Dear Bankless team,

Memecoin season may already be over (for now) on Ethereum, but Bitcoin is having its own foray into memetic madness and it's as bizarre as expected.

Today, we dig into the so-called BRC-20 token and how all of this memecoin mania is being viewed by staunch bitcoiners.

- Bankless team

Bankless Writer: Jack Inabinet & Ben Giove

Memecoin fever is spreading!

A new token type, known as the BRC-20, is captivating degens and providing an Ethereum-like shitcoining experience on Bitcoin. It is built using the Ordinals protocol, which recently gained popularity in its own right for bringing NFTs to Bitcoin.

Today, we’re diving into everything BRC-20, from basic definitions to trending tokens, while dissecting the on-chain carnage this experiment has wrought. Surprise: not everyone is happy about it... Then, we discuss where we see the state of the BRC-20 market headed and why this mania is no different from those that came before.

🚸 New Kid on the Block

Bitcoin’s latest experiment to piss off purists (more on this later) takes its namesake from Ethereum’s ERC-20 token standard and is the brainchild of Domo, a self-proclaimed “terminally on-chain Dune Wizard.”

BRC-20s use Ordinal inscriptions of JSON data to create what is essentially a fungible NFT collection. While this grand experiment has produced a fungible ERC-20 style token, its use cases are fairly narrow.

hear me out: NFTs but tradeable in bulk and no pictures pic.twitter.com/GQHkFisI26

— foobar (@0xfoobar) May 6, 2023

Unlike their ERC-20 cousins which can be used as collateral in a variety of dApps on Ethereum, BRC-20s are limited to mint and transfer functions. In the absence of Bitcoin-native decentralized exchange solutions, asset sales can be accomplished on-chain via escrow or emblem vault functions.

At contract deployment, anyone can mint BRC-20 tokens for free (plus transaction fees) in increments specified by the token contract – asset issuances cannot be pre-mined. Despite hype around the token type, the Project’s whitepaper notes that Taproot-enabled issuance of assets on Bitcoin is not a novel concept and cites Taro Protocol as providing an “unequivocally better solution.”

6/ Then anybody can mint it for free. All BRC-20 tokens are free mints with no pre-mine. In this example token the "lim" (limit) was set to 1,000 and the "max" (max supply) was set to 21,000,000. So anybody can inscribe a mint JSON which works until 21,000,000 tokens are minted. pic.twitter.com/Gqo8TLrQjR

— Leonidas.og (@LeonidasNFT) May 8, 2023

🌝 BRC-20s Moon

The total market cap of BRC-20s has soared over the past several weeks, exploding 3441% from $17.5M on April 25 to $619.7M on May 9. Many individual BRC-20s have experienced parabolic runs in conjunction with this move.

For instance, ORDI, the first and largest BRC-20 with a market-cap of $434M has mooned 2357% during this period from $0.75 to $18.43. Since April 2, ORDI has surged an astounding 18,330% and has begun to be listed on centralized exchanges like Gate.io.

Other BRC-20s have delivered similarly exponential returns for holders. Tokens like PEPE, MEME, and MOON have all rallied more than 2000% over the past month.

🚘 BTC Rush Hour

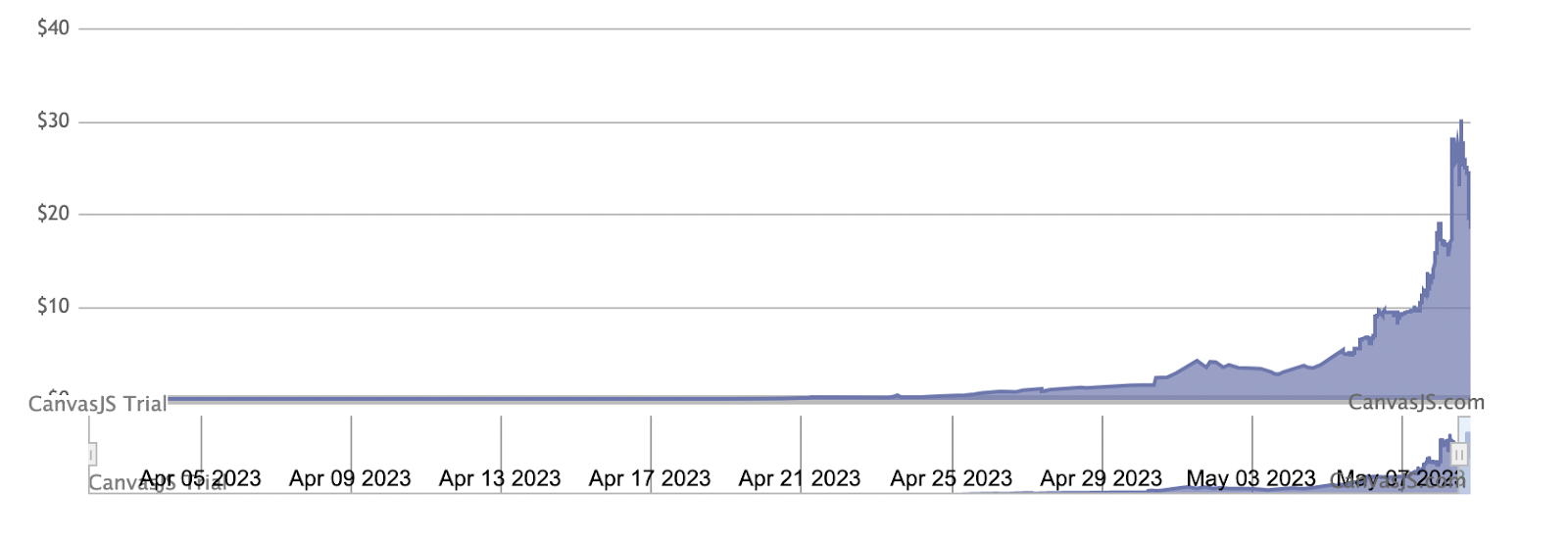

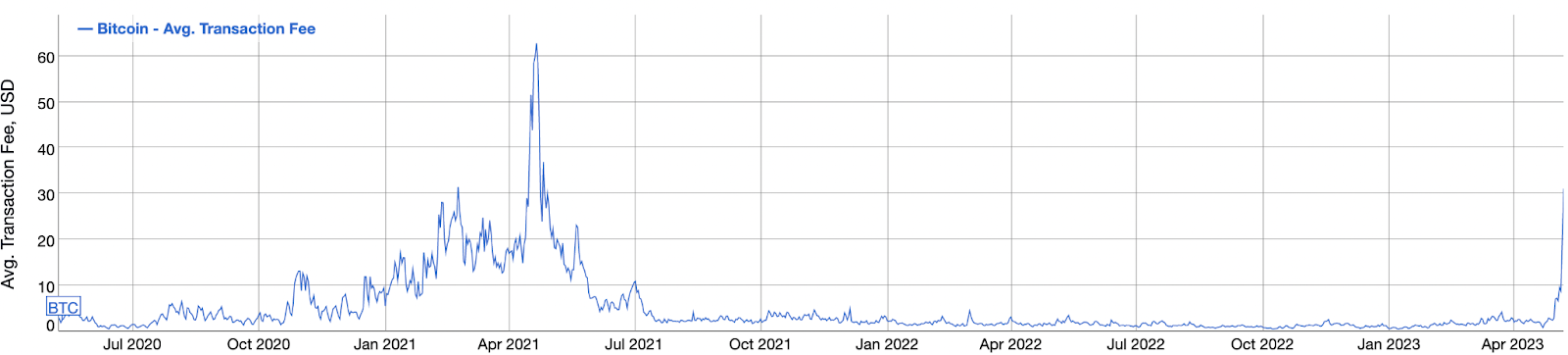

The BRC-20 frenzy has caused chaos in the Bitcoin fee markets.

BTC fees have reached their highest levels since April 2021, with the average fee per transaction spiking, currently at roughly $31.

In total, Bitcoin has generated more than $49M in transaction fees over the past week as the BRC-20 craze has intensified. Between that and blockspace rewards, miners have generated more than $204M in revenue during this period.

For reference, this weekly revenue is the highest since May 2022.

This surge in demand for blockspace has led to massive congestion on the network. There are currently more than 411,000 pending transactions in the mempool.

Congestion has also had ramifications in the centralized crypto universe. Binance was forced to halt withdrawals on two separate occasions between May 6-7, and is now prioritizing implementation of Lightning withdrawals to provide alternative escape routes for users.

👮 Fun Police

Speculators are busy throwing it all on red at the meme casino, meanwhile, individuals who had adopted crypto systems for real world use – particularly those in Latin America, Africa, and Asia – must now compete against these degens for blockspace.

I’m in El Salvador 🇸🇻 right now. Just witnessed a cash withdrawal via #btc

— Marce Romero (@MarceMR19) May 8, 2023

This individual now had to pay $20 in fees for getting $100 out in a country where the avg. salary is $300-350

I want you to think about this when enabling gambling on fkn jpegs or meme coins.

This is… pic.twitter.com/RTVLqG7DNn

Providing both an alternative store of value to inflationary local currencies and financial services for the unbanked have long been two of Bitcoin’s most potent value propositions. Spiking transaction fees pose a major hurdle to adoption among fee-sensitive individuals with lower incomes – the group standing to benefit the most from alternative currencies and financial systems.

Activists are decrying the BRC-20 craze as the root cause of congestion, and some observers have gone as far as to claim that BRC-20 adoption is akin to a DDoS attack on the Bitcoin network.

Can anyone explain how I'm going to onboard people with these fees?

— Anita ⚡🏳️🌈 Bitcoin for Fairness (@AnitaPosch) May 8, 2023

Can't use on-chain, can't open channels.

Makes custodial Lightning the only option.

And all that because some people think it's fun to "break Bitcoin". Why not use Liquid or RSK? https://t.co/luuqLoNN7d

While it's certainly unfortunate that Bitcoin fees have reached elevated levels limiting certain users' ability to transact on-chain, this is the reality of publicly available, commoditized blockspace. These transactions, as stupid and meaningless as they may appear to some, are perfectly valid uses of Bitcoin blockspace.

gn

— Eric Wall 🧙♂️ Taproot Wizard #2 (@ercwl) May 8, 2023

what happened today was the emergence of the brc-20 asset class

it wasn’t an attack, it wasn’t a ddos

taproot has just made it simple to productize the bitcoin blockspace into any arbitrary protocol

shitcoin trading protocols is an obvious buyer of that blockspace pic.twitter.com/KdAwWLCUEO

Blockchains have yet to see significant adoption and the notion that the future of consumer finance is carried out on the Layer-1 base is laughable. Layer-1 networks alone, be it Bitcoin or Ethereum, will not provide enough blockspace to obtain scale required by the next generation of financial primitives.

Rather than fight against present fee increases (a relatively minor blip when considering exponential increases in future adoption) by attacking specific use cases, we must instead focus our attention on establishing credibly decentralized scaling solutions to handle the load.

📉Familiar Fate

Like their Ethereum-based memecoin cousins, demand for BRC-20s will be fleeting over the long term. Their price will not be an upwards grind, but rather a series of blow-off tops: these instruments are not for investment!

They have no value, beyond what can be generated on the memetic layer, and while BRC-20s have existed for two months, these fungible Bitcoin ecosystem tokens required cross-chain meme fervor to attract significant attention. While we have witnessed the explosive growth of memecoins past, they always come back to orbit, scorching top buyers upon re-entry.

Although you may be tempted to ape into some of the more explosive-sounding tickers, be aware: you may incur losses up to the value of your investment. Allocate appropriately, as these tokens are both valueless and operate on a novel spec!

The Bottom Line

BRC-20s likely fail to facilitate any meaningful crypto progress, yet represent a powerful thought experiment utilizing ordinal theory that highlights the role culture plays in the crypto financial system.

The presence of painfully high gas fees (already at levels unsustainable for crypto adoption in developing nations, despite extremely limited usage of crypto financial systems today) should serve as a glaring reminder of inability for contemporary blockchain systems to meet future demand and provide additional awareness to the need for decentralized scaling solutions.

While memes may come and go, creating demand for blockspace is crucial to ensure the continued security of the network. This holds especially true for the Bitcoin network, where miners will become increasingly dependent on transaction fee revenue to cover costs from operations, as block incentives decrease with successive halvings.

Action Steps:

- 📖 Read Nic Carter's take on BRC-20s

- 📚 Read The BRC-20 Boom in Metaversal