Unpacking Arbitrum Orbit and the $ARB Airdrop

Dear Bankless Nation,

What a week. And it just got crazier.

$ARB is coming and we've got the details. How will this shake up the L2 Wars? And how bullish is this for the Arbitrum ecosystem? We dig in.

- Bankless team

p.s. Head over to our YouTube channel at 4PM ET when we'll interview Steven Goldfeder & Harry Kalodner about the $ARB airdrop and Arbitrum governance launch!

Everything you need to know about the Arbitrum Airdrop

Bankless Writer: Ben Giove

No, your eyes do not deceive you. This is not a drill.

At long last, ARB is coming. Arbitrum is (finally) dropping its token.

One of the most anticipated token launches in crypto history, ARB will be used to govern over the Arbitrum ecosystem, and yes, will be airdropped to early users.

But that’s not the only big news of the day. Arbitrum has also announced Arbitrum Orbit, a framework for creating L3s that settle to Arbitrum-based rollups.

Have a few minutes to take a break from watching TradFi immolate? If so, I’ll break down all you need to know about ARB and Orbit, their impact on the Arbitrum ecosystem, and how these releases are set to shake up the increasingly fierce “Layer 2 Wars.”

Let’s dive in.

🥏 Tl;dr of ARB

Let’s break down what we know so far about ARB.

ARB will be used to participate in the Arbitrum DAO, which will govern over the Arbitrum ecosystem including Arbitrum One (the “main” L2 which most refer to as just Arbitrum), and Arbitrum Nova.

Notably, Arbitrum will be the first L2 to have “self-executing governance,” meaning that governance will happen entirely on-chain and that proposals do not have to be implemented manually by the core team.

Arbitrum is also creating what’s known as the “Arbitrum Security Council,” which is a 9/12 multi-sig that will have the authority to make changes to the rollup in the event of a security emergency. The composition of the Security Council will be determined by the DAO.

It also appears that tokenholders will control the rights to Arbitrum IP, as DAO governance has the ability to approve the creation of other L2s that settle to Ethereum which are built using Arbitrum's tech.

These L2s can either be governed by ARB holders (a governed chain), or have their own independent governance system (an ungoverned chain). DAO governance does not have to approve the creation of L3s that settle to Arbitrum itself (more on this later).

Did we miss anything? Oh right. There WILL be an ARB airdrop to early participants within the ecosystem, and the token is set to go live on March 23.

You can check your eligibility here.

How it this airdrop being distributed?

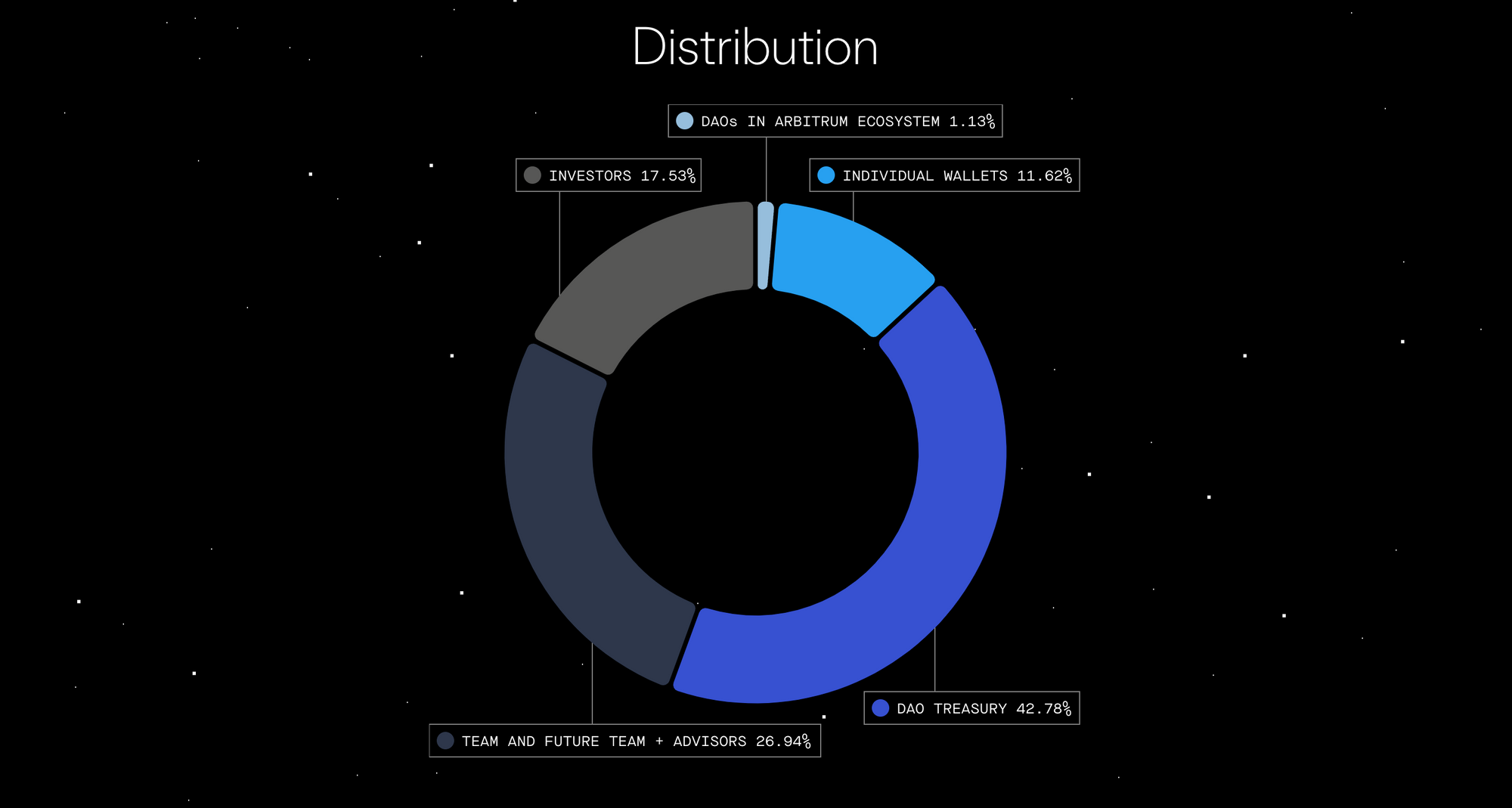

So, 11.62 percent of the total 10 billion token supply will be airdropped to individual user wallets. Otherwise, the lion's share is going to the DAO treasury (∼43%) with ∼27% being reserved for the team and a healthy ∼17.5% going to the project's investors. The remaining ∼1% will be going to DAOs in the Arbitrum ecosystem.

Arbitrum snapshotted user activity February 3 and will award tokens based on the number of transactions completed, applications used, and time spent on the network.

🛰 Tl;dr of Arbitrum Orbit

Now, it’s time to take a look at today’s second big announcement from Arbitrum…Orbit!

As mentioned above, Arbitrum Orbit is a development framework for creating Layer 3s (L3s).

L3s are “L2s for L2s” in that they refer to a rollup that settles to another L2, rather than an L1. L3s still retain the security guarantees of an L2 but have the potential to provide a massive increase in scalability, as throughput compounds in each layer of the stack.

For example, let’s say an L3 has a 10x increase in throughput relative to an L2, and an L2 has a 10x increase in throughput compared with L1. This means that the L3 has a 100x increase in throughput over L1. This massive increase in scalability means that L3s are well suited for use cases like order-book exchanges, games, or other high throughput use cases that require incredibly fast and cheap transactions.

Orbit is permissionless, as developers can use the tech to create an L3 that settles to an Arbitrum Chain without requiring the permission of the DAO. Orbit will also be compatible with Arbitrum Stylus, a future upgrade that will enable developers to build dapps in traditional programming languages including C, C++ and Rust.

💰 Impact on The Arbitrum Economy

Now, that we have a tldr of ARB and Orbit, let’s touch on the ways in which they will impact the Arbitrum economy.

Arbi Szn (V3)

The airdrop of ARB should serve as a stimulus for the Arbitrum economy, creating a wealth effect in early adopters by providing them with capital with which they can ape.

This should not come as a surprise to all the degens out there, but Arbitrum-based governance tokens are set to be among the primary beneficiaries from this airdrop. For one, they are set to be the recipients of airdrop stimmy, but also will benefit from the capital set to pour into the ecosystem from incentive programs (more on that below).

Broadly speaking, Arbitrum coins have had two periods in which they’ve outperformed over the past year: The summer of 2022 and first six weeks of 2023, coinciding with broader market rallies during these times.

While some of this most recent rally may have been due to anticipation of the airdrop, given the insatiable desire to speculate among on-chain degens who are armed with fresh ammo, it is likely that we’ll still see a V3 of “Arbi Szn.”

Other than structural flows, there are fundamental reasons to be bullish on Arbitrum-based tokens over the coming weeks and months. Armed with ARB incentives to fuel usage, projects on the L2 should see increases in revenue, users, and other core KPIs as users flock and capital flows into the L2.

Furthermore, these tokens should also benefit from a broader “L2 Trade,” as excitement around both Arbitrum’s individual growth story, and further confirmation of L2s as crypto's preeminent scaling solution, builds among traders.

Farming Frenzy and Liquidity Influx

Arbitrum already has a flourishing DeFi ecosystem, ranking first among L2s and fourth among all networks with a DeFi TVL of $1.6B.

The L2 is already a degen’s paradise, with numerous spot and perpetuals DEXs, options protocols, and lending markets. Yield farmers have already been eating, but are set up for an even more bountiful harvest in a post-ARB world.

This is because, as previously mentioned, ARB will likely be utilized by many projects for incentive programs. This will increase yields for farmers, who are now able to earn these ARB rewards on top of existing lending interest, trading fees and/or existing liquidity mining incentives.

If history is our guide, these rewards programs should catalyze significant liquidity inflows into the Arbitrum ecosystem, and therefore, a massive increase in TVL, over the coming months.

For instance, Optimism saw its TVL increase 232% from $269M to $894M in the three months following the release of OP.

Given its already existing liquidity, ecosystem of dapps, and increased security guarantees (in its current state) relative to Optimism, it seems likely that Arbitrum will attract billions in inflows and grow at an even faster rate.

Ethereum is undergoing a period of rapid infrastructural development. The upcoming Shanghai/Capella upgrade will simultaneously upgrade the blockchain’s execution and consensus layers to enable staked ETH withdrawals. What does this mean for stakers and the web3 ecosystem?

🥊 Impact on the L2 Wars

The launch of ARB, the Arbitrum DAO and Orbit will significantly shake up the L2 competitive landscape. Let’s highlight a few ways in which it will do so:

Cementing Arbitrum’s DeFi Moat

As mentioned above Arbitrum currently has $1.6B in DeFi TVL, good for a 62.8% share among L2s and a 3.5% slice of TVL across all networks.

The billions in liquidity inflows post-ARB should not only lead to a marked increase in both categories, but also help Arbitrum cement its lead as the go-to L2 for DeFi by further strengthening the network effects it has from its current ecosystem of dapps.

Users and developers go where the liquidity and other applications are. The release of ARB and subsequent incentive programs should spur a substantial increase in both, and should help Arbitrum further distance itself from competitors like Optimism. In the long-run, there is a strong possibility that Arbitrum flips Tron and BNB Chain to become the second largest L1 or L2 by TVL.

A (Potential) New Value Proposition for L2 Tokens

ARB will also shake up the L2 landscape by imbuing its DAO with the rights to license Arbitrum’s IP.

L2s already control their IP to varying degrees. For instance, Optimism’s OP Stack can be used without permission, with anyone able to fork Optimism mainnet or create their own L2 without needing governance approval. Other L2s act as service providers, but their development companies typically internalize all profits from this.

A debate on the use of intellectual property within crypto goes beyond the scope of this article. But through this model, the Arbitrum DAO will now be the first major L2 to open source this process.

This greatly increases the value proposition of ARB, as not only will it potentially be used to decentralize the sequencer in the future, but holders will also control the rights to incredibly valuable IP. We’ve seen some early signs of this model being used in crypto, with an example being Uniswap, whose DAO controls the business license for Uniswap V3.

Some projects have approached UNI holders to seek permission to fork V3 such as Voltz, an interest rate swap protocol which allocated 1% of their token supply to the Uniswap DAO after being allowed to do so.

However, likely due to the general inactivity of Uniswap governance, we’ve not seen many other examples. This means that we’re likely to see this model be utilized at scale for the first time with Arbitrum, and should it prove successful, likely pressure other L2 providers to follow suit.

From Few To Many

Before the announcement of Orbit, the Arbitrum ecosystem appeared to be largely concentrated around Arbitrum One and Arbitrum Nova. This ran counter to the approach of other L2s such as Optimism, which is developing a burgeoning ecosystem of networks built with the OP Stack, including Coinbase’s Base, Ribbon’s Aevo exchange, and Lattice’s on-chain game OPCraft.

Other L2s such as zkSync are planning to build out extensive L3 ecosystems, while StarkWare has also provided the tech to build application specific validiums via StarkEx.

In an L2 landscape that is becoming increasingly multi-rollup, particularly after the announcement of Base, it appeared as though Arbitrum may have been behind the 8-ball on this front. Orbit changes this.

Orbit will likely turn Arbitrum One into a settlement layer (similar to ETH), and in doing so, enable the broader Arbitrum ecosystem to scale over the long-run. Orbit should also increase the attractiveness of building a custom L2 within the Arbitrum ecosystem, as not only will applications benefit from the value that L3s provide such as the aforementioned increased throughput and secure bridging, but also from the interoperability and network effects of the existing Arbitrum ecosystem.

It's obviously too early to tell which L2 tech stack developers will ultimately prefer - but Orbit has certainly leveled the playing field relative to the OP Stack.

$ARB IS HERE

It’s a big week. As TradFi burns, Arbitrum is set to shake up the L2 with the launch of ARB and Orbit. While the token is not yet live, ARB will already begin to impact markets and the broader L2 landscape.

The L2 wars are far from over. But as of now, Arbitrum appears to be back in the driver's seat.