Yield Opps:

Earn an estimated 17% APY when you deposit into the gTrade USDC vaults on either Arbitrum or Solana!

🪙 Merkl

Website | Twitter

Best For: Yield incentives

Risk Level: Variable

About:

Merkl helps crypto teams manage rewards campaigns, like airdrops, liquidity incentives, and lending/borrowing subsidies.

While more so a developer-centric distribution protocol than a DeFi degen deposit opportunity, Merkl features hundreds of distinct token campaigns for scores of crypto assets, offered by all manner of DeFi protocols.

Top Yield Opps:

Visit Merkl to view available yield incentive opportunities. Claim a 1.5% APR bonus for supplying USDC to Morpho markets on Base, or get an 11% APR subsidy by supplying BYUSD to Dolomite.

🏦 Fraxlend

Website | Twitter

Best For: Lending Yield

Risk Level: Medium

About:

Fraxlend is the native lending market for DeFi everything engine Frax Finance. Holders of Frax-native tokens (such as Frax USD and Frax Ether) can use Fraxlend markets to earn lending yield or leverage their assets as collateral.

Fraxlend markets tend to offer slightly higher yields than competitors, and depositors can determine which assets they want to lend against. Each lending market requires a specific collateral and has one borrowable asset.

Top Yield Opps:

Earn 9% APY when you deposit Frax USD into Fraxlend’s WBTC market on Ethereum.

⚔️ Katana

Website | Twitter

Best For: Airdrop-incentivized yield

Risk Level: High

About:

Katana is an up-and-coming DeFi-centric blockchain incubated by Polygon that uses bridged funds to earn yield on Ethereum while simultaneously allowing users to deploy their capital to onchain opportunities available on the Katana network, doubling up on yield sources.

Katana uses network sequencer fees to feed its “chain-owned liquidity,” which distributes the yield earned through various Katana applications back to users to boost their own yields. Additionally, this liquidity enables application users to receive superior pricing and liquidity than they otherwise would.

Katana has rolled out a sweeping airdrop incentives program that will reward early chain users with 20% of the total KAT supply and 15% of the total KAT supply to Polygon POL stakers. Katana makes it easy for users to earn airdrop incentives on top of set-and-forget DeFi yields.

Top Yield Opps:

Should the KAT token debut above a $1B fully diluted valuation (the default calculation for Katana deposit APYs), you’ll earn over 50% APY on USDC and 20% APY on WETH with Katana’s Yearn and Morpho powered “Earn” vaults. These rewards rates will vary significantly depending on KAT’s value.

Additionally, please note that Katana Earn vaults lend deposits out through Morpho on riskier collateral, including restaked ETH and BTC tokens. These transactions come with veiled risk, and depositors could receive less than the value of their initial contribution.

Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today.

What does BlackRock’s former crypto lead see in Ethereum that others still miss?

Joseph Chalom joins Bankless to take us inside the IBIT/ETHA ramp, why BUIDL launched on Ethereum mainnet, and the simple – but powerful – framework he uses to value ETH as “high-octane money.”

We break down staking inside ETFs, the tokenization roadmap from stablecoins to the S&P in your wallet, and the real mechanics of ETH treasury companies – mNAV premiums, ATMs, converts, and the transparency metrics that matter. Less hype, more architecture: if security, liquidity, and 24/7 settlement are the future, this is the bridge.

Listen to the full episode (early access for paying subscribers only!)👇