August's Most Chaotic Altcoins ($)

View in Browser

Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet.

- 🦊 MetaMask Confirms Stablecoin Plans. The wallet’s mUSD stablecoin will debut on Ethereum and Linea later this year.

- 👻 Aave Expands Beyond EVM With Aptos Launch. The DeFi giant’s first non-EVM deployment supports USDC, USDT, APT, and sUSDe on Aptos.

- 🤑 Kanye-Linked Memecoin YZY Money Takes Crypto Twitter by Storm. The Ye-linked Solana memecoin spiked, then crashed below $1.

| Prices as of 3pm ET | 24hr | 7d |

|

Crypto $3.83T | ↘ 0.9% | ↘ 4.3% |

|

BTC $112,646 | ↘ 0.9% | ↘ 4.7% |

|

ETH $4,267 | ↘ 0.7% | ↘ 6.1% |

Market Plays:

- 🪙 Exploring Cap

- 🏦 Swapping deRWA tokens

- 💱 Trying the Pendle YT Tool

- 💸 Earning in Strategy Vaults

- 🔑 Trading keys on Backrooms

Hot Reads:

- ⛲ Fundamentals vs. Flows - Jon Charbonneau

- 💲 iDollar: Apple’s Next Multi-Billion Play? - Andrew Huang

- 💻 The Rise of Stablecoin Operating Systems - Frax

- 🪖 Wargaming Digital Asset Treasury Reflexivity - Cheshire Capital

- 📆 Four-Year Cycle Top vs Extended Cycle to 2026 - Aylo

Farming Opps:

- 🟠 BTC: 10% APR with Aerodrome’s cbBTC-LBTC pool on Base

- 🟠 BTC: 2% APY with Euler’s WBTC vault on Ethereum

- 🔵 ETH: 11% APR with Aerodrome’s cbETH-WETH pool on Base

- 🔵 ETH: 5% APY with Pendle’s cmETH PT on Mantle

- 🟢 USD: 13% APY with Euler’s USDC vault on Ethereum

- 🟢 USD: 9% APY with Morpho’s Yearn OG USDC vault on Base

Airdrop Hunter:

- ⏩ Hyperlane: Claim HYPER rewards

- 🦭 Walrus: Claim WAL airdrop

- 🌟 Spark: Position for SPK Season 2

- 🏦 Kamino: Claim KMNO rewards

Crypto markets thrive on chaos, and this month has been no exception! July’s high-fliers became August’s rejects as new narratives flipped the script and traders rotated into fresher manias.

Whether you’re hunting the next moonshot or dodging the next rug, these five tokens that have defined August will be worth paying attention to in the month ahead. Today, we’re diving into the biggest winners, the hardest losers, and the wild catalysts behind this month’s most explosive altcoin stories. 👇

Pro tip: view analyst ratings for these tokens in the Bankless Token Hub!

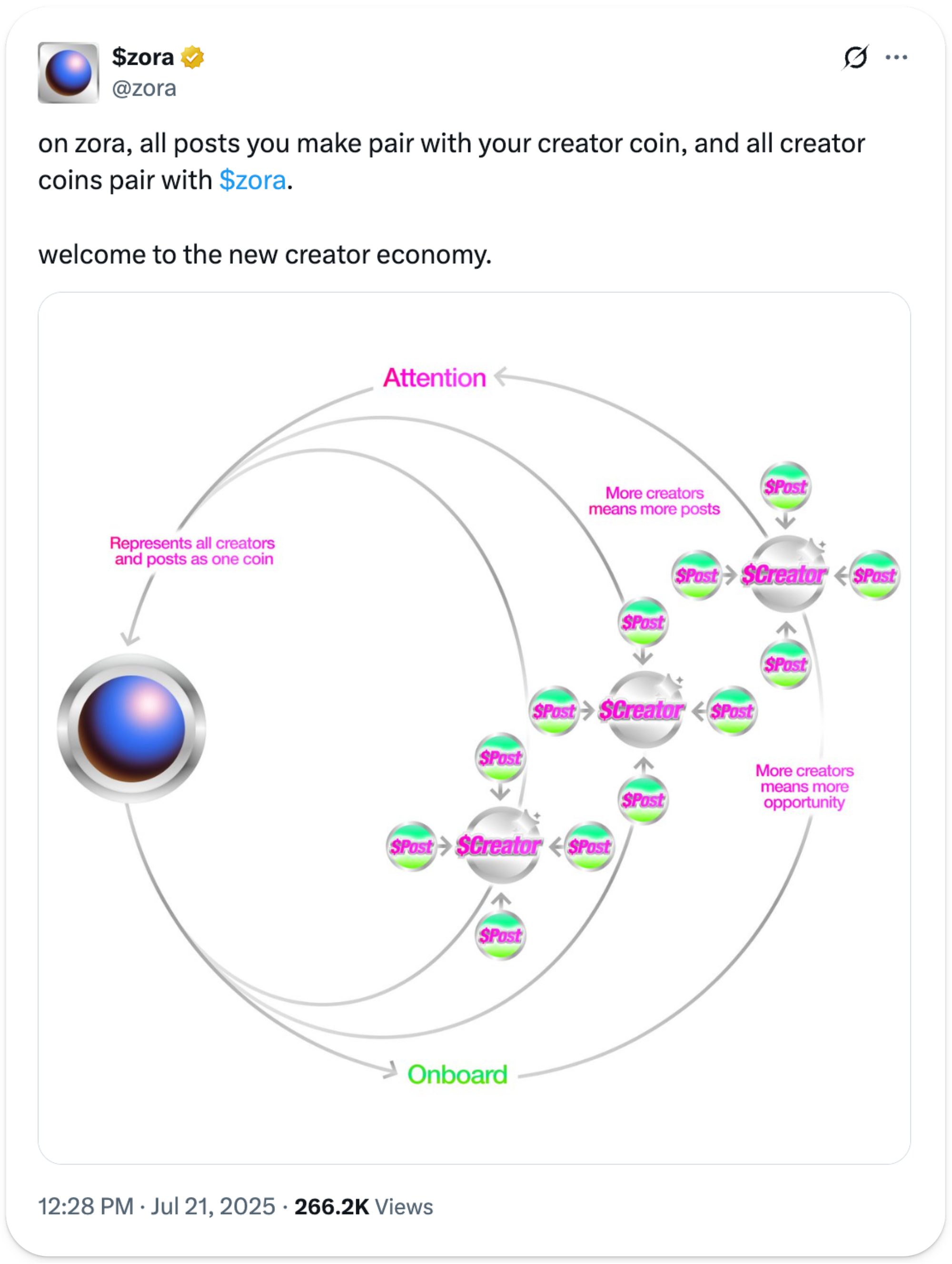

🪙 Zora

Website | Twitter

30-Day Change: +240%

Ticker: ZORA

About:

Previously an artist-centric platform for easy NFT creation and distribution, Zora has transformed itself into an onchain social network for monetized “content coins.”

Although Zora’s legacy NFT niche proved fleeting this cycle as traders flocked to better-performing memecoins, this platform truly made the most of the market’s changing attitude by pivoting to fungible tokens based on social media posts in 2025.

The ZORA token was released just two months after the launch of content coins in February 2025, and while mania would take a couple more months to ignite, content coins found their stride by July, allowing ZORA to rip as much as 1,500% in the weeks that followed.

Token Catalysts:

- Growth Spurt: Zora has experienced over $6B in content coin trading volumes since July 21, which produced $4M of revenues and rescued the protocol from obscurity.

- Unclear Longevity: Content coins remain in vogue for the moment, but crypto narratives tend to cycle frequently. ZORA price appreciation hinges on sustained adoption, and with no content coin utility beyond speculation, it is uncertain how long this meta will last.

🤖 Venice

Website | Twitter

30-Day Change: +30%

Ticker: VVV

About:

Launched by cryptocurrency entrepreneur Erik Voorhees in May 2024, Venice.AI is a chat-based platform for decentralized, private, and censorship-free access to leading generative AI models.

Unlike mainstream AI services that log every request and potentially share user data, Venice does not store conversation histories. Instead, it routes encrypted queries through a decentralized network of GPU providers. Nodes see only the immediate request, keeping personal information and user activity out of reach.

Token Catalysts:

- Enhanced Utility: Venice users have always needed to stake VVV to receive platform compute allowances. Starting August 20, these computation units (known as “Diem”) will be tokenized, providing Venice users with the ability to trade decentralized compute.

- Mobile First: Many crypto observers cite mobile-first applications as the next frontier for mainstream adoption. Venice introduced a mobile application for iOS and Android devices on August 14, creating easier access for users of its products.

- AI Mania: The incessant clamor for artificial intelligence exposure continues on Wall Street. Tech heavyweights have committed hundreds of billions to AI infrastructure and Sam Altman recently suggested he’ll spend “trillions” building data centers.

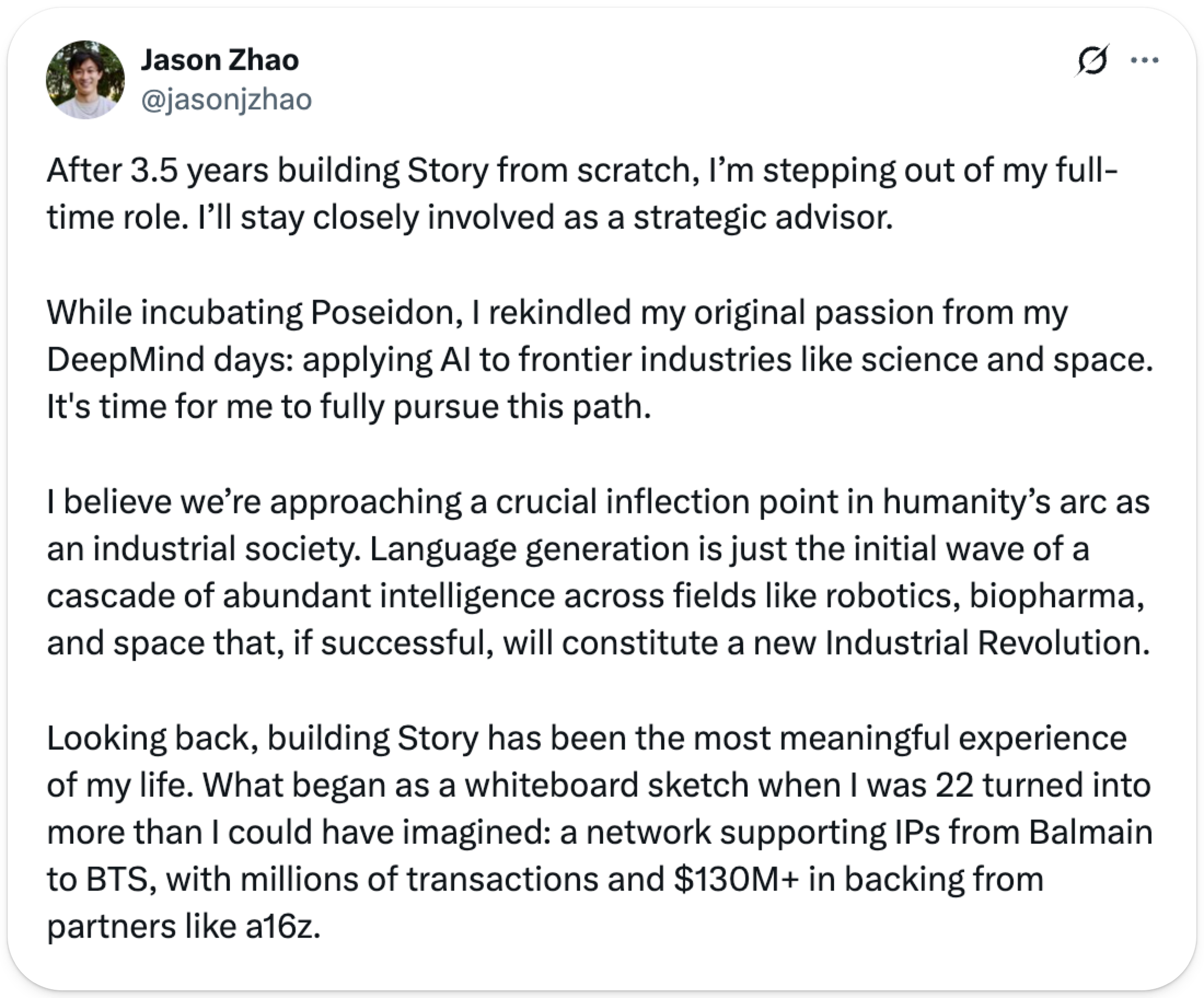

📕 Story Protocol

Website | Twitter

30-Day Change: +22%

Ticker: IP

About:

Story Protocol markets itself as a blockchain-based solution for internet intellectual property (IP) that combines an onchain ownership registry with “modules” designed to facilitate licensing. It aims to make IP a programmable asset class.

While Story does not pursue copyright infringement cases and cannot track royalties external to its blockchain (two key features of intellectual property), by anchoring ownership in smart contracts, Story Protocol hopes to help IP evolve with the modern era.

Token Catalysts:

- Departing Founder: Story co-founder Jason Zhao has stepped down from his “active role" just six months after the launch of its IP token to pursue a new AI initiative. A move that earned the ire of Crypto Twitter for coming so soon after the token's launch.

- Unproven Use Case: Although legacy IP structures could benefit from blockchain integrations, Story has struggled to prove itself as a suitable platform for such use cases. The Story blockchain frequently posts dismal dollar-denominated daily fee revenues in the low double digits, speaking to limited utilization.

- Treasury Play: On August 11, publicly traded Heritage Distilling Holding Company (CASK) announced that it would adopt the IP token as a treasury reserve asset. Heritage received $120M of IP tokens through private investor PIPE offerings and raised $100M to purchase IP OTC from Story Foundation at a 50% discount.

🕵️ Monero

Website | Twitter

30-Day Change: -18%

Ticker: XMR

About:

Monero is a privacy-focused network touted for its ability to provide an untraceable blockchain experience by obscuring transaction details. The XMR token is frequently used as a bridge currency for individuals seeking to conduct transactions out of view of prying eyes.

Transaction outputs on Monero are obfuscated through “ring signatures,” a special type of cryptography that combines a sender’s signature with decoy signatures from other addresses. Meanwhile, recipients use untraceable “stealth addresses” and transaction values are protected by zero-knowledge “bulletproofs.”

While not explicitly banned in the United States, Monero’s use in illicit finance has spawned concern among regulators and led many centralized exchanges to delist the token. It is possible that Monero privacy is already compromised; Chainalysis received an IRS contract for cryptocurrency tracing in 2020 and leaked firm materials outline XMR tracking procedures.

Token Catalysts:

- Miner Attack: On August 11, rumors began circulating that Qubic (a blockchain created by IOTA co-founder Sergey Ivancheglo) had acquired majority 51% control over the Monero network after it successfully executed a six-block transaction reorganization.

- Little Truth: While XMR price traded lower on the attack, there was little truth to be found in the rumors. In reality, Qubic controlled less than 41% of Monero’s hashrate at the time of reorganization. The “attack” has been received as a temporary blip that resulted from intensive mining spend to promote the QUBIC token.

💊 pump.fun

Website | Twitter

30-Day Change: -30%

Ticker: PUMP

About:

As the premier memecoin launchpad on Solana, pump.fun provides users with a seamless and efficient way to engage with the wild world of memecoins.

This no-code platform allows users to launch memecoins with zero technical experience and provides a unified interface for traders to ape freshly launched gems. Pump.fun charges a 1% platform fee for buys and sells on ungraduated tokens that have not achieved a $100k market capitalization. It also gives token creators 0.05% of all trade fees.

In March, pump.fun launched pump.swap, a proprietary decentralized exchange to host the liquidity for graduated tokens that charges a 0.3% fee on all trades.

Token Catalysts:

- Usage Resurgence: Users began abandoning pump.fun en masse after its July 12 token sale. While platform activity has yet to regain early 2025 highs, key fee and revenue metrics have since rebounded to their pre-token baselines.

- Reward Potential: Airdrop hunters were dismayed by the lack of a PUMP coin airdrop. While pump.fun did not hand out free money at TGE, 24% of token supply is earmarked for incentives. These tokens may be allocated as rewards to drive user engagement and boost platform utilization.

- Buyback Program: The pump.fun team may use protocol earnings at its discretion to purchase PUMP tokens, presenting a source of buy pressure that scales with platform utilization.

Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today.

Eric Peters, CIO of Coinbase Asset Management, joins Ryan to chart how crypto matured to today’s institutional market with deep liquidity, ETF rails, and stablecoin clarity.

They unpack why Wall Street is leaning in, why the next wave is digitally native issuance of treasuries, bonds, and equities on Ethereum, and how macro tailwinds (fiscal dominance, Fed-Treasury convergence, AI-driven productivity) intersect with crypto’s reflexivity.

Risks and realities aren’t ignored—over-financialized “treasury companies,” security lapses, and policy whiplash—plus a 12–18 month roadmap of real on-chain use cases as pensions and sovereigns start arriving.

Listen to the full episode (early access for paying subscribers only!)👇