Dear Bankless Nation,

Markets continue to pump this week as the broader macro environment gains steam.

What are CPI numbers telling us and what should you do about it? Today, we’re making sense of the crypto pump.

- Bankless team

BTC is up 23% to $21,100 in the past week. All of this is leaving Crypto Twitter asking some important hopium-fueled questions:

- Has crypto bottomed?

- Is it time to be bullish?

Today, we dissect the market interpretation of the domestic consumer price index (CPI) print, examine the logic behind Thursday’s volatile trading session, and extract untold warnings from the data they don’t want you to see.

Strap on your hopium masks, and let’s go.

What’s behind the pump?

December CPI data was released by the Bureau of Labor Statistics on Thursday (January 12) and, as par for the course, a volatility-filled trading day ensued.

December’s decline marked the third month in a row CPI has decreased. “Beating back inflation” summarized the Fed’s monetary policy approach throughout 2022 and the Fed continues to pummel it into submission. Crucially, December’s data is seen by many macro economic pundits as the beginning of a disinflationary, or potentially even deflationary, trend for CPI.

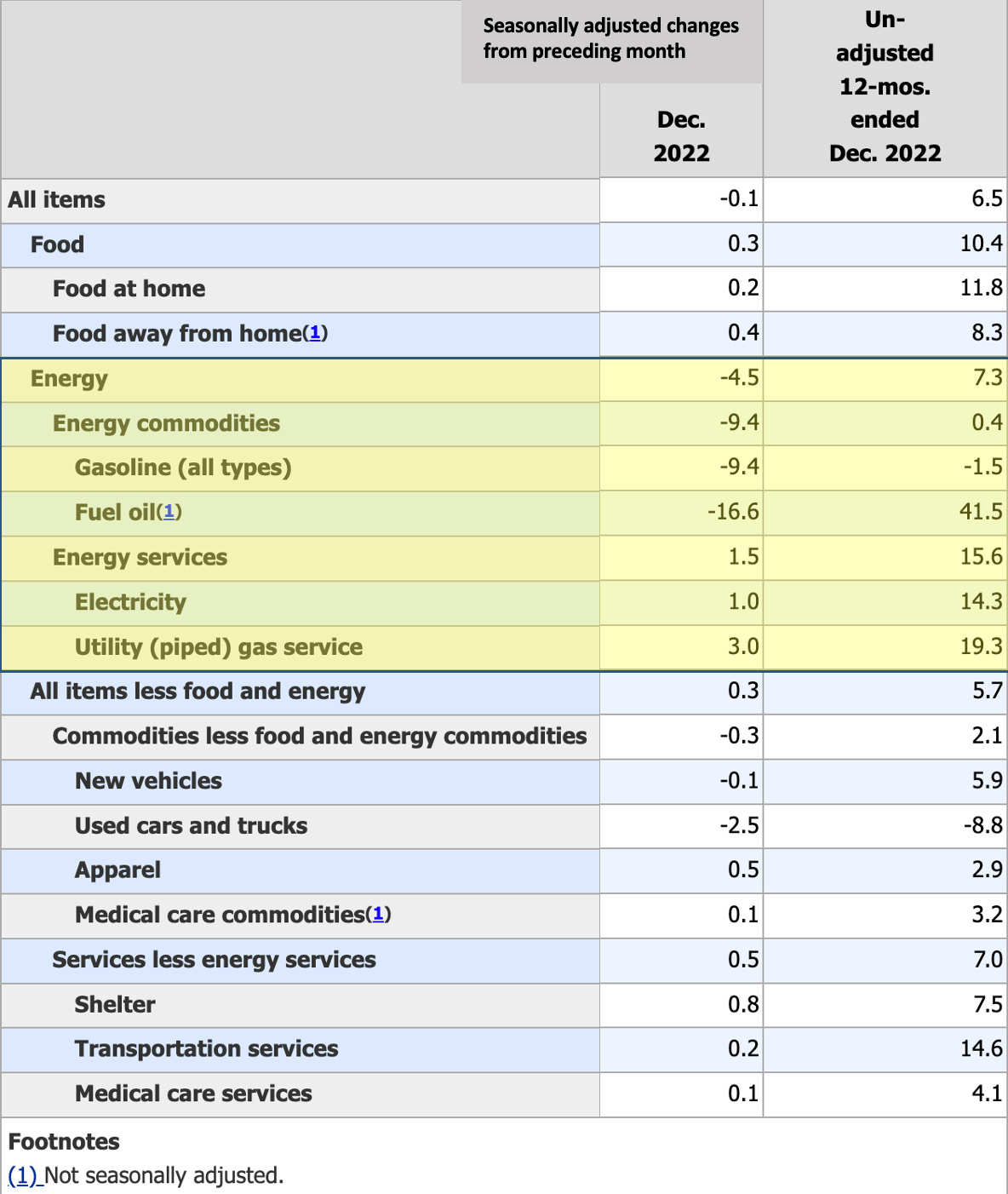

Year-over-year CPI declined from 7.1% to 6.5%, with an unexpected 10 basis point decrease in CPI from November’s measurement. The decline can largely be attributed to the broader energy category, which saw a 4.5% seasonally adjusted decrease from the prior month.

Service sector-based inflation, however, is inherently stickier than flexible-price food and energy goods, and remains elevated, increasing 0.5% mark-to-market from December. Sticky inflation components, as their name suggests, are less volatile than commodity-derived factors of CPI.

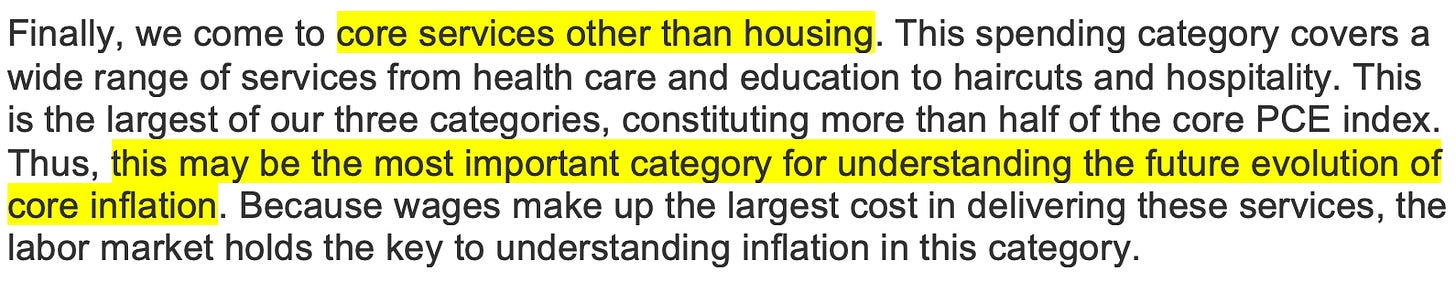

Over 2022, beating back sticky inflation was a priority of the Fed. As noted by Chair Powell, core service inflation is one of the most important metrics the Federal Reserve’s Board of Governors examines to predict economic health and steer monetary policy.

What the Fed is doing

Why does inflation matter to the Federal Reserve and how do they use monetary policy to combat it? The Federal Reserve is charged with a dual mandate, tasked with maintaining both: Price Stability and Full Employment.

In practice, simultaneously achieving these goals is difficult.

Inflation can be controlled via the tightening of economic conditions and achieved by raising interest rates. As the cost of capital increases and financing becomes more expensive, spending slows, providing downward pressure on inflation.

Contractionary monetary policy is the term used to describe the Fed’s current efforts to slow economic activity by increasing the targeted Federal Funds Rate (the aggregate interest rate charged for interbank secured overnight lending). While the Federal Reserve does not lend directly in the Federal Funds market, it can impact monetary policy with a variety of policy tools, including open market operations, discount window lending, and repo lending facilities.

Markets are forward-looking — they incorporate anticipated future Federal Reserve monetary policy into today’s cost of borrowing. Changes in how the market perceives the future path of inflation become incorporated into yields and asset valuations as the market reconciles these adjustments.

Rising interest rates slow growth and typically lower the level of employment, forcing the Fed to play a balancing game in how quickly and at what magnitude they can increase the Fed Funds rate without driving the economy off a cliff into recession.

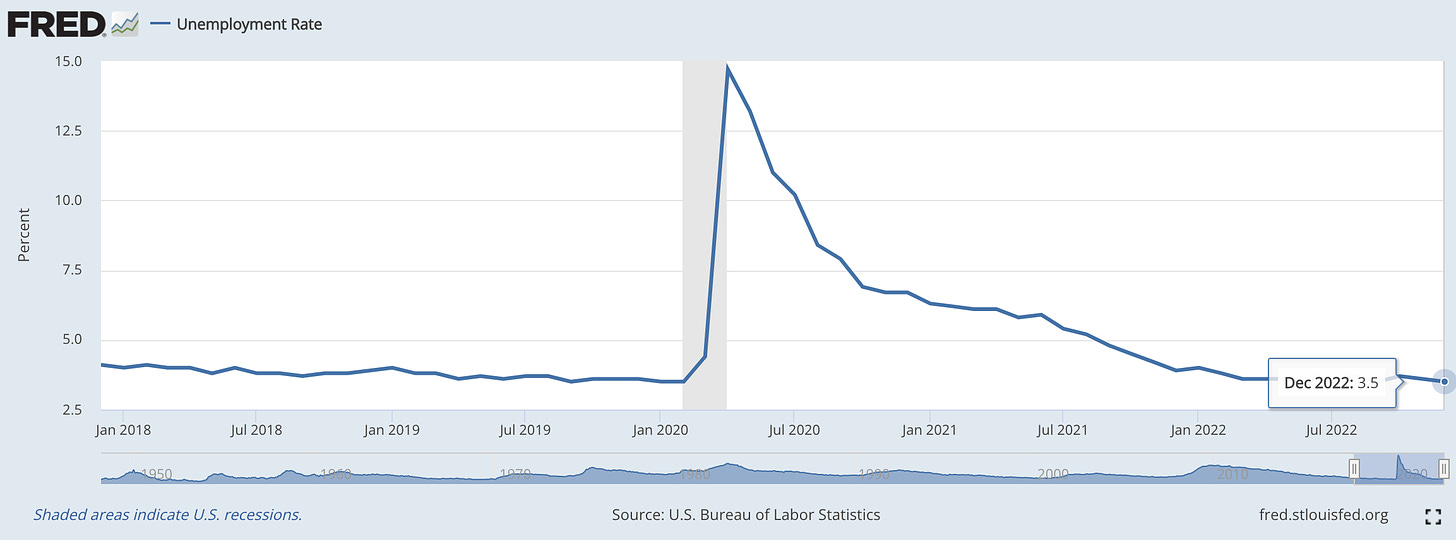

Labor markets remained surprisingly resilient throughout 2022, with unemployment down-only, closing out the year at a post-COVID low of 3.5%.

Strength in employment allows the Federal Reserve to continue to ratchet up interest rates. Asset values are not a primary consideration for the Fed when setting monetary policy. Ironically, over the past year strong employment data has spawned fears that the Fed will have greater room to raise interest rates which has negatively impacted valuations.

With limited relief in sight as the unemployment rate continued to fall, a slowdown in inflation remained investors’ life-line to looser financial conditions.

December’s CPI data finally provided that relief.

What the numbers say

While the data was not entirely rosy, given the continued inflationary pressures in sticky categories, you better believe Wall Street MBAs did the mental gymnastics to get bullish! As highlighted by the WSJ:

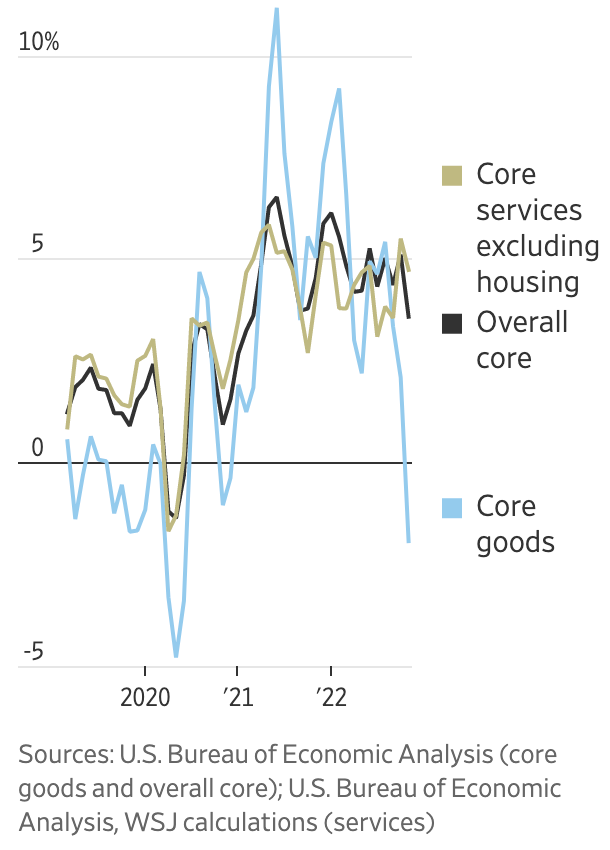

Core inflation, the preferred inflationary metric of many policy makers and market participants, already strips out the volatile components of commodities pricing in the measurement. Supercore inflation estimates are Wall Street’s attempt to rationalize the increasingly complicated inflation story.

Inflation metrics for many core goods categories have turned deflationary, due to normalizing supply chains and moderating demand for goods (a direct impact of contractionary monetary policy), while inflation in service-based buckets remains high, partially a result of a stubbornly tight jobs market and upwards wage pressures.

Supercore inflation scores exclude both core goods and shelter service baskets, with some market participants opting to precluding medical services, as well.

Roger Hallam, global head of rates at Vanguard, notes that, “the goods and the shelter print will get less relative focus compared to what’s happening on the services side of things,” over the course of the next year. Additionally, Hallam sees market participants placing greater emphasis on employment figures.

Okay, so thinks are looking mixed but promising — what should you do about it though?

Stay cautiously bullish

You never want to be the clown who stays in crypto throughout the bear market and misses the rally. But you really don’t want to be the fool that FOMOs into $21k BTC or $1550 ETH at their local tops, then get liquidated on the way to the actual bottom.

Even I, resident Bankless bear, admit: this may be the Goldilocks zone!

- Inflation is on the mend

- Employment remains strong

- Everyone else seems to be buying

Cautious optimism is the key, however.

Remember when Soylana and Craptos were tanking post-FTX? Perhaps, check the optimism you have in this present moment. Those fund redemptions that were going to take place? Just ask yourself if there is a chance that they are occurring right now…

If I have learned one lesson throughout my time in crypto that has repeatedly burned me, it’s that price action on weekends (especially three day weekends) is often scam price action. Bitcoin’s largest dumps since August were all preceded by Friday pumps that carried over into the weekend (indicated by the purple box.

Subsequent trading action took BTC to new cycle lows every time.

As the market makers head home for the weekend and TradFi markets close for the weekend, liquidity decreases. This increases volatility and makes price more susceptible to extraordinary swings. Abnormally high trading volume can easily push price to the extreme in both directions.

This weekend high saw BTC push to highs nearly 14% above the Friday close.

Keep in mind that while BTC spot markets may be difficult for an individual or small group to manipulate, low-float altcoins are certainly not immune to such behavior.

As your token goes up in value, you can borrow more against it! Hypothetically, if you are a decently capitalized VC that just got hit with redemptions and holds a lot of low-float coins, say a collateral-tier bluechip DeFi project like Lido, you could borrow against their increasing values, long your coin in a low-liquidity market, and attract rotatooors who will pump your coin alongside you.

While VCs bag dumping will depress market prices, attracting fresh blood and renewed attention to their shitcoins enables them to exit at much more favorable prices. Remember anon: VCs play games! Don’t let them steamroll you on their way out the door!

Yes I have abandoned Ethereum despite supporting it in the past.

— Zhu Su 🔺 (@zhusu) November 21, 2021

Yes Ethereum has abandoned its users despite supporting them in the past.

The idea of sitting around jerking off watching the burn and concocting purity tests, while zero newcomers can afford the chain, is gross.

This tweet marks the beginning of an aggressive AltL1 bag shilling campaign from the folks over at 3AC.

Their efforts proved resoundingly successful, with LUNA mooning nearly 200% over the subsequent five months!

Despite publicly announcing support for Alt L1s and prophesying the death of Ethereum in late 2021, 3AC had acquired their bags long before.

Hedge funds and venture firms generally do not announce what they are actually doing in public! Why would they? They’re profit-maximizing institutions seeking to extract maximum returns from crypto markets. They play games of misdirection and distraction designed to separate you from your capital and to get you to ape their bags.

If you’ve read all of this and are still intending on playing the markets right now:

- Avoid leverage

- Don’t marry your bags

- Hit the big red button at the first sign of increasing unemployment

- Exercise a healthy dose of skepticism towards anyone shilling their bags

If you can do these three things and stay cautiously bullish, you’ll (hopefully) have enough ammo for wherever the market goes!

Don’t ape. Don’t FOMO. DYOR.

And most importantly, ignore the noise on Twitter 🤝

Action steps

- 🤑 Execute any good market opportunities that you saw