How Arbitrum Beats Optimism

Dear Bankless Nation,

ARB has arrived! Oh, and also... Do Kwon got arrested. Coinbase is in the SEC cross-hairs. Justin Sun got sued. Jake Paul, Lindsey Lohan and other celebrities got Gary's attention because of crypto ads... This has been one hell of a week.

Today, we focus our newsletter energy on Arbitrum and what the launch of the ARB token means for its future prospects as the undisputed L2 King.

- Bankless team

$ARB vs. $OP

Bankless Writer: Jack Inabinet

L2 summer is now in full swing!

How are we kicking it off? With crypto’s most anticipated airdrop of course: ARB. True believers have long foretold of the day; pessimists said it would never come! The time to scoop your ARB allocation is now.

Long at stasis, the dynamic between two of Ethereum’s most popular Layer 2 rollup solutions is fundamentally shifting. Last week’s ARB announcement also provided clarity on how the Arbitrum team intends to scale the Arbitrum network, and thus the future of Ethereum.

Arbitrum Orbit will allow for the permissionless creation of L3 chains – rollups settling to Arbitrum – while requiring DAO approval for the usage of Arbitrum IP to create L2s. This comes in stark contrast to the OP Stack “Superchain” vision, a model that opens-sources Optimism’s code for the permissionless creation of L2s with shared sequencer sets.

Today, we’re exploring the Arbitrum v. Optimism competitive landscape at present, considering how ARB shakes up the current paradigm, and contrasting their differing approaches to achieving scale.

🚁 Claiming with the Arbitrum Foundation portal is a chore. 😵💫

Check your eligibility and claim your ARB easily using Earnifi instead!

Setting the Scene

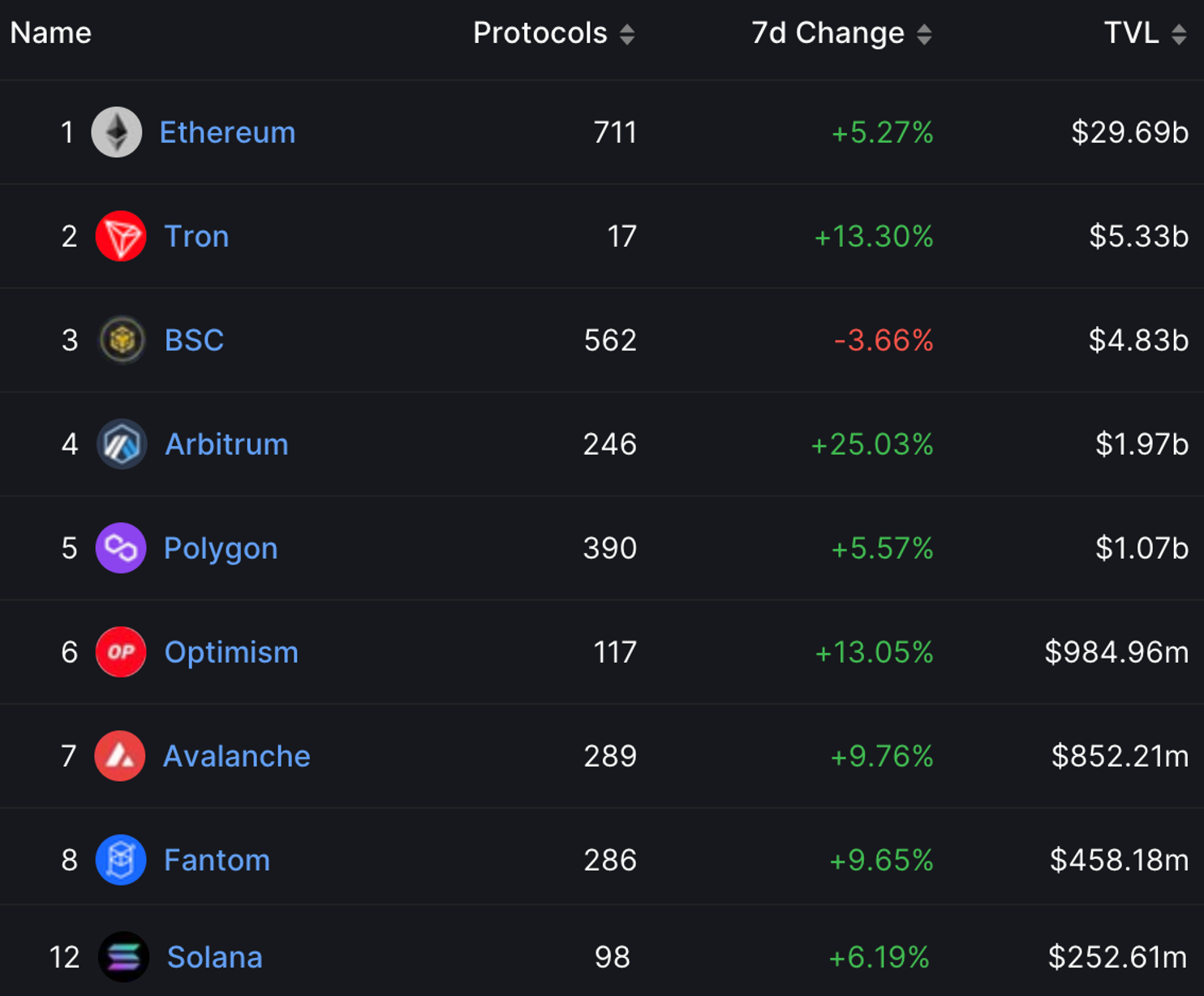

Arbitrum and Optimism are not only Ethereum heavyweights. They’re some of crypto’s largest chains by TVL.

Sitting at the number four and six slots, split by he-who-must-not-be-named (Polygon), Arbitrum and Optimism have surpassed many of the bull market’s favorite alt-L1s in terms of TVL, including Avalanche, Fantom, and Solana.

While other chains have enjoyed increased TVL as broader crypto markets pumped, the 25% increase to Arbitrum TVL over the past seven days is notable. Liquidity is flowing to the chain in anticipation of the ARB drop.

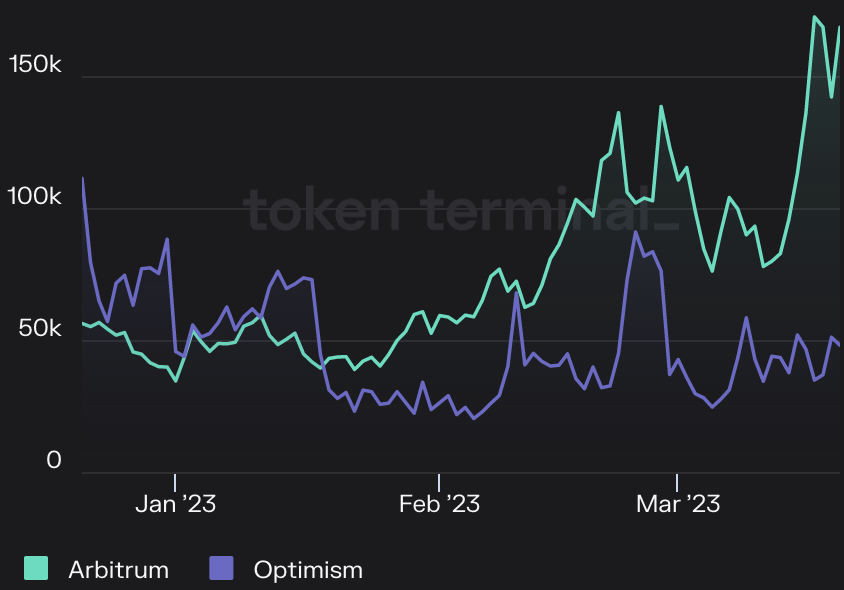

But it's not only a shift in liquidity, we’ve seen massive increases in the number of daily users on Arbitrum, hitting an all-time high of 172.4k active addresses on March 17th. Arbitrum’s DeFi core combined with March’s nutty price action were contributing factors to the rollup’s dominance this month, averaging 188% more active daily users than Optimism.

We all remember when transactions on Arbitrum flipped the Ethereum L1 in late February. Far from a one-time occurrence, Arbitrum transactions yet again flipped Ethereum on March 16th and have held steady around the 1M mark since.

Optimism is the clear laggard, having fallen far off its all-time high of 800k transactions in January. The network has been unable to break over 300k daily transactions over the month of March.

Token Shenanigans

And you thought BLUR was big.

Arbitrum will be dropping 12.75% of the total ARB supply to early users and 137 DAOs with an Arbitrum presence. Depending on which Crypto Twitter user you ask, we could soon see $ARB trade anywhere from $0.30 to an eye-popping $10! As nice as these fairly outlandish early predictions sounds, more reasonable (and quantitatively based) valuation frameworks see the token likely trade in and around the $1 to $2 range, which is exactly where the price of $ARB has seemed to settle after early volatile trading.

Even when assuming the conservative $1 prediction as a base case, over $1B in value was just injected into the Arbitrum ecosystem.

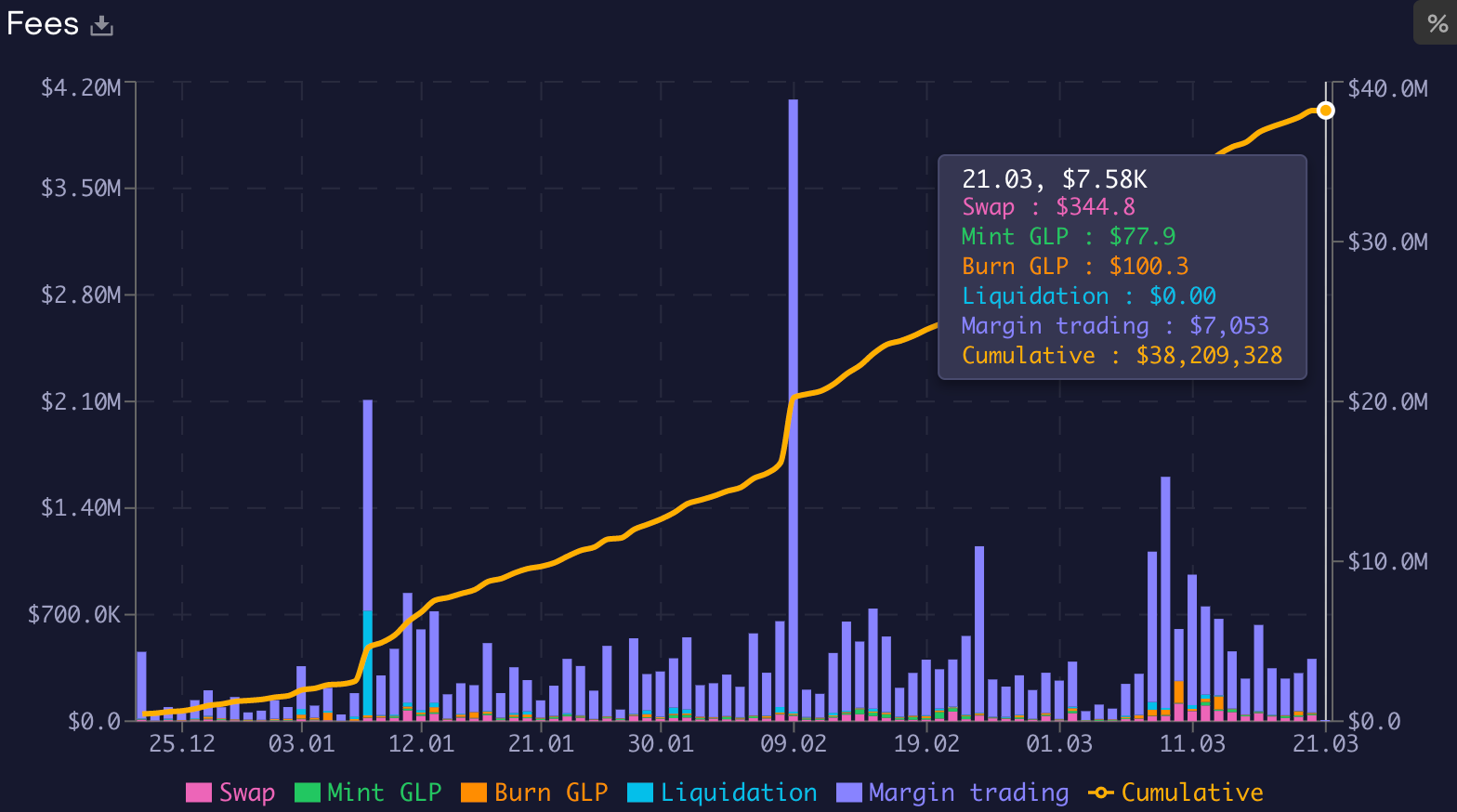

Projects on Optimism have long provided their users with OP token rewards, thanks to distributions from the chain’s Ecosystem Fund. Arbitrum has finally unlocked the ability to provide similar incentives to its protocols. While Arbitrum GMX dominance has declined to 25% of Arbitrum TVL, the degen-favored platform continues to rake in the dough, with just under $40M in fees collected over the past three months.

Yield farms on Arbitrum outside of GMX have continued to provide bountiful harvests, meanwhile shitcoin szn has been juicing yields on all of your favorite ArbiDEX casinos, including Camelot. Emergence of the GambleFi scene on Arbitrum appears poised to provide additional yield opportunities from degens who have grown tired of speculating solely on token price.

ARB incentives on top of these yields likely funnel additional capital and liquidity into the Arbitrum ecosystem, especially when the 137 projects with allocations begin to announce the structure of their liquidity incentive and rewards programs.

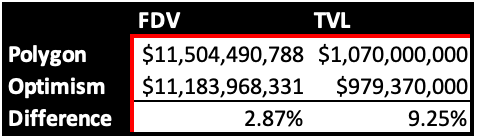

Chains with higher TVLs generally command higher FDVs. Polygon’s MATIC token has a fully diluted value of $11.5B, 2.9% greater than Optimism’s $11.2B FDV. While the gap between Polygon and Optimism TVL is not perfectly captured in this calculation, it displays the correlation between TVL and valuation for Ethereum-settling rollups.

Between Arbitrum’s DAO treasury and Optimism’s RetroPGF, Ecosystem, and Future Airdrop funds, untapped token incentives are available for both chains to flex in the never-ending battle for liquidity.

Liquidity begets liquidity, which in turn begets valuations. Thanks to a (presumed) higher valuation for Arbitrum, the DAO will benefit from an inflated treasury valuation, giving it a greater amount of ammunition compared to Optimism. Effective usage of this treasury should translate to greater spending power, giving the DAO an advantage in attracting users and liquidity.

MetaMask Learn is an educational resource to help people understand what web3 is, why it matters, and how to get started. Consider adding MetaMask Learn to your onboarding guides if you’re a dapp developer or NFT creator to give your community the welcome they deserve.

Pulled into Arbitrum’s Orbit

As mentioned above, Arbitrum’s scaling roadmap is fundamentally different from Optimism’s.

OP Stack will provide for the permissionless creation of L2s, affording anyone the ability to build modular chains from a codebase receiving contributions from Optimism, Coinbase, and other OP Stack developers. Inherently, OP Stack empowers Optimism competitors. While the future of the OP Stack aims to allow chains sharing sequencer sets the ability to conduct atomic transactions, there is no guarantee that a chain will opt into this shared security model.

Optimism runs the risk that another general purpose rollup, built on its tech stack, may steal liquidity and users directly from the mother chain. There is also zero guarantee that these chains will be as charitable as Base and decide to share fee income with Optimism.

The @BuildOnBase Chain will commit a portion of transaction fee revenue back to the Optimism Collective.

— Optimism (✨🔴_🔴✨) (@optimismFND) February 23, 2023

This furthers the Collective’s vision for a sustainable future where Impact = Profit.

In comparison, Offchain Labs, the development team behind Arbitrum, is granting IP rights for the creation of L2s to the Arbitrum DAO, while allowing for the permissionless creation of L3s with the Orbit program. Instead of enabling the competition to spin up chains directly competing with Arbitrum, the DAO will have the ability to dictate terms and may even elect to prohibit L2 competitors to fork Arbitrum tech.

Separating IP between permissioned L2 deployments and permissionless L3 deployments seems to give Arbitrum (and L3 devs) the best of both worlds. Developers on Orbit will be contributing to the leading L2 codebase, while inheriting the compression and programming advantages of Nitro and Stylus.

Unlike OP Stack, Orbit provides a direct value accrual model for ARB token holders: L3s built on Arbitrum must pay fees to Arbitrum sequencers. This capture is unique to Arbitrum and is a novel solution to open-sourcing code and generating economic benefits.

Forget about utility: the frontier of tokenomics is value accrual. ARB holders will benefit from the potential, eventually realized, fee generation machine that is L3s deployments on Arbitrum.

ArbiDominance

For too long, ARB has been absent from the wallets of crypto degens. Competition is the nexus of innovation, and as the consumer, I’m pleased with the massive leap forward Arbitrum has made on its roadmap.

Token incentives and future airdrops will likely prove a potent tonic to attract new users and additional liquidity to the chain. How Optimism and other L2s react remains to be seen. Orbit changes the paradigm, displaying that it’s possible for L2s to align with crypto open-source values while embracing the inner capitalist and establishing revenue streams for token holders.

The roadmap for ArbiDominance is clear: continue to build a world-class rollup to attract world-class dApps and L3s (incentivized by deeper liquidity and superior tech to build on the chain), continue to command a higher valuation than its competitors (due to increased development and user activity in combination with a higher TVL), and effectively employ token incentives and novel airdrop strategies to attract further liquidity! Continuation is the hard part, but with a rock solid dev team and an invigorated community to boot, Arbitrum appears up to the challenge.

The Arbitrum flywheel has arrived. Will you be positioned to capitalize?

The Infura NFT API + SDK is the toolkit you’re missing.

🔥 Learn More at Infura.io